19800 will confirm strong rally

above life time top at 20222.45

Technical Analysis,Research & Weekly

Outlook(Oct 09 to Oct 13,2023)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (06-Oct-2023):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-(ii) of Wave-3 completion at 16828.3 on 20-03-2023 and Impulsive Wave-(iii) of Wave-3 beginning.

2- Impulsive Wave-(iii) of Wave-3 completion at 19991.8 on 20-07-2023.

3- Corrective Wave-(iv) of Wave-3 completion at at 19223.7 on 31-08-2023.

4- Impulsive Wave-(v) of Wave-3 continuation with recent and life time top formations at 20222.45 on 5-09-2023 but Short Term correction beginning from this level.

6- Short Term correction continuation with recent bottom formations at 19333.60 on 04-10-2023.

7- Last 10 sessions sideways trading between 19333-19798

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-(iii) of Wave-3 started after from 16828.3 on 20-03-2023 after corrective Wave-(ii) of Wave-3 completion at this level. Now impulsive Wave-(v) of Wave-3 of this this Waves structure is in continuation with recent and life time top formations at 20222.45 on 5-09-2023 but Short Term correction begun from this level which is in continuation with recent recent bottom formations at 19333.60 on 04-10-2023. As last 10 sessions trading has turned sideways between 19333-19798 and finally sustaining beyond this range will confirm next Trend formation and big moves therefore it should be firstly watched in the coming week/weeks.

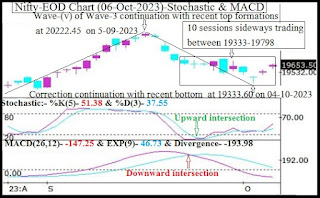

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (06-Oct-2023):-

Technical Patterns and Formations in EOD charts

1- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising from Over sold zone.

2- Stochastic:- %K(5)- 51.38 & %D(3)- 37.55.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative and positive zone.

4- MACD(26,12)- -147.25 & EXP(9)- 46.73 & Divergence- -193.98

Conclusions from EOD chart analysis

(Stochastic & MACD)

Positions of Daily indicators are as follows:-

1- As in Stochastic its %K(5) line has intersected %D(3) line upward and its both lines are rising from Over sold zone therefore indicating previous week started up moves continuation in the coming week.

2- As in MACD indicator its MACD line has intersected Average line downward and its both lines are falling in negative and positive zone therefore this indicator is showing stronger indications of Short term Trend formations.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (06-Oct-2023):-

Technical Patterns and Formations in EOD charts

Averages:-

1- 5-Day SMA is today at 19560

2- 21-Day SMA is today at 19778

3- 55-Day SMA is today at 19623

4- 100-Day SMA is today at 19264

5- 200-Day SMA is today at 18517

Conclusions from EOD chart analysis

(Averages)

Although Nifty showed stronger indications of Intermediate Trend turning downward after forcefully slipping below its decider 55-Day SMA but strong recovery was seen from lower levels in last 3 sessions of previous week and and Nifty has closed above 55-Day SMA(19623) at 19653.50 last Friday. As Intermediate Trend is at stake and finally sustaining beyond 55-Day SMA will generate strong signals of next Trend formation and decisive moves beginning hence should be firstly watched in next week.

Short term trend is down and if Nifty moves above 55-Day SMA(19623) then finally sustaining beyond Short term trend decider 21-Day SMA(today at 19778) should be watched for its confirmations. It should also be kept in mind that once sustaining above 21-Day SMA will mean Rally above life time highest(20222.45) after all trends turning upward and on going correction completion confirmations.

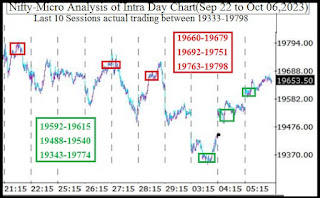

Nifty-Last 10 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Sep 22 to Oct 06,2023):-

Technical Patterns formation in last 10 Sessions intraday charts

1- Selling(Resistances) in last 10 Sessions are as follows:-

A- 19660-19679

B- 19692-19751

C- 19763-19798

2- Consolidation(Supports) in last 10 Sessions are as follows:-

A- 19592-19615

B- 19488-19540

C- 19343-19774

3- Last 10 Sessions actual trading between 19333-19798

Conclusions from 10 Sessions

intra day chart analysis

Last 10 Sessions sideways trading between 19333-19798 with above mentioned supports and resistances which seems to be almost equally strong and last Friday closing was also almost in the centre of last 10 sessions trading range therefore it will be understood that:-

1- Nifty will firstly trade and prepare for next big moves within and last 10 sessions trading range in the beginning of next week.

2- Finally sustaining beyond last 10 sessions trading range will confirm next Trend formations and big moves beginning.

Conclusions

(After putting all studies together)

1- Long Term trend is up.

2- Intermediate Term trend is at stake.

3- Short Term trend is down.

Correction of Impulsive Wave-(v) of Wave-3 from 20222.45 on 5-09-2023 after life time top formations at this level which is in continuation with recent bottom formation at 19333.60 on 04-10-2023 and no confirmation of its completion yet on EOD charts but few signals of its completion have been emerged in previous week:-

1- Weekly Candle of previous week was "Bullish Hammer"

2- Weekly closing of previous week was both above 5-Day and 55-Day SMA.

3- Forceful recovery was seen from lower levels in previous week.

4- Intraday consolidation patterns and supports were seen at lower levels in all the last 3 sessions of previous week.

As Short Term Indicator Stochastic is showing signals of previous week started up moves continuation in the coming sessions therefore firstly sustaining beyond following levels should be watched in next week:-

1- 21-Day SMA(today at 19778)

2- Top of last 10 Sessions trading range at 19798.

As finally sustaining above these 2 levels will mean 10 sessions trading range break out and all trends turning upward confirmations as well therefore finally sustaining above psychological level of 19800 should be watched for fresh rally beginning above life time top(20222.45) because psychological level of 19800 is little above these 2 levels(19778 & 19798).