Rally continuation above life time highest without sustaining below

"Modi ji's victory Gap(11426-11591)"

Technical Analysis,Research & Weekly Outlook

(Jun 10 to Jun 14,2019)

Nifty-EOD Chart Analysis

"Modi ji's gap"

Nifty-EOD Chart (07-Jun-2019):- |

| Just click on chart for its enlarged view |

1- 165 Points strong gap supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- 165 Points was formed on the "high expectations like Bullet Trains recovery of Indian economy" after Modi ji's victory in 2019 Parliamentary elections therefore this gap will be told "Modi ji's gap"

Nifty-EOD Chart Analysis

Nifty-EOD Chart (07-Jun-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave 5 beginning from 10004.55 on 26-10-2018

2- Strong 165 points gap support formations between 11426-11591 on 20-05-2019

3- Last 14 sesions trading with both buying and selling after 165 points gap formations on 20-05-2019

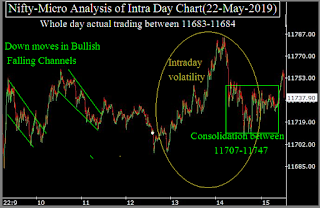

Nifty-Previous 14 Sessions intraday charts analysis

Nifty-Intra Day Chart (May 20 to Jun 07,2019):- |

| Just click on chart for its enlarged view |

1- 165 Points strong gap supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- Last supports of 14 sessions range are between 11645-11730

3- Crucial supports are at 11829.50

4- Both buying and selling above 11829.50 in last 11 sessions

5- Consolidation between 11808-11897 on 07-06-2019

6- 14 Sessions actual trading between 11592-12103

Nifty-Intra Day Chart Analysis(07-06-2019)

Nifty-Intra Day Chart (07-Jun-2019):- |

| Just click on chart for its enlarged view |

1- 6 Hours consolidation Patterns formation between 11808-11897

2- Whole day actual trading between 11770-11897

Conclusions (After Putting All Studies Together)

It must be kept in mind that 165 Points like big gap between 11426-11591 was formed on 20-05-2019 after Exit Polls results on 19-05-2019. As this gap was formed on the "high expectations like Bullet Trains recovery of Indian economy" after Modi ji's victory in 2019 Parliamentary elections therefore this gap will be told:-

"Modi ji's victory Gap"

formation on 20-05-2019 and until these expections are alive till then Nifty will not sustain below 11591 and rally will remain contunued with new life time highs formations after fresh and follow up higher levels consolidations and corrections in the coming years.1- Long Term Trend is up

2- Intermediate Term Trend is up

3- Short Term Trend is sideways between 11592-12103 for the last 14 Sessions

165 Points strong gap supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 and after that Nifty is trading sideways between 11592-12103 for the last 14 Sessions. Although continuously supports getting above 11591 but Nifty is failing to sustain above 12000 also after fresh selling developments near about it in the last 11 sessions.

As Nifty is getting supports with rising bottoms after good consolidation between 11645-11730 and follow up consolidation also near crucial supports (11829.50) between 11808-11897 last Friday therefore fresh rally hopes above life time highest is alive but follow up consolidation is also required because multiple selling was also seen near about 12000.

As 6 Hours good consolidation between 11808-11897 last Friday therefore fresh up moves will be seen in the beginning of next week but sustaining above 12000 should also be firstly watched because selling was seen there and fresh consolidation is also required for sustaining above 12000.

Final budget for the current financial year(2019-20) will be presented in the Lok Sabha on July 5 and Finance Minister Nirmala Sitharaman capacities are not known yet therefore Indian markets may wait and prepare for post Budget decisive moves in the coming weeks but as per our views Budget will be good and rally will remain continued above life time highest without sustaining below

"Modi ji's victory Gap(11426-11591)"

"Modi ji's victory Gap(11426-11591)"