1- Benchmark Indices closed in Red.

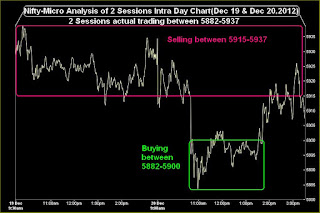

2- Volatile market today.

3- Bullish hammer Candle formation after good recovery from lower levels.

Ratios

Index Options Put Call Ratio: 0.99

Total Options Put Call Ratio: 0.94

Nifty P/E Ratio(20-Dec-2012): 18.44

Advances & Declines

BSE Advances : 1,262

BSE Declines : 1,636

NSE Advances : 698

NSE Declines : 1,027

Nifty Open Interest Changed Today

Nifty- 5700 CE(Dec)- -37,750(-4.31%)

Nifty- 5700 PE(Dec)- -99,350(-1.37%)

Nifty- 5800 CE(Dec)- -64,400(-3.07%)

Nifty- 5800 PE(Dec)- -8,500(-0.09%)

Nifty- 5900 CE(Dec)- 271,050(4.26%)

Nifty- 5900 PE(Dec)- 7,600(0.11%)

Nifty- 6000 CE(Dec)- 698,850(6.17%)

Nifty- 6000 PE(Dec)- 122,750(3.78%)

Nifty- 6000 CE(Dec)- 245,700(2.68%)

Nifty- 6000 PE(Dec)- 213,050(-33.91%)

Closing

Sensex- closed at 19453.92(-22.08 Points & -0.11%)

Nifty- closed at 5,916.40(-13.20 Points & -0.22%)

CNX Midcap - closed at 8,471.60(-9.10 Points & -0.11%)

CNX Smallcap- closed at 3,728.00(-5.30 Points & -0.14%)