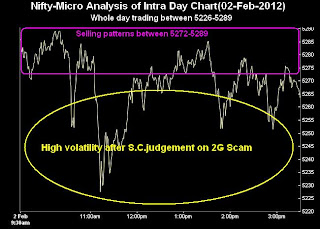

Main features of today trading are as follows

1- All the Indices closed in Green.

2- Doji candle formation in both NIFTY and SENSEX.

3- S.C.judgement on 2G Scam based highly volatile market today.

Ratios

Nifty Put Call Ratio:

1.16

Nifty P/E Ratio(021-Feb-2012):

18.77

Advances & Declines

BSE Advances : 1575

BSE Declines : 1305

NSE Advances : 802

NSE Declines : 652

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -284550(-12.01%)

Nifty- 5100 PE(Feb)- +1139800(+20.59%)

Nifty- 5200 CE(Feb)- -153800(-3.81%)

Nifty- 5200 PE(Feb)- +1362450(+37.71%)

Nifty- 5300 CE(Feb)- -24700(-0.42%)

Nifty- 5300 PE(Feb)- +782400(+48.77%)

Closing

Nifty- closed at 5,269.90(+34.20 Points & +0.65%)

Sensex- closed at 17,431.85(+131.27 Points & +0.76% )

CNX Midcap - closed at 7,225.90(+37.50 Points & +0.52%)

BSE Smallcap- closed at 6,608.97(+35.39 Points & +0.54%)