Nifty-Intra Day Chart (31-Dec-2012):-

Technical Patterns and Formations in today intraday charts

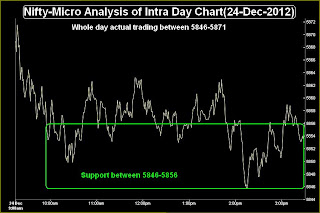

1- Most time trading between 5898-5910.

2- Lower levels support between 5898-5902.

3- First more than 3 hours consolidation patterns.

4- Minor selling in last hour.

5- Whole day actual trading between 5898-5915.

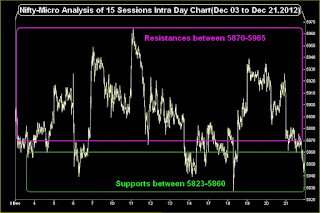

Long Term Trend is up,Intermediate and Short Term Trends are sideways for the last 20 Sessions between 5823-5965. Technical positions within this range are as follows:-

1- Supports between 5823-5865

2- Resistances between 5904-5965

Most of the time narrow range quiet trading within 12 points between 5898-5910 today with most of the time intraday consolidation patterns. Although Nifty slipped to intraday lowest levels in last minutes but good consolidation seen between 20 Sessions resistance range today therefore up moves hopes turned alive. As strong resistances above today trading range therefore follow up consolidation is also required tomorrow and in the coming sessions for valid break out above 5965.

Expected that finally rally above 5965 will be seen after follow up consolidation and Indian markets will be positive after Green opening tomorrow.

|

| Just click on chart for its enlarged view |

1- Most time trading between 5898-5910.

2- Lower levels support between 5898-5902.

3- First more than 3 hours consolidation patterns.

4- Minor selling in last hour.

5- Whole day actual trading between 5898-5915.

Conclusions from intra day chart analysis

Long Term Trend is up,Intermediate and Short Term Trends are sideways for the last 20 Sessions between 5823-5965. Technical positions within this range are as follows:-

1- Supports between 5823-5865

2- Resistances between 5904-5965

Most of the time narrow range quiet trading within 12 points between 5898-5910 today with most of the time intraday consolidation patterns. Although Nifty slipped to intraday lowest levels in last minutes but good consolidation seen between 20 Sessions resistance range today therefore up moves hopes turned alive. As strong resistances above today trading range therefore follow up consolidation is also required tomorrow and in the coming sessions for valid break out above 5965.

Expected that finally rally above 5965 will be seen after follow up consolidation and Indian markets will be positive after Green opening tomorrow.

.jpg)