NIFTY APR F & O(SHORTED ON 26-04-2011)-COVER AND BOOK PROFIT IMMEDIATELY-CMP-5856

Trading "calls" from our "Software" with more than "90% accuracy"

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

NIFTY-APR F&O-1ST SHORTING OF 25-04-2011-COVERING

NIFTY APR F & O(SHORTED ON 26-04-2011)-COVER AND BOOK PROFIT IMMEDIATELY-CMP-5856

Pre-Open Market Outlook(26-04-2011)

All trends are up,weekly MACD has given rally confirmation and Pennant pattern formation is also giving confirmation to continuation on going bullish. It is clear that Indian markets are technically well prepared for rally but intra day charts of last 2 sessions are showing distribution patterns therefore very short term down move is due and will be seen today.

Next support range is between 5785-5805 therefore Nifty will first trade between 5805-5880 today. Confirm narrow range selling in last 2 sessions,market market require fresh consolidation for a rally above 5912 and follow up selling today will mean deeper correction to test mentioned first support range.

Nifty will first hover around 5865 after Weak opening today and prepare for next moves. First expected trading range is 5840-4880. Most of the time negative zone trading and Red closing expected today

Next support range is between 5785-5805 therefore Nifty will first trade between 5805-5880 today. Confirm narrow range selling in last 2 sessions,market market require fresh consolidation for a rally above 5912 and follow up selling today will mean deeper correction to test mentioned first support range.

Nifty will first hover around 5865 after Weak opening today and prepare for next moves. First expected trading range is 5840-4880. Most of the time negative zone trading and Red closing expected today

Post-closing Report(25-04-2011) & Tomorrow Outlook

Main features of today trading are as follows:-

1- Moderate reversal Gravestone Shooting Star/Gravestone Doji Bearish Candle.

2- Intra day genuine selling pattern

3- Flat closing in almost all the Indices.

4- Follow up selling today after 21st Apr selling.

Ratios:

Nifty Put Call Ratio:1.02

Nifty P/E Ratio(25-04-2011):21.94

Advances & Declines:

BSE ADVANCES : 1342

BSE DECLINES : 1568

NSE ADVANCES : 602

NSE DECLINES : 806

Nifty Open Interest Changed Today:-

Nifty- 5700 CE(28APR2011)- -1421600(-46.60%)

Nifty- 5700 PE(28APR2011)- +14550(+0.17%)

Nifty- 5800 CE(28APR2011)- -52050(-1.33%)

Nifty- 5800 PE(28APR2011)- -307950(-4.06%)

Nifty- 5900 CE(28APR2011)- +1152100(+19.99%)

Nifty- 5900 PE(28APR2011)- +194500(+2.65%)

Closing :-

Nifty- closed at 5,874.50(-10.20 Points & -0.17%)

Sensex- closed at 19,584.31(-17.92 Points & -0.09% )

CNX MIDCAP - closed at 8,327.55(+13.60 Points & +0.16%)

BSE SMALL CAP- closed at 8,899.90(+21.33 Points & +0.24%)

Nifty-Micro Analysis of Intra Day Chart(25-04-2011):-

Tomorrow(26-04-2011) Outlook

3 days selling formations

As and when intra day selling developed then intra day selling patterns formarions was told daily in Mid-session Outlooks. Just click following links and understand development of selling one by one in last 3 days:-

1- Rising Wedge(Bearish Pattern) formation between 5825-5855 on 20-04-2011.

2- Higher levels selling between 5880-5912 on 21-04-2011.

3- Genuine selling between 5874-5905 today.

As genuine selling today therefore above mentioned selling ranges are resistances and very short term correction or correction within range bound market within 5700-5900 will be seen. All trends are up and Indian markets are technically well poised for a strong rally but previous 2 sessions selling therefore Indian markets will firstly slip tomorrow. Next support range is near 5800 therefore Nifty will first trade below 5880 and most of the time negative zone trading and Red closing expected tomorrow..

1- Moderate reversal Gravestone Shooting Star/Gravestone Doji Bearish Candle.

2- Intra day genuine selling pattern

3- Flat closing in almost all the Indices.

4- Follow up selling today after 21st Apr selling.

Ratios:

Nifty Put Call Ratio:1.02

Nifty P/E Ratio(25-04-2011):21.94

Advances & Declines:

BSE ADVANCES : 1342

BSE DECLINES : 1568

NSE ADVANCES : 602

NSE DECLINES : 806

Nifty Open Interest Changed Today:-

Nifty- 5700 CE(28APR2011)- -1421600(-46.60%)

Nifty- 5700 PE(28APR2011)- +14550(+0.17%)

Nifty- 5800 CE(28APR2011)- -52050(-1.33%)

Nifty- 5800 PE(28APR2011)- -307950(-4.06%)

Nifty- 5900 CE(28APR2011)- +1152100(+19.99%)

Nifty- 5900 PE(28APR2011)- +194500(+2.65%)

Closing :-

Nifty- closed at 5,874.50(-10.20 Points & -0.17%)

Sensex- closed at 19,584.31(-17.92 Points & -0.09% )

CNX MIDCAP - closed at 8,327.55(+13.60 Points & +0.16%)

BSE SMALL CAP- closed at 8,899.90(+21.33 Points & +0.24%)

Nifty-Micro Analysis of Intra Day Chart(25-04-2011):-

|

| Just click on chart for its enlarged view |

3 days selling formations

As and when intra day selling developed then intra day selling patterns formarions was told daily in Mid-session Outlooks. Just click following links and understand development of selling one by one in last 3 days:-

1- Rising Wedge(Bearish Pattern) formation between 5825-5855 on 20-04-2011.

2- Higher levels selling between 5880-5912 on 21-04-2011.

3- Genuine selling between 5874-5905 today.

As genuine selling today therefore above mentioned selling ranges are resistances and very short term correction or correction within range bound market within 5700-5900 will be seen. All trends are up and Indian markets are technically well poised for a strong rally but previous 2 sessions selling therefore Indian markets will firstly slip tomorrow. Next support range is near 5800 therefore Nifty will first trade below 5880 and most of the time negative zone trading and Red closing expected tomorrow..

FII & DII trading activity in Capital Market Segment on 25-Apr-2011

| ||||||||||||||||

| ||||||||||||||||

Nifty-Micro Analysis of Intra Day Chart(25-04-2011)

|

| Just click on chart for its enlarged view |

Genuine Selling seen between 5874-5905 today and it was follow up selling after higher levels selling between 5880-5912 on 21-04-2011.

As soon as selling indicated from intra day charts then following line was told in Mid-session Outlook-2 at 12:25:00 PM today:-

"Intra day charts of today are suggesting selling patterns at higher levels today also."

Following line was also told in Pre-closing Outlook at 03:05:00 PM today:-

"Short term down move possibility increased"

Selling was informed well before the begining of down moves and Indian markets closed at the lowest of the day.

Detailed analysis will be posted today in "Post-closing Report(25-04-2011) & Tomorrow Outlook"

Bank Nifty(Apr Fut)-Levels & Trading Strategy for 26-04-2011

Bank Nifty(Apr Fut)-Levels

R3 12135

R2 12080

R1 12000

Avg 11945

S1 11865

S2 11810

S3 11730

Bank Nifty(Apr Fut)-Trading Strategy

H6 12056 Trgt 2

H5 12025 Trgt 1

H4 11995 Long breakout

H3 11958 Go Short

H2 11945

H1 11933

L1 11908

L2 11896

L3 11883 Long

L4 11846 Short Breakout

L5 11816 Trgt 1

L6 11785 Trgt 2

R3 12135

R2 12080

R1 12000

Avg 11945

S1 11865

S2 11810

S3 11730

Bank Nifty(Apr Fut)-Trading Strategy

H6 12056 Trgt 2

H5 12025 Trgt 1

H4 11995 Long breakout

H3 11958 Go Short

H2 11945

H1 11933

L1 11908

L2 11896

L3 11883 Long

L4 11846 Short Breakout

L5 11816 Trgt 1

L6 11785 Trgt 2

NIFTY-APR F&O-1ST SELLING OF 25-04-2011-TRADE

NIFTY(APR FUT-SELL-POSITIONAL)SL-5926-TGT5836-CMP-5888

NIFTY(APR PUT OPTION-BUY-POSITIONAL)SL-5926-TGT5836-S.P.FOR PUT-5800,5900(APR FUT-RATES FOR ALL OPTIONS)-CMP-5888

Pre-closing Outlook(25-04-2011)

Following line was told in Mid-session Outlook-2:-

"Intra day charts of today are suggesting selling patterns at higher levels today also."

As selling at higher levels therefore Indian markets slipped from higher levels in last hour today.

Short term down move possibility increased but It will be better to wait for sustaining beyond 21-04-2011 range(5864-5912) and also will be watched first for next moves confirmations.

"Intra day charts of today are suggesting selling patterns at higher levels today also."

As selling at higher levels therefore Indian markets slipped from higher levels in last hour today.

Short term down move possibility increased but It will be better to wait for sustaining beyond 21-04-2011 range(5864-5912) and also will be watched first for next moves confirmations.

Mid-session Outlook-2(25-04-2011)

Technically market is poised for rally but higher levels selling seen on 21-04-2011 and Nifty is trading between 5874-5906 since opening today and preparing for mext moves within mentioned range today. Intra day charts of today are suggesting selling patterns at higher levels today also.

As lower level buying was also seen on 21-04-2011 therefore sustaining beyond 21-04-2011 range(5864-5912) will be watched first for next moves confirmations.

Let market prepare then final conclusions will be drawn according to coming hours intra day trading patterns.

As lower level buying was also seen on 21-04-2011 therefore sustaining beyond 21-04-2011 range(5864-5912) will be watched first for next moves confirmations.

Let market prepare then final conclusions will be drawn according to coming hours intra day trading patterns.

Mid-session Outlook(25-04-2011)

21-04-2011 trading range was- (5864-5912).

25-04-2011 trading range at 10:38 AM is- (5874-5906)

Following lines were told in Post-closing Report(21-04-2011) & Monday Outlook on 21-04-2011.As applicable today also therefore repeating:-

1- "Indian market require more preparation for any side sustained moves and that will be done near about today range(5864-5912) on Monday"

2- "First 3/4 hours intraday patterns will certainly be watched first on Monday and follow up buying and consolidation will be next rally confirmation"

25-04-2011 trading range at 10:38 AM is- (5874-5906)

Following lines were told in Post-closing Report(21-04-2011) & Monday Outlook on 21-04-2011.As applicable today also therefore repeating:-

1- "Indian market require more preparation for any side sustained moves and that will be done near about today range(5864-5912) on Monday"

2- "First 3/4 hours intraday patterns will certainly be watched first on Monday and follow up buying and consolidation will be next rally confirmation"

Post-open Outlook(25-04-2011)

Whatsoever is being happened in today Indian markets,was already told in following lines on 21-04-2011:-

1- I told at 12:34 PM on 21-04-2011 in Nifty-Micro Analysis of Intra Day Chart- "Mixed patterns at this moment and let market prepare for one side move then confirmation will be possible"

2- I told at 12:34 PM on 21-04-2011 in Pre-closing Report(21-04-2011)- "Market require more preperation for any side sustained moves and that will be done near today range on Monday"

Above lines were told in all the outlooks for today market and same is seen today and Indian markets are trading between 21-04-2011 range since opening today. Let Indian markets prepare then final moves will be seen after break out of 21-04-2011 range(5864-5912).

Rally is on after completion of Corrections

Weekly Outlook(25-04 to 29-04-2011)

Wave-5 is on,all trends are up,Long term indicators are cooled down after Wave-4 correction. Short term indicators also chilled after previous week finished 38.2% 'ABC' correction(Sub Wave-2 of Wave-5)

Corrective Wave-4 and Wave-5 Corrections are as follows:-

1- 3rd impulsive wave begun on 13-07-2009 from 3919

2- Wave-3 finished on 05-11-2010 after gaining 2419 Points

3- Corrective Wave-4 started same day and loose 1161 Points.

4- Wave-4 finished on 11-02-2011 at 5177

5- Impulsive Wave-5 started same day and its Sub Wave-1 started 'ABC'correction from 5944 after 767 Points Rally

6- 38,2% 'ABC'correction completed at 5693 after loosing 251 Points.

1-completion of Corrections Chart

|

| Just click on chart for its enlarged view |

Conclusions

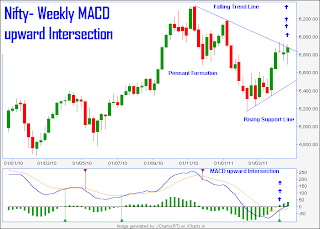

Market is in up trend and and EOD chart is showing Pennant pattern formation in its corrective move which is continuation pattern. It means continuation of on going trend because it is not a trend reversal pattern but trend continuation pattern. As on going trend is Bullish therefore its continuation expected after Pennant falling trend line upward intersection in the coming weeks.

Most important development 3 week before that MACD line upward intersection of Average line and it is confirmation of rally. Weekly MACD cross over gives confirmation to long trend therefore strong confirmation to up trend 3 weeks before. Both lines started to move up near equilibrium line and MACD line has moved it above therefore it is strong indication of rally in the coming week.

It is clear from Nifty-Micro Analysis of Intra Day Chart(21-04-2011) higher level selling and lower level buying therefore mixed patterns on 21-04-2011 and Indian market require more preperation for any side sustained moves and that will be done near 21-04-2011 range(5864-5912) on Monday.

As resistance range and some higher levels selling on 21-04-2011 therefore minor intra day or very short term down moves or correction may be possible in consolidation process but finally market will move up in this week and also very much expected that Nifty will cross immediate resistances and sustain above as well.

Indian markets are well settled for strong rally toward minimum 6120 and expected also in this week. Rally confirmation level is sustaining above 5940.

Bullish Rally Strong Indication From Pennant Formation

Wave-4 Correction in Continuation Pattern Pennant Formation

Waves chart showing Uptrend in EOD Chart:-

Just click on chart for its enlarged view |

Pennant pattern formation in Wave-4 Correction;-

Just click on chart for its enlarged view |

Corrective Wave-4 begun on Diwali-2010 from 5338 and terminated at 5177 on 11-02-2011,impulsive Wave-5 begun from same point as well.

Market is in up trend and and EOD chart is showing Pennant pattern formation in its corrective move which is continuation pattern. It means continuation of on going trend because it is not a trend reversal pattern but trend continuation pattern. As on going trend is Bullish therefore its continuation expected after Pennant falling trend line upward intersection in the coming weeks.

Bullish Formation:Nifty- Weekly MACD upward Intersection

|

| Just click on chart for its enlarged view |

Most important development 3 week before that MACD line upward intersection of Average line and it is confirmation of rally. Weekly MACD cross over gives confirmation to long trend therefore strong confirmation to up trend 3 weeks before. Both lines started to move up near equilibrium line and MACD line has moved it above therefore it is strong indication of rally in the coming week.

Post-closing Report(21-04-2011) & Monday Outlook

Following line was told in Post-open Outlook at 09:36:00 AM today:-

"Gap up opening but not strong"

As clearly told not strong within first half hour and today intra day results are as follows:-

1- Market did not moved up,closed at opening level and today Candle is 'Doji'(confusion)

2- MIDCAP and SMALL CAP slipped and closed near lower levels but not completely selling patterns.

3- Higher levels selling and it was also told with intraday chart at 12:49:00 PM today.

4- Confirm mixed patterns selling at higher levels and buying at lower levels.

Ratios:

Nifty Put Call Ratio: 1.14

Nifty P/E Ratio(21-04-2011):22.18

Advances & Declines:

BSE ADVANCES : 1405

BSE DECLINES : 1523

NSE ADVANCES : 634

NSE DECLINES : 775

Nifty Open Interest Changed Today:-

Nifty- 5700 CE(28APR2011)- -287450(-8.51%)

Nifty- 5700 PE(28APR2011)- +370300(+4.46%)

Nifty- 5800 CE(28APR2011)- -713200(-15.29%)

Nifty- 5800 PE(28APR2011)- +675850(+9.68%)

Nifty- 5900 CE(28APR2011)- -141000(-2.31%)

Nifty- 5900 PE(28APR2011)- +2506200(+50.50%)

Closing :-

Nifty- closed at 5,884.70(+33.05 Points & +0.56%)

Sensex- closed at 19,602.23(+131.25 Points & +0.67% )

CNX MIDCAP - closed at 8,313.95(+9.05 Points & +0.11%)

BSE SMALL CAP- closed at 8,878.57(+2.77 Points & +0.03%)

Nifty-Micro Analysis of Intra Day Chart(21-04-2011):-

Monday(25-04-2011) Outlook

Market was not strong since opening today and it was told within first half hour and today intra day selling was also shown through intra day chart. Although Nifty and SENSEX closed positive with moderate gains but today intraday intra day charts are suggesting mixed formations.

Today intra day consolidation was technical requirements because:-

1- Yesterday last one hour Rising Wedge(Bearish Pattern) Formation between 5825-5855

2- Next immediate resistance range(5860-5940)

Following lines were told in Pre-open Outlook today and again repeating today because already mentioned market moves will be seen in the coming sessions also:-

"Nifty will trade within immediate resistance range(5860-5940) therefore fresh consolidation and follow up buying is must to cross mentioned resistance."

Mixed patterns today and Market require more preparation for any side sustained moves and that will be done near today range on Monday. All trends are up and today consolidation signals also ssen today despite higher levels selling therefore consolidation and follow up buying possibility can not be ruled out on Monday .

Possibilities have been discussed above but Indian market require more preparation for any side sustained moves and that will be done near about today range(5864-5912) on Monday. As intra day higher levels selling today therefore First 3/4 hours intraday patterns will certainly be watched first on Monday and follow up buying snd consolidation will be next rally confirmation.

"Gap up opening but not strong"

As clearly told not strong within first half hour and today intra day results are as follows:-

1- Market did not moved up,closed at opening level and today Candle is 'Doji'(confusion)

2- MIDCAP and SMALL CAP slipped and closed near lower levels but not completely selling patterns.

3- Higher levels selling and it was also told with intraday chart at 12:49:00 PM today.

4- Confirm mixed patterns selling at higher levels and buying at lower levels.

Ratios:

Nifty Put Call Ratio: 1.14

Nifty P/E Ratio(21-04-2011):22.18

Advances & Declines:

BSE ADVANCES : 1405

BSE DECLINES : 1523

NSE ADVANCES : 634

NSE DECLINES : 775

Nifty Open Interest Changed Today:-

Nifty- 5700 CE(28APR2011)- -287450(-8.51%)

Nifty- 5700 PE(28APR2011)- +370300(+4.46%)

Nifty- 5800 CE(28APR2011)- -713200(-15.29%)

Nifty- 5800 PE(28APR2011)- +675850(+9.68%)

Nifty- 5900 CE(28APR2011)- -141000(-2.31%)

Nifty- 5900 PE(28APR2011)- +2506200(+50.50%)

Closing :-

Nifty- closed at 5,884.70(+33.05 Points & +0.56%)

Sensex- closed at 19,602.23(+131.25 Points & +0.67% )

CNX MIDCAP - closed at 8,313.95(+9.05 Points & +0.11%)

BSE SMALL CAP- closed at 8,878.57(+2.77 Points & +0.03%)

Nifty-Micro Analysis of Intra Day Chart(21-04-2011):-

|

| Just click on chart for its enlarged view |

Market was not strong since opening today and it was told within first half hour and today intra day selling was also shown through intra day chart. Although Nifty and SENSEX closed positive with moderate gains but today intraday intra day charts are suggesting mixed formations.

Today intra day consolidation was technical requirements because:-

1- Yesterday last one hour Rising Wedge(Bearish Pattern) Formation between 5825-5855

2- Next immediate resistance range(5860-5940)

Following lines were told in Pre-open Outlook today and again repeating today because already mentioned market moves will be seen in the coming sessions also:-

"Nifty will trade within immediate resistance range(5860-5940) therefore fresh consolidation and follow up buying is must to cross mentioned resistance."

Mixed patterns today and Market require more preparation for any side sustained moves and that will be done near today range on Monday. All trends are up and today consolidation signals also ssen today despite higher levels selling therefore consolidation and follow up buying possibility can not be ruled out on Monday .

Possibilities have been discussed above but Indian market require more preparation for any side sustained moves and that will be done near about today range(5864-5912) on Monday. As intra day higher levels selling today therefore First 3/4 hours intraday patterns will certainly be watched first on Monday and follow up buying snd consolidation will be next rally confirmation.

Subscribe to:

Posts (Atom)