As busy therefore Stock Market Outlook of today(08-02-2022) is not being updated.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

17498 will confirm correction towards and below the bottom of Wave-A(16410.20)

Technical Analysis,Research & Weekly

Outlook(Feb 07 to Feb 11,2022)

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (04-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

2- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

3- Wave-C continuation with recent bottom formation at 16836.8 on 25-01-2022

4- Budget-2022 rally completion at 17794.6 on 02-02-2022

5- In Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling from Over bought zone.

6- Stochastic:- %K(5)- 71.72 & %D(3)- 81.52.

7- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

8- MACD(26,12)- -364.42 & EXP(9)- -113.06 & Divergence- -251.36

Conclusions from EOD chart analysis

(Stochastic & MACD)

Wave-C of "ABC" correction continuation with recent bottom formation at 16836.8 on 25-01-2022. From this level Budget-2022 rally started which completed at 17794.6 on 02-02-2022 and after that down moves begun which are in continuation with recent bottom formations at 17462.5 on 04-02-2022.

In Stochastic both lines are falling from Over bought zone after %K(5) line downward intersection of %D(3) line therefore suggesting more down moves possibilities.

In MACD MACD line has intersected Average line downward and its both lines are falling in negative zone therefore showing downward trend formations and showing more down moves in the coming week also.

Nifty-EOD Chart Analysis

(Bollinger Band)

Nifty-EOD Chart (04-Feb-2022):-

Technical Patterns and Formations in EOD charts

1- Budget-2022 rally faced resistance at Middle Band

2- Down moves started towards Lower Band

Conclusions from EOD chart analysis

(Bollinger Band)

As Budget-2022 rally faced resistance at Middle Band and after that down moves started towards Lower Band therefore indications of Nifty slipping towards the lowest of Pre-Budget rally at 16836.8.

Nifty-Last 4 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Feb 01 to Feb 04,2022):-

Technical Patterns formation in last 4 Sessions intraday charts

1- More than 11 hours sideways trading between 17498-17622 on Budget day(1st Feb) and last Friday(4th Feb)

2- Selling(Resistances) on 03-02-2022:-

A- 17607-17635

B- 17648-17684

C- 17699-17731

D- 17736-17761

3- Last 4 Sessions actual trading between 17245-17794

Conclusions from 4 Sessions

intra day chart analysis

Nifty traded most time between 17498-17622 on Budget-2022 day and again traded most time within this this range last Friday(04-02-2022) as well as Nifty closed 3 days within this range of Feb-2022 also:-

1- Nifty closed at 17576.6 on 01-02-2022

2- Nifty closed at 17560.2 on 03-02-2022

3- Nifty closed at 17516.3 on 04-02-2022

As more than 11 hours sideways trading and above mentioned 3 previous sessions closing also between 17498-17622 therefore this range has become more crucial and next big moves decider as well. Good selling was seen within and above it on 03-02-2022 therefore once sustaining below it(17498) will mean deeper correction beginning hence should be firstly watched in next week for its confirmations.

Conclusions (After putting all studies together)

1- Short Term Trend is sideways.

2- Intermediate Term Trend is sideways.

3- Long Term Trend is up.

Pre/Post Budget rally and its termination also was seen in previous week. As last 2 sessions of previous week were affected by facebook negative news led depressing Global markets also therefore firstly sustaining beyond 11 hours sideways trading range(17498-17622) should be watched in next week for decisive moves beginning confirmations.

As above mentioned indicators are suggesting down moves possibilities therefore fresh selling and after that sustaining below 17498 will mean corrective Wave-C continuation confirmations towards and below the bottom of Wave-A(16410.20) which is expected also.

facebook news based market requires next decisive moves confirmations from 17498-17622

Nifty-Intra Day Chart Analysis &

Market Outlook(04-02-2022)

Nifty-Intra Day Chart (03-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Whole day down moves with upward corrections

2- Whole day actual trading between 17512-17781

Conclusions from intra day chart analysis

Sentiment turned weak today morning because facebook share moved down 20% in US markets after its disclosure that its advertisements are not running on APPLE hence NASDAQ Futures was also trading more than 300 points down today morning and in reaction NIFTYIT crashed after opening and closed more than 2% down today.

As US Futures and all the European markets were traded in deep Red today therefore Whole day down moves were seen with upward corrections in Indian markets also and today closing was at the lower levels of the day.

Nifty traded sideways between 17498-17622 on Budget day and closed within it after higher levels falls today. As facebook news based market today therefore firstly sustaining it beyond should be watched in the coming sessions for next decisive moves beginning confirmations

facebook negative news led weakness in Indian markets

Post-open Outlook(03-02-2022)

As facebook share moved down 20% in US markets after its disclosure that its advertisements are not running on APPLE hence NASDAQ Futures is more than 300 points down today morning and in reaction NIFTYIT is also trading 390 points weak today and resultant NIFTY is also 95 points down.

Rally towards and above 18000

Nifty-Intra Day Chart Analysis &

Market Outlook(03-02-2022)

Nifty-Intra Day Chart (02-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Consolidation between 17718-17765

2- Whole day actual trading between 17675-17794

Conclusions from intra day chart analysis

As good consolidation between 17718-17765 therefore rally will remain continued towards and above 18000 tomorrow.

Rally towards next resistances

Nifty-Intra Day Chart Analysis &

Market Outlook(02-02-2022)

Nifty-Intra Day Chart (01-Feb-2022):-

Technical Patterns formation in today intraday charts

1- Sideways trading between 17498-17622

2- Mid-session high volatility after Budget

3- Whole day actual trading between 17245-17622

Conclusions from intra day chart analysis

As market friendly and economically sound Budget presentation by our FM Nirmala Sitaraman in Parliament therefore Nifty closed near the higher levels of the day with 01.37% gains. Although Mid-session high volatility after Budget but rally continuation is expected towards following next resistances in the coming sessions:-

1- 17795-17832

2- 17959-18129

3- 18292-18321

Watch 2 levels for Post Union-Budget-2022 big moves beginning confirmations

Nifty-Intra Day Charts Analysis &

Market Outlook(01-02-2022)

Nifty-Intra Day Chart (Jan 28 & Jan 31,2022):-

Technical Patterns formation in last 2 Sessions intraday charts

1- Selling between 17319-17373 on 28-01-2022

2- Sideways trading between 17277-17373 on 28-01-2022

3- Sharp down moves in Mid-session on 28-01-2022

4- Whole day sideways trading between 17268-17410 on 31-01-2022

5- Last 2 Sessions actual trading between 17078-17410

Conclusions from 2 Sessions

intra day chart analysis

More than 10 hours sideways trading between 17268-17410 in last 2 sessions therefore firstly sustaining it beyond should be watched tomorrow for Post-Budget decisive moves beginning confirmations. As good selling between 17319-17373 on 28-01-2022 therefore sustaining below 17268 will mean sharp fall.

Firstly watch above mentioned 2 levels tomorrow for above updated big moves beginning confirmations after Union-Budget-2022.

Minimum Target of Nifty at 16156.7 & finally 16867-17373 will confirm

Post-Budget next big moves

Technical Analysis,Research & Weekly

Outlook(Jan 31 to Feb 04,2022)

Nifty-EOD Chart Analysis

(Corrective Waves)

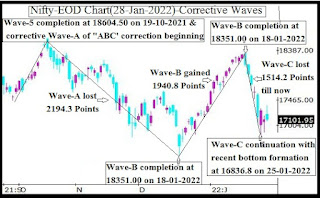

Nifty-EOD Chart (28-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

3- Wave-A lost 2194.3 Points

4- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

5- Wave-B gained 1940.8 Points

6- Wave-C continuation with recent bottom formation at 16836.8 on 25-01-2022

7- Wave-C lost 1514.2 Points till now

Conclusions from EOD chart analysis

(Corrective Waves)

Waves structure which started through is Impulsive Wave-1 from 7511.10 on 24-03-2020 completed after its Impulsive Wave-5 completion with new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction begun.

As "ABC" correction has been started therefore it will correct whole rally between 7511.10-18604.50. Now its Wave-C continuation and it should minimum retrace 100% of Wave-A which is 2194.3 Points.

Wave-C started from 18351.00 and minimum 100% correction ie 2194.3 Points does mean Minimum Target of on going Nifty correction is at 16156.7(18351.00-2194.3).

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (28-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- 5-Day SMA is today at 17251

2- 21-Day SMA is today at 17744

3- 55-Day SMA is today at 17486

4- 100-Day SMA is today at 17639

5- 200-Day SMA is today at 16638

Conclusions from EOD chart analysis

(Averages)

Nifty has closed below all the Short and Intermediate Term Averages last Friday but has not tested Long Term Average(200-Day SMA) during on going correction. As 200-Day SMA is most crucial and next big moves decider therefore sustaining it beyond should also be watched in the coming weeks for Long Term Trend confirmations

Nifty-Weekly Chart Analysis

(Stochastic & MACD)

Nifty-Weekly Chart (28-Jan-2022):-

Technical Patterns and Formations in Weekly charts

1- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling from Over bought zone.

2- Stochastic:- %K(5)- 59.41 & %D(3)- 77.41.

3- In MACD- MACD line has intersected Average line downward and its MACD line is falling in negative zone while its Average line is falling in positive zone.

4- MACD(26,12)- -93.85 & EXP(9)- 246.06 & Divergence- -339.91

Conclusions from Weekly chart analysis

(Stochastic & MACD)

As in Weekly Stochastic %K(5) line has intersected %D(3) line downward and its both lines are falling from Over bought zone therefore suggesting decisive down moves on cards.

As in Weekly MACD line has intersected Average line downward and its both lines falling therefore showing Intermediate Term down trend formations hence finally down moves will be expected in the coming weeks.

Nifty-Last 2 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Jan 27 & Jan 28,2022):-

Technical Patterns formation in last 2 Sessions intraday charts

1- Consolidation through Down moves in Bullish Falling Channel and Up moves with downward corrections between 16867-17031 on 27-01-2022

2- Sharp up moves in Mid-session on 27-01-2022

3- Selling between 17319-17373 on 28-01-2022

4- Sharp down moves in Mid-session on 28-01-2022

5- Last 2 Sessions actual trading between 16867-17373

Conclusions from 2 Sessions

intra day chart analysis

As lower levels consolidation was seen through Down moves in Bullish Falling Channel and Up moves with downward corrections between 16867-17031 therefore sharp up moves developed in Mid-session on 27-01-2022. In the same manner higher levels good Selling was seen between 17319-17373 therefore sharp down moves developed in Mid-session on 28-01-2022 also.

Last 2 Sessions actual trading between 16867-17373 with good consolidation and equally good selling within above mentioned trading range therefore at present Nifty is not prepared for any side one sided big decisive moves and that will be firstly done in the beginning of next week. As finally sustaining beyond 16867-17373 will generate next big moves therefore these levels should also be watched for next big moves beginning confirmations.

Conclusions

(After putting all studies together)

1- Short Term Trend is down.

2- Intermediate Term Trend is down.

3- Long Term Trend is up.

Wave-C continuation with recent bottom formation at 16836.8 and no indication of its completion yet. As minimum Target of Wave-C is at 16156.7 and Intermediate Term indicators are showing more down moves possibilities as well as Averages are suggesting inherent weakness therefore expected that finally on going correction will remain continued towards and below 16156.7.

As last 2 Sessions trading between 16867-17373 with both lower levels good consolidation and equally good higher levels selling within this range therefore Nifty will firstly trade within this range and finally sustaining it beyond will confirm next decisive big moves beginning.

Union-Budget 2022 will be tabled in Parliament at 11:00 AM on 01-02-2022 and market may be highly volatile also during its announcements. As Indian Stock Markets final reactions on Budget will be from sustaining beyond 16867-17373 therefore should be firstly watched on Budget and following days for next big moves beginning confirmations.

Sustaining beyond 16867-17202 will

generate next big moves

Nifty-Intra Day Chart Analysis &

Market Outlook(28-01-2022)

Nifty-Intra Day Chart (27-Jan-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channel

2- Up moves with downward corrections

3- Volatility in last 2 hours between 17052-17182

4- Whole day actual trading between 16867-17182

Conclusions from intra day chart analysis

As all the Global markets were in crashing mode therefore Nifty opened 215 points down and after that traded 411 points weaker also but lower levels good consolidation was seen seen through down moves in Bullish Falling Channel and until complete selling will not develop till then Nifty will not sustain below it,

Although intraday up moves with downward corrections but higher levels 130 points volatility was also seen between 17052-17182. Nifty traded 6 hours trading between 16998-17202 in 2 previous sessions and closed within it at 7110.15 also.

As huge Global markets pressure therefore Pre-Budget rally could not develop and only 2 sessions are left before Budget as well as Indian markets will prepare for post-Budget big decisive moves between 16867-17202 in these 2 sessions.

As finally sustaining beyond 16867-17202 will generate next big moves before or after Budget therefore should be watched for its confirmations.

Only watch 17202 for Pre-Budget rally confirmations amid

FOMC announcements reactions

led Global markets

Nifty-Intra Day Chart Analysis &

Market Outlook(27-01-2022)

Nifty-Intra Day Chart (25-Jan-2022):-

Technical Patterns formation in today intraday charts

1- 313 Points fall in first 4 minutes

2- 190 Points jump in next 45 minutes

3- Almost 4 hours trading between 17009-17202

4- Slow up moves in last hour

5- Whole day actual trading between 16837-17309

Conclusions from intra day chart analysis

Following lines were told at 12:22 AM on 25-01-2022 in "16998-17186 will confirm Pre Budget rally":-

Sustaining beyond 16998-17186 should be firstly watched in the coming sessions for Pre Budget rally

Nifty traded almost 4 hours within near about 16998-17186 between 17009-17202 and finally moved up and closed above 17186 as well as generated first strong signal of Pre-Budget rally.

Although huge volatility between 16837-17002 in first hour on 25-01-2022 but closing was at the top of the day and almost 6 hours trading between 16998-17202 in last 2 sessions therefore only sustaining above 17202 should be watched in the coming sessions for Pre-Budget rally confirmations amid FOMC announcements reactions led Global markets tomorrow.

16998-17186 will confirm

Pre Budget rally

Nifty-Intra Day Chart Analysis &

Market Outlook(25-01-2022)

Nifty-Intra Day Chart (24-Jan-2022):-

Technical Patterns formation in today intraday charts

1- 5 Hours down moves after weak opening

2- Last 2 hours trading between 16998-17186 with lower levels consolidation patterns formations

3- Down moves in Bullish Falling Channels

4- Whole day actual trading between 16998-17599

Conclusions from intra day chart analysis

Although 5 Hours down moves after weak opening but last 2 hours trading between 16998-17186 and lower levels consolidation was seen through Down moves in Bullish Falling Channels therefore sustaining beyond 16998-17186 should be

firstly watched in the coming sessions for

Pre Budget rally.

Firstly watch most crucial supports and resistances amid Union Budget-2022 expectations and announcements led high volatility

Technical Analysis,Research & Weekly Outlook

(Jan 24 to Jan 28,2022)

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (21-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

3- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

4- Wave-C continuation with recent bottom formation at 17485.8 on 21-01-2022

5- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are in Over sold zone.

5- Stochastic:- %K(5)- 14.04 & %D(3)- 21.92.

6- In MACD- MACD line has intersected Average line downward and its MACD line is falling while Average line is flat

7- MACD(26,12)- 418.83 & EXP(9)- 495.43 & Divergence- -76.6

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are in Over sold zone therefore suggesting that up moves may start any day.

As in MACD- MACD line has intersected Average line downward and its MACD line is falling while Average line is flat therefore MACD has started to show downward trend formation signals.

Although Stochastic is suggesting some up moves possibilities but MACD is showing downward trend formation signals therefore expected that finally down moves will be seen after some up moves.

Nifty-EOD Chart Analysis

(Fibonacci retracement levels)

Nifty-EOD Chart (21-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021 and Wave-B beginning

2- Wave-B completion at 18351.00 on 18-01-2022 and and Wave-C beginning

3- Wave-C continuation with recent bottom formation at 17485.8 on 21-01-2022

4- Fibonacci Retracement levels from Wave-B(18351-16410)

1- 13.0%-18,098

2- 23.6%-17,892

3- 27.0%-17,826

4- 38.2%-17,609(Crucial)

5- 50.0%-17,380(Crucial)

6- 61.8%-17,151(Crucial)

7- 70.7%-16,978

8- 76.4%-16,868

9- 78.6%-16,825

10-88.6%-16,631

Conclusions from EOD chart analysis

(Fibonacci retracement levels)

Wave-B which started from 16410.20 on 20-12-2021 completed at 18351.00 on 18-01-2022. Now Wave-C continuation with recent bottom formation at 17485.8 which is between 38.2% and 50.0%. As Nifty closed near 38.2% level(17609) at 17617.15 last Friday therefore firstly sustaining it beyond should be watched in the coming sessions for pre-Budget next decisive moves beginning confirmations.

Nifty-Intra Day Chart Analysis(21-01-2022)

Nifty-Intra Day Chart (21-01-2022):-

Technical Patterns formation in today intraday charts

1- 230 Points fall in first 15 minutes after gap down opening

2- Selling between 17591-17706

3- Down moves in Bullish Falling Channel

4- 160 Points jump in last half hour

5- Whole day actual trading between 17486-17707

Conclusions from intra day chart analysis

Although 230 Points fall in first 15 minutes after gap down opening but after that up moves were seen from lower levels. As fresh good selling developed at higher levels between 17591-17706 therefore down moves were seen till last hour but were in Bullish Falling Channel also hence Nifty jumped 160 Points in last half hour

As higher levels good selling last Friday therefore firstly down moves will be seen towards 17486 in the beginning of next week and firstly sustaining it beyond should be watched for next decisive moves beginning confirmations because some consolidation was also seen above it in last hours through Down moves in Bullish Falling Channel.

Conclusions

(After putting all studies together)

1- Long Term Trend is up.

2- Intermediate Term Trend is up.

3- Short Term Trend is down.

Corrective Wave-C started in previous week for moving below the bottom of Wave-B(16410.20) but Short term indicators have turned oversold therefore some up moves can not be ruled out but finally down moves will be seen towards and below 16410.20 in the coming weeks/months without moving above the top of Impulsive Wave-5(18604.50).

As Union Budget-2022 will be tabled in Parliament on 01-02-2022 after 5 trading sessions therefore volatility may be high hence following supports and resistances should also be firstly watched for next trend beginning:-

Next supports between 18604.50-16410.20 are as follows:-

1- 17332-17371

2- 17192-17241

3- 16884-17093

4- 16820-16918

5- 16739-16782

6- 16411-16530

Next resistances between 16410.20-18604.50 are as follows:-

1- 17591-17706

2- 17795-17832

3- 17959-18129

4- 18292-18321

5- 18379-18458

6- 18548-18604

As Indian markets may be highly volatile also on Budget expectations and announcements therefore firstly sustaining beyond above next supports and resistances should be watched one by one in the coming 2 weeks amid Union Budget-2022 led high volatility.

Above most crucial supports and resistances are between the top of Impulsive Wave-5(18604.50) ie life time top and bottom of Wave-A(16410.20) ie lowest of on going 'ABC" correction. As finally sustaining beyond 16410.20-18604.50 will form next trend and will generate next big moves as well therefore should be finally watched in next 2 weeks amid pre-Budget expectations till 1st Feb 2022 and finally Post-Budget announcements on and after 1st Feb 2022.

Firstly watch 17648-17943 for next decisive moves beginning confirmations

Nifty-Intra Day Chart Analysis &

Market Outlook(21-01-2022)

Nifty-Intra Day Chart (20-Jan-2022):-

Technical Patterns formation in today intraday charts

1- Down moves with upward corrections

2- Down moves in Bullish Falling Channels

3- 135 Points Sharp up moves in last hour

4- Whole day actual trading between 17648-17943

Conclusions from intra day chart analysis

Following lines were told in previous Outlook named "Expectations of down moves towards next supports":-

Finally down moves will be seen towards following next supports:-

1- 17740-17788

2- 17657-17721

As was told 100% same happened and down moves were seen towards 17648.45 which was just below 17657 and after that Nifty moved up 135 points up moves sharply.

Although positive opening but after that down moves started in Bullish Falling Channels which means that follow up selling was seen. As some consolidation also developed at lower levels through Down moves in Bullish Falling Channels therefore 135 Points Sharp up moves was in last hour.

Technically higher levels selling and lower levels buying will be understood for day's trading between 17648-17943 therefore Nifty will firstly trade within this range and prepare for next decisive moves. Let Nifty prepare then will be decided according to coming sessions intraday patterns formations and will be updated,till then sustaing beyond 17648-17943 should be firstly watched in the coming sessions for next decisive moves beginning confirmations.

Expectations of down moves

towards next supports

Nifty-Intra Day Chart Analysis &

Market Outlook(20-01-2022)

Nifty-Intra Day Chart (19-Jan-2022):-

Technical Patterns formation in today intraday charts

1- More than 100 points fall in first 3 minutes

2- Up moves in Bearish Rising Channel

3- Sideways trading between 17959-18129

4- Whole day actual trading between 17885-18129

Conclusions from intra day chart analysis

Although positive opening but immediately after that more than 100 points sharp fall in first 3 minutes and then selling was seen through down moves with upward corrections.

As some lower levels supports were also seen during sideways trading in last 3 hours between 17959-18129 therefore firsly sustaining beyond lowest of the day(17885) should be watched in the coming sessions for immediate down moves confirmations but expected that finally down moves will be seen towards following next supports:-

1- 17740-17788

2- 17657-17721

Short Term correction will begin

Nifty-Intra Day Chart Analysis &

Market Outlook(18-01-2022)

Nifty-Intra Day Chart (17-Jan-2022):-

Technical Patterns formation in today intraday charts

1- Up moves in Bearish Rising Channel

2- Selling between 18292-18321

3- Whole day actual trading between 18228-18321

Conclusions from intra day chart analysis

As firstly up moves in Bearish Rising Channel and after that higher levels good selling therefore Short Term correction will begin without sustaining above today highest(18321) despite today closing at the top of on going Pull Back rally.

Deeper correction towards

next supports

Technical Analysis,Research & Weekly Outlook

(Jan 17 to Jan 21,2022)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (14-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020

4- Impulsive Wave-3 completion at 15431.8 on 16-02-2021

5- Corrective Wave-4 completion at 14151.4 on 22-04-2021

6- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

7- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

8- Wave-B continuation with recent top formation at 18286.95 on 14-01-2022 and no confirmation of its completion yet.

Conclusions from EOD chart analysis

(Waves structure)

Bullish rally which started through its Impulsive Wave-1 from 7511.10 on 24-03-2020 completed from its 5th Wave after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction begun which completed at 16410.20 on 20-12-2021.

Now Wave-B continuation with recent top formation at 18286.95 on 14-01-2022 and no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (14-Jan-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC' correction beginning.

2- Corrective Wave-A of "ABC" correction completion at 16410.20 on 20-12-2021

3- Wave-B continuation with recent top formation at 18286.95 on 14-01-2022 and no confirmation of its completion yet.

4- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling in bought zone.

5- Stochastic is showing negative divergence

6- Stochastic:- %K(5)- 96.69 & %D(3)- 95.97.

7- In MACD- MACD line has intersected Average line upward and its both lines are rising in positive zone.

8- MACD(26,12)- 550.41 & EXP(9)- 314.89 & Divergence- 235.52

Conclusions from EOD chart analysis

(Stochastic & MACD)

As in Stochastic both lines are kissing in over bought zone and this indicator is in over bought zone since long therefore if down moves starts then sharp fall will be seen in next week.

As in MACD MACD line has intersected Average line upward and its both lines are rising in positive zone therefore it showing upward trend formations.

Conclusion from these 2 indicators is that Short Term correction is very much due which will start any day in next week but will not be deep because in MACD both lines are rising in positive zone and its has not given any indication of downward trend formation.

Nifty-Intra Day Chart Analysis

(14-Jan-2022)

Nifty-Intra Day Chart (14-Jan-2022):-

Technical Patterns formation in today intraday charts

1- 137 Points sharp fall in first 3 minutes

2- More than 110 points jump from lower levels in first 40 Minutes

3- Down moves with upward corrections

4- Up moves in Bearish Rising Channels

5- Whole day actual trading between 18120-18286

Conclusions from intra day chart analysis

Although firstly 137 points sharp fall in first 3 minutes but after that more than 110 points jump also from lower levels in first 40 Minutes therefore first hour trading was highly volatile last Friday

As firstly down moves were with upward corrections and after that whole day up moves were in Bearish Rising Channels therefore good intraday selling patterns formations last Friday hence expected that down moves will be seen below last Friday in the beginning oof next week.

Conclusions

(After putting all studies together)

All the trends are up and Wave-B continuation with recent top formation at 18286.95 on 14-01-2022 and no confirmation of its completion yet on EOD charts.

As short Term indicator Stochastic is in over bought zone since long and its both lines are kissing therefore emergence of Short Term correction beginning strong indications which will start any day in next week.

Union Budget 2022 is scheduled on 01-02-2022 and on going rally is on the back of market favouring Budget. Last 20 sessions rally which started from 16410.20 and on 20-12-2021 is in continuation without any significant correction. As Short Term indicators are completely overbought and good intraday selling patterns formations also last Friday therefore expected that deeper correction will be seen towards following supports in next week:-

1- 17965-18025

2- 17902-17945

3- 17740-17788

4- 17657-17721

5- 17332-17371

6- 17192-17241

18119 will confirm correction

beginning of on going rally

Post-open Outlook(14-01-2022)

As Dow Jones closed 176 points down yesterday therefore most Asian markets were trading more than 0.65% down and resultant sentiment turned weaker hence gap down opening of Indian markets.

As selling patterns were not seen and consolidation patterns were formed yesterday therefore Nifty recovered more than 110 points from lower levels in first 40 Minutes and fresh selling patterns formations today will mean first signal of correction beginning.

Last 2 sessions trading between 18129-18272 and today first 3 minutes lowest is below it at 18119.65 therefore firstly sustaining beyond 18119 should also be watched in the coming sessions for correction beginning confirmation of that on going rally which started from 16410.20 on 20-12-2021.

Rally on Union Budget expectations

Nifty-Intra Day Chart Analysis &

Market Outlook(14-01-2022)

Nifty-Intra Day Chart (13-Jan-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channels

2- Consolidation between 18211-18222

3- Sharp up moves in last half hour

4- Whole day actual trading between 18164-18272

Conclusions from intra day chart analysis

Although positive opening but down moves were seen after that. As whole day down moves were in Bullish Falling Channels and consolidation was also seen between 18211-18222 therefore sharp up moves developed in last half hour.

As Union Budget will be tabled in Parliament on 01-02-2022 therefore Indian markets are preparing for post Budget decisive one sided moves hence moving up on post Budget expectations. As whole day consolidation today therefore up moves will be seen tomorrow and let selling develop then correction will be considered according to the size of selling patterns formations but remain cautious because Short Term indicators are Over bought and correction may also begin any day after fresh selling patterns formations.

Sustaining beyond 18161-18227 will confirm Indian markets reaction on 3 IT big quarterly results

Nifty-Intra Day Chart Analysis &

Market Outlook(13-01-2022)

Nifty-Intra Day Chart (12-Jan-2022):-

Technical Patterns formation in today intraday charts

1- 5 Hours sideways trading between 18161-18227

2- Whole day actual trading between 18129-18227

Conclusions from intra day chart analysis

As most Asian markets were trading with more than 1.5% gains after strong closing of US markets yesterday therefore gap up opening of Indian markets and Nifty traded 5 hours sideways between 18161-18227 as well as prepared for next moves tomorrow after quarterly results announcement of 3 big companies(INFY,TCS & WIPRO).

As Indian markets will firstly react on the results of these 3 big companies tomorrow and and sustaining beyond today sideways trading range(18161-18227) will finally confirm it therefore should be firstly watched tomorrow.

Sharp fall & correction of Rally

will start in next 2 sessions

Nifty-Intra Day Chart (11-Jan-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channel

2- Sharp up

3- Up moves in Bearish Rising Channels

4- Sharp fall

5- Selling patterns formations between 18020-18081 in last 5 hours

6- Whole day actual trading between 17965-18081

Conclusions from intra day chart analysis

Although firstly Down moves after flat opening but were in Bullish Falling Channel therefore after that sharp up moves were seen.

As selling patterns formations between 18020-18081 through Up moves in Bearish Rising Channels in last 5 hours therefore Nifty will not sustain above 18020 and sharp fall as well as correction of that rally which begun from 16410.20 on 20-12-2021 will start in next 2 sessions despite:-

1- at present All US Indices are trading in Green and Nasdaq is 145 Points up.

2- at present SGX Nifty is trading more than 100 Points up.

3- All the European markets closed with good gains today.

Subscribe to:

Posts (Atom)