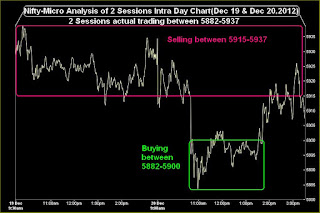

We always talk with those proofs which no one can deny. Following proofs are being shown to prove that we understood selling well before beginning of today down moves and then updated selling patterns message in our this Blog as well as also sent Nifty Futures selling and Put Option(5900) buying SMS to our paid clients:-

1st proof is that we posted following line at 12:37 PM in Mid-session Outlook(21-12-2012)

"Selling patterns formations in first 3 hours intraday charts"

Following NIFTY Dec F&O shorting SMS was sent to our paid Clients at 12:53 PM today:-

NIFTY-Dec Fut-Sell and/or Dec Put Options(5900)-Buy-Positional-SL-5906 & TGT-5836-CMP-5883(Dec Fut-Rates are given for all trading)(Lalit39)

Following covering SMS of above call was sent to our paid Clients at 03:21 PM today:-

NIFTY Dec F&O(Shorted on 21-12-2012)-Cover and book profit immediately-CMP-5852(Lalit39)

We always send 2 SMS for each and every call and their covering messages from those fastest websites which deliver SMS within 15 seconds. Live proofs of above mentioned SMS pictures are as follows:-

1st Website- Nifty Shorting and Covering messages SMS pictures are as follows:-

If unable to read text in above picture then:-

1- Firstly click on above SMS picture and enlarge it.

2- If unable to read then Save picture on yours desktop and after that

3- Open and again enlarge the picture in Windows Picture Viewer.

Only 2 following information are deleted in above Picture due to official secrecy rules:-

1- Numbers of sent SMS.

2- SMS sending Website name.