Strong rally after Global markets recovery from Corona virus fear

Technical Analysis,Research & Weekly Outlook

(Feb 03 to Feb 07,2020)

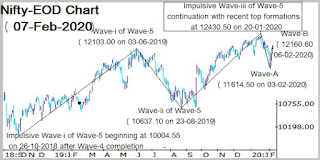

Nifty-EOD Chart Analysis

(5th Wave structure)

Nifty-EOD Chart (01-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-i of Wave-5 beginning at 10004.55 on 26-10-2018 after Wave-4 completion

2- Wave-i of Wave-5 completion at 12103.00 on 03-06-2019 and corrective Wave-ii beginning

3- Corrective Wave-ii of Wave-5 completion at 10637.10 on 23-08-2019 and impulsive Wave-iii beginning

4- Impulsive Wave-iii of Wave-5 completion at 12430.50 on 20-01-2020 and its correction continuation

5- Correction continuation with recent bottom formation at 11633.30 on 01-02-2020

6- First signal of deeper correction through Nifty testing 200 Day SMA(today at 11654.90) on 01-02-2020

Nifty-Fibonacci Retracement levels of Wave-5

Nifty-EOD Chart (01-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Nifty-Fibonacci Retracement levels of Wave-5(10004-12430)

2- 27% Retracement has been completed

Nifty-Intra Day Chart Analysis (01-Feb-2020)

Nifty-Intra Day Chart (01-Feb-2020):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- 4 Hours selling between 11900-12017

2- Follow up selling between 11808-111842

3- 175 Points slipping in last hour

4- Whole day actual trading between 11633-12017

Conclusions from EOD chart analysis

1- Long Term Trend is at stake after Nifty testing its decider 200 Day SMA(today at 11654.90) on 01-02-2020.

2- Intermediate Term Trend down.

3- Short Term Trend is down.

Conclusions from Fibonacci Retracement levels analysis

Nifty-Fibonacci Retracement levels of Wave-5(10004-12430):-

1- 13.0%-12114 (Retraced)

2- 23.6%-11857 (Retraced)

3- 27.0%-11775 (Retraced)

4- 38.2%-11503 (Crucial)

5- 50.0%-11217 (Crucial)

6- 61.8%-10930 (Crucial)

7- 70.7%-10714

8- 76.4%-10576

9- 78.6%-10523

10-88.6%-10280

Conclusions from intra day chart analysis

As Dow Jones closed more than 600 points down last Friday therefore Nifty slipped 75 points in first 15 seconds after gap down opening and after that slow up moves remained continued till Budget speech opening.

As Budget enthusiasm therefore selling was done on the back of Budget led heated sentiments and down moves started after 1 PM. Again follow up selling between 11808-111842 after some up moves and finally 175 Points slipping in last hour as well as closing at the lowest of Union Budget day after loosing 300 points.

Certainly huge selling therefore until complete consolidation will not develop till then Nifty will not moves above day's highest(12017) but some up moves may be seen up to 11808

Conclusions (After Putting All Studies Together)

Crucial Simple Moving Averages are as follows:-

5 Day SMA is today at-11969

13 Day SMA is today at-12123

55 Day SMA is today at-12109

200 Day SMA is today at-11654

As Nifty tested Long Term Trend decider 200 Day SMA(today at 11654.90) on 01-02-2020 and closed just above it at 11661.85 on Union Budget like day therefore too much depression of sentiments will be understood but Corona virus spreading fear was also one of the reason of such big fall therefore firstly sustaining beyond 200 Day SMA and Global markets reaction on Corona virus should be watched for the life of Long Term Trend.

27.0% retracement has been completed and Short Term Indicators have also turned Oversold therefore some up moves towards following resistances can not be ruled out and until Nifty will sustain above 12216 till then correction completion will not be considered.

1- 11808-111842

2- 11900-12017

3- 12003-12048

4- 12125-12169

5- 12160-12216

Union Budget 2-020-21 is good enough and Indian markets are following Corona virus led Global markets weakness,let world recover from this disease then strong rally will be seen in Indian markets also.