Technical Analysis and Research For 26-07-2011

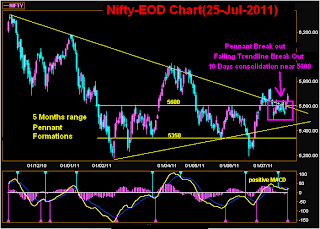

Nifty-EOD Chart(25-Jul-2011):-

8 Bullish patterns in charts are as follows

1- 10 Days trading range(5497-5654) broken out confirmation on 25-07-2011.

2- 5 months range(5350-5600) broken out confirmations on 25-07-2011.

3- Sustaining above all crucial EMAs(8,21,55,200) confirmation.

4- All trends turning up confirmation.

5- Daily MACD upward cross over.

6- Weekly MACD upward cross over

7 Falling Trendline Break Out.

8- Pennant Break out.

Next resistances are as follows

1- 5675-5699(Last one hour mixed intraday patterns and today follow up buying/selling will decide next immediate moves)

2- 5700-5740(Resistance and consolidation requires for crossing 5740)

Conclusions

Yesterday rally gave Bullish markets beginning confirmations and should be expected that market will consolidate near about above mentioned resistances as well as cross 5740 in the coming sessions.

Asian markets are little positive today morning therefore firstly range bound market expected between 5665-5700. RBI credit policy today and its announcements may also show decisive direction to Indian markets but voltality possibility can not be ruled out.

Positive closing is expected after consolidations between 5665-5700 but sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations.

Nifty-EOD Chart(25-Jul-2011):-

|

| Just click on chart for its enlarged view |

1- 10 Days trading range(5497-5654) broken out confirmation on 25-07-2011.

2- 5 months range(5350-5600) broken out confirmations on 25-07-2011.

3- Sustaining above all crucial EMAs(8,21,55,200) confirmation.

4- All trends turning up confirmation.

5- Daily MACD upward cross over.

6- Weekly MACD upward cross over

7 Falling Trendline Break Out.

8- Pennant Break out.

Next resistances are as follows

1- 5675-5699(Last one hour mixed intraday patterns and today follow up buying/selling will decide next immediate moves)

2- 5700-5740(Resistance and consolidation requires for crossing 5740)

Conclusions

Yesterday rally gave Bullish markets beginning confirmations and should be expected that market will consolidate near about above mentioned resistances as well as cross 5740 in the coming sessions.

Asian markets are little positive today morning therefore firstly range bound market expected between 5665-5700. RBI credit policy today and its announcements may also show decisive direction to Indian markets but voltality possibility can not be ruled out.

Positive closing is expected after consolidations between 5665-5700 but sentiment is heated therefore voltality after minor profit booking may be seen. As markets have to trade between resistances therefore fresh consolidation is must and long positions should be created after intraday consolidations.