Technical Analysis,Research & Weekly Outlook

(Apr 08 to Apr 12,2013)

Nifty-EOD Chart (05-Apr-2013):- |

| Just click on chart for its enlarged view |

1- 4531.15 on 20-12-2011(Wave-3 beginning after 13 Months Wave-2 correction completion)

2- Wave 1(5629.95 on 22-02-2012)

3- Wave 2(4770.35 on 04-06-2012)

4- Wave 3(6111.80 on 29-01-2013)

5- Wave 4 correction beginning

6- Wave A(5663.60 on 04-03-2012)

7- Wave A retraced 448.20 points.

8- Wave B(5971.20 on 11-03-2012)

9- Wave B gained 307.60 points

7- Wave B(5971.20 on 11-03-2012)

10- Wave C of Wave 4 bottom formation at 5534.70 on 05-04-2012

12- Wave C has retraced 436.50 points yet.

13- Corrective Wave C of Wave 4 continuation.

14- 200 Day EMA at 5670 on 05-04-2012

15- 200 Day DMA at 5641 on 05-04-2012

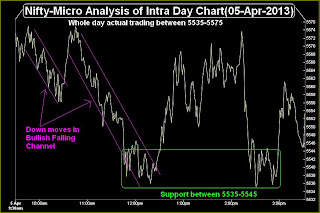

Nifty-Intra Day Chart (05-Apr-2013):-

|

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel.

2- Support between 5535-5545

3- Whole day actual trading between 5535-5575

Conclusions (After Putting All Studies Together)

As Per Elliot Wave Theory:-

The bottom of Wave-4 should not dip below the top of Wave 1,at least on a closing basis.

Top of Wave 1 is at 5629.95 and Nifty closed below it in last 2 sessions therefore it means recounting of Waves which started from 4531.15 on 20-12-2011 but as per our view last 2 sessions down closing was due to negative news flow from Global markets therefore breaking down confirmation is required through sustaining below 5629.95. Although Nifty closed below 200 Day EMA and DMA but Long Term Trend turning down confirmation is required yet through sustaining below both mentioned Averages.

Following target with following calculation was told on 26-03-2013 in Long Term Trend is at stake:-

ABC Waves of Wave 4 continuation and Wave A retraced 448.20 points therefore equal 100% retracement of Wave c can not be ruled out. Wave C correction continuation is expectd target is at:-

5971.20(Wave B)-448.20(Wave A lost)=5523.00

As bottom formation at 5534.70 on 05-04-2012 which is near above given target therefore possibility of Wave 4 correction completion is still alive. Previous week down moves were due to weaker Global cues therefore finally sustaining beyond following levels will be next trend confirmations and should be firstly watched in next week:-

1- 5629.95(Top of Wave 1)

2- 5670(200 Day EMA on 05-04-2012)

3- 5641(200 Day DMA at 05-04-2012)

Although negative closing last Friday but consolidation patterns formation through Down moves in Bullish Falling Channel and lower levels supports as well therefore strong indications of up moves in the beginning of next week.