Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

FII Trading Data in Derivatives Segment on 06-Mar-2012

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 07-03-2012

Nifty Spot-Levels

R3 5510

R2 5446

R1 5334

Avg 5270

S1 5158

S2 5094

S3 4982

Nifty Spot-Trading Strategy

H6 5398 Trgt 2

H5 5358 Trgt 1

H4 5318 Long breakout

H3 5270 Go Short

H2 5254

H1 5238

L1 5205

L2 5189

L3 5173 Long

L4 5125 Short Breakout

L5 5085 Trgt 1

L6 5045 Trgt 2

R3 5510

R2 5446

R1 5334

Avg 5270

S1 5158

S2 5094

S3 4982

Nifty Spot-Trading Strategy

H6 5398 Trgt 2

H5 5358 Trgt 1

H4 5318 Long breakout

H3 5270 Go Short

H2 5254

H1 5238

L1 5205

L2 5189

L3 5173 Long

L4 5125 Short Breakout

L5 5085 Trgt 1

L6 5045 Trgt 2

Nifty(Mar Fut)-Levels & Trading Strategy for 07-03-2012

Nifty(Mar Fut)-Levels

R3 5570

R2 5499

R1 5374

Avg 5303

S1 5178

S2 5107

S3 4982

Nifty(Mar Fut)-Trading Strategy

H6 5446 Trgt 2

H5 5402 Trgt 1

H4 5357 Long breakout

H3 5303 Go Short

H2 5285

H1 5267

L1 5232

L2 5214

L3 5196 Long

L4 5142 Short Breakout

L5 5097 Trgt 1

L6 5053 Trgt 2

R3 5570

R2 5499

R1 5374

Avg 5303

S1 5178

S2 5107

S3 4982

Nifty(Mar Fut)-Trading Strategy

H6 5446 Trgt 2

H5 5402 Trgt 1

H4 5357 Long breakout

H3 5303 Go Short

H2 5285

H1 5267

L1 5232

L2 5214

L3 5196 Long

L4 5142 Short Breakout

L5 5097 Trgt 1

L6 5053 Trgt 2

Bank Nifty(Mar Fut)-Levels & Trading Strategy for 07-03-2012

Bank Nifty(Mar Fut)-Levels

R3 10881

R2 10706

R1 10410

Avg 10235

S1 9939

S2 9764

S3 9468

Bank Nifty(Mar Fut)-Trading Strategy

H6 10587 Trgt 2

H5 10480 Trgt 1

H4 10373 Long breakout

H3 10243 Go Short

H2 10200

H1 10157

L1 10070

L2 10027

L3 9984 Long

L4 9854 Short Breakout

L5 9747 Trgt 1

L6 9640 Trgt 2

R3 10881

R2 10706

R1 10410

Avg 10235

S1 9939

S2 9764

S3 9468

Bank Nifty(Mar Fut)-Trading Strategy

H6 10587 Trgt 2

H5 10480 Trgt 1

H4 10373 Long breakout

H3 10243 Go Short

H2 10200

H1 10157

L1 10070

L2 10027

L3 9984 Long

L4 9854 Short Breakout

L5 9747 Trgt 1

L6 9640 Trgt 2

Pre-Closing Outlook(06-03-2012)

Today intraday moves were according to Congress expectations during Assembly Elections results day. When intial results trend indicated gains for Congress then up moves were seen but as soon as results confirmed the defeat of Congress then markets started to tumble down and Market is more than 1% down.

5267-5322 has been broken down and Intermediate term trend turning down confirmations also therefore more down moves are expected. As down moves possibility was alive therefore following topic was updated on 03-03-2012:-

Just click above topic Link and understand all the crucial support levels.

5267-5322 has been broken down and Intermediate term trend turning down confirmations also therefore more down moves are expected. As down moves possibility was alive therefore following topic was updated on 03-03-2012:-

Just click above topic Link and understand all the crucial support levels.

Mid-session Outlook(06-03-2012)

Highly volatile markets during Assembly Election Results day,Nifty is trading between yesterday trading range(5267-5322) at this moment and importance of this range have already been discussed in previous outlook.

It was expected that on going correction will complete now fresh up moves will start after correction completion and increase in Congress strength but market could not sustain at higher levels after confirmation of Punjab defeat and no role in U.P. Govt. formations.

Tough to understand the change of Technical positions during such high volatility therefore next moves and fate of Intermediate term trend will get confirmations through:-

1- Sustaining beyond yesterday trading range(5267-5322) for first indication.

2- Sustaining beyond intermediate term trend decider 5340 for final confirmations.

It was expected that on going correction will complete now fresh up moves will start after correction completion and increase in Congress strength but market could not sustain at higher levels after confirmation of Punjab defeat and no role in U.P. Govt. formations.

Tough to understand the change of Technical positions during such high volatility therefore next moves and fate of Intermediate term trend will get confirmations through:-

1- Sustaining beyond yesterday trading range(5267-5322) for first indication.

2- Sustaining beyond intermediate term trend decider 5340 for final confirmations.

Live Proofs of our 100% accurate projections and Guidance during Assembly results

Post-open Outlook(06-03-2012)

Indian markets more than 1.00% down immediately after opening today and then more than 1 % up within first half hour today and proved ours following projections 100% accurate:-

In Pre-Closing Outlook(05-03-2012) at 02:59PM yesterday:-

A- strong indication of intermediate term trend turning down and high possibility of more down moves to text next support levels.

B-Indian markets are prepared for more down moves in the coming sessions.

2- In Technical and Assembly results implications Analysis yesterday

A- Technically Intermediate term trend turning down strong indication

B- technically high possibility of more down moves to test next support levels in the coming sessions

C- Indian markets are technically prepared for more down moves in the coming sessions.

High volatility today but we told following lines yesterday;-

1- Assembly results uncertainty led volatility can not be ruled out tomorrow

2- in such situations technical positins reverses also therefore sustaining beyond today trading range(5267-5322) should be firstly watched for next moves confirmations.

3- Indian markets will only be effected by Congress conclusive gains/loss and change of dependence on other parties.

Highly Volatile market today and technical positins reverses also in such situations therefore following levels should be firstly watched:-

1- Sustaining beyond yesterday trading range(5267-5322) for first indication.

2- Sustaining beyond intermediate term trend decider 5340

Long term trend is up Short term trend is down and correction completion/continuation through survival of intermediate term trend will be decided through sustaining beyond above levels and should be firstly watched.

Expected that no fresh up moves will start after correction completion today.

Technical and Assembly results implications Analysis For 06-03-2012

Nifty-Intra Day Chart(05-Mar-2012):-

Technical Patterns and Formations in today intraday charts

1- Selling between 5305-5322

2- Minor intraday support between 5267-5280

3- Whole day trading between 5267-5322

Technically Intermediate term trend turning down strong indication through:-

Continuous Whole day down moves below intermediate term trend decider 5340 today with intraday selling patterns immediately after opening between 5305-5322 today

Although minor intraday support between 5267-5280 today but good selling at higher levels therefore technically high possibility of more down moves to test next support levels in the coming sessions. As down moves possibility was alive therefore following topic was updated on 03-03-2012:-

Just click above topic link and prepare for trading after understanding all crucial levels

Assembly results Uncertainity led volatility can not be ruled out tomorrow and in such situations technical positins reverses also therefore sustaining beyond today trading range(5267-5322) should be firstly watched for next moves confirmations.

Indian markets will only be effected by Congress conclusive gains/loss and change of dependence on other parties. As it may trigger next trend also therefore implications of Assembly results should be understood under this purview also because it may also give final confirmation to the 7 sessions struggling Intermediate term trend.

If anything miraculous come out from Assembly results tomorrow then any up moves will be expected otherwise Indian markets are technically prepared for more down moves in the coming sessions.

|

| Just click on chart for its enlarged view |

1- Selling between 5305-5322

2- Minor intraday support between 5267-5280

3- Whole day trading between 5267-5322

Conclusions from intra day chart analysis

Technically Intermediate term trend turning down strong indication through:-

Continuous Whole day down moves below intermediate term trend decider 5340 today with intraday selling patterns immediately after opening between 5305-5322 today

Although minor intraday support between 5267-5280 today but good selling at higher levels therefore technically high possibility of more down moves to test next support levels in the coming sessions. As down moves possibility was alive therefore following topic was updated on 03-03-2012:-

Just click above topic link and prepare for trading after understanding all crucial levels

Assembly results Uncertainity led volatility can not be ruled out tomorrow and in such situations technical positins reverses also therefore sustaining beyond today trading range(5267-5322) should be firstly watched for next moves confirmations.

Indian markets will only be effected by Congress conclusive gains/loss and change of dependence on other parties. As it may trigger next trend also therefore implications of Assembly results should be understood under this purview also because it may also give final confirmation to the 7 sessions struggling Intermediate term trend.

If anything miraculous come out from Assembly results tomorrow then any up moves will be expected otherwise Indian markets are technically prepared for more down moves in the coming sessions.

Indian Stock Markets Closing Reports(05-Mar-2012)

Main features of today trading are as follows

1- Long Black Candle.

2- All the Indices closed in Red except FMCG.

3- whole day down moves after weak opening.

Ratios

Nifty Put Call Ratio: 0.95

Nifty P/E Ratio(05-Mar-2012): 18.71

Advances & Declines

BSE Advances : 952

BSE Declines : 1899

NSE Advances : 412

NSE Declines : 1044

Nifty Open Interest Changed Today

Nifty- 5200 CE(Mar)- +381950(+18.28%)

Nifty- 5200 PE(Mar)- +996150(+13.41%)

Nifty- 5300 CE(Mar)- +807100(+39.52%)

Nifty- 5300 PE(Mar)- +348750(+5.30%)

Nifty- 5400 CE(Mar)- +488900(+15.30%)

Nifty- 5400 PE(Mar)- +175650(+4.78%)

Nifty- 5500 CE(Mar)- +440200(+10.34%)

Nifty- 5500 PE(Mar)- -13900(-0.46%)

Closing

Nifty- closed at 5,280.35(-79.05 Points & -1.47%)

Sensex- closed at 17,362.87(-274.12 Points & -1.55% )

CNX Midcap - closed at 7,529.50(-125.95 Points & -1.65%)

BSE Smallcap- closed at 6,787.70(-65.39 Points & -0.95%)

1- Long Black Candle.

2- All the Indices closed in Red except FMCG.

3- whole day down moves after weak opening.

Ratios

Nifty Put Call Ratio: 0.95

Nifty P/E Ratio(05-Mar-2012): 18.71

Advances & Declines

BSE Advances : 952

BSE Declines : 1899

NSE Advances : 412

NSE Declines : 1044

Nifty Open Interest Changed Today

Nifty- 5200 CE(Mar)- +381950(+18.28%)

Nifty- 5200 PE(Mar)- +996150(+13.41%)

Nifty- 5300 CE(Mar)- +807100(+39.52%)

Nifty- 5300 PE(Mar)- +348750(+5.30%)

Nifty- 5400 CE(Mar)- +488900(+15.30%)

Nifty- 5400 PE(Mar)- +175650(+4.78%)

Nifty- 5500 CE(Mar)- +440200(+10.34%)

Nifty- 5500 PE(Mar)- -13900(-0.46%)

Closing

Nifty- closed at 5,280.35(-79.05 Points & -1.47%)

Sensex- closed at 17,362.87(-274.12 Points & -1.55% )

CNX Midcap - closed at 7,529.50(-125.95 Points & -1.65%)

BSE Smallcap- closed at 6,787.70(-65.39 Points & -0.95%)

FII & DII trading activity in Capital Market Segment on 05-Mar-2012

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 06-03-2012

Nifty Spot-Levels

R3 5406

R2 5375

R1 5327

Avg 5296

S1 5248

S2 5217

S3 5169

Nifty Spot-Trading Strategy

H6 5359 Trgt 2

H5 5341 Trgt 1

H4 5323 Long breakout

H3 5301 Go Short

H2 5294

H1 5287

L1 5272

L2 5265

L3 5258 Long

L4 5236 Short Breakout

L5 5218 Trgt 1

L6 5200 Trgt 2

R3 5406

R2 5375

R1 5327

Avg 5296

S1 5248

S2 5217

S3 5169

Nifty Spot-Trading Strategy

H6 5359 Trgt 2

H5 5341 Trgt 1

H4 5323 Long breakout

H3 5301 Go Short

H2 5294

H1 5287

L1 5272

L2 5265

L3 5258 Long

L4 5236 Short Breakout

L5 5218 Trgt 1

L6 5200 Trgt 2

Nifty(Mar Fut)-Levels & Trading Strategy for 06-03-2012

Nifty(Mar Fut)-Levels

R3 5447

R2 5412

R1 5365

Avg 5330

S1 5283

S2 5248

S3 5201

Nifty(Mar Fut)-Trading Strategy

H6 5400 Trgt 2

H5 5381 Trgt 1

H4 5363 Long breakout

H3 5340 Go Short

H2 5333

H1 5325

L1 5310

L2 5302

L3 5295 Long

L4 5272 Short Breakout

L5 5254 Trgt 1

L6 5235 Trgt 2

R3 5447

R2 5412

R1 5365

Avg 5330

S1 5283

S2 5248

S3 5201

Nifty(Mar Fut)-Trading Strategy

H6 5400 Trgt 2

H5 5381 Trgt 1

H4 5363 Long breakout

H3 5340 Go Short

H2 5333

H1 5325

L1 5310

L2 5302

L3 5295 Long

L4 5272 Short Breakout

L5 5254 Trgt 1

L6 5235 Trgt 2

Bank Nifty(Mar Fut)-Levels & Trading Strategy for 06-03-2012

Bank Nifty(Mar Fut)-Levels

R3 10717

R2 10605

R1 10423

Avg 10311

S1 10129

S2 10017

S3 9835

Bank Nifty(Mar Fut)-Trading Strategy

H6 10536 Trgt 2

H5 10469 Trgt 1

H4 10402 Long breakout

H3 10321 Go Short

H2 10294

H1 10267

L1 10214

L2 10187

L3 10160 Long

L4 10079 Short Breakout

L5 10012 Trgt 1

L6 9945 Trgt 2

R3 10717

R2 10605

R1 10423

Avg 10311

S1 10129

S2 10017

S3 9835

Bank Nifty(Mar Fut)-Trading Strategy

H6 10536 Trgt 2

H5 10469 Trgt 1

H4 10402 Long breakout

H3 10321 Go Short

H2 10294

H1 10267

L1 10214

L2 10187

L3 10160 Long

L4 10079 Short Breakout

L5 10012 Trgt 1

L6 9945 Trgt 2

Pre-Closing Outlook(05-03-2012)

Whole day trading below intermediate term trend decider 5340 today with intraday selling patterns today means strong indication of intermediate term trend turning down and high possibility of more down moves to text next support levels.

If anything miraculous come out from tomorrow Assembly results then expect any up move otherwise Indian markets are prepared for more down moves in the coming sessions.

If anything miraculous come out from tomorrow Assembly results then expect any up move otherwise Indian markets are prepared for more down moves in the coming sessions.

Post-open Outlook(05-03-2012)

All Asian markrets are in Red and some are more than 1% down therefore Red zone trading after weak opening today. Assembly results season today because market is reacting exit poll results today and tomorrow will react on achual results therefore volatility may be high and sustaining it beyond 5298 should be firstly watched for next decisive big move confirmations.

Finally Rally above 5458 after Volatility

Technical Analysis,Research & Weekly Outlook

(Mar 05 to Mar 09,2012)

Technical Analysis and Research of EOD,weekly and Monthly charts,Micro Analysis of Nifty Intra Day Chart,Technical Positions,next possibilities have already been explained in following topics with 5 Charts therefore not being repeated. Just click following topic links and go through detailed analysis for trading in next week:-

1- Blasing Rally above 5458

2- Crucial Supports in Assembly Election Results Week

3- For Decisive Break out more Preparation within 5298-5458

4- Correction Fate Decider 5340-5415

Conclusions (After Putting All Studies Together)

Long term trend is up,Short term trend is down and fate of next long term moves deciding Intermediate term trend was sideways between 5268-5458 in previous week. All the possibilities regarding break out side direction and supports/resistances have already been discussed in above topics.

It is clear from previous week intraday charts analysis that good supporta at lower levels. Although selling at higher levels but intraday patterns of previous week are suggesting consolidation formations therefore breaking out and sustaining above 5458 is high.

Assembly election results will be declared on 06-03-2012 as well as negative results for Congress will certainly badly hamper sentiment therefore coming sessions may be highly volatile also but until Nifty will not sustain below 5268 till then any decisive down move will not be considered.

Expected that Nifty will not sustain below 5120 and Long term trend will not turn down in worst sentiments also but on the other hand very much expected also that Nifty will not sustain below 5268 and finally rally above 5458 will be seen in the coming week/weeks

Blasting Rally above 5458

It is clear from both previous topics that Indian markets are technically not prepared for any side decisive break out and weekly closing in the center of previous week range after both selling at higher levels and buying at lower levels. Indian markets will prepare in the coming 1/2 sessions for next moves and follow up buying/selling will trigger break out/down.

Rally begun on 20-12-2011 from 4531.15 and correction started from 5629.95 after 1098.80 Nifty Points rally in 45 sessions. Immediate technical positions of this rally are as follows:-

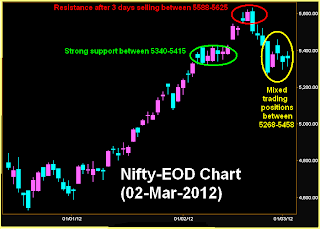

Nifty-EOD Chart(02-Mar-2012):-

1- Resistance after 3 days selling between 5588-5625

2- Strong support between 5340-5415

3- Mixed trading positions between 5268-5458 in previous week.

Only one resistance range above previous week trading range and sustaining above 5458 will be confirmation of correction completion as well as testing of above mentioned resistance range with high possibility of sustaining as well as blasting rally also above 5625 because fresh impulsive wave will develop above 5458 after correction completion.

Rally begun on 20-12-2011 from 4531.15 and correction started from 5629.95 after 1098.80 Nifty Points rally in 45 sessions. Immediate technical positions of this rally are as follows:-

Nifty-EOD Chart(02-Mar-2012):-

|

| Just click on chart for its enlarged view |

Conclusions from EOD chart analysis

1- Resistance after 3 days selling between 5588-5625

2- Strong support between 5340-5415

3- Mixed trading positions between 5268-5458 in previous week.

Only one resistance range above previous week trading range and sustaining above 5458 will be confirmation of correction completion as well as testing of above mentioned resistance range with high possibility of sustaining as well as blasting rally also above 5625 because fresh impulsive wave will develop above 5458 after correction completion.

Crucial Supports in Assembly Election Results Week

Mixed trading positions in previous week 5268-5458 and Assembly election results will be declared on 06-03-2012 as well as negative results for Congress will certainly badly hamper sentiment therefore coming sessions may be highly volatile and follow up selling after any nervous news may result slipping below 5340/5268 also. Keep in mind all following 7 Supports of 2012 Rally with their strength:-

Nifty-EOD Chart(02-Mar-2012):-

1- Strong support and base formation between 4532-4670

2- Minor support between 4590-4640

3- Strong support between 4680-4760

4- Support between 4810-4900

5- Minor support between 4992-5068

6- Support between 5120-5190

7- Strong support between 5340-5415

Sustaining below 5340/5268 will mean retracement of 20-Dec-2011 begun rally according to following Fibonacci Retracement Levels(4531-5629):-

Nifty-EOD Chart(02-Mar-2012):-

13.0%- 5486

23.6%- 5369

27.0%- 5332

38.2%- 5209

50.0%- 5080

61.8%- 4950

70.7%- 4852

76.4%- 4790

78.6%- 4765

88.6%- 4656

Sustaining below 5340 will mean intermediate term trend turning down and that will mean:-

1- 3 weeks to 3 months down trend and more down moves possibility within this period.

2- Testing possibility of above Supports and Retracement Levels.

Next support range(5120-5190) below 5340 is most important and long term trend decider also because it is containing little above and within it following crucial levels:

1- 38.2% Retracement Level- 5209

2- 55-Day EMA - today at 5192

3- 200-Day EMA- today at 5185

4- 200-Day SMA- today at 5167

Sustaining below 5340 will be first strong indication and sustaining below 5268 will be confirmation of deeper correction also and above mentioned levels will prove most helpful in thst situation.

Nifty-EOD Chart(02-Mar-2012):-

|

| Just click on chart for its enlarged view |

2- Minor support between 4590-4640

3- Strong support between 4680-4760

4- Support between 4810-4900

5- Minor support between 4992-5068

6- Support between 5120-5190

7- Strong support between 5340-5415

Sustaining below 5340/5268 will mean retracement of 20-Dec-2011 begun rally according to following Fibonacci Retracement Levels(4531-5629):-

Nifty-EOD Chart(02-Mar-2012):-

|

| Just click on chart for its enlarged view |

23.6%- 5369

27.0%- 5332

38.2%- 5209

50.0%- 5080

61.8%- 4950

70.7%- 4852

76.4%- 4790

78.6%- 4765

88.6%- 4656

Sustaining below 5340 will mean intermediate term trend turning down and that will mean:-

1- 3 weeks to 3 months down trend and more down moves possibility within this period.

2- Testing possibility of above Supports and Retracement Levels.

Most Important Support Range

Next support range(5120-5190) below 5340 is most important and long term trend decider also because it is containing little above and within it following crucial levels:

1- 38.2% Retracement Level- 5209

2- 55-Day EMA - today at 5192

3- 200-Day EMA- today at 5185

4- 200-Day SMA- today at 5167

Sustaining below 5340 will be first strong indication and sustaining below 5268 will be confirmation of deeper correction also and above mentioned levels will prove most helpful in thst situation.

Subscribe to:

Posts (Atom)