Firstly watch levels for next

Trend beginning confirmations

Technical Analysis,Research & Weekly

Outlook(Oct 21 to Oct 25,2024)5

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (18-Oct-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of previous Waves structure "ABC correction" completion at 15183.40 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning.

2- Impulsive Wave-1 completion at 18887.60 on 01-12-2022.

3- Corrective Wave-2 completion at 16828.30 on 20-03-2023.

4- Impulsive Wave-(i) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

5- Wave-A of Wave-(ii) of Wave-3 completion at 19333.60 on 04-10-2023.

6- Wave-B of Wave-(ii) of Wave-3 completion at 19849.80 on 17-10-2023.

7- Corrective Wave-C of Wave-(ii) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 beginning.

8- Impulsive Wave-(iii) of Wave-3 completion with new life time top formations at 26277.30 on 27-09-2024.

9- Short Term correction continuation with recent bottom formations at 24567.65 on 18-10-2024.

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-1 of new Waves structure begun from 15183.40 on 17-06-2022 after Corrective Wave-C of "ABC correction" of previous Waves structure completion at this level. Wave-1 completed at 18887.60 on 01-12-2022 and from this level Wave-2 started which completed at 16828.30 on 20-03-2023 and Impulsive Wave-3 begun from this level which is now in continuation.

Impulsive Wave-(i) of Wave-3 completed at 20222.4 on 15-09-20235 and from this level corrective Wave-A of "ABC" correction of Wave-(ii) of Wave-3 started which completed at 19333.60 on 04-10-2023 and Wave-B begun from this level. Wave-B completed at 19849.80 on 17-10-2023 and Wave-C started from this levels which completed at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 begun from this level.

Impulsive Wave-(iii) of Wave-3 is completed with new life time top formations at 26277.30 on 27-09-2024 and Short Term correction started which is in continuation with its recent bottom formations at 24567.65 on 18-10-2024 as well as no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (18-Oct-2024):-

Technical Patterns and Formations in EOD charts

1- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling towards Over sold zone.

2- Stochastic:- %K(5)- 23.16 & %D(3)- 31.16.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in negative zone.

4- MACD(26,12)- -408.46 & EXP(9)- -238.37 & Divergence- -170.09

Conclusions from EOD chart analysis

(Stochastic & MACD)

Technical positions of Short Term indicators are as follows:-

1- As in Stochastic its %K(5) line has intersected %D(3) line downward and its both lines are falling towards Over sold zone therefore it will be understood that on going short Term Correction will remain continued in the beginning of next week also.

2- As in MACD indicator its MACD line has intersected Average line downward and its both lines are falling in negative zone therefore confirmations of Downward Trend formations and on going Short Term correction continuation

Nifty-EOD Chart Analysis (Averages)

Nifty-EOD Chart (18-Oct-2024):-

Technical Patterns and Formations in EOD charts

Averages:-

1- 5-Day SMA is today at 24952

2- 21-Day SMA is today at 25375

3- 55-Day SMA is today at 25042

4- 100-Day SMA is today at 24507

5- 200-Day SMA is today at 23310

Conclusions from EOD chart analysis (Averages)

Short Term Trend is confirm down and strong indications of Intermediate Term Trend turning downward after Nifty closing below its decider 55-Day SMA for the last 3 sessions. As Nifty is well above Long Term Trend decider 200-Day SMA therefore it is confirm up and Until Nifty will not sustain below 200-Day SMA till then no risk of its turning downward. It should also be kept in mind that Intermediate Term Trend turning downward confirmation will mean minimum 3 weeks to 3 months long correction and in that situation Long Term Trend decider 200-Day SMA should also be firstly watch for the life and lenght of on going correction.

Nifty-Intra Day Chart Analysis

(18-Oct-2024)

Nifty-Intra Day Chart (18-Oct-2024):-

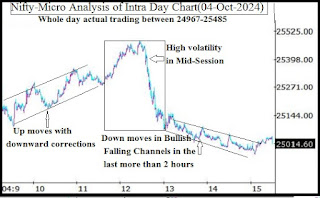

1- 97 Points down moves in first 15 minutes after 84 points gap down opening

2- More than 3 hours up moves with downward corrections

3- Sideways trading in the last more than 2 hours between 24839-24886

4- Whole day actual trading between 24568-24886

Conclusions from intra day chart analysis

Although firstly 97 Points down moves in first 15 minutes after 84 points gap down opening but after that more than 3 hours up moves with downward corrections were also seen which is a consolidation pattern. As sideways trading also developed in the last more than 2 hours between 24839-24886 therefore firstly sustaining beyond this range should be watched in the beginning of next week for next intraday decisive moves beginning confirmations and until complete intraday selling patterns will not develop on intraday charts till then Nifty will not sustain below last Friday lowest(24568).

Conclusions (After putting

all studies together)

1- Long Term Trend is up.

2- Intermediate Term trend is at stake.

3- Short Term Trend is down.

Correction which begun from 26277.30 on 27-09-2024 after impulsive Wave-(iii) of Wave-3 completion is now in continuation with recent bottom formations at 24567.65 on 18-10-2024 and no indication of its completion yet on EOD and intraday charts.

As Intermediate Term trend is at stake therefore firstly is turning downward or maintaining upward Trend should be watched in the coming weeks/weeks for next bigger moves beginning confirmations because that will confirm:-

1- Sustaining below its decider 55-Day SMA(today at 25042) will confirm deeper corretion beginning for the period of next 3 weeks to 3 months.

2- Sustaining above 55-Day SMA will confirm fresh rally beginning after on going Short Term correction completion.

Short Term indicators are showing clear signals of Short Term correction continuation. Intraday charts of last Friday are showing lower levels consolidation but Sideways trading was seen in the last more than 2 hours between 24839-24886 therefore firstly sustaining it beyond should also be watched in the coming sessions for the confirmations of next Short Term moves beginning.

"Bearish Head and Shoulders pattern formations with its Neckline at 24753" was posted in previous Weekly Outlook. Although Nifty slipped below its Neckline in previous sessions but closed above it both sessions therefore firstly sustaining beyond Neckline(24753) should be watched and once sustaining below it will mean deeper correction beginning confirmations.

Finally concluded that firstly following levels should be watched for next Trend beginning confirmations in the coming week/weeks:-

1- 24839-24886(Last more than 2 hours trading between 24839-24886 on 17-10-2024)

2- 24753(Neckline)