Finally rally above Life Time Highs after follow up consolidation

Technical Analysis,Research & Weekly Outlook

(May 06 to May 10,2019)

Nifty-EOD Chart Analysis

Nifty-EOD Chart (03-May-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Corrective Wave 2 beginning after Wave 1 completion at 8968.70 on 07-09-2016

3- Impulsive Wave 3 beginning after Corrective Wave-2 completion at 7893.80 on 26-12-2016

4- Corrective Wave 4 beginning after Wave 3 completion at 11760.20 on 28-08-2018

5- Impulsive Wave 5 beginning after Corrective Wave-4 completion at 10004.55 on 26-10-2018

6- Impulsive Wave-5 continuation with new life time top formation at 11856.15 on 18-04-2018

7- 22 Sessions sideways trading between 11550-11811 near life time highs

Nifty-Previous 22 Sessions intraday charts analysis

Nifty-Intra Day Chart (Mar 29 to May 03,2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in last 22 Sessions intraday charts

1- 22 Sessions sideways trading with lower levels supports and higher levels resistances

2- Supports between 11550-11611

3- Supports between 11662-11693

4- Resistances between 11749-11811

5- 22 Sessions actual trading between 11550-11811

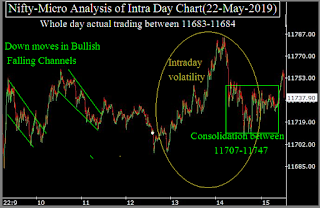

Nifty-Intra Day Chart Analysis(03-05-2019)

Nifty-Intra Day Chart (03-May-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- Mixed Patterns formation between 11732-11770

2- Down moves in Bullish Falling Channel

3- Whole day actual trading between 11700-11770

Conclusions from EOD chart analysis

Long and Intermediate Term Trends are up but Short Term Trend is sideways near life time highs between 11550-11811 for the last 22 Sessions means that indian markets are preparing for next big moves beyond this range.

Conclusions from 22 Sessions intra day chart analysis

Last 22 Sessions like big sideways trading between 11550-11811 is suggesting that Indian markets are preparing for next big moves. As lower levels good supports and higher levels resisatnces also within this range therefore nifty will firstly trade and prepare for next decisive moves within this range in next week.

Conclusions from intra day chart analysis

Although closing near the lower levels of the day after last hours down moves but view will not be bearish because down moves were in Bullish Falling Channel and before it more then 4 hours trading was with Mixed Patterns formation and genuine selling was not seen.

Conclusions (After Putting All Studies Together)

It is confirm that Indian markets are preparing for very very big moves for the last 22 sessions between 11550-11811. As these sideways moves are near life time highs therefore it is confirm that finally sustaining beyond or forceful break out of 11550-11811 will mean more that 10% sharp moves which will be seen just before or after Parliamentary results(23-05-2019)

As per our own analysis BJP will win more than 300 and NDA will win more than 350 seats as well as lower levels good supports lave also developed above 11550 in last 22 sessions therefore expected that finally strong rally will be seen above life time highs(11856.15) but follow up consolidation is also required in next week because resistances are also lying betweeen 11749-11811.