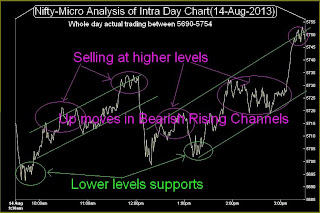

Live Proofs of our Bearish Views and Trading Calls on 14-08-2013 before 4% Crash of Indian Stock Markets

When Indian markets were trading with good gains and experts in leading Hindi Business news channel were telling for Nifty target at 5850 on 14-08-2013 then at that time also we were Bearish and gave following call to our paid clients:-NIFTY-Aug Put Option(5600)-Buy-Positional-SL-19-TGT-94-CMP-39(Lalit39)

When Indian markets were trading at the highest of the day then also we were expecting down moves on 16-08-2013 therefore sent following SMS to our paid clients at 03:21 PM on 14-08-2013 :-

NIFTY-Aug PE(5600)-Bought on 14-08-2013-Just hold and carry over to 16-08-2013(Lalit39)

As we always talk with those proofs which no one can deny therefore updating following picture of above SMS sent to our paid clients:-

|

| Just click on above picture for enlarged view of those SMS which were sent to paid clients |

Miraculous Bearish Prediction of Nifty on 13-08-2013 only in this Blog

Who told in whole India that:-

Nifty will not be able to cross next resistance range(5740-5765) and fresh down moves will begin after development of follow up selling in the coming sessions.

Only we told above line at 10:35:00 PM on 13-08-2013 and Nifty could not cross 5765 as well as reversed after formation the high at 5754.55 on 14-08-2013. Just click following topic link and verify above 100% accurate prediction on yours own.

Technical Analysis and Market Outlook(14-08-2013)

Just click following topic links also for more proofs of our previous Bearish Outlooks:-

1- Technical Analysis and Market Outlook(16-08-2013)

2- Mid-session Outlook(14-08-2013)

If unable to read text in above SMS picture then:-

1- Firstly click on above SMS picture and enlarge it.

2- Save picture on yours desktop.

3- Open and again enlarge the picture in Windows Picture Viewer.

Only 2 following information are deleted in above SMS Picture due to official secrecy rules:-

1- Numbers of sent SMS.

2- SMS sending Website name.

We always talk with only those proofs which no one can deny therefore live proofs have been updated and even though if anyone has any doubt then may call us and then he will be given the Mobile Numbers of those who enjoyed profits from any part in India.