As lower levels supports also seen after higher levels selling today therefore Indian markets will be understood sideways between 6130-6185 and valid break out of this range will be next trend confirmation. Impulsive Wave-3 is on therefore only very Short Term correction and limited down moves were expected but QE-3 tampering fear developed in all Global markets today therefore deeper correction possibility will also be considered after valid breaking down below 6130.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Mid-session Outlook(08-11-2013)

As fear of QE-3 tampering developed yesterday therefore all the Global markets and USDINR are weak today and resultant Indian markets also tumbled. Fresh intraday selling seen today therefore until Nifty will not sustain above today highest(6185) till then next up move will not be considered and complete consolidation is required for any decisive rally.

Pre-open Outlook(08-11-2013)

As US markets closed in deep Red yesterday therefore all the Asian markets are weak today morning resultant sentiment turned weak and gap down opening will be seen in Indian markets. Short Term correction of impulsive Wave-3 is on and lower levels consolidation was also seen yesterday therefore deeper correction is not possible and finally impulsive Wave-3 rally continuation is expected in next week after on going Short Term correction completion within 1/2 sessions.

Technical Analysis and Market Outlook(08-11-2013)

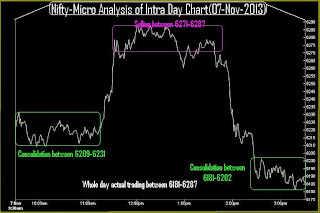

Nifty-Intra Day Chart (07-Nov-2013):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 6209-6231

2- Selling between 6271-6287

3- Consolidation between 6181-6202

4- Whole day actual trading between 6181-6287

Highly volatile day with lower levels good consolidations and higher levels selling also therefore follow up moves and valid break out of today trading range(6181-6287) will be next trend confirmation.

As impulsive Wave-3 is on towards 6724.60 and previous 3 sessions down moves are only very Short Term correction therefore only limited down moves up to next supports(6194) were considered and were seen also with today closing at 6,187.25.

Although today closing is near the lowest of the day but last 1 hour lower levels good consolidation therefore rally continuation hopes above today highest(6,288.95) is alive and once sustaining it above will mean strong indication of very short term correction completion and impulsive Wave-3 continuation.

|

| Just click on chart for its enlarged view |

1- Consolidation between 6209-6231

2- Selling between 6271-6287

3- Consolidation between 6181-6202

4- Whole day actual trading between 6181-6287

Conclusions from intra day chart analysis

Highly volatile day with lower levels good consolidations and higher levels selling also therefore follow up moves and valid break out of today trading range(6181-6287) will be next trend confirmation.

As impulsive Wave-3 is on towards 6724.60 and previous 3 sessions down moves are only very Short Term correction therefore only limited down moves up to next supports(6194) were considered and were seen also with today closing at 6,187.25.

Although today closing is near the lowest of the day but last 1 hour lower levels good consolidation therefore rally continuation hopes above today highest(6,288.95) is alive and once sustaining it above will mean strong indication of very short term correction completion and impulsive Wave-3 continuation.

Expected that tomorrow Nifty will firstly trade within today actual trading range(6181-6287) and finally sustain above 6287 in the coming week after follow up consolidations.

Mid-session Outlook(07-11-2013)

Although up moves after lower levels good consolidations but good selling also at higher levels today therefore firstly sustaining beyond 6194 should be watched for on going correction completion conformations. As today up moves were not showing required strength therefore we booked profit in our buying trade of Nov CE(6400) at 64.00 which is now trading at 44.00(Live proofs of this trade have already been updated in previous topic)

Live Proofs of Profits,Perfect Timing and the Best Services of Indian Stock Markets to Our Paid Clients

We told following line in both previous Outlooks which were posted yesterday:-

emergence of first signal of on going correction completion.

As sson as we got confirmation of correction completion then we gave following call and profit booking messages to out paid clients:-

1- 09:40:48 AM:-NIFTY-Nov CE(6400)-Buy-Positio nal-SL-34 & TGT-74-CMP-49(Lalit39)

07-11-2013

2- 11:32:18 AM:-NIFTY-Nov CE(6400)-Bought on 07-11-2013-Cover and book profit immediately-CMP-64(L alit39)

As we always talk with those proofs which no one can deny therefore updating following picture of above SMS which was sent to our paid clients today:-

Website Picture:-

Technical Analysis and Market Outlook(07-11-2013)

Nifty-Intra Day Chart (06-Nov-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling between 6255-6269

2- Down moves in Bullish Falling Channel.

3- Whole day actual trading between 6209-6269

Firstly selling at higher levels and after that without force down moves in Bullish Falling Channel which is one of consolidation pattern also therefore emergence of first signal of on going correction completion.

Following line was told yesterday in Firstly Watch now next Supports at 6194:-

Next supports are at 6194 and slipping towards it can not be ruled out today

As was told same happened today and bottom formation at 6,208.70 after whole day slipping from intraday higher levels. Although correction is on but sustaining beyond 6194 should be firstly watched today because that will give deeper correction or correction completion confirmation.

As impulsive Wave-3 is on towards 6724.60 and on going down moves are only very Short Term correction therefore only limited down moves up to next supports(6194) were considered and those were seen in previous sessions. As consolidation patterns formations also seen today therefore if Nifty sustain above 6194 tomorrow then that will be very short term correction completion confirmation and then rally above all time high of Nifty will be seen in the coming weeks.

|

| Just click on chart for its enlarged view |

1- Selling between 6255-6269

2- Down moves in Bullish Falling Channel.

3- Whole day actual trading between 6209-6269

Conclusions from intra day chart analysis

Firstly selling at higher levels and after that without force down moves in Bullish Falling Channel which is one of consolidation pattern also therefore emergence of first signal of on going correction completion.

Following line was told yesterday in Firstly Watch now next Supports at 6194:-

Next supports are at 6194 and slipping towards it can not be ruled out today

As was told same happened today and bottom formation at 6,208.70 after whole day slipping from intraday higher levels. Although correction is on but sustaining beyond 6194 should be firstly watched today because that will give deeper correction or correction completion confirmation.

As impulsive Wave-3 is on towards 6724.60 and on going down moves are only very Short Term correction therefore only limited down moves up to next supports(6194) were considered and those were seen in previous sessions. As consolidation patterns formations also seen today therefore if Nifty sustain above 6194 tomorrow then that will be very short term correction completion confirmation and then rally above all time high of Nifty will be seen in the coming weeks.

Pre-closing Outlook(06-11-2013)

Market is now trading near the lowest of the day but today intraday charts are showing only some selling patterns at higher levels and on the contrary consolidation patterns have also seen therefore emergence of on going correction completion signals.

view is cautious today and deeper correction should be considered only after sustaining below 6194,finally sustaining above 6194 will mean rally continuation after correction completion..

view is cautious today and deeper correction should be considered only after sustaining below 6194,finally sustaining above 6194 will mean rally continuation after correction completion..

Mid-session Outlook(06-11-2013)

Although selling at higher levels but down moves are also not showing required force therefore view is cautious and deeper correction should be considered only after sustaining below 6194.

Firstly Watch now next Supports at 6194

Technical Analysis and Market Outlook

(06-11-2013)

Nifty-Intra Day Chart (Nov 01 to Nov 01,2013):- |

| Just click on chart for its enlarged view |

1- Selling in Muhurat Trading session on 03-11-2013

2- Higher levels selling on 05-11-2013

3- Lower levels supports on 05-11-2013

4- 2 Sessions actual trading between 6244-6333

Conclusions from 2 Sessions intra day chart analysis

All trends are up but Short Term Indicators were overbought and sentiment was too much heated therefore we started to tell for very Short Term correction possibility from 01-11-2013 and it was seen also in both next sessions on 3rd and 5th November. As both higher levels selling and lower levels supports between 6244-6304 therefore Nifty closed between this range yesterday but very Short Term correction is on and some more correction can not be ruled out today because most Asian markets are in Red today morning.

Next supports are at 6194 and slipping towards it can not be ruled out today because correction is on but sustaining beyond 6194 should be firstly watched today because that will give deeper correction or correction completion confirmation. As impulsive Wave-3 is on towards 6724.60 and on going down moves are only very Short Term correction therefore only limited down moves upto 6194 are being considered at this moment.

Mid-session Outlook(05-11-2013)

Although all trends are up but good intraday selling on 01-11-2013 therefore very Short Term correction within next 1/2 sessions was told which was seen immediately after opening today. As support also seen at 6248 today therefore sideways market will be seen between 6194-6330 and expected that Nifty will prepare for next decisive moves within this range and:-

1- Above 6330 will mean rally continuation after very Short Term correction completion within sideways market.

2- Below 6194 will mean deeper correction.

1- Above 6330 will mean rally continuation after very Short Term correction completion within sideways market.

2- Below 6194 will mean deeper correction.

Firstly sustaining beyond 6194-6330 should be watched now for next trend confirmations.

Correction continuation

Post-open Outlook(05-11-2013)

Post-open Outlook(05-11-2013)

When all Business News Channels and websites were telling for most Bullish and immediate rally then we told following lines in "Correction in Muhurat Trading session on 03-11-2013 on 01-11-2013":-

"finally Nifty will not sustain above today highest(6330) and will slip as well as close below today lowest(6293)"

As was told almost same happened and:-

1- Nifty could not sustain above 6330 in Muhurat Trading session on 03-11-2013.

2- Nifty opened below 6293 at 6282.15 today(immediate next trading session).

3- Correction is on and Nifty is more than 60 points down now with lowest formation at 6256.

Following line was told in both Mid-session Outlooks on 01-11-2013:-

very Short Term correction possibility in the coming 1/2 sessions.

As was told 100% same happened within 1/2 sessions and very Short Term correction is being seen today,deeper correction will get confirmation after sustaining below 6194.

Subscribe to:

Comments (Atom)