Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

FII & DII trading activity in Capital Market Segment on 12-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(12-Apr-2013)

Main features of today trading are as follows

RatiosIndex Options Put Call Ratio: 1.02

Total Options Put Call Ratio: 1.00

Nifty P/E Ratio(12-Apr-2013): 16.71

Advances & Declines

BSE Advances : 1,031

BSE Declines : 1,275

NSE Advances : 548

NSE Declines : 761

Nifty Open Interest Changed Today

Nifty- 5400 CE(Apr)- -37,550(-3.74%)

Nifty- 5400 PE(Apr)- -529,000(-7.46%)

Nifty- 5500 CE(Apr)- 769,650(27.87%)

Nifty- 5500 PE(Apr)- -769,250(-10.44%)

Nifty- 5600 CE(Apr)- 1,208,750(20.79%)

Nifty- 5600 PE(Apr)- -871,800(-13.85%)

Nifty- 5700 CE(Apr)- 585,900(7.87%)

Nifty- 5700 PE(Apr)- -204,100(-7.62%)

Nifty- 5800 CE(Apr)- 303,400(4.35%)

Nifty- 5800 PE(Apr)- -176,300(-13.20%)

Closing

Sensex- closed at 18,242.56(-299.64 Points & -1.62%)

Nifty- closed at 5,528.55(-65.45 Points & -1.17%)

CNX Midcap - closed at 7,419.55(-6.00 Points & -0.08%)

CNX Smallcap- closed at 3,129.00(-11.50 Points & -0.37%)

Nifty Spot-Levels & Trading Strategy for 15-04-2013

Nifty Spot-Levels

R3 5600

R2 5572

R1 5550

Avg 5522

S1 5500

S2 5472

S3 5450

Nifty Spot-Trading Strategy

H6 5578 Trgt 2

H5 5566 Trgt 1

H4 5555 Long breakout

H3 5541 Go Short

H2 5537

H1 5532

L1 5523

L2 5518

L3 5514 Long

L4 5500 Short Breakout

L5 5489 Trgt 1

L6 5477 Trgt 2

R3 5600

R2 5572

R1 5550

Avg 5522

S1 5500

S2 5472

S3 5450

Nifty Spot-Trading Strategy

H6 5578 Trgt 2

H5 5566 Trgt 1

H4 5555 Long breakout

H3 5541 Go Short

H2 5537

H1 5532

L1 5523

L2 5518

L3 5514 Long

L4 5500 Short Breakout

L5 5489 Trgt 1

L6 5477 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 15-04-2013

Nifty(Apr Fut)-Levels

R3 5608

R2 5585

R1 5560

Avg 5537

S1 5512

S2 5489

S3 5464

Nifty(Apr Fut)-Trading Strategy

H6 5583 Trgt 2

H5 5572 Trgt 1

H4 5561 Long breakout

H3 5548 Go Short

H2 5543

H1 5539

L1 5530

L2 5526

L3 5521 Long

L4 5508 Short Breakout

L5 5497 Trgt 1

L6 5486 Trgt 2

R3 5608

R2 5585

R1 5560

Avg 5537

S1 5512

S2 5489

S3 5464

Nifty(Apr Fut)-Trading Strategy

H6 5583 Trgt 2

H5 5572 Trgt 1

H4 5561 Long breakout

H3 5548 Go Short

H2 5543

H1 5539

L1 5530

L2 5526

L3 5521 Long

L4 5508 Short Breakout

L5 5497 Trgt 1

L6 5486 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 15-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11806

R2 11626

R1 11513

Avg 11333

S1 11220

S2 11040

S3 10927

Bank Nifty(Apr Fut)-Trading Strategy

H6 11700 Trgt 2

H5 11631 Trgt 1

H4 11562 Long breakout

H3 11481 Go Short

H2 11454

H1 11427

L1 11374

L2 11347

L3 11320 Long

L4 11239 Short Breakout

L5 11170 Trgt 1

L6 11101 Trgt 2

R3 11806

R2 11626

R1 11513

Avg 11333

S1 11220

S2 11040

S3 10927

Bank Nifty(Apr Fut)-Trading Strategy

H6 11700 Trgt 2

H5 11631 Trgt 1

H4 11562 Long breakout

H3 11481 Go Short

H2 11454

H1 11427

L1 11374

L2 11347

L3 11320 Long

L4 11239 Short Breakout

L5 11170 Trgt 1

L6 11101 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Apr 15 to Apr 18,2013)

Nifty Spot-Weekly Levels

R3 5734

R2 5672

R1 5600

Avg 5538

S1 5466

S2 5404

S3 5332

Nifty Spot-Weekly Trading Strategy

H6 5663 Trgt 2

H5 5632 Trgt 1

H4 5601 Long breakout

H3 5564 Go Short

H2 5552

H1 5540

L1 5515

L2 5503

L3 5491 Long

L4 5454 Short Breakout

L5 5423 Trgt 1

L6 5392 Trgt 2

R3 5734

R2 5672

R1 5600

Avg 5538

S1 5466

S2 5404

S3 5332

Nifty Spot-Weekly Trading Strategy

H6 5663 Trgt 2

H5 5632 Trgt 1

H4 5601 Long breakout

H3 5564 Go Short

H2 5552

H1 5540

L1 5515

L2 5503

L3 5491 Long

L4 5454 Short Breakout

L5 5423 Trgt 1

L6 5392 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Apr 15 to Apr 18,2013)

Bank Nifty Spot-Weekly Levels

R3 12159

R2 11801

R1 11605

Avg 11247

S1 11051

S2 10693

S3 10497

Bank Nifty Spot-Weekly Trading Strategy

H6 11990 Trgt 2

H5 11852 Trgt 1

H4 11714 Long breakout

H3 11562 Go Short

H2 11511

H1 11460

L1 11359

L2 11308

L3 11257 Long

L4 11105 Short Breakout

L5 10967 Trgt 1

L6 10829 Trgt 2

R3 12159

R2 11801

R1 11605

Avg 11247

S1 11051

S2 10693

S3 10497

Bank Nifty Spot-Weekly Trading Strategy

H6 11990 Trgt 2

H5 11852 Trgt 1

H4 11714 Long breakout

H3 11562 Go Short

H2 11511

H1 11460

L1 11359

L2 11308

L3 11257 Long

L4 11105 Short Breakout

L5 10967 Trgt 1

L6 10829 Trgt 2

Mid-session Outlook(12-04-2013)

Although first 3 hours trading without selling patterns between 5522-5543 but this range broken down because sentiment is depressed today therefore immediate much down moves not seen. As some supports also seen at lower levels today therefore Very Short Term view is not bearish and break out of today actual trading range(5508-5543) should be watched for next moves confirmations towards next wider trading range(5478-5610)

Post-open Outlook(12-04-2013)

When INFY was trading near the top of day after gaining more than Rs 100/- then following line was told yesterday at 02:29 PM in Pre-Closing Outlook:-

As INFY was more than 30% up after previous results therefore selling can not be ruled out on the back of such bullish psychology today

Technical positions have already been updated in Technical Analysis and Market Outlook(12-04-2013) and INFY results led volatility today. As technical reverses sharply in such volatility therefore next moves will get confirmations after stabilising of market.

It should be kept in mind that Technically nothing is left for Bulls after crucial levels broken down confirmations but FIIs bought more than 3200 Cr in Stock Futures during April 2013 and they were net buyers daily therefore firstly valid break out previous 2 sessions trading range(5478-5610) should be firstly watched for next trend confirmations because both buying and selling seen within this range and Nifty is trading within this range today amid most depressing sentiments.

As INFY was more than 30% up after previous results therefore selling can not be ruled out on the back of such bullish psychology today

As was told same happened and INFY is down more than 17% today after yesterday selling.

Technical positions have already been updated in Technical Analysis and Market Outlook(12-04-2013) and INFY results led volatility today. As technical reverses sharply in such volatility therefore next moves will get confirmations after stabilising of market.

It should be kept in mind that Technically nothing is left for Bulls after crucial levels broken down confirmations but FIIs bought more than 3200 Cr in Stock Futures during April 2013 and they were net buyers daily therefore firstly valid break out previous 2 sessions trading range(5478-5610) should be firstly watched for next trend confirmations because both buying and selling seen within this range and Nifty is trading within this range today amid most depressing sentiments.

Technical Analysis and Market Outlook(12-04-2013)

Nifty-Intra Day Chart (11-Apr-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling between 5574-5589

2- Support between 5542-5562

3- High volatility in last 2 hours

3- Whole day actual trading between 5542-5610

Totally mixed patterns and technical positions reverses also during High volatility therefore Indian markets are not prepared for any side decisive moves in the coming session. As Following 3 news today therefore again high volatility can not be ruled out:-

1- INFY results.

2- IIP numbers.

3- Inflation data.

Following crucial levels have already been broken down:-

1- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

2- 5629.95(Top of Wave 1)

3- Long Term Trend decider 200 Day DMA at 5650 on 11-04-2012

4- Long Term Trend decider 200 Day EMA at 5666 on 11-04-2012

Although Bearish market confirmations through breaking down of above levels and until Nifty will not close and sustain above Long Term Trend decider 200 Day EMA(5666) till then trend reversal will not be considered but positive moves indication also due to following reasons:-

1- Nifty closed 5548.35 in last 2 sessions.

2- Lower levels supports also seen in last 2 sessions.

3- FIIs bought more than 3200 Cr in Stock Futures during April 2013 and they were net buyers daily.

Such high buying in Stock Futures does also mean that sentiment made depressed through Indices stocks and Futures selling and making long positions created through Stock Futures buying therefore emergence of 1st signal of up moves and coming sessions follow up positions will decide next trend.

Technically nothing is left for Bulls after above mentioned all crucial levels broken down confirmations but above mentioned 3 indications of Positive markets also seen therefore firstly valid break out of previous 2 sessions trading range(5478-5610) should be firstly watched for next trend confirmations because both buying and selling seen within this range.

|

| Just click on chart for its enlarged view |

1- Selling between 5574-5589

2- Support between 5542-5562

3- High volatility in last 2 hours

3- Whole day actual trading between 5542-5610

Conclusions from intra day chart analysis

Totally mixed patterns and technical positions reverses also during High volatility therefore Indian markets are not prepared for any side decisive moves in the coming session. As Following 3 news today therefore again high volatility can not be ruled out:-

1- INFY results.

2- IIP numbers.

3- Inflation data.

Following crucial levels have already been broken down:-

1- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

2- 5629.95(Top of Wave 1)

3- Long Term Trend decider 200 Day DMA at 5650 on 11-04-2012

4- Long Term Trend decider 200 Day EMA at 5666 on 11-04-2012

Although Bearish market confirmations through breaking down of above levels and until Nifty will not close and sustain above Long Term Trend decider 200 Day EMA(5666) till then trend reversal will not be considered but positive moves indication also due to following reasons:-

1- Nifty closed 5548.35 in last 2 sessions.

2- Lower levels supports also seen in last 2 sessions.

3- FIIs bought more than 3200 Cr in Stock Futures during April 2013 and they were net buyers daily.

Such high buying in Stock Futures does also mean that sentiment made depressed through Indices stocks and Futures selling and making long positions created through Stock Futures buying therefore emergence of 1st signal of up moves and coming sessions follow up positions will decide next trend.

Technically nothing is left for Bulls after above mentioned all crucial levels broken down confirmations but above mentioned 3 indications of Positive markets also seen therefore firstly valid break out of previous 2 sessions trading range(5478-5610) should be firstly watched for next trend confirmations because both buying and selling seen within this range.

FII & DII trading activity in Capital Market Segment on 11-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(11-Apr-2013)

Main features of today trading are as follows

RatiosIndex Options Put Call Ratio: 1.01

Total Options Put Call Ratio: 0.98

Nifty P/E Ratio(11-Apr-2013): 16.83

Advances & Declines

BSE Advances : 869

BSE Declines : 812

NSE Advances : 700

NSE Declines : 611

Nifty Open Interest Changed Today

Nifty- 5700 CE(Apr)- -362,500(-11.60%)

Nifty- 5700 PE(Apr)- 1,228,100(20.00%)

Nifty- 5800 CE(Apr)- -145,200(-2.44%)

Nifty- 5800 PE(Apr)- 628,450(11.09%)

Nifty- 5700 CE(Apr)- -863,150(-10.39%)

Nifty- 5700 PE(Apr)- 151,650(6.00%)

Nifty- 5800 CE(Apr)- -767,200(-9.91%)

Nifty- 5800 PE(Apr)- -47,550(-3.44%)

Closing

Sensex- closed at 18,542.20(127.75 Points & 0.69%)

Nifty- closed at 5,594.00(35.30 Points & 0.64%)

CNX Midcap - closed at 7,425.55(-9.25 Points & -0.12%)

CNX Smallcap- closed at 3,140.50(2.25 Points & 0.07 %)

Nifty Spot-Levels & Trading Strategy for 12-04-2013

Nifty Spot-Levels

R3 5690

R2 5650

R1 5622

Avg 5582

S1 5554

S2 5514

S3 5486

Trading Strategy

H6 5662 Trgt 2

H5 5647 Trgt 1

H4 5631 Long breakout

H3 5612 Go Short

H2 5606

H1 5600

L1 5587

L2 5581

L3 5575 Long

L4 5556 Short Breakout

L5 5540 Trgt 1

L6 5525 Trgt 2

R3 5690

R2 5650

R1 5622

Avg 5582

S1 5554

S2 5514

S3 5486

Trading Strategy

H6 5662 Trgt 2

H5 5647 Trgt 1

H4 5631 Long breakout

H3 5612 Go Short

H2 5606

H1 5600

L1 5587

L2 5581

L3 5575 Long

L4 5556 Short Breakout

L5 5540 Trgt 1

L6 5525 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 12-04-2013

Nifty(Apr Fut)-Levels

R3 5701

R2 5659

R1 5626

Avg 5584

S1 5551

S2 5509

S3 5476

Nifty(Apr Fut)-Trading Strategy

H6 5669 Trgt 2

H5 5652 Trgt 1

H4 5635 Long breakout

H3 5614 Go Short

H2 5607

H1 5600

L1 5587

L2 5580

L3 5573 Long

L4 5552 Short Breakout

L5 5535 Trgt 1

L6 5518 Trgt 2

R3 5701

R2 5659

R1 5626

Avg 5584

S1 5551

S2 5509

S3 5476

Nifty(Apr Fut)-Trading Strategy

H6 5669 Trgt 2

H5 5652 Trgt 1

H4 5635 Long breakout

H3 5614 Go Short

H2 5607

H1 5600

L1 5587

L2 5580

L3 5573 Long

L4 5552 Short Breakout

L5 5535 Trgt 1

L6 5518 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 12-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11586

R2 11467

R1 11388

Avg 11269

S1 11190

S2 11071

S3 10992

Bank Nifty(Apr Fut)-Trading Strategy

H6 11509 Trgt 2

H5 11463 Trgt 1

H4 11417 Long breakout

H3 11363 Go Short

H2 11345

H1 11327

L1 11290

L2 11272

L3 11254 Long

L4 11200 Short Breakout

L5 11154 Trgt 1

L6 11108 Trgt 2

R3 11586

R2 11467

R1 11388

Avg 11269

S1 11190

S2 11071

S3 10992

Bank Nifty(Apr Fut)-Trading Strategy

H6 11509 Trgt 2

H5 11463 Trgt 1

H4 11417 Long breakout

H3 11363 Go Short

H2 11345

H1 11327

L1 11290

L2 11272

L3 11254 Long

L4 11200 Short Breakout

L5 11154 Trgt 1

L6 11108 Trgt 2

Pre-Closing Outlook(11-04-2013)

Sharp fall after first 3 hours selling indications between 5574-5589 and formation of new intraday low at 5542.85 but equally fast recovery and new trading high formation at 5610 which is above Next resistance(5590-5600). 3 Following news tomorrow:-

1- INFY results.

2- IIP numbers.

3- Inflation data.

Pull Back rally continuation as per expectations and further up moves will depend on above news tomorrow but decisive rally confirmation will be after sustaining above those levels which have been updated in following topic yesterday:-

As INFY was more than 30% up after previous results therefore selling can not be ruled out on the back of such bullish psychology today. Let Nifty sustain above 5600 then up moves will be considered otherwise only intraday volatility and finally down moves because selling during first 3 hours today.

1- INFY results.

2- IIP numbers.

3- Inflation data.

Pull Back rally continuation as per expectations and further up moves will depend on above news tomorrow but decisive rally confirmation will be after sustaining above those levels which have been updated in following topic yesterday:-

As INFY was more than 30% up after previous results therefore selling can not be ruled out on the back of such bullish psychology today. Let Nifty sustain above 5600 then up moves will be considered otherwise only intraday volatility and finally down moves because selling during first 3 hours today.

Mid-session Outlook(11-04-2013)

Next resistance is between 5590-5600 and today first 3 hours trading between 5574-5589 with selling indications therefore development of down moves possibilities.

Pull Back Rally Continuation

Nifty-Intra Day Chart (10-Apr-2013):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 5488-5518

2- Sudden volatility

3- Up moves in Rising Channel which broken down also in last 15 minutes.

3- Whole day actual trading between 5478-5569

Recovery from lower levels after first 3 hours consolidation and after that high volatility with both side new highs and lows formations. Finally up moves seen in Rising Channel during last hours but Rising Channel broken down also in last 15 minutes. Sentiment was extremely depressed due to 5 crucial levels broken down confirmation therefore Bounce back(Pull Back rally) was expected and that was seen also but complete consolidation patterns are required for any decisive rally and at present only Pull Back rally continuation will be considered.

US markets are more than 1% up at this moment and such closing today will mean strong sentiment tomorrow morning and all the Asian markets may be strong resultant Gap Up opening can not be ruled out in Indian markets but all trends are down and multiple resistances at higher levels therefore until Nifty will not sustain above Long Term Trend decider 200 Day EMA(today at 5666) till then any decisive rally will not be considered. Sustaining above following levels will give next up moves confirmations one by one and failure will result down moves continuation but after fresh selling patterns formations:-

1- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

2- 5629.95(Top of Wave 1)

3- Long Term Trend decider 200 Day DMA at 5647 on 10-04-2012

|

| Just click on chart for its enlarged view |

1- Consolidation between 5488-5518

2- Sudden volatility

3- Up moves in Rising Channel which broken down also in last 15 minutes.

3- Whole day actual trading between 5478-5569

Conclusions from intra day chart analysis

Recovery from lower levels after first 3 hours consolidation and after that high volatility with both side new highs and lows formations. Finally up moves seen in Rising Channel during last hours but Rising Channel broken down also in last 15 minutes. Sentiment was extremely depressed due to 5 crucial levels broken down confirmation therefore Bounce back(Pull Back rally) was expected and that was seen also but complete consolidation patterns are required for any decisive rally and at present only Pull Back rally continuation will be considered.

US markets are more than 1% up at this moment and such closing today will mean strong sentiment tomorrow morning and all the Asian markets may be strong resultant Gap Up opening can not be ruled out in Indian markets but all trends are down and multiple resistances at higher levels therefore until Nifty will not sustain above Long Term Trend decider 200 Day EMA(today at 5666) till then any decisive rally will not be considered. Sustaining above following levels will give next up moves confirmations one by one and failure will result down moves continuation but after fresh selling patterns formations:-

1- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

2- 5629.95(Top of Wave 1)

3- Long Term Trend decider 200 Day DMA at 5647 on 10-04-2012

FII & DII trading activity in Capital Market Segment on 10-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(10-Apr-2013)

Main features of today trading are as follows

RatiosIndex Options Put Call Ratio:0.90

Total Options Put Call Ratio:0.88

Nifty P/E Ratio(10-Apr-2013):16.75

Advances & Declines

BSE Advances : 848

BSE Declines : 847

NSE Advances : 689

NSE Declines : 628

Nifty Open Interest Changed Today

Nifty- 5500 CE(Apr)- -269,050(-7.93%)

Nifty- 5500 PE(Apr)- 653,050(11.90%)

Nifty- 5600 CE(Apr)- -49,600(-0.83%)

Nifty- 5600 PE(Apr)- -210,200(-3.58%)

Nifty- 5700 CE(Apr)- -214,100(-2.51%)

Nifty- 5700 PE(Apr)- -408,000(-13.90%)

Nifty- 5800 CE(Apr)- -533,700(-6.45%)

Nifty- 5800 PE(Apr)- -94,000(-6.36%)

Nifty- 5900 CE(Apr)- -20,950(-0.33%)

Nifty- 5900 PE(Apr)- -38,750(-4.57%)

Closing

Sensex- closed at 18,414.45(187.97 Points & 1.03%)

Nifty- closed at 5,558.70(63.60 Points & 1.16%)

CNX Midcap - closed at 7,434.80(64.15 Points & 0.87%)

CNX Smallcap- closed at 3,138.25(21.55 Points & 0.69%)

Nifty Spot-Levels & Trading Strategy for 11-04-2013

Nifty Spot-Levels

R3 5684

R2 5626

R1 5592

Avg 5534

S1 5500

S2 5442

S3 5408

Nifty Spot-Trading Strategy

H6 5651 Trgt 2

H5 5629 Trgt 1

H4 5608 Long breakout

H3 5583 Go Short

H2 5574

H1 5566

L1 5549

L2 5541

L3 5532 Long

L4 5507 Short Breakout

L5 5486 Trgt 1

L6 5464 Trgt 2

R3 5684

R2 5626

R1 5592

Avg 5534

S1 5500

S2 5442

S3 5408

Nifty Spot-Trading Strategy

H6 5651 Trgt 2

H5 5629 Trgt 1

H4 5608 Long breakout

H3 5583 Go Short

H2 5574

H1 5566

L1 5549

L2 5541

L3 5532 Long

L4 5507 Short Breakout

L5 5486 Trgt 1

L6 5464 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 11-04-2013

Nifty(Apr Fut)-Levels

R3 5697

R2 5637

R1 5600

Avg 5540

S1 5503

S2 5443

S3 5406

Nifty(Apr Fut)-Trading Strategy

H6 5661 Trgt 2

H5 5638 Trgt 1

H4 5616 Long breakout

H3 5589 Go Short

H2 5580

H1 5571

L1 5554

L2 5545

L3 5536 Long

L4 5509 Short Breakout

L5 5487 Trgt 1

L6 5464 Trgt 2

R3 5697

R2 5637

R1 5600

Avg 5540

S1 5503

S2 5443

S3 5406

Nifty(Apr Fut)-Trading Strategy

H6 5661 Trgt 2

H5 5638 Trgt 1

H4 5616 Long breakout

H3 5589 Go Short

H2 5580

H1 5571

L1 5554

L2 5545

L3 5536 Long

L4 5509 Short Breakout

L5 5487 Trgt 1

L6 5464 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 11-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11498

R2 11332

R1 11236

Avg 11070

S1 10974

S2 10808

S3 10712

Bank Nifty(Apr Fut)-Trading Strategy

H6 11407 Trgt 2

H5 11345 Trgt 1

H4 11284 Long breakout

H3 11212 Go Short

H2 11188

H1 11164

L1 11115

L2 11091

L3 11067 Long

L4 10995 Short Breakout

L5 10934 Trgt 1

L6 10872 Trgt 2

R3 11498

R2 11332

R1 11236

Avg 11070

S1 10974

S2 10808

S3 10712

Bank Nifty(Apr Fut)-Trading Strategy

H6 11407 Trgt 2

H5 11345 Trgt 1

H4 11284 Long breakout

H3 11212 Go Short

H2 11188

H1 11164

L1 11115

L2 11091

L3 11067 Long

L4 10995 Short Breakout

L5 10934 Trgt 1

L6 10872 Trgt 2

Mid-session Outlook(10-04-2013)

First 3 hours trading with consolidation pattern between 5488-5518 and after that high volatility as well as both side high and low broken out. Although finally bounce seen today but until complete consolidation will not happen till then any decisive rally will not be seen and only Pull Back rally will be considered at this moment after sustaining above 5548.35.

Pre-open Outlook(10-04-2013)

Short term indicators are oversold and yesterday closing within gap supports range(447.45-5526.95) as well as sentiment is positive after Green closing in US markets therefore some up moves and Pull Back Rally can not be ruled out but until Nifty will not sustain above Long Term Trend decider 200 Day EMA(today at 5667) till then any decisive rally will not be considered.

Bearish phase after crucial levels breaking down confirmations

Nifty-EOD Chart (01-Apr-2013):-

Technical Patterns and Formations in EOD charts

1- 4531.15 on 20-12-2011(Wave-3 beginning after 13 Months Wave-2 correction completion)

2- Wave 1(5629.95 on 22-02-2012)

3- Wave 2(4770.35 on 04-06-2012)

4- Wave 3(6111.80 on 29-01-2013)

5- Wave 4 correction beginning

6- Wave 4 bottom formation at 5487.00 on 09-04-2012

7- 200 Day EMA at 5667 on 09-04-2012

8- 200 Day DMA at 5645 on 09-04-2012

9- Neckline broken down of almost 7 months old Huge Bearish Head and Shoulders pattern which started on 14-09-2012.

Following crucial levels broken down confirmation:-

1- 5629.95(Top of Wave 1)

2- Long Term Trend decider 200 Day EMA at 5667 on 09-04-2012

3- Long Term Trend decider 200 Day DMA at 5645 on 09-04-2012

4- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

5- Neckline of almost 7 months old Huge Bearish Head and Shoulders pattern

Bearish phase beginning after breaking down confirmation of above most crucial levels and testing possibility of unbelievable lower levels in the coming months. Next supports are as follows which may generate Pull Back Rally:-

1- Gap Support between 5447.45-5526.95

2- Gap Support between 5260.60-5309.20

3- Support at 5215.70

4- Support at 5032.40

5- Support at 4770.35

|

| Just click on chart for its enlarged view |

1- 4531.15 on 20-12-2011(Wave-3 beginning after 13 Months Wave-2 correction completion)

2- Wave 1(5629.95 on 22-02-2012)

3- Wave 2(4770.35 on 04-06-2012)

4- Wave 3(6111.80 on 29-01-2013)

5- Wave 4 correction beginning

6- Wave 4 bottom formation at 5487.00 on 09-04-2012

7- 200 Day EMA at 5667 on 09-04-2012

8- 200 Day DMA at 5645 on 09-04-2012

9- Neckline broken down of almost 7 months old Huge Bearish Head and Shoulders pattern which started on 14-09-2012.

Conclusions from EOD chart analysis

Following crucial levels broken down confirmation:-

1- 5629.95(Top of Wave 1)

2- Long Term Trend decider 200 Day EMA at 5667 on 09-04-2012

3- Long Term Trend decider 200 Day DMA at 5645 on 09-04-2012

4- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

5- Neckline of almost 7 months old Huge Bearish Head and Shoulders pattern

Bearish phase beginning after breaking down confirmation of above most crucial levels and testing possibility of unbelievable lower levels in the coming months. Next supports are as follows which may generate Pull Back Rally:-

1- Gap Support between 5447.45-5526.95

2- Gap Support between 5260.60-5309.20

3- Support at 5215.70

4- Support at 5032.40

5- Support at 4770.35

Nifty(Apr Fut)- Intraday Trading levels , Strategy and Targets for 10-04-2013

-------------------------------------------------

Buy at or above:-5513

-------------------------------

1st Targets:5528

2nd Targets:5547

3rd Targets:5566

4th Targets:5584

-------------------------------

Stop Loss:5494

-------------------------------------------------

Sell at or below:-5494

-------------------------------

1st Targets:5478

2nd Targets:5460

3rd Targets:5441

4th Targets:5423

-------------------------------

Stop Loss:5513

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

6- Firstly go through today Outlooks also for better profits and more accuracy.

Bank Nifty(Apr Fut)- Intraday Trading levels,Strategy and Targets for 10-04-2013

-------------------------------------------------

Buy at or above:-10946

-------------------------------

1st Targets:10967

2nd Targets:10993

3rd Targets:11019

4th Targets:11045

-------------------------------

Stop Loss:10920

-------------------------------------------------

Sell at or below:-10920

-------------------------------

1st Targets:10899

2nd Targets:10873

3rd Targets:10847

4th Targets:10821

-------------------------------

Stop Loss:10946

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

Buy at or above:-10946

-------------------------------

1st Targets:10967

2nd Targets:10993

3rd Targets:11019

4th Targets:11045

-------------------------------

Stop Loss:10920

-------------------------------------------------

Sell at or below:-10920

-------------------------------

1st Targets:10899

2nd Targets:10873

3rd Targets:10847

4th Targets:10821

-------------------------------

Stop Loss:10946

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

FII & DII trading activity in Capital Market Segment on 09-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(09-Apr-2013)

Main features of today trading are as follows

Ratios

Index Options Put Call Ratio:0.93

Total Options Put Call Ratio:0.90

Nifty P/E Ratio(09-Apr-2013):16.59

Advances & Declines

BSE Advances : 544

BSE Declines :1,147

NSE Advances : 419

NSE Declines : 902

Nifty Open Interest Changed Today

Nifty- 5300 CE(Apr)- 18,400(5.18%)

Nifty- 5300 PE(Apr)- -224,650(-5.48%)

Nifty- 5400 CE(Apr)- 312,250(42.16%)

Nifty- 5400 PE(Apr)- 745,450(17.25%)

Nifty- 5500 CE(Apr)- 1,537,050(82.82%)

Nifty- 5500 PE(Apr)- -190,050(-3.35%)

Nifty- 5600 CE(Apr)- 531,300(9.70%)

Nifty- 5600 PE(Apr)- 367,800(6.68%)

Nifty- 5700 CE(Apr)- -191,950(-2.20%)

Nifty- 5700 PE(Apr)- -712,550(-19.53%)

Closing

Sensex- closed at 18,226.48(-211.30 Points & -1.15%)

Nifty- closed at 5,495.10(-47.85 Points & -0.86%)

CNX Midcap - closed at 7,370.65(-58.95 Points & -0.79%)

CNX Smallcap- closed at 1,925.55(-21.00 Points & -1.08%)

Nifty Spot-Levels & Trading Strategy for 10-04-2013

Nifty Spot-Levels

3 5685

R2 5644

R1 5569

Avg 5528

S1 5453

S2 5412

S3 5337

Nifty Spot-Trading Strategy

H6 5611 Trgt 2

H5 5584 Trgt 1

H4 5558 Long breakout

H3 5526 Go Short

H2 5516

H1 5505

L1 5484

L2 5473

L3 5463 Long

L4 5431 Short Breakout

L5 5405 Trgt 1

L6 5378 Trgt 2

3 5685

R2 5644

R1 5569

Avg 5528

S1 5453

S2 5412

S3 5337

Nifty Spot-Trading Strategy

H6 5611 Trgt 2

H5 5584 Trgt 1

H4 5558 Long breakout

H3 5526 Go Short

H2 5516

H1 5505

L1 5484

L2 5473

L3 5463 Long

L4 5431 Short Breakout

L5 5405 Trgt 1

L6 5378 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 10-04-2013

Nifty(Apr Fut)-Levels

R3 5711

R2 5666

R1 5583

Avg 5538

S1 5455

S2 5410

S3 5327

Nifty(Apr Fut)-Trading Strategy

H6 5628 Trgt 2

H5 5599 Trgt 1

H4 5570 Long breakout

H3 5535 Go Short

H2 5523

H1 5511

L1 5488

L2 5476

L3 5464 Long

L4 5429 Short Breakout

L5 5400 Trgt 1

L6 5371 Trgt 2

R3 5711

R2 5666

R1 5583

Avg 5538

S1 5455

S2 5410

S3 5327

Nifty(Apr Fut)-Trading Strategy

H6 5628 Trgt 2

H5 5599 Trgt 1

H4 5570 Long breakout

H3 5535 Go Short

H2 5523

H1 5511

L1 5488

L2 5476

L3 5464 Long

L4 5429 Short Breakout

L5 5400 Trgt 1

L6 5371 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 10-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11477

R2 11362

R1 11153

Avg 11038

S1 10829

S2 10714

S3 10505

Bank Nifty(Apr Fut)-Trading Strategy

H6 11268 Trgt 2

H5 11195 Trgt 1

H4 11122 Long breakout

H3 11033 Go Short

H2 11003

H1 10973

L1 10914

L2 10884

L3 10854 Long

L4 10765 Short Breakout

L5 10692 Trgt 1

L6 10619 Trgt 2

R3 11477

R2 11362

R1 11153

Avg 11038

S1 10829

S2 10714

S3 10505

Bank Nifty(Apr Fut)-Trading Strategy

H6 11268 Trgt 2

H5 11195 Trgt 1

H4 11122 Long breakout

H3 11033 Go Short

H2 11003

H1 10973

L1 10914

L2 10884

L3 10854 Long

L4 10765 Short Breakout

L5 10692 Trgt 1

L6 10619 Trgt 2

CRUDEOIL-Apr Fut-Selling Trade

CRUDEOIL-Apr Fut-Sell-Intraday/Positional-SL-5126 & TGT-5026-CMP-5092(Lalit39)

Pre-Closing Outlook(09-04-2013)

5535 broken down and with this termination of Bullish markets hopes as well as those crucial levels broken down confirmation which were told in Technical Analysis and Market Outlook(09-04-2013).

Following line was also told and being repeated:-

Following line was also told and being repeated:-

Below 5535 will mean crashing like situation in Indian markets and testing of unbelievable lower levels

Mid-session Outlook-2(09-04-2013)

Although forceful break out of previous 2 sessions trading range but not sustaining at higher levels and again slipping into mentioned range. Now again trading within mentioned range(5535-5575) amid high volatility and no other way but to wait for valid break out of mentioned range for next moves confirmations.

Mid-session Outlook(09-04-2013)

Last 2 sessions trading range(5535-5575) broken out forcefully and out performing Global markets as well therefore first strong indication of impulsive Wave 5 beginning after 48 sessions Wave 4 correction completion and confirmation will be after sustaining above Long Term Trend decider 200 Day EMA(5669).

Post-open Outlook(09-04-2013)

Strong global cues led gap up opening and most time trading within last 2 sessions trading range(5535-5575). Although first 2 minutes trading above 5575 today but its break out confirmation is required and that is must because today positive trading is only Global markets reaction.

Technical Analysis and Market Outlook(09-04-2013)

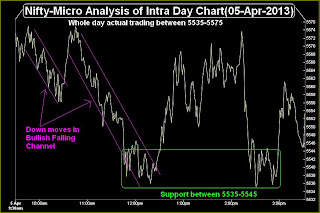

Nifty-Intra Day Chart (Apr 05 & Apr 08,2013):-

Technical Patterns and Formations in last 2 Sessions intraday charts

1- Down moves in Bullish Falling Channel on 05-04-2013

2- Support at lower levels between 5535-5546 in both sessions.

3- Selling Patterns between 5551-5560 on 08-04-2013

4- 2 Sessions actual trading between 5535-5575

Following Crucial levels have been broken down:-

1- 5629.95(Top of Wave 1)

2- 5669(200 Day EMA on 08-04-2012)

3- 5643(200 Day DMA at 08-04-2012)

4- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

Only breaking down confirmations of above levels is left and that will be through valid break out of last 2 sessions 40 points narrow trading range(5535-5575) for following big moves:-

1- Below 5535 will mean crashing like situation in Indian markets and testing of unbelievable lower levels.

2- Above 5575 will mean Wave 5 beginning to form new highs above 6111 but after sustaining above Long Term Trend decider 200 Day EMA(5669)

As last 2 sessions trading with mixed intraday patterns formations between 5535-5575 therefore valid break out of this range must be firstly watched for above mentioned next trend confirmations.

|

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel on 05-04-2013

2- Support at lower levels between 5535-5546 in both sessions.

3- Selling Patterns between 5551-5560 on 08-04-2013

4- 2 Sessions actual trading between 5535-5575

Conclusions from 2 Sessions intra day chart analysis

Following Crucial levels have been broken down:-

1- 5629.95(Top of Wave 1)

2- 5669(200 Day EMA on 08-04-2012)

3- 5643(200 Day DMA at 08-04-2012)

4- 5548.35(Strong support because Wave v begun from this levels after almost 2 months range bound consolidations)

Only breaking down confirmations of above levels is left and that will be through valid break out of last 2 sessions 40 points narrow trading range(5535-5575) for following big moves:-

1- Below 5535 will mean crashing like situation in Indian markets and testing of unbelievable lower levels.

2- Above 5575 will mean Wave 5 beginning to form new highs above 6111 but after sustaining above Long Term Trend decider 200 Day EMA(5669)

As last 2 sessions trading with mixed intraday patterns formations between 5535-5575 therefore valid break out of this range must be firstly watched for above mentioned next trend confirmations.

FII & DII trading activity in Capital Market Segment on 08-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 09-04-2013

Nifty Spot-Levels

R3 5593

R2 5581

R1 5561

Avg 5549

S1 5529

S2 5517

S3 5497

Nifty Spot-Trading Strategy

H6 5574 Trgt 2

H5 5566 Trgt 1

H4 5559 Long breakout

H3 5550 Go Short

H2 5547

H1 5544

L1 5539

L2 5536

L3 5533 Long

L4 5524 Short Breakout

L5 5517 Trgt 1

L6 5509 Trgt 2

R3 5593

R2 5581

R1 5561

Avg 5549

S1 5529

S2 5517

S3 5497

Nifty Spot-Trading Strategy

H6 5574 Trgt 2

H5 5566 Trgt 1

H4 5559 Long breakout

H3 5550 Go Short

H2 5547

H1 5544

L1 5539

L2 5536

L3 5533 Long

L4 5524 Short Breakout

L5 5517 Trgt 1

L6 5509 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 09-04-2013

Nifty(Apr Fut)-Levels

3 5617

R2 5602

R1 5580

Avg 5565

S1 5543

S2 5528

S3 5506

Nifty(Apr Fut)-Trading Strategy

H6 5596 Trgt 2

H5 5587 Trgt 1

H4 5579 Long breakout

H3 5569 Go Short

H2 5565

H1 5562

L1 5555

L2 5552

L3 5548 Long

L4 5538 Short Breakout

L5 5530 Trgt 1

L6 5521 Trgt 2

3 5617

R2 5602

R1 5580

Avg 5565

S1 5543

S2 5528

S3 5506

Nifty(Apr Fut)-Trading Strategy

H6 5596 Trgt 2

H5 5587 Trgt 1

H4 5579 Long breakout

H3 5569 Go Short

H2 5565

H1 5562

L1 5555

L2 5552

L3 5548 Long

L4 5538 Short Breakout

L5 5530 Trgt 1

L6 5521 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 09-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11296

R2 11241

R1 11144

Avg 11089

S1 10992

S2 10937

S3 10840

Bank Nifty(Apr Fut)-Trading Strategy

H6 11199 Trgt 2

H5 11164 Trgt 1

H4 11130 Long breakout

H3 11088 Go Short

H2 11074

H1 11060

L1 11033

L2 11019

L3 11005 Long

L4 10963 Short Breakout

L5 10929 Trgt 1

L6 10894 Trgt 2

R3 11296

R2 11241

R1 11144

Avg 11089

S1 10992

S2 10937

S3 10840

Bank Nifty(Apr Fut)-Trading Strategy

H6 11199 Trgt 2

H5 11164 Trgt 1

H4 11130 Long breakout

H3 11088 Go Short

H2 11074

H1 11060

L1 11033

L2 11019

L3 11005 Long

L4 10963 Short Breakout

L5 10929 Trgt 1

L6 10894 Trgt 2

Pre-Closing Outlook(08-04-2013)

2 Sessions trading between 5535-5575 with good consolidations last Friday and today lower levels supports but selling patterns formations at higher levels also seen today therefore View is cautious and valid break out of mentioned trading range should be firstly watched for next decisive moves and Trend confirmation.

Mid-session Outlook-2(08-04-2013)

Quiet market between 5538-5568 with selling indications at higher levels but lower levels good supports also therefore valid break out of mentioned today trading range will be next decisive moves and Trend confirmation.

Mid-session Outlook(08-04-2013)

Although consolidation patterns formations last Friday but selling indications today therefore view is cautious and will be Bullish only after sustaining above those crucial levels which have been updated in previous Outlook.

View is cautious and not Bearish at this moment because only selling indications today.

View is cautious and not Bearish at this moment because only selling indications today.

NIFTY-Apr Call Option(5700)-Buying of 05-04-2013-Covering

NIFTY-Apr CE(5700)-Bought on 05-04-2013-cover immediately-CMP-26(Lalit39)

NIFTY-Apr Call Option(5700)- Buying of 05-04-2013-Message

NIFTY-Apr CE(5700)- Bought on 05-04-2013-Weak Global markets but just hold and cover after my covering message(Lalit39)

Technical Analysis,Research & Weekly Outlook

(Apr 08 to Apr 12,2013)

Nifty-EOD Chart (05-Apr-2013):- |

| Just click on chart for its enlarged view |

1- 4531.15 on 20-12-2011(Wave-3 beginning after 13 Months Wave-2 correction completion)

2- Wave 1(5629.95 on 22-02-2012)

3- Wave 2(4770.35 on 04-06-2012)

4- Wave 3(6111.80 on 29-01-2013)

5- Wave 4 correction beginning

6- Wave A(5663.60 on 04-03-2012)

7- Wave A retraced 448.20 points.

8- Wave B(5971.20 on 11-03-2012)

9- Wave B gained 307.60 points

7- Wave B(5971.20 on 11-03-2012)

10- Wave C of Wave 4 bottom formation at 5534.70 on 05-04-2012

12- Wave C has retraced 436.50 points yet.

13- Corrective Wave C of Wave 4 continuation.

14- 200 Day EMA at 5670 on 05-04-2012

15- 200 Day DMA at 5641 on 05-04-2012

Nifty-Intra Day Chart (05-Apr-2013):-

|

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel.

2- Support between 5535-5545

3- Whole day actual trading between 5535-5575

Conclusions (After Putting All Studies Together)

As Per Elliot Wave Theory:-

The bottom of Wave-4 should not dip below the top of Wave 1,at least on a closing basis.

Top of Wave 1 is at 5629.95 and Nifty closed below it in last 2 sessions therefore it means recounting of Waves which started from 4531.15 on 20-12-2011 but as per our view last 2 sessions down closing was due to negative news flow from Global markets therefore breaking down confirmation is required through sustaining below 5629.95. Although Nifty closed below 200 Day EMA and DMA but Long Term Trend turning down confirmation is required yet through sustaining below both mentioned Averages.

Following target with following calculation was told on 26-03-2013 in Long Term Trend is at stake:-

ABC Waves of Wave 4 continuation and Wave A retraced 448.20 points therefore equal 100% retracement of Wave c can not be ruled out. Wave C correction continuation is expectd target is at:-

5971.20(Wave B)-448.20(Wave A lost)=5523.00

As bottom formation at 5534.70 on 05-04-2012 which is near above given target therefore possibility of Wave 4 correction completion is still alive. Previous week down moves were due to weaker Global cues therefore finally sustaining beyond following levels will be next trend confirmations and should be firstly watched in next week:-

1- 5629.95(Top of Wave 1)

2- 5670(200 Day EMA on 05-04-2012)

3- 5641(200 Day DMA at 05-04-2012)

Although negative closing last Friday but consolidation patterns formation through Down moves in Bullish Falling Channel and lower levels supports as well therefore strong indications of up moves in the beginning of next week.

Nifty(Apr Fut)- Intraday Trading levels , Strategy and Targets for 08-04-2013

-------------------------------------------------

Buy at or above:-5587

-------------------------------

1st Targets:5603

2nd Targets:5622

3rd Targets:5640

4th Targets:5659

-------------------------------

Stop Loss:5568

-------------------------------------------------

Sell at or below:-5568

-------------------------------

1st Targets:5553

2nd Targets:5534

3rd Targets:5515

4th Targets:5497

-------------------------------

Stop Loss:5587

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

6- Firstly go through today Outlooks also for better profits and more accuracy.

Buy at or above:-5587

-------------------------------

1st Targets:5603

2nd Targets:5622

3rd Targets:5640

4th Targets:5659

-------------------------------

Stop Loss:5568

-------------------------------------------------

Sell at or below:-5568

-------------------------------

1st Targets:5553

2nd Targets:5534

3rd Targets:5515

4th Targets:5497

-------------------------------

Stop Loss:5587

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

6- Firstly go through today Outlooks also for better profits and more accuracy.

Bank Nifty(Apr Fut)- Intraday Trading levels,Strategy and Targets for 08-04-2013

-------------------------------------------------

Buy at or above:-11156

-------------------------------

1st Targets:11177

2nd Targets:11203

3rd Targets:11230

4th Targets:11256

-------------------------------

Stop Loss:11130

-------------------------------------------------

Sell at or below:-11109

-------------------------------

1st Targets:11130

2nd Targets:11083

3rd Targets:11056

4th Targets:11030

-------------------------------

Stop Loss:11156

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

Buy at or above:-11156

-------------------------------

1st Targets:11177

2nd Targets:11203

3rd Targets:11230

4th Targets:11256

-------------------------------

Stop Loss:11130

-------------------------------------------------

Sell at or below:-11109

-------------------------------

1st Targets:11130

2nd Targets:11083

3rd Targets:11056

4th Targets:11030

-------------------------------

Stop Loss:11156

-------------------------------------------------

Trading guidance:-

1- Trade with Strict Stop Loss

2- Trade along the trend.

3- Cover at any Target or hold for next target with previous target as Stop Loss.

4- May reverse yours trade also according to market with previous level as Stop Loss.

5- Profitable intraday trading strategy in trending and volatile markets.

FII & DII trading activity in Capital Market Segment on 05-Apr-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(05-Apr-2013)

Main features of trading are as follows

Ratios

Index Options Put Call Ratio: 0.92

Total Options Put Call Ratio: 0.90

Nifty P/E Ratio(05-Apr-2013): 16.82

Advances & Declines

BSE Advances : 1,408

BSE Declines : 1,343

NSE Advances : 740

NSE Declines : 773

Nifty Open Interest Changed Today

Nifty- 5500 CE(Apr)- 513,400(42.79%)

Nifty- 5500 PE(Apr)- 10,300(0.19%)

Nifty- 5600 CE(Apr)- 1,127,900(29.26%)

Nifty- 5600 PE(Apr)- -1,236,900(-17.57%)

Nifty- 5700 CE(Apr)- 1,012,550(14.38%)

Nifty- 5700 PE(Apr)- -609,300(-14.17%)

Nifty- 5800 CE(Apr)- 870,750(12.55%)

Nifty- 5800 PE(Apr)- -101,100(-5.93%)

Nifty- 5900 CE(Apr)- 489,300(8.00%)

Nifty- 5900 PE(Apr)- -80,500(-8.28%)

Closing

Sensex- closed at 18,450.23(-59.47 Points & -0.32%)

Nifty- closed at 5,553.25(-21.50 Points & -0.39%)

CNX Midcap - closed at 7,422.75(20.05 Points & 0.27%)

CNX Smallcap- closed at 3,176.65(3.75 Points & 0.12%)

Nifty Spot-Levels & Trading Strategy for 08-04-2013

Nifty Spot-Levels

R3 5618

R2 5597

R1 5575

Avg 5554

S1 5532

S2 5511

S3 5489

Nifty Spot-Trading Strategy

H6 5596 Trgt 2

H5 5586 Trgt 1

H4 5576 Long breakout

H3 5564 Go Short

H2 5560

H1 5556

L1 5549

L2 5545

L3 5541 Long

L4 5529 Short Breakout

L5 5519 Trgt 1

L6 5509 Trgt 2

R3 5618

R2 5597

R1 5575

Avg 5554

S1 5532

S2 5511

S3 5489

Nifty Spot-Trading Strategy

H6 5596 Trgt 2

H5 5586 Trgt 1

H4 5576 Long breakout

H3 5564 Go Short

H2 5560

H1 5556

L1 5549

L2 5545

L3 5541 Long

L4 5529 Short Breakout

L5 5519 Trgt 1

L6 5509 Trgt 2

Nifty(Apr Fut)-Levels & Trading Strategy for 08-04-2013

Nifty(Apr Fut)-Levels

R3 5635

R2 5614

R1 5593

Avg 5572

S1 5551

S2 5530

S3 5509

Nifty(Apr Fut)-Trading Strategy

H6 5614 Trgt 2

H5 5604 Trgt 1

H4 5595 Long breakout

H3 5583 Go Short

H2 5579

H1 5575

L1 5568

L2 5564

L3 5560 Long

L4 5548 Short Breakout

L5 5539 Trgt 1

L6 5529 Trgt 2

R3 5635

R2 5614

R1 5593

Avg 5572

S1 5551

S2 5530

S3 5509

Nifty(Apr Fut)-Trading Strategy

H6 5614 Trgt 2

H5 5604 Trgt 1

H4 5595 Long breakout

H3 5583 Go Short

H2 5579

H1 5575

L1 5568

L2 5564

L3 5560 Long

L4 5548 Short Breakout

L5 5539 Trgt 1

L6 5529 Trgt 2

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 08-04-2013

Bank Nifty(Apr Fut)-Levels

R3 11373

R2 11296

R1 11219

Avg 11142

S1 11065

S2 10988

S3 10911

Bank Nifty(Apr Fut)-Trading Strategy

H6 11297 Trgt 2

H5 11261 Trgt 1

H4 11226 Long breakout

H3 11184 Go Short

H2 11170

H1 11156

L1 11127

L2 11113

L3 11099 Long

L4 11057 Short Breakout

L5 11022 Trgt 1

L6 10986 Trgt 2

R3 11373

R2 11296

R1 11219

Avg 11142

S1 11065

S2 10988

S3 10911

Bank Nifty(Apr Fut)-Trading Strategy

H6 11297 Trgt 2

H5 11261 Trgt 1

H4 11226 Long breakout

H3 11184 Go Short

H2 11170

H1 11156

L1 11127

L2 11113

L3 11099 Long

L4 11057 Short Breakout

L5 11022 Trgt 1

L6 10986 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Apr 08 to Apr 12,2013)

Nifty Spot-Weekly Levels

R3 5915

R2 5835

R1 5694

Avg 5614

S1 5473

S2 5393

S3 5252

Nifty Spot-Weekly Trading Strategy

H6 4577 Trgt 2

H5 5724 Trgt 1

H4 5674 Long breakout

H3 5613 Go Short

H2 5593

H1 5573

L1 5532

L2 5512

L3 5492 Long

L4 5431 Short Breakout

L5 5381 Trgt 1

L6 5331 Trgt 2

R3 5915

R2 5835

R1 5694

Avg 5614

S1 5473

S2 5393

S3 5252

Nifty Spot-Weekly Trading Strategy

H6 4577 Trgt 2

H5 5724 Trgt 1

H4 5674 Long breakout

H3 5613 Go Short

H2 5593

H1 5573

L1 5532

L2 5512

L3 5492 Long

L4 5431 Short Breakout

L5 5381 Trgt 1

L6 5331 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Apr 08 to Apr 12,2013)

Bank Nifty Spot-Weekly Levels

R3 12022

R2 11806

R1 11452

Avg 11236

S1 10882

S2 10666

S3 10312

Bank Nifty Spot-Weekly Trading Strategy

H6 11671 Trgt 2

H5 11541 Trgt 1

H4 11411 Long breakout

H3 11254 Go Short

H2 11202

H1 11150

L1 11045

L2 10993

L3 10941 Long

L4 10784 Short Breakout

L5 10654 Trgt 1

L6 10524 Trgt 2

R3 12022

R2 11806

R1 11452

Avg 11236

S1 10882

S2 10666

S3 10312

Bank Nifty Spot-Weekly Trading Strategy

H6 11671 Trgt 2

H5 11541 Trgt 1

H4 11411 Long breakout

H3 11254 Go Short

H2 11202

H1 11150

L1 11045

L2 10993

L3 10941 Long

L4 10784 Short Breakout

L5 10654 Trgt 1

L6 10524 Trgt 2

Subscribe to:

Comments (Atom)