Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

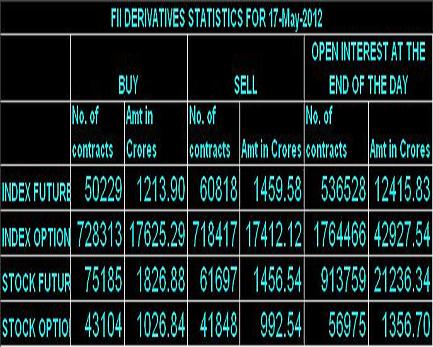

FII & DII trading activity in Capital Market Segment on 17-May-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(17-May-2012)

Main features of today trading are as follows

1- Benchmark Indices closed in Green with marginal gains.

2- Most Indices closed with marginal gains or loss except FMCG closing after good intraday up moves.

3- Doji Candle formation.

Ratios

Nifty Put Call Ratio: 0.94

Nifty P/E Ratio(17-May-2012): 16.78

Advances & Declines

BSE Advances : 1335

BSE Declines : 1385

NSE Advances : 720

NSE Declines : 697

Nifty Open Interest Changed Today

Nifty- 4700 CE(May)- -13000(-1.90%)

Nifty- 4700 PE(May)- +342150(+5.65%)

Nifty- 4800 CE(May)- +423100(+19.88%)

Nifty- 4800 PE(May)- +5250(+0.08%)

Nifty- 4900 CE(May)- +300500(+6.63%)

Nifty- 4900 PE(May)- +193100(+3.31%)

Nifty- 5000 CE(May)- +99900(+1.77%)

Nifty- 5000 PE(May)- -308550(-7.89%)

Nifty- 5100 CE(May)- +208000(+3.31%)

Nifty- 5100 PE(May)- -107200(-3.59%)

Closing

Nifty- closed at 4,870.20(+11.95 Points & +0.25%)

Sensex- closed at 16,070.48(+40.39 Points & +0.25% )

CNX Midcap - closed at 6,886.55(-15.50 Points & -0.22%)

BSE Smallcap- closed at 6,270.36(+5.41 Points & +0.09%)

1- Benchmark Indices closed in Green with marginal gains.

2- Most Indices closed with marginal gains or loss except FMCG closing after good intraday up moves.

3- Doji Candle formation.

Ratios

Nifty Put Call Ratio: 0.94

Nifty P/E Ratio(17-May-2012): 16.78

Advances & Declines

BSE Advances : 1335

BSE Declines : 1385

NSE Advances : 720

NSE Declines : 697

Nifty Open Interest Changed Today

Nifty- 4700 CE(May)- -13000(-1.90%)

Nifty- 4700 PE(May)- +342150(+5.65%)

Nifty- 4800 CE(May)- +423100(+19.88%)

Nifty- 4800 PE(May)- +5250(+0.08%)

Nifty- 4900 CE(May)- +300500(+6.63%)

Nifty- 4900 PE(May)- +193100(+3.31%)

Nifty- 5000 CE(May)- +99900(+1.77%)

Nifty- 5000 PE(May)- -308550(-7.89%)

Nifty- 5100 CE(May)- +208000(+3.31%)

Nifty- 5100 PE(May)- -107200(-3.59%)

Closing

Nifty- closed at 4,870.20(+11.95 Points & +0.25%)

Sensex- closed at 16,070.48(+40.39 Points & +0.25% )

CNX Midcap - closed at 6,886.55(-15.50 Points & -0.22%)

BSE Smallcap- closed at 6,270.36(+5.41 Points & +0.09%)

Nifty Spot-Levels & Trading Strategy for 18-05-2012

Nifty Spot-Levels

R3 4983

R2 4952

R1 4911

Avg 4880

S1 4839

S2 4808

S3 4767

Nifty Spot-Trading Strategy

H6 4942 Trgt 2

H5 4925 Trgt 1

H4 4909 Long breakout

H3 4889 Go Short

H2 4883

H1 4876

L1 4863

L2 4856

L3 4850 Long

L4 4830 Short Breakout

L5 4814 Trgt 1

L6 4797 Trgt 2

R3 4983

R2 4952

R1 4911

Avg 4880

S1 4839

S2 4808

S3 4767

Nifty Spot-Trading Strategy

H6 4942 Trgt 2

H5 4925 Trgt 1

H4 4909 Long breakout

H3 4889 Go Short

H2 4883

H1 4876

L1 4863

L2 4856

L3 4850 Long

L4 4830 Short Breakout

L5 4814 Trgt 1

L6 4797 Trgt 2

Nifty(May Fut)-Levels & Trading Strategy for 18-05-2012

Nifty(May Fut)-Levels

R3 4979

R2 4945

R1 4898

Avg 4864

S1 4817

S2 4783

S3 4736

Nifty(May Fut)-Trading Strategy

H6 4933 Trgt 2

H5 4914 Trgt 1

H4 4896 Long breakout

H3 4874 Go Short

H2 4866

H1 4859

L1 4844

L2 4837

L3 4829 Long

L4 4807 Short Breakout

L5 4789 Trgt 1

L6 4770 Trgt 2

R3 4979

R2 4945

R1 4898

Avg 4864

S1 4817

S2 4783

S3 4736

Nifty(May Fut)-Trading Strategy

H6 4933 Trgt 2

H5 4914 Trgt 1

H4 4896 Long breakout

H3 4874 Go Short

H2 4866

H1 4859

L1 4844

L2 4837

L3 4829 Long

L4 4807 Short Breakout

L5 4789 Trgt 1

L6 4770 Trgt 2

Bank Nifty(May Fut)-Levels & Trading Strategy for 18-05-2012

Bank Nifty(May Fut)-Levels

R3 9478

R2 9381

R1 9233

Avg 9136

S1 8988

S2 8891

S3 8743

Bank Nifty(May Fut)-Trading Strategy

H6 9331 Trgt 2

H5 9275 Trgt 1

H4 9219 Long breakout

H3 9152 Go Short

H2 9129

H1 9107

L1 9062

L2 9040

L3 9017 Long

L4 8950 Short Breakout

L5 8894 Trgt 1

L6 8838 Trgt 2

R3 9478

R2 9381

R1 9233

Avg 9136

S1 8988

S2 8891

S3 8743

Bank Nifty(May Fut)-Trading Strategy

H6 9331 Trgt 2

H5 9275 Trgt 1

H4 9219 Long breakout

H3 9152 Go Short

H2 9129

H1 9107

L1 9062

L2 9040

L3 9017 Long

L4 8950 Short Breakout

L5 8894 Trgt 1

L6 8838 Trgt 2

Pre-Closing Outlook(17-05-2012)

When Indian markets were trading near the highs of the day and selling started to develop then it was immediately updated with next moves confirmation levels in Mid-session Outlook and following lines were told:-

1- minor selling formations also seen at higher levels today..

2- next moves confirmations is through sustaining above 4895/4882.

Indian markets are in the hands of Bears and selling again seen at higher levels today as well as formations of new intraday lows also observed. Although whole day down moves in Falling Channel(Bullish pattern) but good selling at higher levels also therefore following levels will be firstly watched tomorrow for next moves confirmations:-

1- Sustaing above 4890 will be first upmove strong indication.

2- Sustaing above 4922 will be up moves confirmations.

3- Sustaining below 4838(yesterday lowest) will be deep down moves confirmation.

As Falling Channel(Bullish pattern) formation was seen above 4838 yesterday therefore sustaining below is must for more down moves confirmations.

Mid-session Outlook(17-05-2012)

That more than 1% up move and Pull Back rally is being seen today which was projected in both previous outlooks with the confirmation through sustaining above 4882.

Nifty is trading above 4882 since opening today but lot of consolidation is required for up moves because multiple resistances at higher levels and minor selling formations also seen at higher levels today..

Same view for next moves confirmations is through sustaining above 4895/4882.

4882 for deciding the fate of Pull Back rally

Nifty-Micro Analysis of Intra Day Chart For 17-05-2012

Nifty-Intra Day Chart (16-May-2012):-

|

| Just click on chart for its enlarged view |

1- Down moves in Falling Channel.

2- Falling Channel upward Break out.

3- Last 2 hours volatility after Break out.

3- Whole day trading between 4838-4882

Conclusions from intra day chart analysis

Intraday trading within 4838-4882 with Falling Channel formation and its upward break out was also seen. Falling channel and its upward break out are Bullish formations and sustaining above intraday high(4882) will be Pull Back rally confirmation.

As all trands are down therefore more consolidations are required for decisive up moves and follow up buying in the coming sessions will mean Pull Back rally after forceful break out or sustaining above 4882.

Firstly watch sustaining or closing beyond 4882 for next moves confirmations and it will decide the fate of Pull Back rally.

Indian Stock Markets Closing Reports(16-May-2012)

Main features of today trading are as follows

1- Red closing.

2- Whole day negative zone trading after gap down opening.

3- Benchmark Indives got intraday support at lower levels.

Ratios

Nifty Put Call Ratio:0.94

Nifty P/E Ratio(16-May-2012):16.74

Advances & Declines

BSE Advances : 920

BSE Declines : 1808

NSE Advances : 364

NSE Declines : 1055

Nifty Open Interest Changed Today

Nifty- 4700 CE(May)- +481950(+238.24%)

Nifty- 4700 PE(May)- +1098350(+22.14%)

Nifty- 4800 CE(May)- +1010450(+90.44%)

Nifty- 4800 PE(May)- -724900(-10.09%)

Nifty- 4900 CE(May)- +1706200(+57.14%)

Nifty- 4900 PE(May)- -721800(-10.40%)

Nifty- 5000 CE(May)- +690300(+13.96%)

Nifty- 5000 PE(May)- -869450(-18.18%)

Closing

Nifty- closed at 4,858.25(-84.55 Points & -1.71%)

Sensex- closed at 16,030.09(-298.16 Points & -1.83% )

CNX Midcap - closed at 6,902.05(-60.10 Points & -0.86%)

BSE Smallcap- closed at 6,264.95(-70.32 Points & -1.11%)

1- Red closing.

2- Whole day negative zone trading after gap down opening.

3- Benchmark Indives got intraday support at lower levels.

Ratios

Nifty Put Call Ratio:0.94

Nifty P/E Ratio(16-May-2012):16.74

Advances & Declines

BSE Advances : 920

BSE Declines : 1808

NSE Advances : 364

NSE Declines : 1055

Nifty Open Interest Changed Today

Nifty- 4700 CE(May)- +481950(+238.24%)

Nifty- 4700 PE(May)- +1098350(+22.14%)

Nifty- 4800 CE(May)- +1010450(+90.44%)

Nifty- 4800 PE(May)- -724900(-10.09%)

Nifty- 4900 CE(May)- +1706200(+57.14%)

Nifty- 4900 PE(May)- -721800(-10.40%)

Nifty- 5000 CE(May)- +690300(+13.96%)

Nifty- 5000 PE(May)- -869450(-18.18%)

Closing

Nifty- closed at 4,858.25(-84.55 Points & -1.71%)

Sensex- closed at 16,030.09(-298.16 Points & -1.83% )

CNX Midcap - closed at 6,902.05(-60.10 Points & -0.86%)

BSE Smallcap- closed at 6,264.95(-70.32 Points & -1.11%)

FII & DII trading activity in Capital Market Segment on 16-May-2012

| ||||||||||||||||

| ||||||||||||||||

Nifty Spot-Levels & Trading Strategy for 17-05-2012

Nifty Spot-Levels

R3 4926

R2 4904

R1 4881

Avg 4859

S1 4836

S2 4814

S3 4791

Nifty Spot-Trading Strategy

H6 4903 Trgt 2

H5 4892 Trgt 1

H4 4882 Long breakout

H3 4870 Go Short

H2 4866

H1 4862

L1 4853

L2 4849

L3 4845 Long

L4 4833 Short Breakout

L5 4823 Trgt 1

L6 4812 Trgt 2

R3 4926

R2 4904

R1 4881

Avg 4859

S1 4836

S2 4814

S3 4791

Nifty Spot-Trading Strategy

H6 4903 Trgt 2

H5 4892 Trgt 1

H4 4882 Long breakout

H3 4870 Go Short

H2 4866

H1 4862

L1 4853

L2 4849

L3 4845 Long

L4 4833 Short Breakout

L5 4823 Trgt 1

L6 4812 Trgt 2

Nifty(May Fut)-Levels & Trading Strategy for 17-05-2012

Nifty(May Fut)-Levels

R3 4931

R2 4904

R1 4880

Avg 4853

S1 4829

S2 4802

S3 4778

Nifty(May Fut)-Trading Strategy

H6 4907 Trgt 2

H5 4895 Trgt 1

H4 4884 Long breakout

H3 4870 Go Short

H2 4865

H1 4860

L1 4851

L2 4846

L3 4841 Long

L4 4827 Short Breakout

L5 4816 Trgt 1

L6 4804 Trgt 2

R3 4931

R2 4904

R1 4880

Avg 4853

S1 4829

S2 4802

S3 4778

Nifty(May Fut)-Trading Strategy

H6 4907 Trgt 2

H5 4895 Trgt 1

H4 4884 Long breakout

H3 4870 Go Short

H2 4865

H1 4860

L1 4851

L2 4846

L3 4841 Long

L4 4827 Short Breakout

L5 4816 Trgt 1

L6 4804 Trgt 2

Bank Nifty(May Fut)-Levels & Trading Strategy for 17-05-2012

Bank Nifty(May Fut)-Levels

R3 9397

R2 9290

R1 9199

Avg 9092

S1 9001

S2 8894

S3 8803

Bank Nifty(May Fut)-Trading Strategy

H6 9308 Trgt 2

H5 9262 Trgt 1

H4 9216 Long breakout

H3 9162 Go Short

H2 9144

H1 9126

L1 9089

L2 9071

L3 9053 Long

L4 8999 Short Breakout

L5 8953 Trgt 1

L6 8907 Trgt 2

R3 9397

R2 9290

R1 9199

Avg 9092

S1 9001

S2 8894

S3 8803

Bank Nifty(May Fut)-Trading Strategy

H6 9308 Trgt 2

H5 9262 Trgt 1

H4 9216 Long breakout

H3 9162 Go Short

H2 9144

H1 9126

L1 9089

L2 9071

L3 9053 Long

L4 8999 Short Breakout

L5 8953 Trgt 1

L6 8907 Trgt 2

Mid-session Outlook(16-05-2012)

Nowadays complete manipulation through US futures. Yesterday Indian markets surged from intraday lower levels on the back of Dow'Futures more than 90 points up moves during Indian markets trading time but Dow Jones closed 63.35 down yesterday.

Indian markets complete reaction on Dow'Futures was updated yesterday in Pre-Closing Outlook(15-05-2012)

Intraday selling was done yesterday through manipulated up moves in Us Futures and today gap down after most depressed global cues. All trends are down and all the patterns,strong supports and crucial levels have been broken down in on going correction.

Intraday trading within 4838-4881 with falling channel formation and its upward break out also seen today. Although falling channel and its upward break out is Bullish formations but sustaining above today trading range is must for Pull Back rally confirmations.

Indian markets complete reaction on Dow'Futures was updated yesterday in Pre-Closing Outlook(15-05-2012)

Intraday selling was done yesterday through manipulated up moves in Us Futures and today gap down after most depressed global cues. All trends are down and all the patterns,strong supports and crucial levels have been broken down in on going correction.

Intraday trading within 4838-4881 with falling channel formation and its upward break out also seen today. Although falling channel and its upward break out is Bullish formations but sustaining above today trading range is must for Pull Back rally confirmations.

Pre-open Outlook(16-05-2012)

All the Asian markets are in down and Following Indices are in deep Red:-

1- HANG SENG INDEX- 508.40 (2.56%) Points down

2- Nikkei 225- 79.95 (0.90%) Points down

3- KOSPI Composite Index- 27.60 (1.45%) Points down

4- Singapur STI- 30.56 (1.06%) Points down

5- Taiwan Weighted- 63.12 (0.85%) Points down

Correction is on in Indian markets and after depressed sentiment negative zone trading will be seen weak opening.

1- HANG SENG INDEX- 508.40 (2.56%) Points down

2- Nikkei 225- 79.95 (0.90%) Points down

3- KOSPI Composite Index- 27.60 (1.45%) Points down

4- Singapur STI- 30.56 (1.06%) Points down

5- Taiwan Weighted- 63.12 (0.85%) Points down

Correction is on in Indian markets and after depressed sentiment negative zone trading will be seen weak opening.

Pre-Closing Outlook(15-05-2012)

Firstly intraday supports at lower levels and after that up moves to 4955 on the back of positive European markets and Dow'Futures more than 90 points up. As Dow'Futures slipped to +45 points and all the European markets moved down as well as traded flat therefore Nifty also moved down to 4919. Up moves repeation again in Dow'Futures and European markets therefore Indian markets also surged now.

Lower levels supports and today intraday patterns are showing consolidation formations therefore Pull Back rally possibility turning high now. As multiple resistances at higher level therefore consolidation is required at each step before any up move.

Sustaining above 5036 will be Pull Back Rally confirmation after lower levels supports and should be firstly watched.

Lower levels supports and today intraday patterns are showing consolidation formations therefore Pull Back rally possibility turning high now. As multiple resistances at higher level therefore consolidation is required at each step before any up move.

Sustaining above 5036 will be Pull Back Rally confirmation after lower levels supports and should be firstly watched.

Mid-session Outlook(15-05-2012)

Confirm intraday support at lower levels between 4896-4915 today but strong resistances at higher levels therefore consolidation is required before any up moves.

Sustaining above 5036 will be Pull Back Rally confirmation after lower levels supports and should be firstly watched.

Sustaining above 5036 will be Pull Back Rally confirmation after lower levels supports and should be firstly watched.

Post-open Outlook(15-05-2012)

Crashing global markets reaction through weak opening but immediate recovery in first minute and trading near 4908. Intraday support seen below 4908 yesterday and hovering it around today despite depressing global markets.

Sustaining beyond 4908 should be firstly watched for next trend first signal.

Sustaining beyond 4908 should be firstly watched for next trend first signal.

Next moves generation through sustaining beyond 4908

Nifty-Micro Analysis of Intra Day Chart For 15-05-2012

Nifty-Intra Day Chart (14-May-2012):-

|

| Just click on chart for its enlarged view |

1- Selling between 4945-4955

2- Support between 4877-4900 in last 3 hours.

3- Falling Channel formations with its break out in last 3 hours.

3- Whole day trading between 4877-4955.

Conclusions from intra day chart analysis

Following lines were told in "Bull-Bear Match Final confirmation through Most Crucial 4908-4938" on 12-May-2012:-

"Bull-Bear Match Final confirmation will be through Most Crucial 4908-4938.Sustaining below 4908 will be Bear markets confirmation and sustaining above 4938 will be survival of up moves expectations"

Today closing is at 4907.80 and Bear markets confirmation is left through sustaining below 4908.

Although markets slipped after Inflation upward data in March 2012 but could not crash after Dow' Futures is more than 100 points down and most of the European markets are 2% or more down trading. On the other hand Nifty got support also in last more than 3 hours supports between 4877-4900 and Falling Channel formations with its break out in last 3 hours.

As most of the oscillators in EOD charts are oversold therefore Pull Back rally may be seen any day and its its possibility is alive today after last 2 sessions supports at lower levels. All the trends are down and continuation of correction therefore more down moves possibilities can not be ruled out and following levels should be watched for next moves confirmations:-

1- Sustaining beyond 4908 because last 2 sessions supports below and above it.

2- Sustaining below 4877 will be sharp declines confirmations.

3- Sustaining above 5036 will be Pull Back Rally confirmation.

Firstly sustaining beyond 4908 should be watched for next moves confirmations with keeping in mind above mentioned possibilities.

Subscribe to:

Posts (Atom)