Market Outlooks updating will be restarted in this week after recovering completely.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Firstly Sideways Market for next

Trend Preparations

Trend Preparations

Intra Day Chart Analysis & Market Outlook

(25-11-2016)

Nifty-Intra Day Chart (24-Nov-2016):- |

| Just click on chart for its enlarged view |

1- Selling between 7977-8004

2- Volatility in last 2 hours between 7953-8024

3- Whole day actual trading between 7953-8024

Conclusions from intra day chart analysis

As most Asian markets were trading in Red therefore weak opening and some selling also but high volatility in last 2 hours due to derivative expiry today therefore any conclusion can not be drawn only from today intraday charts formations.

As technical positions reverses during today like high volatility and higher levels selling,lower levels buying in last 4 sessions between 7917-8063 therefore Nifty will have to trade and prepare for next decisive moves within this range. Expected that Nifty will remain sideways between mentioned range in the coming 1/2 sessions and its valid break out will confirm next trend beginning which should be watched for confirmations.

Emergence of Pull Back Rally beginning Expectations

Intra Day Chart Analysis & Market Outlook

(24-11-2016)

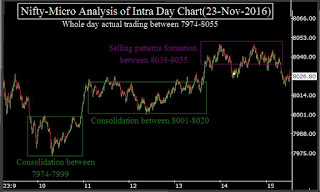

Nifty-Intra Day Chart (23-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Consolidation between 7974-7999

2- Consolidation between 8001-8020

3- Selling patterns formation between 8038-8055

4- Whole day actual trading between 7974-8055

Conclusions from intra day chart analysis

As follow up consolidation today after lower levels consolidation yesterday therefore emergence of Pull Back Rally beginning expectations but some more consolidation is firstly required tomorrow for sustaining above today highest because minor selling at higher levels of the day today.

7917-8063 will Confirm Next Decisive Moves Beginning

Intra Day Chart Analysis & Market Outlook

(23-11-2016)

Nifty-Intra Day Chart (22-Nov-2016):- |

| Just click on chart for its enlarged view |

1- More than 5 hours consolidation between 7939-7983

2- Whole day actual trading between 7939-8019

Conclusions from intra day chart analysis

As 4 hours trading with Mixed Patterns between 7928-7984 yesterday and fresh consolidation was firstly required for decisive up moves above it therefore Nifty traded more than 5 hours within this range between 7939-7983 and moved up after some consolidation within this range today. Although today closing near the higher levels of the day but Recovery from lower levels was after strong opening of European markets and Indian markets under performed all the Asian markets and Dow's Futures also therefore sustaining above day's highest(8019) is must for the confirmation of Pull Back Rally beginning.

Expected that Nifty will firstly trade and prepare for next decisive moves between 7917-8063 and valid break out of this range will confirm its beginning.

Firstly Watch Next Supports after Breaking Down Confirmation of

Long Term Trend

Long Term Trend

Intra Day Chart Analysis & Market Outlook

(22-11-2016)

Nifty-Intra Day Chart (21-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- 4 hours trading with Mixed Patterns between 7928-7984

3- Whole day actual trading between 7917-8102

Conclusions from intra day chart analysis

Although positive opening but slipping 61 points in first 7 minutes as well as 150 points continuous down moves till 11:00 AM because pressures on all assets classes and Stock Markets due to demonetisation of Rs 1000 and Rs 500 notes. Although all the Global markets moved up after Trump victory huge fall but Indian markets are continuously falling which may be due sudden high imbalance in the cash of big operators due to demonetisation.

May be any reason but correction is on and no confirmation of its completion yet. As slipped below the bottom of Wave-ii of Wave-3(7927.05) therefore waves will have to be recounted and Fibonacci Retracement levels of post Budget Rally(6826-8968) are as follows:-

1- 13.0%- 8689(Corrected)

2- 23.6%- 8462(Corrected)

3- 27.0%- 8389(Corrected)

4- 38.2%- 8149(Corrected)(Crucial)

5- 50.0%- 7897(Crucial)

6- 61.8%- 7644(Crucial)

7- 70.7%- 7453

8- 76.4%- 7331

9- 78.6%- 7284

10-88.6%- 7070

As 4 hours trading with Mixed Patterns between 7928-7984 near the lower levels of the day amid correction continuation therefore once slipping below today lowest(7917) will mean correction continuation towards following supports:-

1- 7690-7795(Multiple supports)

2- 7525-7595

Although long term impact of demonetisation will be highly positive for Indian economy and country growth but big jolt for big players and let all the things settle till then wait for bottom formation confirmations during on going correction and firstly watch above mentioned supports after breaking down confirmation of Long Term Trend decider 200 Day SMA(8140) today.

Firstly Watch 8003 amid Fresh and Decisive Up Moves Expectations

Technical Analysis,Research & Weekly Outlook

(Nov 21 to Nov 25,2016)

Nifty-EOD Chart (18-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Impulsive Wave-1 beginning after bottom formation at 6825.80 on 29-02-2016

2- Wave-1(7777.6 on 31-03-2016)

3- Wave-2(7516.90 on 11-04-2016)

4- Wave-i of Wave-3(8294.95 on 07-06-2016)

5- Wave-ii of Wave-3(7927.05 on 24-06-2016)

6- Wave-iii of Wave-3 completion at 8968.70 on 07-09-2016 and corrective Wave-A beginning

7- Wave-A(8506.20 on 17-10-2016)

8- Wave-B(8737.00 on 24-10-2016)

9- Corrective Wave-B continuation with recent bottom formation at 8002.30 on 09-11-2016

Intra Day Chart Analysis(18-11-2016)

Nifty-Intra Day Chart (18-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Up moves with intraday corrections

2- Down moves in Bullish Falling Channel

3- Whole day actual trading between 8049-8128

Conclusions from intra day chart analysis

Although closing near the lower levels of the day after last 2 hours down moves but view will not be Bearish because intraday selling patterns were not seen and on the contrary consolidation developed through up moves with intraday corrections and last hours down moves in Bullish Falling Channel after slipping of all European markets.As consolidation was seen in last 3 sessions between 8049-8236 therefore it will be understood that Indian markets are in consolidation process and hopes are alive that finally rally will remain continued after on going correction completion within and near about 8049-8236.

Conclusions (After Putting All Studies Together)

Trends of Nifty are as follows:-

1- Long Term Trend is down.

2- Intermediate Term Trend is down.

3- Short Term Trend is at stake which will be down after confirmation of sustaining below its decider 200 Day SMA(8137).

Fibonacci Retracement levels of Wave-iii of Wave-3(7927-8968) are as follows:-

1- 13.0%- 8832(Corrected)

2- 23.6%- 8722(Corrected)

3- 27.0%- 8686(Corrected)

4- 38.2%- 8570(Crucial)(Corrected)

5- 50.0%- 8447(Crucial)(Corrected)

6- 61.8%- 8324(Crucial)(Corrected)

7- 70.7%- 8232(Corrected)

8- 76.4%- 8172(Corrected)

9- 78.6%- 8149(Corrected)

10-88.6%- 8045(Corrected)

Wave-iii of Wave-3 completion at 8968.70 on 07-09-2016 and its corrective Wave-C continuation

with recent bottom formations at 8002.30 as well as no confirmation of its completion yet. Following to retracement levels have been completed till now:-

1- Nifty has retraced 88.6% which is the last level of Fibonacci Retracement levels

2- Wave-C has corrected 161.8% of Wave-A

Last 7 sessions were highly volatile due to Donald Trump victory and Banning of Rs 500 and Rs 1000 notes therefore sudden deep correction and high volatility in last 7 sessions. Although most Global markets recovered after post US Presidential sharp fall but Indian markets are continuously moving down for the last 5 sessions.

As intraday charts of last 4 sessions are showing consolidation patterns formations therefore it seems that Indian markets have moved into consolidation process and will prepare for next decisive up moves between 8003-8236. As 88.6% retracement has been completed and Wave-C has corrected 161.8% of Wave-A therefore expected that finally fresh and decisive up moves will be seen within next 2/3 sessions after follow up consolidation in the beginning of next week. As no confirmation of correction completion yet therefore firstly sustaining beyond 8003 should be watched in next week for next trend confirmations

Consolidation Process is on

Intra Day Chart Analysis & Market Outlook

(18-11-2016)

Nifty-Intra Day Chart (17-Nov-2016):- |

| Just click on chart for its enlarged view |

1- Whole day down moves in Bullish Falling Channels

2- Whole day actual trading between 8061-8151

Conclusions from intra day chart analysis

Although first 15 minutes up moves but after that whole day down moves in Bullish Falling Channels therefore it will be understood that Indian markets are in consolidation process because consolidation was seen in last 2 sessions also between 8090-8236,same view which was posted yesterday that Nifty will trade and prepare for next up moves within and near about this range.

It should be kept in mind that slipping below today lowest(8061) is also possible during consolidation process. Let more consolidation develop and bottom formation confirmation come then first strong signal of on going correction completion will be considered and till then Nifty will be understood sideways between 8003-8236.

Consolidation Process beginning Signals

Intra Day Chart Analysis & Market Outlook

(17-11-2016)

Nifty-Intra Day Chart (16-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Whole day down moves in Bullish Falling Channels

2- Whole day actual trading between 8090-8193

Conclusions from intra day chart analysis

Although flat closing near the lower levels of the day today but no intraday selling patterns formations and consolidation through whole day down moves in Bullish Falling Channels also therefore view will not be Bearish. As intraday consolidation patterns formations yesterday and follow up consolidation today also therefore signals of Indian markets moving into consolidation phase which means that Indian markets are preparing for fresh decisive up moves but this process will take its own time.

Last 2 sessions actual trading between 8090-8236 and expected that Nifty will trade and prepare for next up moves within and near about this range. It should be kept in mind that slipping below 8090 is also possible during process. Let more consolidation develop and bottom formation confirmation come then on going correction completion will be considered and till then Nifty will be understood sideways between 8003-8236.

Strong Possibilities of Up Moves above 8193

Intra Day Chart Analysis & Market Outlook

(16-11-2016)

Nifty-Intra Day Chart (15-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- More than 5 hours trading between 8121-8193

2- All the Down moves in Bullish Falling Channels

3- Whole day actual trading between 8094-9236

Conclusions from intra day chart analysis

102 points fall in first minute after huge gap down opening and more than 5 hours trading between 8121-8193 with all the Down moves in Bullish Falling Channels therefore signals of some up moves or Pull Back Rally. Consolidation was seen between 8180-8345 on 09-11-2016 but most time trading below it today with closing near the lower levels of the day which is an indication of on going correction continuation but intraday selling patterns were not seen and consolidation patterns formations today therefore Nifty will not sustain below today lowest and strong possibilities of up moves above 8193.

Firstly watch 8180 for on going correction continuation/completion confirmation

Intra Day Chart Analysis & Market Outlook

(15-11-2016)

Nifty-Intra Day Chart (11-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Selling between 8354-8415

2- Whole day actual trading between 8285-8460

Conclusions from intra day chart analysis

As all the Asian markets were trading weak therefore 68 points gap down opening and after that follow up selling therefore more down moves are expected in the beginning of next week. More than 4 hours consolidation was seen between 8180-8345 on 09-11-2016 and valid break down of this range should be firstly watched now for on going correction continuation/completion confirmation.

Next Trend Confirmations through levels amid Global Markets volatility and Notes Banning news led Uncertainty

Intra Day Chart Analysis & Market Outlook

(11-11-2016)

Nifty-Intra Day Chart (10-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Selling patterns formation between 8550-8598

2- Whole day actual trading between 8511-8598

Conclusions from intra day chart analysis

As all the Global markets were blasting therefore strong up moves after gap up opening and crossing of resistance at 8549 also but fresh selling just above it between 8550-8598 which is an indication of more preparation requirement through fresh consolidation for fresh rally.

In fact all the Global markets were highly volatile therefore Indian markets could not sustain beyond any crucial level. Trading range between 8400-8549 was updated in all 3 previous Outlooks and Nifty closed within it in all 3 previous sessions despite consolidation below it between 8180-8345 on 09-11-2016 and selling above it between 8550-8598 on 10-11-2016.

Although strong up moves in US markets yesterday but SGX Nifty is 134 points down today morning which may be due to Rs.500 and Rs.1000 notes banning and weakness in some Asian markets. As such high Global markets and news led volatility as well as some uncertainty due Notes banning news therefore it will be better to get next trend confirmations through sustaining beyond following levels:-

1- 8400-8549(First indication)

2- 8180-8598(Final confirmation)

8400-8549 will Confirm next Trend

Intra Day Chart Analysis & Market Outlook

(10-11-2016)

Nifty-Intra Day Chart (09-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- More than 4 hours consolidation between 8180-8345

2- Whole day actual trading between 8003-8476

Conclusions from intra day chart analysis

As all the Global markets were crashing due to emergence of Donald Trumpt winning possibility in US Predential elections therefore more than 5% weak opening but 200 points recovery from lower levels in first 5 minutes and after that more than 4 hours consolidation between 8180-8345 therefore until Nifty will not sustain below 8180 after follow up selling till then decisive down moves will not be seen.

Fibonacci Retracement levels of Wave-iii of Wave-3(7927-8968) were updated on 30-10-2016 in "Fresh Bullish Moves require confirmations due to Indo-Pak border Tension". Nifty recovered strongly after retracing up to 88.6% which is a strong signal of corrective Wave-iv of Wave-3 completion after panic bottom formation at 8002.25 today.

As highly volatile US markets today and in reaction some volatility may be seen in Indian markets also but finally sustaining beyond 8400-8549 will confirm next trend and that should be firstly watched tomorrow

Firstly Watch 8400-8549 amid US Presidential Elections Led high Volatility

Intra Day Chart Analysis & Market Outlook

(09-11-2016)

As next 2 sessions market will be on the back of news from US Presidential Elections and not on the base of technical charts therefore intraday charts analysis is not being updated today. News led volatility may be high and next trend will get confirmations through sustaining beyond 8400-8549 and should be firstly watched.

8400-8549 will confirm next trend

Intra Day Chart Analysis & Market Outlook

(08-11-2016)

Nifty-Intra Day Chart (07-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Selling patterns formation between 8510-8532

2- Whole day actual trading between 8482-8532

Conclusions from intra day chart analysis

As FBI clears Clinton in Emails case therefore Dow's Futures was trading more than 220 points up today morning and in reaction all the Asian markets were blasting,resultant strong opening of Indian markets. Although such Bullish news but Indian markets completely under performed Global market and closed near the intraday lower levels of the day while almost all the Global markets closed near the higher levels of the day.

Selling was updated in following levels both in both previous Outlooks:-

1- Updated on 02-11-2016- 8532-8549

2- Updated on 03-11-2016- 8510-8537

As Nifty could not cross 1st selling(resistance) range despite such most strong Global cues and follow up selling was seen in 2nd selling(resistance) range therefore above mentioned selling(resistance) ranges will not be easily crossed. Until Nifty will not sustain above 8549 after complete follow up consolidation till then decisive up moves will not be seen.

As intraday charts of last Friday are showing suficiently good consolidation above 8400 therefore Nifty will not easily slip below it also and will firstly trade as well as prepare for post US Presidential Elections decisive moves between and near about 8400-8549.

Global markets news led today like high volatility can not be ruled out in the coming before Elections results 1/2 sessions and finally valid break out of 8400-8549 will confirm next trend.

8477 will open the doors of Deeper Correction

Intra Day Chart Analysis & Market Outlook

(04-11-2016)

Nifty-Intra Day Chart (03-Nov-2016):- |

| Just click on chart for its enlarged view |

1- First 3 hours selling between 8510-8537

2- Down moves in Bullish Falling Channels in last 3 hours

3- Whole day actual trading between 8477-8537

Conclusions from intra day chart analysis

Although selling in first 3 hours but some consolidation also in last 3 hours through Down moves in Bullish Falling Channels therefore not sustaining below last 77 Sessions lowest(8477) and closing above it at 8484.85 after today lowest formations at 8476.15

Multiple and strong supports between 8477-8580 were updated many times in last 3 months and Nifty got supports exactly at 8476.15 today. As last 3 hours some consolidation also therefore fresh selling is firstly required tomorrow for deeper correction beginning after sustaining below 8477 which should be firstly watched in the coming sessions.

Most Global markets are nervous due to US Presidential Elections uncertainty and once big negative development confirmation from there will mean huge fall in Indian markets also because in that situation 77 sessions like big trading range will be broken down after sustaining below 8477 which will open the doors of deeper correction.

8477 will confirm Sharp fall after FOMC statement Tonight

Intra Day Chart Analysis & Market Outlook

(03-11-2016)

Nifty-Intra Day Chart (02-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Selling patterns formation between 8532-8549

2- Whole day actual trading between 8505-8549

Conclusions from intra day chart analysis

As Crashing like situation in all the Global markets amid 2 days FOMC meet led uncertainty therefore huge gap down opening of Indian markets. Sufficiently good selling patterns formations today therefore more down moves below today lowest can not be ruled out in the coming sessions.

Corrective Wave-iv of Wave-3 was continued with previous lowest formation at 8506.20 and new intraday lowest was formed below it at 8504.85 today. Multiple and strong supports between 8477-8580 were updated many times in last 3 months and Nifty got supports within this range many times as well as new intraday lowest formations within this range today therefore this support range is still intact.

Short Term Trend is sideways between 8507-8728 for the last 16 Sessions and its lowest was tested today. Valid break down of 8507 will mean Intermediate Term Trend turning down high possibility which is sideways between 8477-8968 for the last 76 Sessions.

The FOMC's statement is due out at 11:30 PM today and all the Global markets will react on it tomorrow. As fresh selling just above 8477 and 8507 today therefore follow up selling tomorrow will mean high possibility of sustaining below 8477 which will open the doors of fresh sharp down moves towards following supports:-

1- 8297-8343

2- 8083-8147

3- 7964-8000

Sideways 16 Sessions trading Range will confirm next Short Term Trend

Intra Day Chart Analysis & Market Outlook

(02-11-2016)

Nifty-Intra Day Chart (01-Nov-2016):-

|

| Just click on chart for its enlarged view |

1- Consolidation between 8615-8638

2- Up moves in Bearish Rising Channel

3- Mixed Patterns between 8651-8669

4- Down moves after slipping of all European markets and Dow's Futures.

5- Whole day actual trading between 8615-8669

Conclusions from intra day chart analysis

Although closing near the lower levels of the day but lower levels intraday supports after good consolidation was also seen therefore until Nifty will not sustain below today lowest(8615) till then decisive down moves will not be seen. As up moves Up moves in Bearish Rising Channel and higher levels trading with Mixed Patterns formations therefore sharp down moves after slipping of all European markets and Dow's Futures.

As both consolidation and selling patterns formations today therefore expected that Nifty will firstly trade and prepare for next decisive moves within and near about today trading range(8615-8669)

Short Term Trend is sideways between 8507-8728 for the last 16 Sessions with lower levels consolidation and higher levels selling. Finally valid break out of this range will confirm next trend which should be first watched in the coming sessions because Nifty require more preparations after both Consolidation and selling patterns formations within this range today and in previous sessions.

Subscribe to:

Comments (Atom)