Although Nifty was more than 1% down but intraday patterns were showing consolidation indications therefore valid break out of 5679-5720 was told for next immediate moves confirmations in previous Outlook and now Nifty moved above 5720. If sustains above 5720 then Pull Back Rally will be considered after more than 400 points correction in 6 sessions.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Mid-session Outlook(31-07-2013)

As Indian Rupee further weakened today therefore Indian markets slipped after gap down opening but some recovery also after lower levels supports. Indian markets will react on FOMC announcements tomorrow and preparing today for those moves.

Nifty is more than 1% down and trading between 5679-5720 with consolidation indications therefore mixed signals and valid break out of mentioned range will be firstly watched for next immediate moves confirmations.

Let next moves preparation and intraday charts formation complete then will be updated according to final conclusions.

Nifty is more than 1% down and trading between 5679-5720 with consolidation indications therefore mixed signals and valid break out of mentioned range will be firstly watched for next immediate moves confirmations.

Let next moves preparation and intraday charts formation complete then will be updated according to final conclusions.

Technical Analysis and Market Outlook(31-07-2013)

Nifty-EOD Chart (30-Jul-2013):-

Technical Patterns and Formations in EOD charts

1- 4531.15 on 20-12-2011(Rally beginning after 13 Months correction completion)

2- 6229.45 on 20-05-2013(Rally completion after 5 Waves completion and 'ABC' correction continuation.

3- Long Term Trend decider 200-Day EMA(5792) broken down on 30-07-2013.

Whole rally from 4531.15 to 6229.45 and its correction with Waves structure was updated on 29-07-2013 in "Last hope for Bulls at 5792" and Following lines were also told:-

1- Long Term Trend decider 200-Day EMA is at 5792 and previous closing is well above it at 5886.20 on 26-07-2013 therefore Long Term Trend is up but corrective Wave-c continuation and Short Term Trend is down as well as Intermediate Term Trend will be down after closing below 5888.

2- As 'ABC' correction begun after 5 waves of Bullish market completion at 6229.45 on 20-05-2013 therefore correction of whole up moves will be seen which started from 4531.15 on 20-12-2011.

Nifty closed below Long Term Trend decider 200-Day EMA(5792) yesterday and sustaining below it will mean entering into Bearish phase as well as its possibility is high now. As correction of whole rally between 4531.15-6229.45 is expected therefore following retracement should be kept in mind:-

13.0%-6008(Retraced)

23.6%-5828(Retraced)

27.0%-5770(Retraced)

38.2%-5580(Crucial Level)

50.0%-5380(Crucial Level)

61.8%-5179(Crucial Level)

70.7%-5028

76.4%-4931

78.6%-4894

88.6%-4724

Correction continuation and Bounce Back/Pull Back Rally may be seen after some intraday supports or minor consolidations but until complete consolidation on Daily charts will not happen till then its completion will not be considered.

|

| Just click on chart for its enlarged view |

1- 4531.15 on 20-12-2011(Rally beginning after 13 Months correction completion)

2- 6229.45 on 20-05-2013(Rally completion after 5 Waves completion and 'ABC' correction continuation.

3- Long Term Trend decider 200-Day EMA(5792) broken down on 30-07-2013.

Conclusions from EOD chart analysis

Whole rally from 4531.15 to 6229.45 and its correction with Waves structure was updated on 29-07-2013 in "Last hope for Bulls at 5792" and Following lines were also told:-

1- Long Term Trend decider 200-Day EMA is at 5792 and previous closing is well above it at 5886.20 on 26-07-2013 therefore Long Term Trend is up but corrective Wave-c continuation and Short Term Trend is down as well as Intermediate Term Trend will be down after closing below 5888.

2- As 'ABC' correction begun after 5 waves of Bullish market completion at 6229.45 on 20-05-2013 therefore correction of whole up moves will be seen which started from 4531.15 on 20-12-2011.

Nifty closed below Long Term Trend decider 200-Day EMA(5792) yesterday and sustaining below it will mean entering into Bearish phase as well as its possibility is high now. As correction of whole rally between 4531.15-6229.45 is expected therefore following retracement should be kept in mind:-

13.0%-6008(Retraced)

23.6%-5828(Retraced)

27.0%-5770(Retraced)

38.2%-5580(Crucial Level)

50.0%-5380(Crucial Level)

61.8%-5179(Crucial Level)

70.7%-5028

76.4%-4931

78.6%-4894

88.6%-4724

Correction continuation and Bounce Back/Pull Back Rally may be seen after some intraday supports or minor consolidations but until complete consolidation on Daily charts will not happen till then its completion will not be considered.

Now corrective Wave-C continuation therefore down moves are expected after development of follow up selling. Let down moves stop at near about above mentioned levels and complete consolidation develop then correction completion will be considered otherwise correction is very much on.

Pre-Closing Outlook(30-07-2013)

As Indian Rupee turned more than 1% weak today and neutralised all steps by RBI to support it in previous weeks therefore sentiment depressed and continuous slipping of Indian Stock markets. Long Term Trend decider 200-Day EMA is at 5792 and Nifty is trading below it today once confirmations of sustaining below it will mean entering into Bearish phase as well as its possibility is high now.

corrective Wave-C continuation and following lines are being repeated which were told at 08:20:00 AM yesterday in "Last hope for Bulls at 5792"

corrective Wave-C continuation and following lines are being repeated which were told at 08:20:00 AM yesterday in "Last hope for Bulls at 5792"

Now almost confirmation of corrective Wave-C continuation after completion of Wave-A and B and its target will be below the bottom of Wave-A(5566.25).

Mid-session Outlook(30-07-2013)

Although Indian markets closed near the lower levels of the day yesterday but we did not posted Bearish views because last 2 Sessions down moves within Bullish Falling Channel and resultant Nifty was .40% up today. View is same that firstly volatility and after that finally down moves are expected because corrective Wave-C continuation.

Post-open Outlook(30-07-2013)

As last 2 Sessions down moves within Bullish Falling Channel therefore therefore Indian markets opened positive and now again Green after some recovery from lower levels despite weakening of Indian Rupee today. Some volatility is expected before and after RBI Credit Policy and if nothing encouraging for markets then sharp down will be seen because corrective Wave-C continuation.

Technical Analysis and Market Outlook(30-07-2013)

Nifty-Intra Day Chart (Jul 26 & Jul 29,2013):-

Technical Patterns and Formations in last 2 Sessions intraday charts

1- 2 Sessions Down moves within Bullish Falling Channel.

3- 2 Sessions actual trading between 5827-5944

Long Term Trend is up, Intermediate and Short Term Trends turned down after the beginning on going Wave-C correction. Last 2 sessions continuous down moves but within Bullish Falling Channel therefore sharp up moves or intraday volatility can not be ruled out after any positive announcement in RBI Credit policy tomorrow and/or FOMC meet after 30-31 July 2013.

As corrective Wave-C continuation and finally down moves are expected therefore volatility for the cutting of both sides stop losses is expected in the coming sessions,as it was seen today and both new intraday high and new intraday low formation was seen after 12:30 PM in Nifty Jul Fut.

|

| Just click on chart for its enlarged view |

1- 2 Sessions Down moves within Bullish Falling Channel.

3- 2 Sessions actual trading between 5827-5944

Conclusions from 2 Sessions intra day chart analysis

Long Term Trend is up, Intermediate and Short Term Trends turned down after the beginning on going Wave-C correction. Last 2 sessions continuous down moves but within Bullish Falling Channel therefore sharp up moves or intraday volatility can not be ruled out after any positive announcement in RBI Credit policy tomorrow and/or FOMC meet after 30-31 July 2013.

As corrective Wave-C continuation and finally down moves are expected therefore volatility for the cutting of both sides stop losses is expected in the coming sessions,as it was seen today and both new intraday high and new intraday low formation was seen after 12:30 PM in Nifty Jul Fut.

Pre-Closing Outlook(29-07-2013)

Although down moves after new intraday high formations but new intraday low formation also today therefore trading patterns are suggesting only volatility and decisive moves will be expected after Credit policy but high volatility before and after its announcements may be seen again tomorrow. As today all down moves are showing Bullish Falling Channel formations therefore some up moves,Bounce Back or minor Pull Back Rally can not be ruled out but corrective Wave-C continuation and finally down moves are expected.

Mid-session Outlook-2(29-07-2013)

Nifty July Fut traded at 5923 at 12:36 PM today but when it was trading at 5897 at 11:53 AM then following line was told today in previous Outlook:-

Indian markets are more than .50% down but again down moves are within Bullish Falling Channel therefore emergence of Bounce back possibility.

As lower levels supports today and same formations seen last Friday also therefore some Up moves and Pull Back rally will be considered if Nifty sustains above 5927. It should be kept in mind that corrective Wave-C continuation and once sustaining below today lowest will mean correction continuation with deeper correction possibility.

Indian markets are more than .50% down but again down moves are within Bullish Falling Channel therefore emergence of Bounce back possibility.

As lower levels supports today and same formations seen last Friday also therefore some Up moves and Pull Back rally will be considered if Nifty sustains above 5927. It should be kept in mind that corrective Wave-C continuation and once sustaining below today lowest will mean correction continuation with deeper correction possibility.

Mid-session Outlook(29-07-2013)

Although US markets closed flat last Friday but its Futures are weak since morning today and all the Asian markets are also sufficiently negative today morning therefore sentiment is weak and Indian markets are more than .50% down but again down moves are within Bullish Falling Channel therefore emergence of Bounce back possibility.

Last hope for Bulls at 5792

Technical Analysis,Research & Weekly Outlook

Technical Analysis,Research & Weekly Outlook

(Jul 29 to Aug 02,2013)

Nifty-EOD Chart (26-Jul-2013):-

|

| Just click on chart for its enlarged view |

1- 4531.15 on 20-12-2011(Rally beginning after 13 Months correction completion)

2- Wave-1(5629.95 on 22-02-2012)

3- Wave-2(4770.35 on 04-06-2012)

4- Wave-3(6111.80 on 29-01-2013)

5- Wave-4(5477.20 on 10-04-2012)

6- Wave-5(6229.45 on 20-05-2013) and 'ABC' correction continuation.

7- Wave-A(5566.25 on 24-06-2013)

8- Wave-B(6093.35 on 23-07-2013)

9- Wave-C continuation

Waves structure of ongoing 'ABC'correction

Nifty-EOD Chart (26-Jul-2013):-

|

| Just click on chart for its enlarged view |

1- Wave-5 top formation at 6229.45 on 20-05-2013 and corrective Wave-A continuation

2- Wave-v of Wave-A completion(5566.25 on 24-06-2013)

3- Wave-v of Wave-B completion(6093.35 on 23-07-2013)

4- Wave-c continuation with bottom formation at 5869.50 on 26-07-2013

Nifty-Intra Day Chart (26-Jul-2013):-

|

| Just click on chart for its enlarged view |

1- Down moves with Bullish Falling Channel in first 4 hours.

2- Last 2 hours consolidations between 5870-5885

3- Whole day actual trading between 5870-5944

Conclusions (After Putting All Indicators Together)

Long Term Trend decider 200-Day EMA is at 5792 and previous closing is well above it at 5886.20 on 26-07-2013 therefore Long Term Trend is up but corrective Wave-C continuation and Short Term Trend is down as well as Intermediate Term Trend will be down after closing below 5888. As 'ABC' correction begun after 5 waves of Bullish market completion at 6229.45 on 20-05-2013 therefore correction of whole up moves will be seen which started from 4531.15 on 20-12-2011. Now almost confirmation of corrective Wave-C continuation after completion of Wave-A and B and its target will be below the bottom of Wave-A(5566.25).

Next resistances are as follows:-

1-5957-5990

2-6040-6093

3-6094-6130

Next supports are as follows:-

1-5870--5885

2-5792(Long Term Trend decider 200-Day EMA)

3-5787-5810(Crucial support range)

4-5762-5781

5-5566-5595

As first 4 hours down moves with Bullish Falling Channel formations therefore Bounce back seen last Friday and next decisive down moves confirmation will be after sustaining below 5870 because consolidations also seen above it in last 2 hours. As corrective Wave-C continuation therefore down moves are expected after development of follow up selling and finally sustaining beyond 5792(Long Term Trend decider 200-Day EMA) should be watched in the coming week for the confirmations of deeper correction below it and it is last hope for Bulls also.

Just click following topic links previous weekly analysis also for detailed anylysis:-

1-Posted on 22-07-2013:-Indian markets on the verge of correction

2-Posted on 15-07-2013:-Technical Analysis,Research & Weekly Outlook(Jul 15 to Jul 19,2013)

Pre-Closing Outlook(26-07-2013)

Nifty traded at 5919 at 2:36 PM today but when:-

1- Nifty was trading near the lowest of today at 5876 at 2:09 PM then following line was told today in Mid-session Outlook-3:-

2- Nifty was trading .45% down at 1:37 PM then following line was told today in Mid-session Outlook-2:-

As supports seen at lower levels today therefore next decisive down moves confirmation will be after sustaining below today lowest(5870)

1- Nifty was trading near the lowest of today at 5876 at 2:09 PM then following line was told today in Mid-session Outlook-3:-

next decisive down moves after Bounce back/Minor Pull Back Rally should be kept in mind.

2- Nifty was trading .45% down at 1:37 PM then following line was told today in Mid-session Outlook-2:-

a Bounce back possibility should be kept in mind.

As supports seen at lower levels today therefore next decisive down moves confirmation will be after sustaining below today lowest(5870)

Mid-session Outlook-3(26-07-2013)

Although view is Bearish but today whole day down moves with Bullish Falling Channel formation therefore next decisive down moves after Bounce back/Minor Pull Back Rally should be kept in mind.

Mid-session Outlook-2(26-07-2013)

Although Nifty is more than .45% down but Today down moves are showing consolidation indications and Bullish Falling Channel formation also seen therefore a Bounce back possibility should be kept in mind.

Mid-session Outlook(26-07-2013)

Although some up moves after opening but loosing all intraday gains also after higher levels minor selling but some supports seen at lower levels and very short Term indicators are Oversold therefore today trading range(5898-5944) valid break out should be firstly watched for next immediate moves confirmations.

Post-open Outlook(26-07-2013)

As US markets recovered from lower levels yesterday and Indian Rupee strengthened today morning therefore positive opening and relief rally(minor up moves) is being seen.

Expected that finally down moves will be seen after fresh selling in the coming sessions.

Expected that finally down moves will be seen after fresh selling in the coming sessions.

Technical Analysis and Market Outlook(26-07-2013)

Nifty-Intra Day Chart (25-Jul-2013):-

Technical Patterns and Formations in today intraday charts

1- Firstly more than 4 hours selling between 5957-5990

2- Whole day actual trading between 5903-5990

Firstly more than 4 hours selling and after that continuous down moves as well as closing near the lower levels of the day therefore decisive down moves seen yesterday.

As very short term trend has been oversold therefore minor up moves possibility can not be ruled out but almost confirmation of corrective Wave-C and expected that finally down moves will be seen in the coming sessions.

|

| Just click on chart for its enlarged view |

1- Firstly more than 4 hours selling between 5957-5990

2- Whole day actual trading between 5903-5990

Conclusions from intra day chart analysis

Firstly more than 4 hours selling and after that continuous down moves as well as closing near the lower levels of the day therefore decisive down moves seen yesterday.

As very short term trend has been oversold therefore minor up moves possibility can not be ruled out but almost confirmation of corrective Wave-C and expected that finally down moves will be seen in the coming sessions.

Technical Analysis and Market Outlook(25-07-2013)

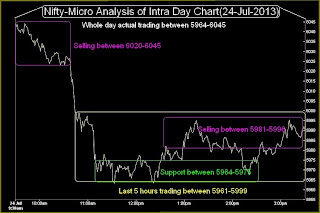

Nifty-Intra Day Chart (24-Jul-2013):-

Technical Patterns and Formations in today intraday charts

1-Selling between 6020-6045

2- Sharp fall

3- Last 5 hours trading between 5961-5999

4- Support between 5964-5975 in last 5 hours

5- Selling between 5981-5996 in last 5 hours

6- Whole day actual trading between 5964-6045

As up moves despite selling patterns formations in previous 3 sessions and on the back of only global positive news flows therefore only Bearish views were updated and resultant sharp fall seen yesterday. High possibility of corrective Wave-C beginning and following supports should be watched for its confirmations and deep down moves possibilities:-

1- 5911

2- 5761

|

| Just click on chart for its enlarged view |

1-Selling between 6020-6045

2- Sharp fall

3- Last 5 hours trading between 5961-5999

4- Support between 5964-5975 in last 5 hours

5- Selling between 5981-5996 in last 5 hours

6- Whole day actual trading between 5964-6045

Conclusions from intra day chart analysis

As up moves despite selling patterns formations in previous 3 sessions and on the back of only global positive news flows therefore only Bearish views were updated and resultant sharp fall seen yesterday. High possibility of corrective Wave-C beginning and following supports should be watched for its confirmations and deep down moves possibilities:-

1- 5911

2- 5761

Mid-session Outlook(24-07-2013)

Whatsoever is being happened in Indian markets today,all that are being continuously daily told for the last 4/5 days therefore quiet today and just telling for going through previous Outlooks and and prepare yourself for coming sessions trading.

Technical Analysis and Market Outlook(24-07-2013)

Nifty-Intra Day Chart (23-Jul-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling between 6083-6093

2- Whole day actual trading between 6065-6093

28 Points sideways trading after strong Asian cues lead gap up opening but selling patterns formations also seen at higher levels therefore same bearish view which has already been updated in previous Outlooks and expected that Indian markets will not sustain at higher levels and finally down moves will be seen in the coming sessions.

|

| Just click on chart for its enlarged view |

1- Selling between 6083-6093

2- Whole day actual trading between 6065-6093

Conclusions from intra day chart analysis

Mid-session Outlook(23-07-2013)

Although Indices traded most time with more than .70% gains and also trading more than .70% up at this moment but selling patterns formation seen also today therefore same bearish view which has already been updated in previous Outlooks.

Subscribe to:

Comments (Atom)