Rally above 12103 and towards 13870.95 after Budget-2019

Technical Analysis,Research & Weekly Outlook

(Jul 01 to Jul 05,2019)

Nifty-EOD Chart Analysis(Waves structure)

Nifty-EOD Chart (28-Jun-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Corrective Wave 2 beginning after Wave 1 completion at 8968.70 on 07-09-2016

3- Wave 1 gained 2142.90 points

4- Impulsive Wave 3 beginning after Corrective Wave-2 completion at 7893.80 on 26-12-2016

5- Corrective Wave 4 beginning after Wave 3 completion at 11760.20 on 28-08-2018

6- Wave 3 gained 3866.40 points

7- Impulsive Wave 5 beginning after Corrective Wave-4 completion at 10004.55 on 26-10-2018

8- Impulsive Wave-5 continuation with new life time top formation at 12103.00 on 03-06-2019

9- Last 29 Sessions sideways trading between 11592-12103

Nifty-EOD Chart Analysis(Modi ji's Victory gap)

Nifty-EOD Chart (28-Jun-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- Last 29 Sessions sideways trading between 11592-12103

Nifty-Previous 29 Sessions intraday charts analysis

Nifty-Intra Day Chart (May 20 to Jun 28,2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in last 29 Sessions intraday charts

1- Buying,selling and mixed Patterns formation in last 29 sessions

2- 29 Sessions actual trading between 11592-12103

Nifty-Intra Day Chart Analysis(01-07-2019)

Nifty-Intra Day Chart (28-Jun-2019):-

|

| Just click on chart for its enlarged view |

Technical Patterns formation in today intraday charts

1- Down moves in Bullish Falling Channels

2- More than 3 hours trading with Mixed Patterns formation between 11800-11832

3- Whole day actual trading between 11776-11871

Conclusions from EOD charts analysis

1- Long Term Trend is up

2- Intermediate Term Trend is up

3- Short Term Trend is sideways between 11592-12103 for the last 29 Sessions after 165 Points "Modi ji's Victory gap" formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

Conclusions from 29 Sessions intra day chart analysis

As first Budget of Modi ji Government 2nd term on 5th July 2019 therefore Indian markets are preparing for post Budget decisive big moves for the last 29 sessions between 11592-12103 after Exit Polls results on 19-05-2019 which is above 165 Points "Modi ji's Victory gap"(11426-11591) that was formed on 20-05-2019.

Last 29 sessions trading is with lower levels Buying and higher levels selling as well as one sideed technical positions not formations yet therefore Nifty has to trade and prepare for next post Budget decisive moves within 11592-12103 and finally sustaining beyond this range will confirm next big moves.

Conclusions from intra day chart analysis

Although last Friday closing was near the lower levels of the day but clear selling patterns were not seen and more than 3 hours trading with Mixed Patterns formation developed as well as consolidation took placed through Down moves in Bullish Falling Channels therefore Indian markets will be understood under consolidation process and emergence of rally continuation expectations but after follow up consolidations in the coming week.

Conclusions (After Putting All Studies Together)

As Long and Intermediate Term Trends are still up therefore Indian markets will be understood Bullish and as per following calculations on going Rally will be expected towards 13870.95 in the coming weeks:-

As per Elliott Wave theory "Wave-3 should not be shorter than both Wave-1 and Wave-5. Now impulsive Wave-5 is on and it should not gain more points than Wave-3 gained(3866.40 points).

Impulsive Wave-1 gained=2142.90 points(8968.70-6825.80)

Impulsive Wave-3 gained=3866.40 points(11760.20-7893.80)

Impulsive Wave-5 has gained 1851.60 points till 18-04-2018(11856.15-10004.55)

As per Elliott Wave theory Wave-5 can gain 3866.40 points from its beginning level(10004.55 )which means that on going Wave-5 has potential to move up to 13870.95(10004.55+3866.40)

As Short Term Trend is sideways between 11592-12103 for the last 29 Sessions therefore firstly sustaining beyond this range should be watched for next big moves confirmations.

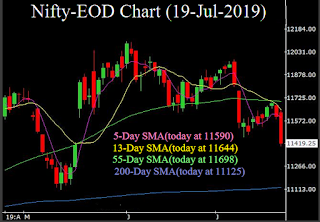

Next supports of Nifty are as follows:-

1- 11642-11727

2- 55-Day SMA(today at 11697)

3- "Modi ji's Victory gap"(11426-11591)

Next resistances of Nifty are as follows:-

1- 11842-11934

2- 11968-12000

3- 12045-12097

It is confirm that Indian markets are well riped for Post Budget big moves in the last 29 sessions sideways trading between 11592-12103 and its forceful break out will be seen just before or after Buget day(05-07-2019). Although high volatility can not be ruled out in the next Pre-Budget week but expected that:-

1- Nifty will not sustain below 29 sessions lowest(11592)

2- Nifty will not fill "Modi ji's Victory gap"(11426-11591),means that Nifty will not slip below 11427.

Indian Stock markets reacted surprisingly on following news:-

1- No rally after Modi ji strong victory on 23rd May 2019.

2- Sharp fall after Smt Nirmala Sitaraman announcement as Finance minister on 31-05-2019

Although above surprising negative moves but Indian markets are well matured and have full faith in Modi ji as well as rally will remain continued above 12103 and towards 13870.95 after Budget-2019 but next one more week may remain sideways between 11427-12103 for consolidation and fresh rally preparation.