Technical Analysis,Research & Weekly Outlook

(Apr 15 to Apr 017,2014)

Nifty-EOD Chart (11-Apr-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6415.25 on 09-12-2013)

5- Wave-ii of Wave-3(5933.30 on 04-02-2014)

6- Wave-iii of Wave-3 continuation with new highest formation at 6819.05 on 10-04-2014

Conclusions from EOD chart analysis

All trends are up and Bullish market Wave-iii of Wave-3 continuation towards those higher levels which can not be easily imagined at this moment because following minimum waves are still left:-

1- Wave-iii of Wave-3 continuation and no signal of its termination yet.

2- Corrective Wave-iv of Wave-3 will start after on going Wave completion and this corrective will correct whole that up move which started from 5933.30.

3- Impulsive Wave-v of Wave-3 will start after previous corrective wave completion and this Wave will form new high above the top of Wave-iii of Wave-3. It should also be kept in mind that Wave-iii of Wave-3 top formations confirmation has not been seen yet.

4- Wave-v of Wave-3 completion will mean termination of Wave-3 and corrective Wave-4 beginning.

5- Corrective Wave-4 will correct whole up moves which started from 5700.95.

6- Impulsive Wave-5 will start towards new top formation above the top of Wave-3.

Nifty-EOD Chart (11-Apr-2014):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Wave-iii of Wave-3 beginning(5933.30 on 04-02-2014)

2- 5th Wave continuation

2- 4th wave of Bearish Rising Wedge like formation

Conclusions from EOD chart analysis

Wave-iii of Wave-3 is on and 4th wave of Bearish Rising Wedge like formation but its 5th Wave is still left which should move above the previous top at 6819.05.

Nifty-Intra Day Chart (11-Apr-2014):-

|

| Just click on chart for its enlarged view |

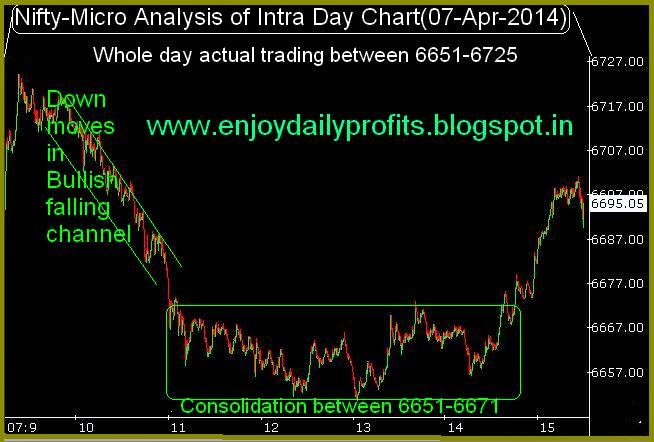

Technical Patterns and Formations in today intraday charts

1- Down moves in Bullish falling channel.

2- Consolidation between 6744-6762

3- Whole day actual trading between 6744-6789

Conclusions from intra day chart analysis

Indian markets out performed Global cues and firstly down moves in Bullish Falling Channel with triple bottom formations near 6744 as well as good consolidation seen therefore 6744-6762 has developed a strong support range,until Nifty will not sustain below 6744 after complete selling till then next down moves will not be considered.

Conclusions (After Putting All Studies Together)

At present impulsive Wave-iii of Wave-3 continuation and 1st signal of its completion developed in previous week because emergence of Bearish Rising Wedge like formation. As its 5th impulsive Wave is still left therefore some more up moves above 6819.05 are still left. Next resistances and supports are as follows:-

1- Next resistances are between 6806-6819

2- Next 1st supports are between 6744-6762

3- Next 2nd supports are between 6706-6732

4- Next 3rd supports are between 6651-6671

Expected that Nifty will firstly trade and prepare for next trend between 6744-6819 and sustaining it beyond should be watched in next week for next trend confirmations but view is cautiously Bullish because Bearish Rising Wedge like formation being developed and its 5th wave is still.

Up moves above 6819.05 are still expected because good supports also developed at lower levels in previous week therefore easily deeper correction will not be seen and much more selling is still left for it and let it happen then will be considered.