Nifty-Intra Day Chart (31-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 6305-6317

2- Selling patterns between 6300-6305

3- Whole day actual trading between 6287-6317

Conclusions from intra day chart analysis

Almost whole day positive zone trading but selling patterns formation above 6300 therefore expected that Nifty will not sustain above it and finally slip below 6300 despite today closing at 6304 today.

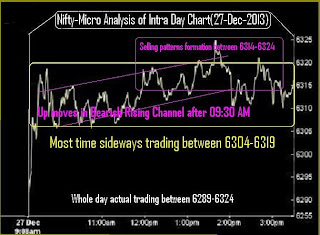

Intraday support between 6274-6287 yesterday and selling patterns formation between 6314-6324 on 27-12-2013 therefore mixed technical positions in last 3 sessions and firstly Nifty has to prepare for next decisive moves between 6274- 6324. It is clear that sustaining beyond 6274- 6324 will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation and should be firstly watched in the coming sessions.

|

| Just click on chart for its enlarged view |

1- Selling patterns between 6305-6317

2- Selling patterns between 6300-6305

3- Whole day actual trading between 6287-6317

Conclusions from intra day chart analysis

Almost whole day positive zone trading but selling patterns formation above 6300 therefore expected that Nifty will not sustain above it and finally slip below 6300 despite today closing at 6304 today.

Intraday support between 6274-6287 yesterday and selling patterns formation between 6314-6324 on 27-12-2013 therefore mixed technical positions in last 3 sessions and firstly Nifty has to prepare for next decisive moves between 6274- 6324. It is clear that sustaining beyond 6274- 6324 will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation and should be firstly watched in the coming sessions.