CRUDEOIL-JAN Fut-Sell-Positional-SL-5046 & TGT-4926-CMP-5006(Lalit39)

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

FII & DII trading activity in Capital Market Segment on 27-Dec-2012

| ||||||||||||||||

| ||||||||||||||||

Live Proofs of our Accurate Predictions

We gave today trading range between 5865-5965 and Nifty traded between 5864.70-5930.80 today. Live proofs are as follows:-

1- We told yesterday in Pre-Closing Outlook(26-12-2012):-"Now next moves preparation trading range is 5865-5965 in all types of sentiments"

2- We told today in Technical Analysis and Market Outlook(27-12-2012):-"Now next moves preparation trading range is 5865-5965 in all types of sentiments and firstly trading within this range is expected"

1- We told yesterday in Pre-Closing Outlook(26-12-2012):-"Now next moves preparation trading range is 5865-5965 in all types of sentiments"

2- We told today in Technical Analysis and Market Outlook(27-12-2012):-"Now next moves preparation trading range is 5865-5965 in all types of sentiments and firstly trading within this range is expected"

Live Proofs today intraday Accurate Predictions have already been updated today in Mid-session Outlook(27-12-2012)

Mid-session Outlook(27-12-2012)

Although positive Asian markets and Green opening in Indian markets but we were not Bullish and told following line in 1st hour at 10:13:00 AM today:-

"As market has not shown required strength after Green opening today therefore view will start to become positive after sustaining above 5920"

More than 3 hours mixed intraday patterns between 5900-5917 yesterday and today again mixed intraday patterns between 5888-5917 with following technical positions;-

1- Selling between 5906-5917

2- Support between 5888-5895

As today intraday selling seen between and just below Previous resistance range(5910-5965) therefore this resistance strengthened today and complete consolidation is required for sustaining above 5965. Although strong up moves yesterday but we told following lines at 08:10 AM today and being repeated for next moves guidance:-

1- good supports between 5846-5865 in last 2 sessions

2- next and last resistance range(5910-5965) of on going rally.

3- Now next moves preparation trading range is 5865-5965 in all types of sentiments and firstly trading within this range is expected in the coming couple of sessions

"As market has not shown required strength after Green opening today therefore view will start to become positive after sustaining above 5920"

Condition of sustaining above 5920 was told and Nifty could not move above 5917 after our above posting.

More than 3 hours mixed intraday patterns between 5900-5917 yesterday and today again mixed intraday patterns between 5888-5917 with following technical positions;-

1- Selling between 5906-5917

2- Support between 5888-5895

As today intraday selling seen between and just below Previous resistance range(5910-5965) therefore this resistance strengthened today and complete consolidation is required for sustaining above 5965. Although strong up moves yesterday but we told following lines at 08:10 AM today and being repeated for next moves guidance:-

1- good supports between 5846-5865 in last 2 sessions

2- next and last resistance range(5910-5965) of on going rally.

3- Now next moves preparation trading range is 5865-5965 in all types of sentiments and firstly trading within this range is expected in the coming couple of sessions

Pre-open Outlook(27-12-2012)

As market has not shown required strength after Green opening today therefore view will start to become positive after sustaining above 5920.

Technical Analysis and Market Outlook(27-12-2012)

Nifty-Micro Analysis of 2 Sessions Intra Day Chart

(Dec 24 & Dec 27,2012)

Nifty-Intra Day Chart (Dec 24 & Dec 27,2012):- |

| Just click on chart for its enlarged view |

1- Consolidation and Support between 5846-5865 in last 2 sessions.

2- More than 3 hours mixed intraday patterns between 5900-5917 on 26-12-2012

3- 2 Sessions actual trading between 5846-5917

Conclusions from 2 Sessions intra day chart analysis

Now next moves preparation trading range is 5865-5965 in all types of sentiments and firstly trading within this range is expected in the coming couple of sessions. Let intraday charts form and show next moves preparations then will be updated accordingly in the coming Outlooks.

FII & DII trading activity in Capital Market Segment on 26-Dec-2012

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 27-12-2012

R3 5986

R2 5951

R1 5928

Avg 5893

S1 5870

S2 5835

S3 5812

Nifty Spot-Trading Strategy

H6 5963 Trgt 2

H5 5950 Trgt 1

H4 5936 Long breakout

H3 5920 Go Short

H2 5915

H1 5910

L1 5899

L2 5894

L3 5889 Long

L4 5873 Short Breakout

L5 5859 Trgt 1

L6 5846 Trgt 2

Nifty(Dec Fut)-Levels & Trading Strategy for 27-12-2012

R3 6000

R2 5963

R1 5938

Avg 5901

S1 5876

S2 5839

S3 5814

Nifty(Dec Fut)-Trading Strategy

H6 5975 Trgt 2

H5 5961 Trgt 1

H4 5947 Long breakout

H3 5930 Go Short

H2 5924

H1 5918

L1 5907

L2 5901

L3 5895 Long

L4 5878 Short Breakout

L5 5864 Trgt 1

L6 5850 Trgt 2

Bank Nifty(Dec Fut)-Levels & Trading Strategy for 27-12-2012

R3 12826

R2 12686

R1 12597

Avg 12457

S1 12368

S2 12228

S3 12139

Bank Nifty(Dec Fut)-Trading Strategy

H6 12740 Trgt 2

H5 12687 Trgt 1

H4 12633 Long breakout

H3 12570 Go Short

H2 12549

H1 12528

L1 12487

L2 12466

L3 12445 Long

L4 12382 Short Breakout

L5 12328 Trgt 1

L6 12275 Trgt 2

Pre-Closing Outlook(26-12-2012)

Forceful up moves after more than 8 hours consolidations and last more than 3 hours mixed intraday patterns trading between 5900-5917 which is within and just below next strong resistance range 5910-5965. As last 3 hours trading with mixed intraday patterns therefore more follow up consolidation is required for valid break out of 17 sessions range(5823-5965).

Now next moves preparation trading range is 5865-5965 in all types of sentiments. Although finally rally above 5865 is expected but firstly follow up consolidations is must to cross above mentioned strong resistance.

Now next moves preparation trading range is 5865-5965 in all types of sentiments. Although finally rally above 5865 is expected but firstly follow up consolidations is must to cross above mentioned strong resistance.

Mid-session Outlook(26-12-2012)

Indian markets are more than .75% up today but it was was projected in our both previous Outlooks and following lines were told:-

1- We told in Mid-session Outlook(24-12-2012):-"lower levels supports and emergence of consolidation patterns also therefore fresh up move hopes turned alive today"

2- Today at 08:09 AM in Technical Analysis and Research For 26-12-2012:-"Lower levels supports with intraday consolidation patterns therefore fresh up move hopes turned alive on 24-12-2012"

First resistance forcefully crossed after more than 8 hours consolidations but strong resistances between 5910-5965 therefore now more follow up consolidation is required for valid break out of 17 sessions range. Sustaining above 5965 should be firstly watched now for Sub Wave-5 of Wave-3 strong rally confirmations.

1- We told in Mid-session Outlook(24-12-2012):-"lower levels supports and emergence of consolidation patterns also therefore fresh up move hopes turned alive today"

2- Today at 08:09 AM in Technical Analysis and Research For 26-12-2012:-"Lower levels supports with intraday consolidation patterns therefore fresh up move hopes turned alive on 24-12-2012"

First resistance forcefully crossed after more than 8 hours consolidations but strong resistances between 5910-5965 therefore now more follow up consolidation is required for valid break out of 17 sessions range. Sustaining above 5965 should be firstly watched now for Sub Wave-5 of Wave-3 strong rally confirmations.

Technical Analysis and Research For 26-12-2012

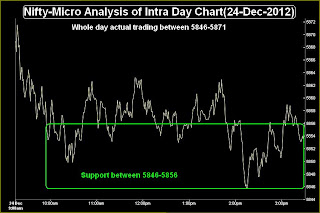

Nifty-Intra Day Chart (24-Dec-2012):-

Technical Patterns and Formations in today intraday charts

1- Support between 5846-5856

2- Whole day actual trading between 5846-5871

Lower levels supports with intraday consolidation patterns therefore fresh up move hopes turned alive on 24-12-2012 but good selling at higher levels and development of strong multiple resistances also in last 16 sessions sideways trading therefore follow up complete consolidation is required in the coming sessions and sustaining beyond next first resistance range(5868-5882) will be fresh up moves confirmation.

Long Term Trend is up,Short Term is down and Intermediate Term is sideways between(5823-5965) for the last 16 sessions with lower levels supports and higher levels resistances. Indian markets are not prepared for any side decisive trend and will firstly trade within 5823-5965. Follow up moves and valid break out of following ranges should be firstly watched for:-

1- Next trend first strong indication 5846-5882

2- Next trend first confirmations 5823-5965

|

| Just click on chart for its enlarged view |

1- Support between 5846-5856

2- Whole day actual trading between 5846-5871

Conclusions from intra day chart analysis

Lower levels supports with intraday consolidation patterns therefore fresh up move hopes turned alive on 24-12-2012 but good selling at higher levels and development of strong multiple resistances also in last 16 sessions sideways trading therefore follow up complete consolidation is required in the coming sessions and sustaining beyond next first resistance range(5868-5882) will be fresh up moves confirmation.

Long Term Trend is up,Short Term is down and Intermediate Term is sideways between(5823-5965) for the last 16 sessions with lower levels supports and higher levels resistances. Indian markets are not prepared for any side decisive trend and will firstly trade within 5823-5965. Follow up moves and valid break out of following ranges should be firstly watched for:-

1- Next trend first strong indication 5846-5882

2- Next trend first confirmations 5823-5965

FII & DII trading activity in Capital Market Segment on 24-Dec-2012

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 26-12-2012

Nifty Spot-Levels

R3 5896

R2 5883

R1 5869

Avg 5856

S1 5842

S2 5829

S3 5815

Nifty Spot-Trading Strategy

H6 5882 Trgt 2

H5 5875 Trgt 1

H4 5869 Long breakout

H3 5862 Go Short

H2 5859

H1 5857

L1 5852

L2 5850

L3 5847 Long

L4 5840 Short Breakout

L5 5834 Trgt 1

L6 5827 Trgt 2

Nifty(Dec Fut)-Levels & Trading Strategy for 26-12-2012

R3 5901

R2 5889

R1 5877

Avg 5865

S1 5853

S2 5841

S3 5829

Nifty(Dec Fut)-Trading Strategy

H6 5889 Trgt 2

H5 5883 Trgt 1

H4 5878 Long breakout

H3 5871 Go Short

H2 5869

H1 5867

L1 5862

L2 5860

L3 5858 Long

L4 5851 Short Breakout

L5 5846 Trgt 1

L6 5840 Trgt 2

Bank Nifty(Dec Fut)-Levels & Trading Strategy for 26-12-2012

R3 12509

R2 12453

R1 12396

Avg 12340

S1 12283

S2 12227

S3 12170

Bank Nifty(Dec Fut)-Trading Strategy

H6 12452 Trgt 2

H5 12426 Trgt 1

H4 12401 Long breakout

H3 12370 Go Short

H2 12359

H1 12349

L1 12328

L2 12318

L3 12307 Long

L4 12276 Short Breakout

L5 12251 Trgt 1

L6 12225 Trgt 2

Subscribe to:

Posts (Atom)

.jpg)