I told yesterday that technically market is not prepare to move and repeating same in following words today:-

All trends are up and very short term correction was seen after selling within 6150-6220 in last week and Nifty consilidated within 6070-6110 last Friday. Mentioned levels are supports and resistances and non trading zone(6110-6150) within it is next move preperation area in which Nifty traded most of the time yesterday. Expected that Nifty will trade first within non trading zone(6110-6150) and also possible that will move little above or below it according to sentiment during trading hours. Breaking out of non trading zone will be next move indication and forceful break out of 6070-6220 will be next move confirmation.

Obvious that trading patterns within 6110-6150 will decide that Nifty will cross 6220 to form new high immediately or correction will start first after dipping below 6070. My long term view is bullish and confirm that 6359 will be crossed finally and only it has to be decided at this moment that Nifty will cross amid on going up move or correct first and will cross 6359 after completion of correction.

Although Indian marketts closed positive yesterday but Intraday charts showed selling indications. Patterns not complete and follow up selling required today for next down move confirmations. As per my view Indian markets are mature for correction and that will be seen after follow up selling today.

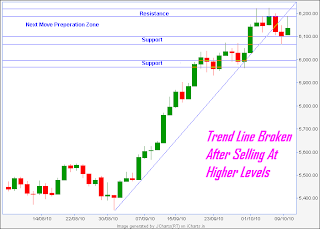

Fast up trend of last 26 sessions has been broken after last week selling and it is strong indication of short term correction begining. Next support is near 6000 and if nifty break 6000 then sharp declines will be seen.Mentioned supports,resistances with trendline are clearly shown in followin daily chart:-

Today trading levels are as follows:-

6225- 2nd Resistance and not expected to test

6180- 1st Resistance and not expected to test

6150- Higher level of today expected 1st range

6095- 1st Support- lower level of today expected 1st range

6060-2ND Support- Will be tested after fresh selling development

6025-3rd Support- Weakness confirmation will mean its confirm testing.

Expected that follow up selling will develop today and correction will be seen after whatsoever good results from companies. Although US markets closed flat yesterday but daily and intraday charts of US markets are showing selling patterns and down moves expeted in US markets which will become trigger for global markets sharp declines in this week.

Opening will depend on global cues and expected that yesterday range will be broken down and Indian markets will close in Red and will give next down move indication today.