Rally continuation except

minor correction possibility

Technical Analysis,Research &

Weekly Outlook(Oct 11 to Oct 14,2021)

Nifty-EOD Chart Analysis

(Averages,Stochastic & MACD)

Nifty-EOD Chart (08-Oct-2021):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 continuation with recent high and new life time top formation at 17947.65 on 24-09-2021

2-Averages

A- 5-Day SMA is today at 17769

B- 21-Day SMA is today at 17634

3- Stochastic- %K(5) is at 69.98 & %D(3) is at 69.25 and its both lones are kissing just below Over bought zone.

4- In MACD- MACD line has intersected Average line downward and its both lines are moving downward in positive zone.

5- MACD is showing negative divergence

6- Doji Candle formation last Friday

Conclusions from EOD chart analysis

(Averages,Stochastic & MACD)

Nifty got supports at 21-Day SMA on 01-10-2021 and after that strong rally was seen as well as last Friday closing was above all the Short Term Averages.

As in Stochastic both its lines are kissing just below Over bought zone therefore has shown 1st indication of Short Term correction beginning but selling patterns have not developed on EOD charts yet therefore let it happen then Short Term correction will be seen.

As in MACD both lines are falling in positive zone after MACD line downward intersection of Average line and it is showing negative divergence also therefore suggesting Downward trend beginning possibilities but selling patterns have not been developed on EOD charts yet hence let it happen the decisive down moves will be seen.

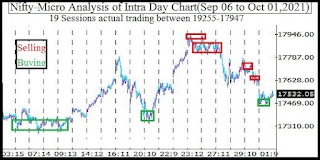

Nifty-Last 11 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Sep 24 to Oct 08,2021):-

Technical Patterns formation in last 11 Sessions intraday charts

1- Selling(Resistances) in last 11 Sessions are as follows:-

A- 17907-17943

B- 17852-17890

2- Consolidation(Supports) in last 11 Sessions are as follows:-

A- 17641-17704

B- 17453 47516

4- Last 11 Sessions actual trading between 17453-17947

Conclusions from 11 Sessions

intra day chart analysis

Last 11 Sessions trading between 17453-17947 with above mentioned lower levels supports and higher levels resistances within it.

As Nifty traded almost whole day last Friday within above mentioned both resistance ranges and closed below 1st resistance range but above 2nd resistance range therefore firstly sustaining beyond or forceful break out of both resistance ranges(17852-17943)should be watched in next week for first strong signal of next decisive moves beginning as well as its confirmation will be sustaining beyond last 11 Sessions trading range(17453-17947).

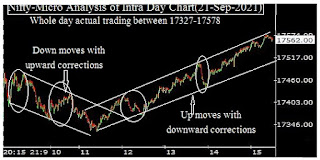

Nifty-Intra Day Chart

Analysis(08-Oct-2021)

Nifty-Intra Day Chart (08-Oct-2021):-

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channels

2- Selling between 17917-17941

3- Sharp fall

4- Up moves with downward corrections

5- Whole day actual trading between 17841-17941

Conclusions from intra day

chart analysis

Although last Friday closing was at life time highest but some intraday selling was also seen at higher levels. As lower levels consolidation patterns have also developed therefore expected that Nifty will firstly trade within last Friday trading range((17841-17941)) in the beginning of next week and will prepare for next decisive moves within this range,firstly sustaining it beyond or its forceful break out should be watched in next week for its beginning.

Conclusions (After Putting

All Studies Together)

All the trends are up with closing at life time highest last Friday and no indication of Impulsive Wave-5 completion yet on EOD charts.

As Doji Candle formation after some higher levels intraday selling patterns formations last Friday but lower levels good consolidation was also seen therefore firstly sustaining beyond last Friday trading range(17841-17941) should be watched in next week for:-

1- Above 17941 will mean rally above 18000 after last 11 sessions trading range break out.

2- Below 17841 will mean Short Term correction beginning towards next supports within above mentioned last 11 sessions trading range(17453-17947)

Sustaining below 17453 will mean correction continuation towards next supports of last 24 sessions trading range:-

1- 17360-17411

2- 17280-17305

Impulsive Wave-5 rally continuation is expected except minor correction possibility because some intraday selling patterns were seen last Friday. It must be kept in mind that until complete selling patterns will not develop on intraday and EOD charts till then Short/Intermediate Term correction will not be seen.