As out of station and busy therefore Stock Market Outlook of today(18-02-2021) is not being updated.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Fresh selling will mean correction towards next supports

Nifty-Intra Day Chart Analysis &

Market Outlook(17-02-2021)

Nifty-Intra Day Chart (16-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 15388-15431

2- Selling between 15335-15367

3- Down moves in Bullish Falling Channels

4- Sideways trading between 15298-15324

5- Whole day actual trading between 15243-15431

Conclusions from intra day chart analysis

Following lines were told yesterday in "Rally continuation":-

1- rally continuation will be seen and

2- until Nifty will not sustain below 15267 after complete selling patterns till then any correction will not be seen.

As was told 100% same happened and and:-

1- Rally gained 117 points in first 20 minutes today.

2- Nifty could not sustain below 15267 and moved up 88 points after lowest formation at 15242.20

Although sharp up after gap up opening but good selling at higher levels therefore down moves remains continued till 02:00 pm. As negative zone down moves were in Bullish Falling Channels therefore lower levels supports developed hence 88 points recovery from lower levels and flat closing after last hour sideways trading between 15298-15324.

Whole day sideways trading was between 15267-15325 yesterday and today lower levels supports plus last hour sideways trading was also within this range therefore this range has become crucial for next decisive moves confirmations.

As good selling above 15325 today therefore if fresh selling develops between and near about 15243-15325 in the coming sessions then decisive down moves will be seen towars following next supports and its confirmation will be valid break down of 15243:-

1- 15106-15135

2- 15007-15065

Rally continuation

Nifty-Intra Day Chart Analysis &

Market Outlook(16-02-2021)

Nifty-Intra Day Chart (15-Feb-2021):-

Technical Patterns formation in today intraday charts

1- 120 Points jumped in first 10 seconds

2- Whole day sideways trading between 15267-15325

3- Whole day actual trading between 15244-15340

Conclusions from intra day chart analysis

As Dow Jones Futures was more than 140 points up and most Asian were trading more than 1.34% up today morning therefore sentiment was heated and resultant Nifty jumped 120 Points in first 10 seconds after gap up opening.

Almost whole day sideways trading between 15267-15325 and closing also within it despite some up movs above it in last 10 minutes.

As consolidation patterns were also between 15267-15325 therefore rally continuation will be seen and until Nifty will not sustain below 15267 after complete selling patterns till then any correction will not be seen.

Firstly watch levels

amid Short term correction possibility

Technical Analysis,Research &

Weekly Outlook(Feb 15 to Feb 19,2021)

Live Proofs of our accuracy

Following topic was updated in previous Weekly Outlook on 06-02-2021

Rally continuation above 15000 was told and 100% same happened in previous week in following manner:-

1- Nifty closed above 15000 in all 5 sessions of previous week.

2- Nifty traded most time above 15000 between 14977-15257 in previous week.

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (12-Feb-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020 and Impulsive Wave-3 beginning

4- Impulsive Wave-3 continuation with new life time highest top formation at 15257.10 on 09-02-2021

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-3 continuation with recent top formation at 15257.10 on 09-02-2021 and no indication of its completion yet.

Nifty-EOD Chart Analysis(Stochastic)

Nifty-EOD Chart (12-Feb-2021):-

Technical Patterns and Formations in EOD charts

1- Wave-3 continuation with new life time highest top formation at 15257.10 on 09-02-2021

2- Last 5 sessions trading between 14977-15257

3- Stochastic- %K(5) is at 72.45 & %D(3) is at 76.75

4- Stochastic is showing negative divergence in over bought through moving down when Nifty is moving up

Conclusions from EOD chart analysis(Stochastic)

Although Wave-3 continuation with new life time highest top formation at 15257.10 on 09-02-2021 but Short term indicator Stochastic is showing short term correction possibility through:-

1- Slipping form over bought zone.

2- Showing negative divergence through Stochastic moving down when Nifty is moving up

3- %K(5) has intersected downward %D.

Last 5 sessions trading was between 14977-15257 which is at the top of rally and Stochastic is showing short term correction possibility therefore once sustaining below 14977 will mean short term correction beginning which should be firstly watched in next week.

Nifty-Last 5 Sessions intraday charts analysis

Nifty-Intra Day Chart (Feb 08 to Feb 12,2021):-

Technical Patterns formation in last 5 Sessions intraday charts

1- Selling(Resistances) in last 5 sessions are between:-

A- 15193-15257

2- Consolidation(Supports) in last 5 sessions are sessions:-

A- 15007-15065

B- 15106-15135

3- Sideways trading in last 5 sessions are between:-

4- 5 Sessions actual trading between 14977-15257

Conclusions from 5 Sessions intra day chart analysis

As last 5 Sessions of previous week trading was between 14977-15257 with some selling at higher levels and some buying also at lower levels therefore expected that Nifty will firsly trade and prepare for next decisive moves within last 5 sessions trading range and finally sustaining it beyond will form next Short term trend which should be firstly watched in next week.

Nifty-Intra Day Chart Analysis(12-Feb-2021)

Nifty-Intra Day Chart (12-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 15193-15243(immediate Resistances)

2- Down moves in Bullish Falling Channel

3- Slow up moves in last hour

4- Whole day actual trading between 15081-15243

Conclusions from intra day chart analysis

As first 4 hours selling between 15193-15243 therefore more than 100 points fall was seen after that but these Down moves were in Bullish Falling Channel hence some consolidation will be understood and resultant up moves in last hour but those up moves were slow.

Although minor supports at lower levels but good selling also at higher levels therefore if follow up selling develops in the beginning of next week then sharp fall will be seen.

Conclusions (After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is up.

3- Short Term Trend is sideways between 14977-15257

Impulsive Wave-3 continuation with recent top formation at 15257.10 on 09-02-2021 and no indication of its completion yet but emergence of Short Term correction possibility because last 5 sessions sideways between 14977-15257 with higher levels selling and Short term indicator Stochastic has also shown Short term correction beginning above mentioned signals therefore follow up selling and sustaining below 14977 will mean correction beginning towards following supports:-

1- 14811-14913

2- 14717-14765

3- 14504-14615

As technically Nifty is not mature for immediate one sided moves therefore firstly prepare for it in the beginning of next week between 14977-15257 and sustaining it beyond should be watched in next week for confirmations amid Short term correction possibility below 14977.

Firstly watch 15066-15188

for next trend

Nifty-Intra Day Chart Analysis &

Market Outlook(12-02-2021)

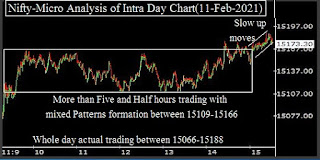

Nifty-Intra Day Chart (11-Feb-2021):-

Technical Patterns formation in today intraday charts

1- More than Five and Half hours trading with mixed Patterns formation between 15109-15166

2- Slow up moves in last half hour

3- Whole day actual trading between 15066-15188

Conclusions from intra day chart analysis

Although today closing at higher levels of the day but last half hour up moves were slow and before that more than Five and Half hours trading was with mixed Patterns formation between 15109-15166 therefore view will not be Bullish because pure consolidation patterns formations were not seen and some selling was also seen today.

Expected that Nifty will firstly trade and prepare for next trend within and near about today trading range(15066-15188) and finally sustaining it beyond will confirm it therefore firstly watch it in the coming sessions.

Watch 2 trading ranges for

first indication & final confirmation

of next trend

Nifty-Intra Day Chart Analysis &

Market Outlook(11-02-2021)

Nifty-Intra Day Chart (10-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Whole day intraday volatility

2- Whole day actual trading between 14978-15168

Conclusions from intra day chart analysis

Although today closing was near the higher levels of the day after last 2 hours up moves from intraday lower levels but as such one sided technical positions formation was not seen and it was only Whole day intraday volatility day today.

As minor supports at lower levels and minor selling at higher levels also therefore firstly valid break out of today trading range(14978-15168) and finally sustaining beyond 14865-15257 should be watched in the coming sessions for next trend confirmations.

Just watch above mentioned 2 trading ranges for first indication(14978-15168) and final confirmation(14865-15257) of next trend.

Levels will confirm next decisive moves

Nifty-Intra Day Chart Analysis &

Market Outlook(10-02-2021)

Nifty-Intra Day Chart (09-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Up moves in Bearish Rising Channel

2- Selling between 15198-15257(immediate Resistances)

3- Sharp fall in last hour

4- Whole day actual trading between 15065-15257

Conclusions from intra day chart analysis

As firstly Up moves in Bearish Rising Channel and after that selling between 15198-15257 therefore sharp fall in last hour and today closing was near the lower levels of the day.

As next supports are between 14865-14925 and Nifty will trade between 14865-15257 in the coming sessions as well as prepare for next decisive moves within this range therefore firstly sustaining beyond this range should be watched for deeper correction below 14865 and fresh rally after Short Term correction completion above 15257.

Tax free Union-Budget led Rally continuation above 15000

Technical Analysis,Research & Weekly Outlook

(Feb 08 to Feb 12,2021)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (05-Feb-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Wave-i of Wave-1(9889.05 on 30-04-2020)

3- Wave-ii of Wave-1(8806.75 on 18-05-2020)

4- Wave-iii of Wave-1(11317.80 on 28-07-2020)

5- Wave-iv of Wave-1(10882.30 on 03-08-2020)

6- Wave-v of Wave-1(11794.30 on 31-08-2020) and Wave-2 beginning

7- Wave-A of Wave-2(11185.10 on 09-09-2020)

8- Wave-B of Wave-2(11618.10 on 16-09-2020)

9- Wave-C of Wave-2(10790.20 on 24-09-2020) and Wave-3 beginning

10- Wave-i of Wave-3(12025.50 on 15-10-2020)

11- Wave-ii of Wave-3(11535.50 on 30-10-2020)

12- Wave-iii of Wave-3(14753.50 on 21-01-2021)

13- Wave-iv of Wave-3(13596.80 on 29-01-2021)

14- Wave-v of Wave-3 continuation with new life time highest top formation at 15014.65 on 05-02-2021

Conclusions from EOD chart analysis

(Waves structure)

Maximum target of previously given Waves structure was at 14754.25 but Nifty moved above it in last week therefore Waves structure has been recounted and has been done in given EOD chart.

As per new Waves structure Wave-v of Wave-3 continuation with recent top formation at 15014.65 on 05-02-2021 and no indication of its completion yet.

Nifty-EOD Chart Analysis

(Stochastic)

Nifty-EOD Chart (05-Feb-2021):-

Technical Patterns and Formations in EOD charts

1- Wave-3 continuation with new life time highest top formation at 15014.65 on 05-02-2021

2- Stochastic-%K(5) is at 95.24 & %D(3) is at 92.63

Conclusions from EOD

chart analysis (Stochastic)

Wave-3 continuation with new life time highest top formation at 15014.65 but Short Term indicator Stochastic is Overbought therefore first signal of Short Term correction beginning.

As Stochastic has not shown negative divergence and %K is also above %D as well as it has not shown negative divergence therefore Short Term correction will not be seen immediately,let these developments happen then will be seen.

Nifty-Intra Day Chart Analysis

(05-Feb-2021)

Nifty-Intra Day Chart (05-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 14972-15014

2- Down moves in Bullish Falling Channel

3- Selling between 14948-14987

4- Mixed Patterns formation between 14900-14959

5- Whole day actual trading between 14865-15014

Conclusions from intra day chart analysis

Although new life time high formation above 15000 but selling developed therefore down moves were seen in first 2 hours. As these Down moves were in Bullish Falling Channel therefore some up moves developed but again follow up selling developed below 15000.

As last 2 hours trading was also with Mixed Patterns formation between 14900-14959 therefore whole day last Friday trading will be understood with Mixed Patterns formation between 14865-15014.

Firstly Nifty will have to trade and prepare for next decisive moves between 14865-15014 because both buying and selling patterns were formed within it last Friday as well as finally sustaining it beyond will confirm next decisive moves which should be firstly watched in the beginning of next week.

Conclusions

(After Putting All Studies Together)

As tax free Union-Budget on 1st Feb 2021 amid Covid-19 like huge pandemic surprised all around and Indian Stock markets also therefore strong rally was seen in previous week which closed at life time highest last Friday.

1- Long Term Trend is up.

2- Intermediate Term Trend is up.

3- Short Term Trend has turned up.

Wave-v of Wave-3 continuation with new life time highest top formation at 15014.65 on 05-02-2021 and no indication of its completion yet on EOD and intraday charts,let it happen then size of correction will be considered according to its corrective patterns formations.

As Short Term indicator Stochastic is Overbought and some selling was also seen between 14865-15014 last Friday therefore firstly follow up moves within and near this range should be watched in the coming week for Short Term correction below 14865 after fresh selling or rally continuation above 15014 after fresh consolidation.

Lot of up moves are left according to given Waves structure because now Wave-v of Wave-3 continuation but Short,Intermediate and Long Term correction is its nature and if fresh selling develops then only Short Term correction will be seen and after its completion fresh rally will be seen above 15000 which will get confirmation through sustaining beyond 14865-15014 in next week.

Rally continuation towards 15000

Nifty-Intra Day Chart Analysis &

Market Outlook(05-02-2021)

Nifty-Intra Day Chart (04-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channel

2- Up moves with downward corrections

3- More than 2 hours consolidation between 14811-14864

4- Consolidation between 14865-14913

5- Whole day actual trading between 14715-14913

Conclusions from intra day chart analysis

Following lines were told yesterday in "14827-14868 will confirm next decisive moves":-

1- firstly fresh consolidation is required for decisive up moves above today highest.

2- Expected that Nifty will firstly trade and prepare for next decisive moves within and near about 14827-14868

As was told yesterday 100% same happened today through:-

Firstly fresh consolidation requirement was told and Nifty consolidated whole day today as well as more than 2 hours consolidated between 14811-14864 today which was within and near about 14827-14868.

Although firstly slipping 75 points after flat opening but firstly lower levels consolidation through Down moves in Bullish Falling Channel therefore after that up moves were seen which were also with consolidation through downward corrections.

As more than 2 consolidation between 14811-14864 in Mid-Session and after that last hours follow up consolidation also therefore whole day today trading will be understood with consolidation hence on going rally continuation is expected towards 15000.

14827-14868 will confirm

next decisive moves

Nifty-Intra Day Chart Analysis &

Market Outlook(04-02-2021)

Nifty-Intra Day Chart (03-Feb-2021):-

Technical Patterns formation in today intraday charts

1- 180 points sharp down in first 6 minutes after gap up strong opening

2- Up moves in Bearish Rising Channel

3- Selling between 14827-14868

4- Whole day actual trading between 14575-14868

Conclusions from intra day chart analysis

Although 180 points sharp down in first 6 minutes after gap up strong opening but after that whole day up moves were seen.

As firstly Up moves were in Bearish Rising Channel and after that higher levels selling was also seen between 14827-14868 therefore firstly fresh consolidation is required for decisive up moves above today highest.

Expected that Nifty will firstly trade and prepare for next decisive moves within and near about 14827-14868 and sustaining it beyond will confirm it which should be watched tomorrow for confirmations.

Sustaining beyond 14505-14720 will form next trend

Nifty-Intra Day Chart Analysis &

Market Outlook(03-02-2021)

Nifty-Intra Day Chart (02-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Volatility in first hour

2- Slow up moves with downward corrections in last 5 hours

3- Whole day actual trading between 14470-14731

Conclusions from intraday chart analysis

Although rally started on 1st February but its preparation though consolidation was started 3 sessions before therefore on the back of intraday consolidation I posted following topics:-

1- "Strong Pull back Rally in the coming 1/2 sessions" for 28-01-2021.

2- "Strong Pull Back Rally tomorrow" for 29-01-2021.

3- Told for Budget day(01-02-2021) Outlook on 30-01-2021 that "consolidation patterns formations between 13730-13816 in last 2 sessions"

As all the Global markets were crashing therefore Pull back Rally was not seen in previous week and Indian markets blasted in this week because its base was formed in previous week through 3 sessions lower levels consolidation.

Firstly huge gap up opening and after that volatility in 1st hour today but after that 5 hours slow up moves were seen which is an indication of some profit booking also. As these up moves were with downward corrections which is an indication of some consolidation also but complete consolidation is firstly required for sustaining above today highest.

Mixed Patterns formation will be understood between 14505-14720 in last 5 hours therefore Nifty will firstly trade and prepare for next decisive moves within and near about this range. As sustaining it beyond will form next trend therefore should be firstly watched for its confirmations.

Pull Back rally continuation towards next resistances

Nifty-Intra Day Chart Analysis &

Market Outlook(02-02-2021)

Nifty-Intra Day Chart (01-Feb-2021):-

Technical Patterns formation in today intraday charts

1- Whole day up moves with downward corrections

2- Sharp up moves started after the end of Budget speech

3- Whole day actual trading between 13662-14336

Conclusions from intra day chart analysis

Although Nifty closed at the lowest of the day last Friday but we were not Bearish and told following lines on 30-01-2021 in "Levels will confirm next Trend after Union-Budget under the shadow of crashing Global markets":-

1- Although Nifty closed below last 25 sessions lowest after loosing 270 points in last hour last Friday but

2- consolidation patterns formations between 13730-13816 in last 2 sessions therefore firstly sustaining it beyond should be watched in the coming week for next Trend confirmation after Union-Budget Next Monday

Nifty traded within and near about 13730-13816 till the end of Budget speech and after that zoomed up as well as closed at the top of the day with 4.74% gains at 14281.20.

As whole day up moves were with downward corrections and selling patterns were not seen therefore today started Pull Back rally continuation is expected towards following next resistances;-

1- 14455-14619

2- 14701-14753

Levels will confirm next Trend after Union-Budget under the shadow of crashing Global markets

Technical Analysis,Research & Weekly Outlook

(Feb 01 to Feb 05,2021)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (29-Jan-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Wave-1(9889.05 on 30-04-2020)

3- Wave-2(8806.75 on 18-05-2020)

4- Wave-3(12025.50 on 15-10-2020)

5- Wave-4(11535.50 on 30-10-2020)

6- Impulsive Wave-5 completion with recent top formation at 14753.55 on 21-01-2021 and correction beginning

7- Correction continuation with recent bottom formation at 13596.75 on 29-01-2021

Conclusions from EOD chart analysis

(Waves structure)

Waves structure which started from 7511.10 on 24-03-2020 completed at 14753.55 on 21-01-2021 and its correction started that is in continuation with recent bottom formation at 13596.75 on 29-01-2021.

Nifty-EOD Chart Analysis

(Averages & Stochastic)

Nifty-EOD Chart (29-Jan-2021):-

Technical Patterns and Formations in EOD charts

1- Averages

A- 5-Day SMA is today at 14006

B- 13-Day SMA is today at 14325

C- 55-Day SMA is today at 13654

D- 200-Day SMA is today at11558

2- Stochastic %K(5) is at 6.11 & %D(3) is at 8.14

Conclusions from EOD chart analysis

(Averages & Stochastic)

Correction continuation with slipping below 55-Day SMA(13654) which is Intermediate Term Trend turning down confirmation.

As Short term Trend indicator has turned extremely over sold therefore signals of a Pull Back rally which will be seen also if Global markets will not be in crashing mode as were in previous week due to new variant of Coronavirus.

Nifty-EOD Chart Analysis

(Fibonacci retracement levels)

Nifty-EOD Chart (29-Jan-2021):-

Technical Patterns and Formations in EOD charts

Fibonacci retracement levels of Whole Wave Structure(7511.10-14753.55)

1- 13.0%- 13811(Corrected)

2- 23.6%- 13044

3- 27.0%- 12797

4- 38.2%- 11986(Crucial)

5- 50.0%- 11132(Crucial)

6- 61.8%- 10278(Crucial)

7- 70.7%- 9633

8- 76.4%- 9220

9- 78.6%- 9061

10-88.6%- 8337

Conclusions from EOD chart analysis

(Fibonacci retracement levels)

As more than 13% correction has been happened therefore Fibonacci retracement levels of Whole Wave Structure(7511.10-14753.55) has been updated because "ABC" correction according to its levels may be seen in the coming weeks/months/years.

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is down.

3- Short Term Trend has turned down.

Immediate maximum target of Nifty was told at 14754.25 on 16-01-2021 and Nifty crashed 1156 points from 14753.55 which was 0.70 points below the given level and it means that given Waves structure is still valid because last Friday closing was below 55-Day SMA(13654) after more than 13% retracement.

As eruption of new variant of Coronavirus therefore all the Global markets are crashing and most markets closed in deep Red last Friday. Although Union-Budget will be tabled next Monday and Indian markets will react according to its announcements as well as next session will be highly volatile therefore firstly sustaining beyond following crucial levels should be firstly watched in next week to understand final reaction of Indian markets on Union-Budget and new variant of Coronavirus:-

Next supports are as follows:-

1- 13500-13546

2- 13193-13286

3- 23.6% retracement levels- 13044

Next resistances are as follows:-

1- 13841-13898

2- 14120-14194

3- 14455-14619

4- 14701-14753

Although Nifty closed below last 25 sessions lowest after loosing 270 points in last hour last Friday but consolidation patterns formations between 13730-13816 in last 2 sessions therefore firstly sustaining it beyond should be watched in the coming week for next Trend confirmation after Union-Budget Next Monday as well as under the shadow of crashing Global markets due to new variant of Coronavirus.

Firstly Watch 13714-13770 amid crashing Global markets and Budget expectation

Mid-session Outlook(29-01-2021)

Global markets are as follows today morning;-

Dow Jones Futures- 360 Points down

Hang Seng- 0.81% down

Taiwan- 1.51% down

Kospi- 3.37% down

Nikkei- 1.83% down

Although such crashing like situation in all Global markets to day morning but Indian markets traded Out Performing and most time traded in Green since opening today.

As lower levels supports between 13714-13770 yesterday therefore firstly sustaining it beyond should be watched today amid crashing Global markets and Budget expectation next Monday.

Strong Pull Back Rally tomorrow

Nifty-Intra Day Chart Analysis &

Market Outlook(29-01-2021)

Nifty-Intra Day Chart (28-Jan-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 13841-13898

2- Down moves in Bullish Falling Channel

3- Sharp up

4- Down moves in Bullish Falling Channel

5- Whole day actual trading between 13714-13898

Conclusions from intra day chart analysis

As most Asian markets were in crashing mode today morning after more than 2% yesterday fall of all US markets Indices therefore huge gap down opening of Indian markets today.

Although firstly more than 2 hours selling but after that lower levels consolidation through down moves in Bullish Falling Channels therefore Sharp up moves were seen in last 4 hours which could not move above 13841 because good selling was above it today.

As today down moves were due to crashing Global markets and Dow Jones is now trading more than 600 points up as well as such higher Dow Jones closing today will lead rally in Asian markets tomorrow therefore resultant up moves will be seen in Indian markets also.

As lower levels consolidation today and Very Short Term indicators have turned Over sold as well as possibility of Bullish Global markets tomorrow therefore resultant strong Pull Back Rally will be seen in Indian markets also.

13772-13912 will confirm Indian markets reaction on Budget and crashing Global markets

Mid-session Outlook(28-01-2021)

As most Asian markets were in crashing mode after more than 2% fall of all US markets Indices therefore huge gap down opening of Indian markets and Nifty is trading between 13795-13898 since today morning which is within previous Outlook mentioned supports(13772-13912).

Indian markets will have to react on Budget expectations and crashing Global markets and Finally sustaining beyond 13772-13912 will confirm next trend as the result of these 2 developments therefore firstly sustaining beyond 13772-13912 should be watched in the coming sessions for Indian markets final reaction and resultant next trend.

Strong Pull back Rally in the coming 1/2 sessions

Nifty-Intra Day Chart Analysis &

Market Outlook(28-01-2021)

Nifty-Intra Day Chart (27-Jan-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 14120-14194

2- Down moves with upward corrections

3- Consolidation between 13930-14010

4- Whole day actual trading between 13930-14237

Conclusions from intra day chart analysis

In both previous Outlooks possibility of huge/sharp fall was told after sustaining below 14265 and it was seen today because following next supports were much below 14265:-

1- 13875-13912

2- 13815-13845

3- 13772-13811(Gap supports)

Slipping 75 points in first 10 seconds and after that selling through Down moves with upward corrections therefore correction continuation and closing below 14000 today.

Although last more than 1 hour consolidation between 13930-14010 but higher levels good selling also therefore complete consolidation is firstly required for fresh rally above 14000.

As crashing like situation in all Global markets therefore more weakness can not be ruled out tomorrow but Very Short Term indicators have turned Oversold and consolidation was seen at lower levels today as well as above mentioned multiple supports are lying below today lowest therefore expected that strong Pull back Rally will be seen in the coming 1/2 sessions after fresh consolidation above 13815.

Firstly watch sustaining beyond 14265

Nifty-Intra Day Chart Analysis &

Market Outlook(27-01-2021)

Nifty-Intra Day Chart (25-Jan-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 14455-14480

2- Sharp fall

3- Selling between 14324-14432

4- Down moves in Bullish Falling Channel

5- Whole day actual trading between 14218-14491

Conclusions from intra day chart analysis

Following conclusive lines were told on 23-01-2021 in "Firstly watch crucial levels in Budget news led highly volatile next week":-

1- Nifty will firstly prepare for post-Budget big moves between and near about 14265-14528 in the beginning of next week

2- As strong resistances are above it therefore Nifty will have to consolidate completely for crossing and sustaining above those resistances

3- Remain completely careful because fresh selling within this range and sustaining below 14265 will mean huge fall because next supports are much below it.

Nifty traded first 6 hours between 14265-14528 and slipped below it in last half hour after good selling above it last Monday therefore more down moves are expected tomorrow, follow up selling and once sustaining below 14265 will mean sharp fall possibility also therefore remain cautious.

As Union Budget led volatility can not be ruled out and last hour Down moves were in Bullish Falling Channel last Monday therefore some up moves possibility can not be ruled but until complete consolidation will not develop till then Nifty will not be able to move and sustain above 14265.

Global markets are also highly volatile due to new variant of coronavirus therefore firstly sustaining beyond 14265 should be watched tomorrow for slow up moves above it and sharp fall below it.

Subscribe to:

Comments (Atom)