Watch levels for mentioned implications in 49 sessions sideways market

Technical Analysis,Research & Weekly Outlook

(Apr 19 to Apr 23,2021)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (16-Apr-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020 and Impulsive Wave-3 beginning

4- Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021

5- Corrective Wave-4 continuation with recent bottom formation at 14248.7 on 12-04-2021

6- Last 49 sessions sideways trading between 14249-15431.

Conclusions from EOD chart analysis

(Waves structure)

Waves structure which started through impulsive Wave-1 on 24-03-2020 from 7511.10 is in continuation. Its impulsive Wave-3 completed after new life time top formation at 15431.8 on 16-02-2021 and now its Corrective Wave-4 continuation with recent bottom formation at 14248.7 on 12-04-2021

Corrective Wave-4 continuation through last 49 sessions sideways trading between 14249-15431 and finally sustaining beyond this range will decide the life and length of on going correction which should be watched in the coming week/weeks for its confirmations.

Nifty-Weekly Chart Analysis

(Stochastic & MACD)

Nifty-Weekly Chart (16-Apr-2021):-

Technical Patterns and Formations in Weekly charts

1- Impulsive Wave-5 completion at 12430.50 on 20-01-2020 and Wave-A of "corrective ABC Waves" beginning

2-Wave-A (11614.50 on 03-02-2020)

3-Wave-B (12246.70 on 14-02-2020)

4- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

5-Wave-1 (11794.30 on 31-08-2020)

6-Wave-2 (10790.20 on 24-09-2020)

7- Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021

8- Corrective Wave-4 continuation with recent bottom formation at 14248.7 on 12-04-2021

9- Stochastic %K(5) is at 51.81 & %D(3) is at 44.75

10- Stochastic- %K(5) line has intersected %D(3) line upward

11- MACD line has intersected Average line downward

Conclusions from Weekly chart analysis

(Stochastic & MACD)

2020 Corona crash like "ABC" correction started after Impulsive Wave-5 completion at 12430.50 on 20-01-2020 and its Wave-C completed at 7511.10 on 24-03-2020.

Impulsive Wave-1 of new Waves structure begun from 7511.10 on 24-03-2020 and its Impulsive Wave-3 finished after new life time top formation at 15431.8 on 16-02-2021. Now its corrective Wave-4 continuation with recent bottom formation at 14248.7 on 12-04-2021 and no indication of its completion yet.

As weekly MACD line has intersected Average line downward and both the lines are moving downward therefore showing downward trend but in Stochastic %K(5) line has intersected %D(3) line upward and showing up moves in Short Term. As both the indicators are showing adverse direction therefore directionless and sideways market will be firstly understood in next week.

Nifty-Last 19 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Mar 18 to Apr 16,2021):-

Technical Patterns formation in last 19 Sessions intraday charts

1- Selling(Resistances) in last 19 Sessions are as follows:-

A- 14649-14697

B- 14698-14785(Gap resistances)

C- 14704-14778

D- 14821-14970

2- Consolidation(Supports) in last 19 Sessions are as follows:-

A- 14354-14457

B- 14307-14357

C- 14249-14360

3- 132 Points gap down previous week opening and after that trading between 14249-14697 with first 3 sessions lower levels buying and last session higher selling.

4- Sideways trading in last 19 Sessions are between 14249-14984

5- 19 Sessions actual trading between 14249-14984

Conclusions from 19 Sessions

intra day chart analysis

Last 49 sessions sideways trading between 14249-15431 and Nifty is trading at lower levels of this range below 15000 between 14249-14984 for the last 19 sessions.

Certainly there are multiple resistances above 15000 and above mentioned 4 resistances are also lying between 14649-14970 but above mentioned 3 supports are also between 14249-14457.

As Nifty traded between 14249-14697 after 132 Points gap down in previous week and after that lower levels consolidation was seen in first 3 sessions and good selling was seen in last session therefore immediate supports and resistances are lying within last week trading range.

Blank zone will be understood between 14457-14649 because resistances are above it and supports are below it. As firstly follow up moves within and near about 14457-14649 as well as finally sustaining it beyond will generate first signal of next big moves beginning therefore should be firstly watched in next week.

As finally sustaining beyond or forceful break out/down of last 19 Sessions trading range(14249-14984) will confirm next big moves beginning therefore should be watched in the coming week/weeks.

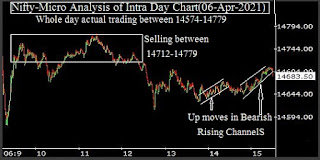

Nifty-Intra Day Chart Analysis

(16-Apr-2021)

Nifty-Intra Day Chart (16-Apr-2021):-

Technical Patterns formation in today intraday charts

1- Up moves in Bearish Rising Channel(immediate Resistances)

2- Selling between 14649-14697

3- Whole day actual trading between 14560-14697

Conclusions from intra day chart analysis

Although most time positive zone trading after Green opening and closing with 0.25% gains also last Friday but good selling was seen at higher levels between 14560-14697 therefore this range will be immediate Resistances of Nifty.

Until Nifty will not sustain above 14697 after complete consolidation till then decisive up moves will not be seen and once sustaining below 14649 after fresh selling will mean Short Term Correction beginning.

As good selling between 14649-14697 last Friday therefore expected that down moves will be seen below last Friday lowest(14560) in the beginning of next week.

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is sideways between 14249-15421 for the last 49 sessions.

3- Short Term Trend is sideways between 14249-14984 for the last 19 sessions.

Now corrective Wave-4 continuation with recent bottom formation at 14248.7 on 12-04-2021 and no indication of its completion yet.

As corrective Wave-4 correction is sideways between 14249-15421 for the last 49 sessions therefore finally sustaining beyond this range will decide the life and length of Wave-4 in following manner:-

1- Sustaining above 15421 will confirm corrective Wave-4 completion and Impulsive Wave-5 beginning.

2- Sustaining below 14249 will confirm breaking down of last 49 sessions like big trading range and resultant deeper correction of Wave-4 beginning.

Although lower levels consolidation was seen in first 3 sessions of previous week but whole day good selling developed in the 4th session of previous week i.e. last Friday as well as immediate supports and resistances are lying within previous week trading range(14249-14697) therefore firstly sustaining it beyond should be watched in next week for 1st strong signal of next above mentioned moves beginning.

As 49 sessions sideways market therefore just note down and Watch above mentioned levels one by one according to above mentioned implications.