8151-8200 will confirm next Decisive Moves

Intra Day Chart Analysis & Market Outlook

(31-05-2016)

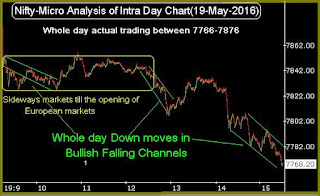

Nifty-Intra Day Chart (30-May-2016):- |

| Just click on chart for its enlarged view |

1- Firstly Down moves in Bullish Falling Channel

2- Last 5 hours sideways trading with Mixed Patterns between 8157-8188

3- Whole day actual trading between 8151-8200

Conclusions from intra day chart analysis

Following lines were told yesterday in "Minimum Target of Nifty at 8844.55":-

finally last week started rally will remain continued towards 8844.55 with only very Short Term and sideways corrections.

Rally remained continued with 5 hours intraday sideways trading today which is a part of very Short Term correction also because very Short Term oscillators have turned overbought after 484 points 5 sessions sharp rally and minor correction turned due after such strong rally.

As firstly Down moves in Bullish Falling Channel today and last 5 hours Mixed Patterns formations therefore today trading will be understood a part of consolidation process and follow up consolidation tomorrow will mean rally continuation above 8200.

It is confirm that until clear and complete selling patterns will not develop on EOD charts till then any deeper correction will not be seen and valid break out of today trading range(8151-8200) should be firstly watched tomorrow for:-

1- very Short Term correction confirmation below 8151 or

2- fresh rally confirmation above 8200

Only it has to be decided that immediate fresh rally above 8200 or after very Short Term correction between 7992-8151 and its confirmation will be from 8151-8200.