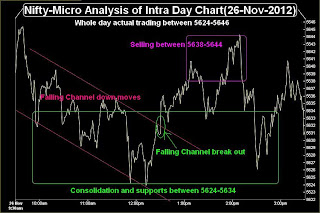

Technical Analysis,Research & Weekly Outlook

(Nov26 to Nov 30,2012)

Nifty-EOD Chart (23-Nov-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 4531.15 on 20-12-2011(Rally beginning after 13 Months correction completion)

2- Wave-1(5629.95 on 22-02-2012)

3- Wave-2(4770.35 on 04-06-2012)

4- Wave-3(5815.35 on 05-10-2012)

5- Bullish Flag formation in last 41 sessions Wave-4 correction between 5549-5815

Conclusions from EOD chart analysis

Wave-3 gained 1045 points in 87 sessions and Wave-4 corrected 266 points(25.4%) in 41 sessions(47.1%). Financial markets corrects both time wise and value wise and has sufficiently corrected time wise but value wise correction is small.

Although Wave-4 corrected only 25.4% but time wise sufficient correction of 47.1%. As strong Bullish markets does not slip too much during correction and possibility of impulsive Wave-5 rally is very much alive after time wise correction completion. As corrective Wave-4 is on with Bullish Flag formation therefore strong rally above 5815 can not be ruled out after on going correction completion.

Nifty-EOD Chart (23-Nov-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Wave-2 correction completion at 4770.35 on 04-06-2012 and Wave-3 beginning.

2- Wave 3 top formation at 5815.35 on 05-10-2012 and Wave-4 correction continuation for the last 41 sessions.

3- Firstly Wave-4 sideways correction with 24 sessions most time trading between 5639-5733.

4- 1st Break down of sideways trading range after RBI Credit policy on 30-10-2012 and new sideways range low formation at 5583.05 on 31-10-2012.

5- 1st Break out of sideways trading range after Obama victory in US Predential Elections on 07-11-2012 and new sideways range high formation at 5777.30 on 07-11-2012.

6- 2nd Break down of sideways trading range after Indian Rupee weakening and sharp fall of European markets on 16-11-2012 and new sideways range low formation at 5548.35 on 20-11-2012.

Conclusions from EOD chart analysis

Firstly sideways trading range(5639-5733) formation and after that its 2 times negative news based without force break down and in the same manner once without force break out also after positive news,resultant Wave-4 correction with Bullish Flag formation.

As corrective Wave-4 is on with Bullish Flag formation therefore strong rally above 5815 can not be ruled out after on going correction completion.

Nifty-Intra Day Chart (Nov 15 to Nov 23,2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in last 7 Sessions intraday charts

1- Good consolidations between 5549-5606 in 4 sessions of previous week.

2- Minor selling between 5620-5650.

3- Break down of sideways trading range(5583-5777) after Indian Rupee weakening and sudden sharp fall of European markets on 16-11-2012

5- Previous 7 sessions trading between 5549-5650.

Conclusions from 7 Sessions intra day chart analysis

8 Points gap down on 15-11-2012 and after that new sideways trading range low formation at 5548.35 on 20-11-2012 but good lower levels consolidations between 5549-5606 in 4 sessions of previous week. Although minor selling at higher levels but lower levels good consolidation also therefore up moves are expected. As selling between 5620-5650 also therefore follow up consolidation is also required for sustaining above 5650.

Nifty-Intra Day Chart (23-Nov-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Down moves from 11:00AM after Parliament adjournment on FDI despite first hour consolidation.

2- Consolidation between 5594-5606.

3- Whole day consolidation pattern formations.

4- Whole day actual trading between 5594-5636.

Conclusions from intra day chart analysis

As whole day intraday consolidation patterns and lower levels supports also after negative news Parliament adjournment on FDI therefore up moves are expected in the beginning of next week.

Conclusions (After Putting All Studies Together)

As on going Wave-4 correction completion possibility after time wise correction completion therefore it is also possible that Wave-4 may not show deeper correction. Bullish Flag formation developed also in last 41 sessions correction and strong Wave-5 rally will be seen after on going Wave-4 correction completion.

Immediate supports are as follows:-

1- 5581-5606.

2- 5549-5566.

As good intraday consolidation seen last Friday therefore expected that

firstly up moves will be seen in the beginning of next week and Nifty will counter following next resistances:-

1- 5620-5650(Immediate resistance)

2- 5652-5660(Gap created on 15-11-2012)

3- 5672-5705.

4- 5700-5720/5733/5777/5815(Multiple Resistances)

As multiple resistances above last Friday closing(5,626.60) therefore market require complete consolidation for any up move and will take its own complete time to cross and sustain above Wave-3 top(5815) but Bullish Flag formation in last 41 sessions Wave-4 correction therefore finally Wave-5 strong and blasting up moves will be seen without much deeper correction.