Technical Analysis,Research & Weekly Outlook

(Nov 11 to Nov 15,2013)

Nifty-EOD Chart (08-Nov-2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013) completion and 'ABC' correction continuation.

3- Wave-2(5700.95 on 21-10-2013) completion and Wave-3 continuation.

4- Wave-3 recent top formation at 6342.95 on 03-11-2013.

5- Short Term continuation continuation with recent bottom formation at 6120.95 on 08-11-2013.

Conclusions from EOD chart analysis

Wave-3 continuation towards minimum target at 6724.60 and its calculation has already been updated in following topic on 21-10-2013:-

When Wave-3 formed top at 6342.95 on 03-11-2013 then all around immediate Bullish moves were told in all the Business News Channels and most Websites but we updated following topic on 01-11-2013:-

Correction started exactly from Muhurat Trading session and whole previous week showed Red closing in all 4 trading sessions.

Technically Long and Intermediate Term Trends are up and Short Term Trend is down. As Wave-3 continuation therefore only Short term correction was expected and that was seen in previous week but deeper correction is not expected.

Nifty-Intra Day Chart (Nov 05 to Nov 08,2013):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in last 4 Sessions intraday charts

1- Down moves in Bullish Falling Channel in all 4 trading sessions.

Conclusions from intra day chart analysis

Although continuous down moves in all 4 previous sessions but in Bullish Falling Channel and without much intraday selling therefore strong indication of fast Up moves after completion of on going Short term correction.

Nifty-Intra Day Chart (08-Nov-2013):-

|

| Just click on chart for its enlarged view |

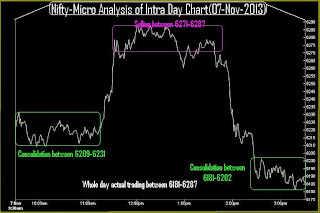

Technical Patterns and Formations in today intraday charts

1- Selling between 6165-6180

2- Consolidation between 6122-6150

3- Whole day actual trading between 6122-6180

Conclusions from intra day chart analysis

Although firstly selling but consolidation also in last more than 3 hours therefore strong indication of on going correction completion.

Conclusions (After Putting All Indicators Together)

Wave-3 is on and only Short term correction was expected because sentiment was heated and indicators were over bought near about 03-11-2013,that was seen also in whole previous week. As Bullish Falling Channel formations in the intraday charts of previous week and good consolidation also seen on 08-11-2013 therefore Wave-3 rally continuation after correction completion is expected in next week.