Rally continuation amid only Short Term Correction expectations

Technical Analysis,Research & Weekly Outlook

(Jun 08 to Jun 12,2020)

Nifty-EOD Chart Analysis

(Wave-B structure)

Nifty-EOD Chart (05-Jun-2020):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-A completion at 7511.10 on 24-03-2020 and Wave-B beginning

2- Wave-a of Wave-B completion at 9889.05 on 30-04-2020

3- Wave-b of Wave-B completion at 8806.75 on 16-05-2020

4- Wave-c of Wave-B continuation with recent top formation at 10177.8 on 05-06-2020

Conclusions from EOD chart analysis

(Wave-B structure)

Wave-c of Wave-B continuation with recent top formation last Friday at 10177.8 and no indication of its completion yet.

Nifty-EOD Chart Analysis

(Bollinger Band & Stochastic)

Nifty-EOD Chart (05-Jun-2020):-

Technical Patterns and Formations in EOD charts

1- Hovering around upper band of Bollinger Band

2- Stochastics showing negative divergence

3- Stochastic-%K(5) is at 86.79 & %D(3) is at 88.89

Conclusions from EOD chart analysis

(Bollinger Band & Stochastics)

Nifty is hovering around upper band of Bollinger Band for the last 3 sessions and Short Term indicator Stochastics is also showing negative divergence in Overbought zone because Nifty is moving up and Stochastics is moving down therefore caution and Short Term Correction signals are being generated by these 2 indicators

Nifty-EOD Chart Analysis

(Fibonacci Extension levels)

Nifty-EOD Chart (05-Jun-2020):-

Technical Patterns and Formations in EOD charts

1- Wave-A(7511.10 on 24-03-2020)

2- Wave-a of Wave-B(9889.05 on 30-04-2020)

3- Wave-a of Wave-B gained 2377.95 points

4- Wave-b of Wave-B(8806.75 on 16-05-2020)

5- Wave-c of Wave-B continuation with recent top formation at 10177.8 on 05-06-2020

6- 61.8% Fibonacci Extension Target of Wave-c of Wave-B is at 10276.32{8806.75+1469.57(61.8% of 2377.95)}

7- 100% Fibonacci Extension Target of Wave-c of Wave-B is at 11184.70{8806.75+2377.95(100% of 2377.95)}

Conclusions from EOD chart analysis

(Fibonacci Extension levels)

Wave-c of Wave-B is very much on and no confirmation of its completion yet as well as its continuation is expected towards its following next Fibonacci Extension Targets:-

1- 61.8%-10276.32

2- 100.0%-11184.70

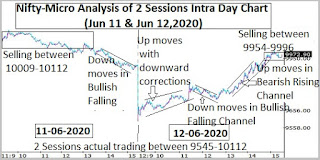

Nifty-Intra Day Chart Analysis

(05-Jun-2020)

Nifty-Intra Day Chart (05-Jun-2020):-

Technical Patterns formation in today intraday charts

1- Minor selling between 120123-10145

2- Sharp fall in first hour

3- Up moves with downward corrections

4- Consolidation in last hour between 10116-10150

5- Whole day actual trading between 10041-10177

Conclusions from intra day chart analysis

Although sharp fall in first hour after minor selling but after that nore than 3 hours up moves with downward corrections and consolidation was also seen in last hour therefore up moves above last Friday highest(10,177.80) will be seen in the beginning of next week because whole day good consolidation and only minor selling last Friday.

Conclusions

(After Putting All Studies Together)

1- Long term trend is down and it will be up after sustaining above its decider 200-Day SMA(Today at 10965.1)

2- Intermediate term trend is up

3- Short term trend is up

Corrective Wave-A of "ABC" correction completed at 7511.10 on 24-03-2020 and now its Wave-c of Wave-B continuation with recent top formation at 10177.8 on 05-06-2020 and no indication of its completion yet,its Fibonacci Extension Targets with calculations{61.8%(10276.32) and 100%(11184.70)} has been updated above and its continuation is expected towards them.

As Short Term indicator Stochastics is also showing negative divergence in Overbought zone therefore Short Term correction may be seen any day but firstly on going rally will remain continued in the beginning of next week because intraday charts of last Friday are showing good consolidation and very little selling patterns formations. Let selling patterns develop on intraday charts then correction will be considered which may be sideways also and deeper correction will be seen only after complete selling patterns formations.

Next resistances of Nifty are as follows:-

1- 10159-10294(Gap Resistance)

2- 10401-10520

3- 10752-11828(Gap Resistance)

4- 10893-11007

5- 11184-11409(Strong Resistances)

Next supports of Nifty are as follows:-

1- 10116-10150

2- 9945-9984

3- 9875-9907

4- 9599-9706(Gap support)

5- 9445-9520(Strong supports)

Rally is on and its continuation is expected in the beginning of next week towards above mentioned levels but emergence of Short Term Correction expectations only which may be sideways also and deeper correction will be considered only after complete selling patterns formations on intraday charts.