Firstly Down Moves towards Next Strong Supports

Technical Analysis,Research & Weekly Outlook

(Dec 30 to Jan 03,2014)

Nifty-EOD Chart (27-Dec-2013):- |

| Just click on chart for its enlarged view |

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6342.95 on 03-11-2013)

5- Wave-ii of Wave-3(5972.45 on 13-11-2013)

6- Wave-iii of Wave-3(6415.25 on 09-12-2013)

7- Wave-iv of Wave-3(6129.95 on 18-12-2013)

8- Wave-v of Wave-3 continuation with recent top formation at 6324.90 on 27-12-2013.

Conclusions from EOD chart analysis

All Trends were up and Wave-3 continuation towards minimum target of Nifty at 6724.60. Its calculation has already been updated in following topic on 21-10-2013:-

It must be kept in mind that it is price vice target and not time vice therefore market will take its own time to achieve it.

Nifty-Intra Day Chart (Dec 09 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Strong support range 6130-6180

2- Resistance between 6360-6387

3- Resistance between 6330-6355

4- Sideways trading between 6260-6324 within only 64 points with higher levels selling in previous week.

5- 14 Sessions actual trading between 6130-6415

Conclusions from 14 Sessions intra day chart analysis

Multiple resistances between 6330-6387 and just below it previous week sideways trading with higher levels selling therefore emergence of down moves possibility.

Nifty-Intra Day Chart (Dec 23 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Daily higher levels selling in all 4 trading sessions of previous week.

3- 4 Sessions actual trading between 6260-6324

Conclusions from 4 Sessions intra day chart analysis

Previous whole week sideways trading within only 64 points therefore sustaining beyond this range will give big moves. As most time selling patterns seen in last 4 sessions therefore finally down moves are expected in the coming week despite previous week closing near weekly highest levels.

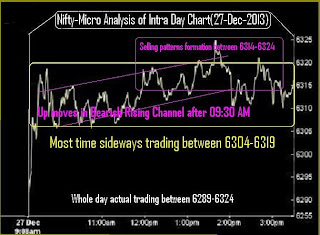

Nifty-Intra Day Chart (27-Dec-2013):-

|

| Just click on chart for its enlarged view |

1- Up moves in Bearish Rising Channel after 09:30 AM.

2- Most time sideways trading between 6304-6319.

3- Selling patterns formation between 6314-6324.

4- Whole day actual trading between 6289-6324.

Conclusions from intra day chart analysis

Most time sideways trading between 6304-6319 with Bearish Rising Channel and higher levels selling patterns formation therefore down moves below 6304 are expected in next week.

Conclusions (After Putting All Indicators Together)

Impulsive Wave-v of impulsive Wave-3 is on with closing near the weekly highest last Friday but most time selling patterns seen in all last 4 sessions of previous week therefore firstly down moves are expected in next week. As strong supports above 6130 also developed in last 14 sessions therefore Nifty will not easily slip below it.

Expected that finally Nifty will sustain above 6415 and move towards minimum 6724.60 but firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend but high possibility of up trend beginning after fresh consolidations near about 6130.

As Indian markets are in Bullish phase therefore expected that Nifty will remain range bound in broader range of last 14 sessions 6130-6415 and prepare for next big trend in the coming weeks.