Correction Continuation Possibility below 7961.35

Technical Analysis,Research & Weekly Outlook

(Dec 22 to Dec 26,2014)

Nifty-EOD Chart (19-Dec-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts:-

1- 5933.30 on 04-02-2014(Rally beginning after correction completion)

2- Wave-1(6869.85 on 25-04-2014)

3- Wave-2(6638.55 on 08-05-2014)

4- Wave-3(8180.20 on 08-09-2014)

5- Wave-4(7723.85 on 17-10-2014)

6- Wave-5(8626.95 on 04-12-2014) and 'ABC' correction beginning.

7- Wave'A' completion at 7961.35 on 17-12-2013

8- Wave'B' continuation with its recent top formation at 8263.45 on 19-12-2013

Conclusions from EOD chart analysis

we told also following line on 12-05-2014 in Minimum target of Nifty at 8616.90:-

Nifty is well set for rally towards minimum target at 8616.90.

8616.90 was told 6 months before and Nifty made intraday highest at 8617 on 28-11-2014 as well as immediately corrected 666 points after forming life time high formation at 8626.95.

When Nifty formed all time high at 8616.90 on 04-12-2014 then at the top of rally we posted following bearish Outlook at 08:02 AM on 05-12-2014 in Technical Analysis and Market Outlook(05-12-2014):-

emergence of correction possibility which may be minimum Short Term to Intermediate term

As was told 100% same happened and Nifty corrected 666 points after ours above prediction.

Now Wave'B' of 'ABC' correction is on after 10 months strong 2693 points strong rally which started from 5933.30 on 04-02-2014 and ended after many times new life time high formation at 8626.95 on 04-12-2014 and Corrective Wave'A' begun which completed at 7961.35 on 17-12-2013.

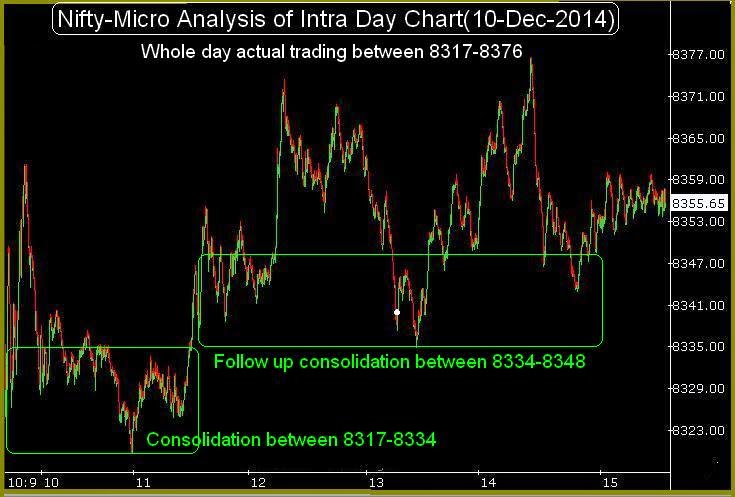

Nifty-Intra Day Chart (19-Dec-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling(immediate Resistance) between 8243-8263

2- Whole day actual trading between 8209-8263

Conclusions from intra day chart analysis

Gap up opening after strong Global cues but higher levels sliing patterns were formation were also seen therefore down moves below day's lowest(8209) are expected. As good selling seen therefore until complete consolidation will not be seen till then up moves above day's highest(8263) will not be seen.

Conclusions (After Putting All Studies Together)

'ABC' correction is confirm and if complete consolidation happens after completion of Wave'C' only then correction completion will be considered otherwise 5 Waves correction(1,2,3,4,5) will be seen in the coming weeks/months. As good selling on 19-12-2014 therefore if follow up selling develops in the beginning of next week then fresh down moves will be seen below the bottom of Wave'A'(7961.35) which will mean Wave'c' beginning after the completion of Wave'B'.

Correction is on and its continuation is expected in the beginning of next week because good selling at higher levels last Friday as well as high possibility of down moves below 7961.35 after completion of Wave'B' at 8263.45 on 19-12-2013.