Crucial level will confirm deeper correction

Intra Day Chart Analysis & Market Outlook

(30-06-2017)

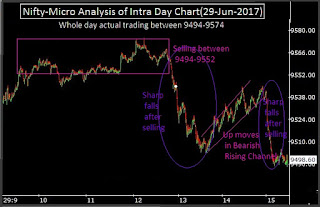

Nifty-Intra Day Chart (29-Jun-2017):-

|

| Just click on chart for its enlarged view |

1- Selling between 9494-9552

2- Up moves in Bearish Rising Channel

3- Sharp falls after selling

4- Whole day actual trading between 9494-9574

Conclusions from intra day chart analysis

As all the Asian markets were trading strong after 144 points positive closing of Dow Jones yesterday therefore up moves after strong opening but not sustaining at higher levels and closing at the lower levels of the day after fresh selling because selling was seen between 9474-9552 in last 2 sessions and today closing is also within this range.

Previous 20 sessions trading between 9561-9698 and and Nifty moved into this range today but could not sustain within it as well as closed below it after follow up selling within this range therefore correction continuation expectations are alive and once valid break down below crucial levels(9473.45) will mean deeper correction which should be firstly watched in the coming sessions.