59 Sessions correction with Bullish flag formation amid Corona tsunami led most depressed sentiments

Technical Analysis,Research & Weekly Outlook

(May 03 to May 07,2021)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (30-Apr-2021):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C completion and Impulsive Wave-1 beginning from 7511.10 on 24-03-2020

2- Impulsive Wave-1 completion at 11794.30 on 31-08-2020 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 10790.20 on 24-09-2020 and Impulsive Wave-3 beginning

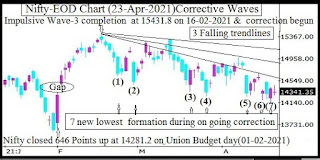

4- Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021

5- Corrective Wave-4 continuation in last 59 sessions with recent bottom formation at 14151.4 on 22-04-2021 and Bullish flag formation during this correction

6- Post Budget day last 59 sessions from 02-02-2021 to 30-04-2021 sideways trading between 14152-15431.

Conclusions from EOD chart analysis(Waves structure)

Impulsive Wave-3 completion after new life time top formation at 15431.8 on 16-02-2021 and after that corrective Wave-4 started which is in continuation with Bullish flag formation for last 59 sessions with recent bottom formation at 14151.4 on 22-04-2021.

Nifty-Weekly Chart Analysis

(Stochastic)

Nifty-EOD Chart (30-Apr-2021):-

Technical Patterns and Formations in Weekly charts

1- Stochastic %K(5) is at 70.27 & %D(3) is at 84.55

2- Stochastic- %K(5) line has intersected %D(3) line downward and started to move down from Overbought zone

3- Last 59 sessions sideways trading between 14152-15431

Conclusions from Weekly chart analysis

(Stochastic)

Last 59 sessions sideways trading between 14152-15431 and in Short term indicator Stochastic %K(5) line has intersected %D(3) line downward as well as started to move down from Overbought zone therefore down moves towards last sessions lowest(14152) is expected in next week.

Nifty-Intra Day Chart Analysis

(30-Apr-2021)

Nifty-Intra Day Chart (30-Apr-2021):-

Technical Patterns formation in today intraday charts

1- 4 Hours selling between 14789-14855(immediate Resistances)

2- Down moves with upward corrections

3- Whole day actual trading between 14602-14855

Conclusions from intra day chart analysis

As firstly 4 Hours good selling therefore down moves started which remained continued till last minute because selling continuation through upward corrections. As whole day selling last Friday therefore down moves will be seen in the beginning of next week.

As good selling between 14789-14855 therefore this range will be immediate resistances of Nifty and until Nifty will not sustain above 14855 till then decisive up moves will not be seen.

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is sideways between 14152-15431 for the last 59 sessions.

3- Short Term Trend is sideways between 14152-15044 for the last 15 sessions

Although most depressed sentiments due to Corona tsunami in India which is far more dangerous than 2020 but indian markets have not crashed like 2020 but traded sideways between 14152-15431 for the last 59 sessions after impulsive Wave-3 completion at 15431.8 on 16-02-2021. As following equally strong supports and resistances are lying beyond last Friday closing therefore Nifty will trade within last 59 sessions trading range in next week:-

Next supports are as follows:-

1-14566-14592

2-14457-14523

3-14316-14359

4-14192-14294

Next resistances are as follows:-

1- 14789-14855

2- 14871-14957

3- 15010-15044

4- 15158-15196

5- 15201-15241

6- 15262-15319

7- 15335-15421

As Wave-4 correction with Bullish flag formation therefore at present deeper correction will not be considered and finally sustaining beyond or forceful break out of last 59 sessions trading range(14152-15431) should be watched for:-

1- Impulsive Wave-5 beginning above 15431

2- Wave-4 correction continuation with deeper correction possibility below 14152