As still out out of station therefore Stock Market Outlook of tomorrow(31-07-2019) will not be updated but Outlook of 01-08-2019 will be posted positively.

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Finally corrective Wave-A continuation expectations

Technical Analysis,Research & Weekly Outlook

(Jul 29 to Aug 02,2019)

Nifty-EOD Chart Analysis(Corrective Waves)

Nifty-EOD Chart (26-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A of "ABC" correction beginning

2- Corrective Wave-A continuation with recent bottom formation at 11210.00 on 26-07-2019

3- Support between 11109-11172(Immediate Supports)

4- Long Term Trend decider 200-Day SMA(today at 11135)

5- Short Term Indicator "Stochastic" is Oversold

Nifty-Intra Day Chart Analysis(26-07-2019)

Nifty-Intra Day Chart (26-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Consolidation between 11211-11235(Immediate Supports)

2- Up moves in Bearish Rising Channel

3- Mixed Patterns formation between 11257-11308

4- Whole day actual trading between 11211-11308

Conclusions (After Putting All Studies Together)

As corrective Wave-A of "ABC" correction beginning confirmation after Impulsive Wave-5 completion therefore Nifty will correct whole rally which started from 6825.80 on 29-02-2016 and completed at 12103.00 on 03-06-2019. Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) with Waves structure has already been updated in previous weekly Outlook(Jul 21 to Jul 26,2019).

Nifty has not slipped below Long Term Trend decider 200-Day SMA(today at 11135) and it is still up as well as Short Term Indicator "Stochastic" has turned Oversold therefore emergence of Pull Back Rally beginning possibility because lower levels some consolidation was seen yesterday and previous sessions also.

Firstly sideways sideways trading between 11103-11400 and finally corrective Wave-A continuation is expected below 11103.

11230 will confirm fresh down moves

Intra Day Chart Analysis & Market Outlook

(26-07-2019)

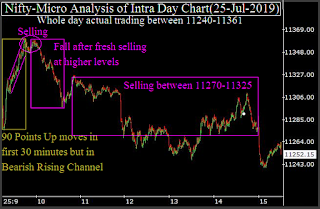

Nifty-Intra Day Chart (25-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 90 Points Up moves in first 30 minutes but in Bearish Rising Channel

2- Fall after fresh selling at higher levels

3- Selling between 11270-11325

4- Whole day actual trading between 11240-11361

Conclusions from intra day chart analysis

As 6 Hours trading of yesterday was showing condolidation patterns formation therefore 90 Points sharp Up moves in first 30 minutes but Bearish Rising Channel formation was also seen at higher levels. As no follow up consolidation and fresh selling also developed at higher levels therefore not sustaining at higher levels and slipping in the next 40 minutes.

Although follow up selling in next 5 hours between 11270-11325 but consolidation was seen also above 11230 yesterday therefore sustaining below it after follow up selling should be firstly watched for fresh down moves confirmations.

11230-11300 will generate more than 1% one sided moves

Intra Day Chart Analysis & Market Outlook

(25-07-2019)

Nifty-Intra Day Chart (24-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 79 Points fall in 6 minutes

2- 6 Hours trading with Mixed Patterns formation between 11230-11300

3- Whole day actual trading between 11230-11359

Conclusions from intra day chart analysis

Immediately after opening 79 Points sharp fall in 6 minutes and after that last 6 Hours trading with Mixed Patterns formation between 11230-11300 therefore valid break out of this range will confirm a Pull Back rally and its valid break down will confirm Wave-A of "ABC" correction continuation towards Long Term Trend decider 200-Day SMA(today at 11130) which is still up and last hope for Bulls.

Although last 6 hours intraday patterns formation are showing condolidation but this trading was in more than 0.50% negative zone and complete consolidation can not be developed at such intraday lower levels therefore follow up consolidation is must and after this once valid break out of 11300 will mean a strong Pull Back rally which may be sharp also because Short Term Indicators have also turned oversold now.

As 6 Hours like sufficiently big trading between 11230-11300 therefore its valid break out will generate more than 1% one sided moves acoording to above mentioned manner.

Firstly watch levels for next decisive moves

Intra Day Chart Analysis & Market Outlook

(24-07-2019)

Nifty-Intra Day Chart (23-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Mixed Patterns formation between 11340-11368

2- Minor consolidation at lower levels between 11317-11333

3- Slow up moves in Mid-session

4- Sharp fall in last hour

5- Whole day actual trading between 11303-11398

Conclusions from intra day chart analysis

As whole day good consolidation patterns formations yesterday therefore Pull Back rally possibility was told and it was seen also today but follow up fresh buying could not develop and selling was done through slow up moves in Mid-session therefore sharp fall in last hour and negative closing today.

As last 2 sessions trading between 11302-11398 with both consolidation and selling therefore finally sustaining beyond this range will form next decisive moves which should be firstly watched in the coming sessions.

Signals of Pull Back Rally

Intra Day Chart Analysis & Market Outlook

(23-07-2019)

Nifty-Intra Day Chart (22-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Firstly more than 1% down in 20 minutes after weaker opening

2- Up moves with intraday corrections

3- Down moves in Bullish Falling Channel

4- Intraday corrections in last hour

5- Whole day actual trading between 11302-11398

Conclusions from intra day chart analysis

Although firstly sharp down and slipping more than 1% after weaker opening but whole day good consolidation patterns formations also therefore signals of Pull Back rally because Very Short Term indicators have turned oversold.

As most time trading was in more than 0.50% negative zone therefore Pull Back rally beginning confirmation is also required through valid break out of 11380 and its next targets will be following resistances:-

1- 11422-11447

2- 11470-11494

3- 11511-11544

Wave-A of "ABC" correction beginning confirmations

Technical Analysis,Research & Weekly Outlook

(Jul 21 to Jul 26,2019)

Nifty-EOD Chart Analysis(Waves structure)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Impulsive Wave-1 completion at 8968.70 on 07-09-2016 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 7893.80 on 26-12-2016 and impulsive Wave-3 beginning

4- Impulsive Wave-3 completion at 11760.20 on 28-08-2018 and corrective Wave-4 beginning

5- Corrective Wave-4 completion at 10004.55 on 26-10-2018 and impulsive Wave-5 beginning

6- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A beginning

7- Corrective Wave-A continuation with recent bottom formation at 11399.30 on 19-07-2019

Nifty-EOD Chart Analysis(Modi ji's Victory gap)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- "Modi ji's Victory gap" filled up on 19-07-2019 after Nifty slipping below 11426 and on that day intraday lowest formation was at 11399.30.

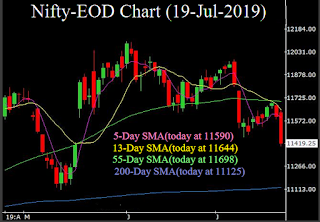

Nifty-EOD Chart Analysis(Averages)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 5-Day SMA(today at 11590)

2- 13-Day SMA(today at 11644)

3- 55-Day SMA(today at 11698)

4- 200-Day SMA(today at 11125)

Conclusions (After Putting All Studies Together)

1- Long Term Trend is up which will be down after sustaining below 200-Day SMA(today at 11125)

2- Intermediate Term Trend has turned down after last 10 sessions closing and sustaining below below 55-Day SMA(today at 11698)

3- Short Term Trend is down

Although 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 but this gap filled up after slipping below 11426 therefore strong rally hopes after Modi ji's Victory have come to an end.

As real disappointment erupted from Union Budget 2019-20 therefore the correction which begun on very that day remained continued on next trading day(08-07-2019) in crashing like situation and Nifty closed on that day below 55-Day SMA. Last 10 sessions closing is below 55-Day SMA and it means that Intermediate Term Trend has turned down. As life of Intermediate Term Trend is minimum from 3 weeks to 3 months therefore this trend will remain down for this period and may be more than it also.

Wave-A beginning confirmation of that 5 Waves rally which started from 6825.80 on 29-02-2016 and finished at 12103.00 on 03-06-2019 after gaining 5278 points. Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) are as follows:-

1- 13.0%-11,416

2- 23.6%-10,857

3- 27.0%-10,677

4- 38.2%-10,086(Crucial)

5- 50.0%-9,464(Crucial)

6- 61.8%-8,841(Crucial)

7- 70.7%-8,371

8- 76.4%-8,070

9- 78.6%-7,954

10-88.6%-7,426

Wave-A of "ABC" correction is on and 13.0%(11416) retracement level has been tested last friday as well as testing of above mentioned lower levels can not be ruled out in next weeks and months because it is just beginning of correction and Nifty has to correct those 5278 points which it gained in 5 Waves rally of 40 months.

Last hope for the Bulls is only Long Term Trend which is still up and that will be down after sustaining below 200-Day SMA(today at 11125) as well as its testing can not be ruled out in the coming weeks.

As and when Short Term Indicators will turn oversold then Pull Back Rallies will be seen which will fuse near about following resistances:-

1- 11467-11493

2- 11511-11543

3- 11637-11700

Correction is on and "investments in Bear markets is like catching a falling knief which results own hand is full of own blood" therefore firstly wait for trend reversal after complete consolidation and correction completion. Although short term trading opportunities through buying will remain avalable after Short Term Indicators turning oversold and emergence of Pull Back rally beginning signals..

Sustaining beyond crucial levels will form next trend

Intra Day Chart Analysis & Market Outlook

(19-07-2019)

Nifty-Intra Day Chart (18-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Selling between 11637-11677(Immediate Resistances)

2- Sharp fall in last hour

3- Whole day actual trading between 11583-11677

Conclusions from intra day chart analysis

As all the global markets were too much weaker in following manner today morning therefore negative opening of Indian markets:-

1- Dow Jones closed more than 100 points down yesterday after weaker closing of all European markets.

2- Dow Jones's Futures was trading more than 100 points down today morning.

3- Most Asian markets were trading 0.50% to 1.5% down today morning.

4- Most European markets were trading more than 0.50% to 0.80% down during Indian trading hours.

As more than 4 hours fresh selling between 11637-11677 today therefore it will be immediate resistance on Nifty. Next supports of Nifty are as follows:-

1- 11520-11573

2- 11461-11500

Although sharp fall in last hour but lower levels above supports are also lying below today lowest therefore firstly Nifty will have to trade and prepare for next trend between 11461-11706 and finally sustaining beyond this range(crucial levels) will form next trend which should be watched in the coming sessions.

Strong rally after follow up consolidation

Intra Day Chart Analysis & Market Outlook

(18-07-2019)

Nifty-Intra Day Chart (17-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Up moves with intraday corrections

2- Down moves in Bullish Falling Channels

3- Minor selling patterns formations

4- Whole day actual trading between 11652-11706

Conclusions from intra day chart analysis

Following lines were told yesterday in "Rally after sideways consolidation":-

tomorrow will be sideways consolidation day which is expected between 11639-11702.

As was told yesterday 100% same happened today and Nifty traded sideways between 11651.15-11706.65.

Although minor selling patterns formations but good consolidation also through Up moves with intraday corrections and Down moves in Bullish Falling Channels therefore on going rally continuation possibility is alive.

Once follow up consolidation tomorrrow will mean strong rally towards next resistance(11798) after sustaining above today highest.

Rally after sideways consolidation

Intra Day Chart Analysis & Market Outlook

(17-07-2019)

Nifty-Intra Day Chart (16-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel

2- Sharp up

3- More than 4 hours consolidation between 11612-11639

4- Last hour trading with Mixed Patterns formation between 11645-11670

5- Whole day actual trading between 11574-11670

Conclusions from intra day chart analysis

Following lines were told yesterday in "11639 Will confirm fresh and decisive up moves":-

if fresh consolidation develops tomorrrow also then finally fresh and decisive up moves will be seen and its confirmation will be after sustaining above 11639.

As firstly consolidation through Down moves in Bullish Falling Channel and after that more than 4 hours consolidation between 11612-11639 as well as 6 hours sustaining above "Modi ji's Victory gap" highest(11591) therefore strong indications of rally continuation above today highest((11670).

Following resistances were updated on 13-07-2019 in ""Modi ji's Victory gap"(11426-11591) will confirm next Trend ":-

1- 11607-11638

2- 11676-11702

3- 11798-11879

4- 11912-11981

Although today closing was near higher levels of the day but last hour trading was with Mixed Patterns formation between 11645-11670 and next resistances is just above today highest is between 11676-11702 as well as Very Short Term Indicators have also turned over bought therefore tomorrow will be sideways consolidation day which is expected between 11639-11702.

Once follow up consolidation and sustaining above 11702 will mean sharp rally towards next resistance(11798) and above.

11639 Will confirm fresh and decisive up moves

Intra Day Chart Analysis & Market Outlook

(16-07-2019)

Nifty-Intra Day Chart (15-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Whole day consolidation through Down moves in Bullish Falling Channels

2- Whole day actual trading between 11533-11618

Conclusions from intra day chart analysis

As whole day consolidation through Down moves in Bullish Falling Channels and consolidation developed in the same manner last Friday also therefore it seems that Indian markets are preparing for fresh up moves.

Mixed Patterns formation within 1st resistance range(11607-11638) between 11610-11639 last Friday therefore if fresh consolidation develops tomorrrow also then finally fresh and decisive up moves will be seen and its confirmation will be after sustaining above 11639.

"Modi ji's Victory gap"(11426-11591) will confirm next Trend

Technical Analysis,Research & Weekly Outlook

(Jul 15 to Jul 19,2019)

Nifty-EOD Chart Analysis(Waves structure)

Nifty-EOD Chart (12-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Corrective Wave-2 beginning after Wave-1 completion at 8968.70 on 07-09-2016

3- Wave 1 gained 2142.90 points

4- Impulsive Wave-3 beginning after Corrective Wave-2 completion at 7893.80 on 26-12-2016

5- Corrective Wave-4 beginning after Wave-3 completion at 11760.20 on 28-08-2018

6- Wave-3 gained 3866.40 points

7- Impulsive Wave-5 beginning after Corrective Wave-4 completion at 10004.55 on 26-10-2018

8- Impulsive Wave-5 Life time top formation at 12103.00 on 03-06-2019

9- Last 39 Sessions sideways correction between 11461-12103

Nifty-EOD Chart Analysis(Fibonacci Retracement levels)

Nifty-EOD Chart (12-Jul-2019):- |

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103)

Nifty-Previous 5 Sessions intraday charts analysis

Nifty-Intra Day Chart (Jul 08 to Jul 12,2019):- |

| Just click on chart for its enlarged view |

1- 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- Last 5 sessions post Budget closing within "Modi ji's Victory gap" support(11426-11591)

Nifty-Intra Day Chart Analysis(12-07-2019)

Nifty-Intra Day Chart (12-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channels

1- Mixed Patterns formation between 11610-11639

3- Sharp fall in last hour

4- Whole day actual trading between 11539-11639

Conclusions from EOD charts analysis

1- Long Term Trend is up

2- Intermediate Term Trend has turned down after last 5 sessions closing below 55-Day SMA(today at 11719)

3- Short Term Trend is down

Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) are as follows:-

1- 13.0%-11,416

2- 23.6%-10,857

3- 27.0%-10,677

4- 38.2%-10,086(Crucial)

5- 50.0%-9,464(Crucial)

6- 61.8%-8,841(Crucial)

7- 70.7%-8,371

8- 76.4%-8,070

9- 78.6%-7,954

10-88.6%-7,426

Conclusions from 5 Sessions intra day chart analysis

"Modi ji's Victory gap" support was formed between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and after that Nifty traded above it 34 sessions and after slipped within it on 08-07-2019 after post Budget down moves beginning on 05-07-2019.

"Modi ji's Victory gap" support(11426-11591) is the last hope for Bulls and it's final break out will confirm next big moves in Indian stock markets.

Conclusions from intra day chart(12-Jul-2019) analysis

Although firstly slipping after positive opening but good consolidation was seen through Down moves in Bullish Falling Channels therefore sharp recovery was seen in Mid-session. Although sharp fall in last hour and closing at lower levels of the day but view will not be Bearish because Mixed Patterns formation at higher levels and genuine selling patterns were not seen as well as consolidation developed in last half hour through Down moves in Bullish Falling Channel.

As sufficiently good intraday consolidation patterns formations last Friday and if follow up consolidation develops in next week also then fresh rally will be seen.

Conclusions (After Putting All Studies Together)

Although 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and after that new life time high formations also at 12103 on 03-06-2019 but strong rally was not seen after such strong Government formation and Nifty remained 34 sessions sideways between 11615-12103 which was above the top of gap(11591).

Sharp down moves which started after Union Budget presentation on 05-07-2019,remain continued on 08-07-2019 and 34 sessions sideways trading range(11615-12103) broken down as well as Nifty closed in all the last 5 sessions within "Modi ji's Victory gap"(11426-11591).

As correction is on and both Short with Intermediate Term Trends have also turned down therefore Fibonacci Retracement levels of whole rally(6825-12103) has been updated above. Next supports/resistances of Nifty are as follows:-

Supports:-

1- 11520-11560

2- 11461-11500

3- Lowest of "Modi ji's Victory gap"(11426)

Resistances:-

1- 11607-11638

2- 11676-11702

3- 11798-11879

4- 11912-11981

As 165 Points "Modi ji's Victory gap"(11426-11591) has shown its significance from on 20-05-2019 and last 5 sessions closing was also within this range after Budget therefore finally break out of this range will confirm next trend through following decisive moves which should be kept in mind:-

1- Sustaining above 11591 for first signal of strong Pull Back rally beginning.

2- Deeper correction beginning confirmation below 11426.

Finally "Modi ji's Victory gap" support(11426-11591) will confirm next decisive moves

Intra Day Chart Analysis & Market Outlook

(12-07-2019)

Nifty-Intra Day Chart (11-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Consolidation between 11520-11538

2- Consolidation between 11535-11557

3- Down moves in Bullish Falling Channel

4- Intraday correction

5- Selling between 11581-11599

6- Whole day actual trading between 11520-11599

Conclusions from intra day chart analysis

As all the Asian markets were blasting today morning after US markets rally yesterday and Dow Jones"s Futures was also trading with good gains therefore strong opening of Indian markets but slipped for consolidation between 11520-11538 because Selling was seen between 11514-11538 yesterday. As consolidation was below 11514 yesterday through Down moves in Bullish Falling Channels therefore Nifty could not slip below it today.

Higher levels selling was seen between 11565-11593 yesterday and higher levels fresh selling again developed today between 11581-11599 therefore 11565-11599 has become immediate resistance range and until Nifty will not sustain above 11599 till then decisive up moves will not be seen. As today up moves were with consolidation therefore if fresh consolidation develops within and near about 11565-11599 then fresh rally will be seen above 11599.

165 Points "Modi ji's Victory gap" supports was formed between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019. Firstly Nifty traded 34 sessions above this range and after that Nifty traded most of the time within this range in last 3 sessions as well as closed also within this range in last 4 sessions. As such long time this range has shown its significance therefore finally break out of this range will confirm following decisive moves:-

1- Sustaining above 11591/11599 for first signal of strong Pull Back rally beginning.

2- Deeper correction beginning confirmation below 11426.

Today lowest will confirm decisive down moves

Intra Day Chart Analysis & Market Outlook

(11-07-2019)

Nifty-Intra Day Chart (10-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Selling between 11565-11593

2- Selling between 11514-11538

3- Selling between 11527-11532

4- Minor buying at lower levels through Down moves in Bullish Falling Channels

5- Whole day actual trading between 11476-11593

Conclusions from intra day chart analysis

Although firstly up moves immediately after opening but fresh selling developed just below yesterday mentioned 1st resistance range(11607-11638) and after that slipping into negative zone.

As follow up selling also developed after higher levels selling therefore emergence of some more down moves expectations but minor buying at lower levels through Down moves in Bullish Falling Channels also hence firstly sustaining below today lowest should be watched for decisive down moves.

Nifty and Bank Nifty weekly expiry tomorrow and higher levels huge selling in first 4 sessions of this week therefore lowest of "Modi ji's Victory gap" (11426-11591) should also be watched because once filling of this gap after slipping below 11426 will mean strong signal of sharp fall and deeper correction beginning.

Pull Back Rally possibility towards next resistances

Intra Day Chart Analysis & Market Outlook

(10-07-2019)

Nifty-Intra Day Chart (09-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Whole day many Down moves in Bullish Falling Channels

2- Minor selling at higher level through Up moves in Bearish Rising Channel

3- Whole day actual trading between 11461-11582

Conclusions from intra day chart analysis

Although firstly slipping after negative opening but whole day good consolidation through many Down moves in Bullish Falling Channels therefore emergence of Pull Back Rally possibility towards following next resistances despite minor selling at higher level through Up moves in Bearish Rising Channel and all the Global markets are in negative zone today:-

1- 11607-11638

2- 11676-11702

3- 11798-11879

4- 11912-11981

Firstly watch "Modi ji's Victory gap" support(11426-11591) for next decisive moves

Intra Day Chart Analysis & Market Outlook

(09-07-2019)

Nifty-Intra Day Chart (08-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Selling between 11676-11702

2- Selling between 11607-11638

3- Mixed Patterns formation between 11524-11573

4- Whole day actual trading between 11524-11724

Conclusions from intra day chart analysis

As crashing like situation in most Asian markets today morning therefore Nifty slipped 87 points in first 15 seconds after weaker opening and after that whole day down moves were seen through selling within sideways trading also.

Last one hour trading was seen with Mixed Patterns formation between 11524-11573 and once sustaining below it will mean fresh down moves beginning but until complete consolidation will not develop till then decisive up moves will not be seen above 11573.

Emergence of Intermediate Term Trend turning down strong signals today because Nifty slipped below 34 sessions lowest(11592) and 55-Day SMA(today at 11719) and once sustaining below 55-Day SMA will mean Intermediate Term Trend turning down confirmation.

165 Points "Modi ji's Victory gap" supports developed between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and Nifty slipped below 11591 today. It should alse be kept in mind that once slipping below 11427 will mean filling of this gap and emergence of deeper correction possibility.

Although completely depressed sentiment today but Nifty has not slipped below 11427 yet therefore firstly keep in mind following line also which was told on 29-06-2019 in "Rally above 12103 and towards 13870.95 after Budget-2019":-

Indian markets are well matured and have full faith in Modi ji as well as rally will remain continued above 12103 and towards 13870.95 after Budget-2019 but next one more week may remain sideways between 11427-12103 for consolidation and fresh rally preparation.

"Modi ji's Victory gap" supports was formed between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and Nifty closed within this range today. Firstly break out of this range should be watched for deeper correction beginning confirmation below 11426 and sustaining above 11591 for first signal of Pull Back rally beginning.

Firstly watch next strong supports after crashing like situation in Asian markets

Pre-open Outlook(08-07-2019)

As most Asian markets are trading 1% to 2% down and Dow Jones's Futures is also more than 60 points weak today morning therefore sentiment is completely depressed and resultant negative opening will be seen in indian markets.

Next supports below last Friday lowest are lying between 11642-11727 and firstly sustaining it beyond should be watched after crashing like situation in Asian markets because this supports range is strong and finally sustaining beyond this range will confirm next big trend after

Budget 2019-20.

Budget 2019-20.

Firstly consolidation and then Rally continuation after good Budget

Technical Analysis,Research & Weekly Outlook

(Jul 08 to Jul 12,2019)

Nifty-EOD Chart Analysis(Modi ji's Victory gap)

Nifty-EOD Chart (05-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- Last 34 Sessions sideways trading between 11592-12103

Nifty-Intra Day Chart Analysis(05-07-2019)

Nifty-Intra Day Chart (05-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Selling between 11912-11981(Immediate Resistances)

2- Sharp fall after Budget

3- Mixed Patterns formation between 11798-11879

4- Whole day actual trading between 11798-11981

Conclusions from EOD chart analysis

Although 1.14% fall on Budget 2019-20 day last Friday but Short Term Trend is still sideways because closing was within last 34 Sessions range(11592-12103) at 11811.15.

165 Points "Modi ji's Victory gap" was formed between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and this gap is a symbol on Indian Stock markets faith on Modi ji's Government. Until this gap will not be filled up after slipping below 11426 till then big strong rally expectation will remain alive.

Conclusions from intra day chart analysis

As high expectations from Budget and most of the general traders have come for buying therefore huge selling on Budget expectations led heated sentiments resultant sharp fall after Budget and closing at lower levels of the day.

As last 2 hours trading with Mixed Patterns formation between 11798-11879 therefore firstly follow up moves within and near about this range and finally sustaining beyond this range should be watched in the beginning of next week for real reaction of markets on Budget 2019-20.

Conclusions (After Putting All Studies Together)

Waves structure of Nifty-EOD Chart was updated in previous weekly analysis and no material change since then because Nifty remained sideways within last 34 Sessions range(11592-12103) and no signal of its break out till now therefore Waves structure of Nifty-EOD Chart is not being posted in this Weekly Outlook.

Next resistance of Nifty are as follows:-

1- 11912-12000

2- 12045-12097

Next supports of Nifty below last Friday lowest are as follows:-

1- 11642-11727(Strong supports)

2- "Modi ji's Victory gap"(11426-11591)

As good Budget(2019-20) was presented therefore finally rally will remain continued above life time highest(12103) but firstly consolidation will be seen between 11727-11912in the next few sessions because heated sentiments led huge selling developed yesterday between 11912-11981.

Watch levels also amid rally continuation expectations above life time highest

Intra Day Chart Analysis & Market Outlook

(05-07-2019)

Nifty-Intra Day Chart (04-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Selling between 11950-11960

2- Down moves in Bullish Falling Channels

3- Whole day actual trading between 11924-11969

Conclusions from intra day chart analysis

Following lines were told yesterday in "Firstly Watch Levels amid Economic survey led high volatility expectations":-

Although today closing near lower levels of the day after sharp fall in last hour but sufficient consolidation patterns formations also therefore expected that follow up consolidation will be seen tomorrow and finally rally is expected in next week.

As sufficient consolidation patterns formations yesterday therefore whole day positive zone trading was seen today. Although some selling in first 2 hours but good consolidation through Down moves in Bullish Falling Channels in last hours also today therefore on going rally continuation expectations are alive despite today closing near lower levels of the day.

Following 3 resistance ranges were updated on 02-07-2019 in "Rally towards 12000 after follow up consolidation":-

1- 11842-11934(Crossed)

2- 11968-12000

3- 12045-12097

Nifty was unable to move above 2nd resistance range bottom(11968) and slipped 30 points after making today highest at 11969.25.

Union Budget 2019-20 tomorrow and Nifty failed to cross 2nd resistance today therefore view will be cautious because Budget led high volatility can not be ruled out tomorrow therefore next supports below today lowest should also be kept in mind:-

1- 11879-11896

2- 11815-11844

3- 11642-11727(Strong supports)

4- "Modi ji's Victory gap"(11426-11591)

Although multiple supports below today lowest but multiple resistances are also above today highest and Union Budget 2019-20 like big event by a new Finance Minister tomorrow therefore view will be cautious because Short Term Indicators have also turned overbought after last 12 sessions slow up moves.

As Indian markets have to react on Budget like big event tomorrow and Indian markets are sideways for the last 33 sessions therefore firstly sustaining beyond above levels should be watched also for next big moves confirmations amid finally rally continuation expectations above life time highest in next week.

Firstly Watch Levels amid Economic survey led high volatility expectations

Intra Day Chart Analysis & Market Outlook

(04-07-2019)

Nifty-Intra Day Chart (03-Jul-2019):-1- Sharp up from lower levels

2- Down moves in Bullish Falling Channel

3- Up moves in Bearish Rising Channel

4- 3 Hours Up moves with intraday corrections

5- Sharp fall in last hour

6- Whole day actual trading between 11888-11945

Conclusions from intra day chart analysis

As Indian markets have not shown strength after opening and one sided clear patterns formations were not seen also therefore following lines were told at 11:23 AM today in "Firstly watch Levels after Global markets weakness today":-

firstly sustaining beyond 11879-11934 should be watched for next decisive moves confirmations because minor supports are above 11879 and old resistances are lying below 11934.

Nifty closed between 11879-11934 at 11916.75 today after whole day volatality within and near about this range. Although sharp fall in last hour but it will be understood a part consolidation because whole day sufficient consolidation and only minor selling was seen. As union Budget on 05-07-2019 and general traders would have come for buying in Mid-session after seeing 3 Hours Up moves therefore intraday correction of this up move was seen through sharp fall in last hour today.

Although today closing near lower levels of the day after sharp fall in last hour but sufficient consolidation patterns formations also therefore expected that follow up consolidation will be seen tomorrow and finally rally is expected in next week.

As Economic survey led high volatility can not be ruled out tomorrow therefore firstly sustaining beyond 11815-12000 should be watched because this range will give final reaction on Budget also in the next 2/3 sessions.

Subscribe to:

Posts (Atom)