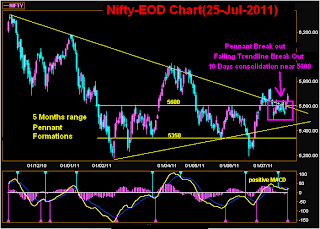

Main features of today trading are as follows

1- Last 12 sessions low(5497) saved and Nifty got support above it at 5522.

2- Most of the Indices got intraday support at lower levels.

3- Black Candle.

Ratios

Nifty Put Call Ratio: 0.93

Nifty P/E Ratio(27-Jul-2011): 20.09

Advances & Declines

BSE ADVANCES : 1314

BSE DECLINES : 1550

NSE ADVANCES : 584

NSE DECLINES : 831

Nifty Open Interest Changed Today

Nifty- 5500 CE(Jul)- +1890550(+33.17%)

Nifty- 5500 PE(Jul)- -1052350(-9.41%)

Nifty- 5600 CE(Jul)- +1892750(+21.38%)

Nifty- 5600 PE(Jul)- -982200(-13.17%)

Closing

Nifty- closed at 5,546.80(-28.05 Points & -0.50%)

Sensex- closed at 18,432.25(-85.97 Points & -0.46% )

CNX MIDCAP - closed at 8,114.15(-5.15 Points & -0.06%)

BSE SMALL CAP- closed at 00.00(+2.43 Points & +0.03%)