NIFTY Feb F & O(Shorted on 02-02-2012)-Cover immediately-CMP-5286

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Covering

NIFTY Feb F & O(Shorted on 02-02-2012)-Cover immediately-CMP-5286

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Message

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Market will be volatile therefore hold and cover after my covering message

Nifty-Micro Analysis of Intra Day Chart For 03-02-2012

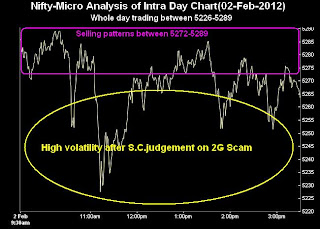

Nifty-Intra Day Chart(02-Feb-2012):-

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Conclusions from intra day chart analysis

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

FII & DII trading activity in Capital Market Segment on 02-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(021-Feb-2012)

1- All the Indices closed in Green.

2- Doji candle formation in both NIFTY and SENSEX.

3- S.C.judgement on 2G Scam based highly volatile market today.

Ratios

Nifty Put Call Ratio: 1.16

Nifty P/E Ratio(021-Feb-2012): 18.77

Advances & Declines

BSE Advances : 1575

BSE Declines : 1305

NSE Advances : 802

NSE Declines : 652

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -284550(-12.01%)

Nifty- 5100 PE(Feb)- +1139800(+20.59%)

Nifty- 5200 CE(Feb)- -153800(-3.81%)

Nifty- 5200 PE(Feb)- +1362450(+37.71%)

Nifty- 5300 CE(Feb)- -24700(-0.42%)

Nifty- 5300 PE(Feb)- +782400(+48.77%)

Closing

Nifty- closed at 5,269.90(+34.20 Points & +0.65%)

Sensex- closed at 17,431.85(+131.27 Points & +0.76% )

CNX Midcap - closed at 7,225.90(+37.50 Points & +0.52%)

BSE Smallcap- closed at 6,608.97(+35.39 Points & +0.54%)

Nifty Spot-Levels & Trading Strategy for 03-02-2012

R3 5361

R2 5325

R1 5297

Avg 5261

S1 5233

S2 5197

S3 5169

Nifty Spot-Trading Strategy

H6 5333 Trgt 2

H5 5318 Trgt 1

H4 5304 Long breakout

H3 5286 Go Short

H2 5280

H1 5274

L1 5263

L2 5257

L3 5251 Long

L4 5233 Short Breakout

L5 5219 Trgt 1

L6 5204 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 5371

R2 5335

R1 5304

Avg 5268

S1 5237

S2 5201

S3 5170

Nifty(Feb Fut)-Trading Strategy

H6 5341 Trgt 2

H5 5326 Trgt 1

H4 5310 Long breakout

H3 5292 Go Short

H2 5286

H1 5280

L1 5267

L2 5261

L3 5255 Long

L4 5237 Short Breakout

L5 5221 Trgt 1

L6 5206 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 10468

R2 10279

R1 10123

Avg 9934

S1 9778

S2 9589

S3 9433

Bank Nifty(Feb Fut)-Trading Strategy

H6 10319 Trgt 2

H5 10238 Trgt 1

H4 10156 Long breakout

H3 10061 Go Short

H2 10030

H1 9998

L1 9935

L2 9903

L3 9872 Long

L4 9777 Short Breakout

L5 9695 Trgt 1

L6 9614 Trgt 2

NIFTY-F&O-1st Selling of 02-02-2012-Trade

NIFTY(Feb Fut-Sell-Intraday/Positional)SL-5296-TGT-5216-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

Pre-Closing Outlook(02-02-2012)

Firstly positive global news based gap up opening and after that S.C.judgement on 2G Scam based highly volatile market today with following 2 main features:-

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

Live Proofs of Our Bullish 2012 Predictions

Strong Rally in Jan 2012 but when Rally begun on 20-12-2011 then only we told on following line on 22-12-2011 in 4693 is Long Term Trend Decider for 2012:-

"2012 will prove Bullish year after all corrections completion in 2011"

Above topic was updated in mudraa.com also and anyone may verify our above statement through clicking following link also:-

http://www.mudraa.com/trading/113122/0/4693-is-long-term-trend-decider-for-2012.html

Three Bullish cross overs on 1st Feb.2012

Technical Analysis,Researches & Market Outlook for

02-02-2012

Nifty-EOD Chart(01-Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 121 Sessions sideways market between 4720-5229.

4- Closing at 5235.70 on 01-02-2012

Three Bullish cross overs on 01-02-2012

1- Closing above 200 Day(SMA)-5195

2- Closing above 200 Day(EMA)-5132

3- Closing above 121 sessions sideways trading range(5229)

Conclusions from EOD chart analysis

Closing above crucial resistance levels yesterday and Our postings in our Blog are live proofs of this fact that we told for such moves dozens of times since 20-12-2011.

Strong Rally in Jan 2012 but when Rally begun on 20-12-2011 then only we told on following line on 22-12-2011 in 4693 is Long Term Trend Decider for 2012:-

"2012 will prove Bullish year after all corrections completion in 2011"

Above topic was updated in mudraa.com also and anyone may verify our above statement through clicking following link also:-

http://www.mudraa.com/trading/113122/0/4693-is-long-term-trend-decider-for-2012.html

Last formality of confirmation through sustaining above 5229 is left and after this only Bullish Indian markets will be seen in 2012 after all trends turning upward confirmations.

US markets are mre than 1% up after European markets more than 1.80% positive closing therefore expected that sentiment will be Bullish today morning but Nifty should firstly trade and sustain above 5265 for long term trend upward confirmations. As setiment may be most heated today morning therefore profit booking posibility also can not be ruled out but finally sustaining above 5229 is must for blasting bullish market in this month.

Expected that finally Nifty will give confirmation of sustaining above 5229 but has to be seen that it will happen within couple of days or after after very short term correction.

FII & DII trading activity in Capital Market Segment on 01-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(01-Feb-2012)

1- White Candle.

2- Closing above all crucial levels.

3- Positive closing after negative opening.

Ratios

Nifty Put Call Ratio: 0.98

Nifty P/E Ratio(01-Feb-2012): 18.66

Advances & Declines

BSE Advances : 1865

BSE Declines : 989

NSE Advances : 1031

NSE Declines : 416

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -15350(-0.64%)

Nifty- 5100 PE(Feb)- +856500(+17.69%)

Nifty- 5200 CE(Feb)- -411250(-8.94%)

Nifty- 5200 PE(Feb)- +680450(+22.33%)

Nifty- 5300 CE(Feb)- +938450(+17.01%)

Nifty- 5300 PE(Feb)- +779450(+84.82%)

Closing

Nifty- closed at 5,235.70(+36.45 Points & +0.70%)

Sensex- closed at 17,300.58(+107.03 Points & +0.62% )

CNX Midcap - closed at 7,188.40(+87.85 Points & +1.24%)

BSE Smallcap- closed at 6,573.58(+110.28 Points & +1.71%)

Nifty Spot-Levels & Trading Strategy for 02-02-2012

R3 5351

R2 5297

R1 5266

Avg 5212

S1 5181

S2 5127

S3 5096

Nifty Spot-Trading Strategy

H6 5321 Trgt 2

H5 5301 Trgt 1

H4 5281 Long breakout

H3 5258 Go Short

H2 5250

H1 5242

L1 5227

L2 5219

L3 5211 Long

L4 5188 Short Breakout

L5 5168 Trgt 1

L6 5148 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 02-02-2012

R3 5389

R2 5330

R1 5296

Avg 5237

S1 5203

S2 5144

S3 5110

Nifty(Feb Fut)-Trading Strategy

H6 5356 Trgt 2

H5 5334 Trgt 1

H4 5313 Long breakout

H3 5287 Go Short

H2 5279

H1 5270

L1 5253

L2 5244

L3 5236 Long

L4 5210 Short Breakout

L5 5189 Trgt 1

L6 5167 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 02-02-2012

R3 10293

R2 10142

R1 10057

Avg 9906

S1 9821

S2 9670

S3 9585

Bank Nifty(Feb Fut)-Trading Strategy

H6 10213 Trgt 2

H5 10157 Trgt 1

H4 10101 Long breakout

H3 10036 Go Short

H2 10015

H1 9993

L1 9950

L2 9928

L3 9907 Long

L4 9842 Short Breakout

L5 9786 Trgt 1

L6 9730 Trgt 2

Pre-Closing Outlook(01-02-2012)

Nifty is trading above 5229 after lower levels supports and last formality of sustaining above confirmation is left which will be seen in the coming couple of sessions and its possibility is high.

Mid-session Outlook-4(01-02-2012)

As soon as support developed at lower levels then it was updated and sharp surge seen after opening of European markets. First 4 hours trading range broken out force fully and it is strong indication of fresh rally.Sustaining above 5217/5229 will mean blasting up moves after all trends turning up..

Subscribe to:

Comments (Atom)