4 Topics for Next week Trading have already been updated and more topics will also be posted before the opening of next Monday markets.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Cross-Over of Crucial Resistances

Nifty-EOD Chart(03-Feb-2012):-

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 123 Sessions sideways market between 4720-5229.

4- Closing at 5325.85 on 03-02-2012

1- Sustaining above 200 Day(SMA)-5190

2- Sustaining above 200 Day(EMA)-5135

3- Sustaining above 123 sessions sideways trading range(5229)

All trends are up after Dec 2011 sharp rally and cross-Over of above mentioned crucial resistances also in previous week.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 123 Sessions sideways market between 4720-5229.

4- Closing at 5325.85 on 03-02-2012

Three Bullish cross overs on 01-02-2012

1- Sustaining above 200 Day(SMA)-5190

2- Sustaining above 200 Day(EMA)-5135

3- Sustaining above 123 sessions sideways trading range(5229)

Conclusions from EOD chart analysis

All trends are up after Dec 2011 sharp rally and cross-Over of above mentioned crucial resistances also in previous week.

Nifty-Micro Analysis of Intra Day Chart of 03-02-2012

Nifty-Intra Day Chart(03Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Support between 5256-5271.

2- Sharp surge

3- Up moves in Rising channel with Bearish rising wedge formation.

4- Rising Channel Broken down in last minutes.

5- Whole day trading between 5256-5333

Conclusions from intra day chart analysis

Strong rally after lower levels support but last one hour moves in Rising channel with Bearish rising wedge formation therefore minor intraday correction signals also from Intraday charts formations.

Strong Bullish rally is on and most of the times markets completes very short term and minor corrections within sideways markets or at higher levels also in most Bullish intraday sentiments. Although minor distribution formations but until follow up selling will not develop in the coming sessions till then any decisive down move will not be considered.

Bullish 'W' formations

Nifty-EOD Chart(03-Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Correction begun from 6338 on 05-11-2010

2- Lowest of 13 months correction at 5431.15 on 20-12-2011

3- Gap down opening on 05-08-5011 with intraday high at 5229

4- 123 sessions sideways market after gap down opening on 05-08-5011

5- Bullish 'W' formation at the bottom of 13 months correction.

Conclusions from EOD chart analysis

Strong indication of 13 months down trend reversal through Bullish 'W' formation at the bottom of 13 months correction.

803 Nifty Points Strong Rally from 13th(Fibonacci number) Month

Nifty-Monthly Chart(03-Feb-2012):-

1- Correction begun from 6338 on 05-11-2010

2- 13 Months correction

3- Lowest of 13 months correction at 5431.15 on 20-12-2011

4- 803 Nifty Points Strong Rally begun from 13th Month

Financial markets have a high probability tendency of reversing on a Fibonacci number. As Stong and sharp rally seen from 20-12-2011 in the 13th month and 13 is a Fibonacci number also therefore following possibilities are high:-

1- Lowest of 13 months correction at 5431.15.

2- Correction completion in the 13th month.

3- Trend reversal of 13 months down trend.

Importance of 13 months Fibonacci number is not being told today after watching strong rally but we told about it many times in previous Outlooks as well its importance was updated in following seperate topic on 03-12-2011 also.

Just Click following topic link and understand Indian markets rally in 2012:-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Correction begun from 6338 on 05-11-2010

2- 13 Months correction

3- Lowest of 13 months correction at 5431.15 on 20-12-2011

4- 803 Nifty Points Strong Rally begun from 13th Month

Conclusions from monthly chart analysis

Financial markets have a high probability tendency of reversing on a Fibonacci number. As Stong and sharp rally seen from 20-12-2011 in the 13th month and 13 is a Fibonacci number also therefore following possibilities are high:-

1- Lowest of 13 months correction at 5431.15.

2- Correction completion in the 13th month.

3- Trend reversal of 13 months down trend.

Importance of 13 months Fibonacci number is not being told today after watching strong rally but we told about it many times in previous Outlooks as well its importance was updated in following seperate topic on 03-12-2011 also.

Just Click following topic link and understand Indian markets rally in 2012:-

FII & DII trading activity in Capital Market Segment on 03-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(03-Feb-2012)

1- All the Indices closed in Green except Metals.

2- Strong rally above 5300.

3- White Candle formations.

Ratios

Nifty Put Call Ratio: 1.10

Nifty P/E Ratio(03-Feb-2012): 18.97

Advances & Declines

BSE Advances : 1713

BSE Declines : 1184

NSE Advances : 879

NSE Declines : 560

Nifty Open Interest Changed Today

Nifty- 5200 CE(Feb)- -435600(-11.44%)

Nifty- 5200 PE(Feb)- +1388950(+29.24%)

Nifty- 5300 CE(Feb)- -631500(-10.93%)

Nifty- 5300 PE(Feb)- +924250(+40.01%)

Nifty- 5400 CE(Feb)- -113050(-2.13%)

Nifty- 5400 PE(Feb)- +341300(+39.50%)

Closing

Nifty- closed at 5,325.85(+55.95 Points & +1.06%)

Sensex- closed at 17,604.96(+173.11 Points & +0.99% )

CNX Midcap - closed at 7,324.15(+98.25 Points & +1.36%)

BSE Smallcap- closed at 6,686.55(+77.58 Points & +1.17%)

Nifty Spot-Levels & Trading Strategy for 06-02-2012

R3 5433

R2 5383

R1 5354

Avg 5304

S1 5275

S2 5225

S3 5196

Nifty Spot-Trading Strategy

H6 5405 Trgt 2

H5 5386 Trgt 1

H4 5368 Long breakout

H3 5346 Go Short

H2 5339

H1 5332

L1 5317

L2 5310

L3 5303 Long

L4 5281 Short Breakout

L5 5263 Trgt 1

L6 5244 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 5473

R2 5415

R1 5380

Avg 5322

S1 5287

S2 5229

S3 5194

Nifty(Feb Fut)-Trading Strategy

H6 5439 Trgt 2

H5 5417 Trgt 1

H4 5396 Long breakout

H3 5370 Go Short

H2 5362

H1 5353

L1 5336

L2 5327

L3 5319 Long

L4 5293 Short Breakout

L5 5272 Trgt 1

L6 5250 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 06-02-2012

R3 10544

R2 10364

R1 10259

Avg 10079

S1 9974

S2 9794

S3 9689

Bank Nifty(Feb Fut)-Trading Strategy

H6 10446 Trgt 2

H5 10378 Trgt 1

H4 10310 Long breakout

H3 10232 Go Short

H2 10206

H1 10180

L1 10127

L2 10101

L3 10075 Long

L4 9997 Short Breakout

L5 9929 Trgt 1

L6 9861 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 5597

R2 5443

R1 5384

Avg 5230

S1 5171

S2 5017

S3 4958

Nifty Spot-Weekly Trading Strategy

H6 5548 Trgt 2

H5 5495 Trgt 1

H4 5442 Long breakout

H3 5383 Go Short

H2 5364

H1 5344

L1 5305

L2 5285

L3 5266 Long

L4 5207 Short Breakout

L5 5154 Trgt 1

L6 5101 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Feb 06 to Feb 10,2012)

R3 11006

R2 10582

R1 10357

Avg 9933

S1 9708

S2 9284

S3 9059

Bank Nifty Spot-Weekly Trading Strategy

H6 10824 Trgt 2

H5 10657 Trgt 1

H4 10489 Long breakout

H3 10311 Go Short

H2 10251

H1 10192

L1 10073

L2 10014

L3 9954 Long

L4 9776 Short Breakout

L5 9608 Trgt 1

L6 9441 Trgt 2

Pre-Closing Outlook(03-02-2012)

All trends upward confirmations at the weekend and blasting Bullish rally is on. Although minor down moves and very short term corrections may be seen any day after intraday selling but until complete selling patterns will not emerge till then short term correction will not be seen.

Mid-session Outlook(03-02-2012)

Minor intraday down moves and trading between 5256-5279 seen today after Intraday selling between 5272-5289 yesterday. Minor intraday support also seen at lower levels today.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

Range of 5256-5289 should be watched for next moves confitmations because mixed technical positions between this range today and yesterday.

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Covering

NIFTY Feb F & O(Shorted on 02-02-2012)-Cover immediately-CMP-5286

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Message

NIFTY-Feb F&O-1st Shorting of 02-02-2012-Market will be volatile therefore hold and cover after my covering message

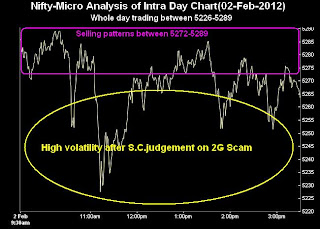

Nifty-Micro Analysis of Intra Day Chart For 03-02-2012

Nifty-Intra Day Chart(02-Feb-2012):-

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 5272-5289.

2- High volatility after S.C.judgement on 2G Scam.

3- Doji candle formation

4- Whole day trading between 5226-5289

Conclusions from intra day chart analysis

Intraday supports at lower leves after high volatility due to negative news of S.C.judgement on 2G Scam but clear intraday selling patterns at higher levels also therefore minor intraday correction is due and that will be seen today.

FII & DII trading activity in Capital Market Segment on 02-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(021-Feb-2012)

1- All the Indices closed in Green.

2- Doji candle formation in both NIFTY and SENSEX.

3- S.C.judgement on 2G Scam based highly volatile market today.

Ratios

Nifty Put Call Ratio: 1.16

Nifty P/E Ratio(021-Feb-2012): 18.77

Advances & Declines

BSE Advances : 1575

BSE Declines : 1305

NSE Advances : 802

NSE Declines : 652

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -284550(-12.01%)

Nifty- 5100 PE(Feb)- +1139800(+20.59%)

Nifty- 5200 CE(Feb)- -153800(-3.81%)

Nifty- 5200 PE(Feb)- +1362450(+37.71%)

Nifty- 5300 CE(Feb)- -24700(-0.42%)

Nifty- 5300 PE(Feb)- +782400(+48.77%)

Closing

Nifty- closed at 5,269.90(+34.20 Points & +0.65%)

Sensex- closed at 17,431.85(+131.27 Points & +0.76% )

CNX Midcap - closed at 7,225.90(+37.50 Points & +0.52%)

BSE Smallcap- closed at 6,608.97(+35.39 Points & +0.54%)

Nifty Spot-Levels & Trading Strategy for 03-02-2012

R3 5361

R2 5325

R1 5297

Avg 5261

S1 5233

S2 5197

S3 5169

Nifty Spot-Trading Strategy

H6 5333 Trgt 2

H5 5318 Trgt 1

H4 5304 Long breakout

H3 5286 Go Short

H2 5280

H1 5274

L1 5263

L2 5257

L3 5251 Long

L4 5233 Short Breakout

L5 5219 Trgt 1

L6 5204 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 5371

R2 5335

R1 5304

Avg 5268

S1 5237

S2 5201

S3 5170

Nifty(Feb Fut)-Trading Strategy

H6 5341 Trgt 2

H5 5326 Trgt 1

H4 5310 Long breakout

H3 5292 Go Short

H2 5286

H1 5280

L1 5267

L2 5261

L3 5255 Long

L4 5237 Short Breakout

L5 5221 Trgt 1

L6 5206 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 03-02-2012

R3 10468

R2 10279

R1 10123

Avg 9934

S1 9778

S2 9589

S3 9433

Bank Nifty(Feb Fut)-Trading Strategy

H6 10319 Trgt 2

H5 10238 Trgt 1

H4 10156 Long breakout

H3 10061 Go Short

H2 10030

H1 9998

L1 9935

L2 9903

L3 9872 Long

L4 9777 Short Breakout

L5 9695 Trgt 1

L6 9614 Trgt 2

NIFTY-F&O-1st Selling of 02-02-2012-Trade

NIFTY(Feb Fut-Sell-Intraday/Positional)SL-5296-TGT-5216-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

NIFTY(Jan Put Option-Buy-Intraday/Positional)SL-5296-TGT-5216-S.P.FOR Put-5200,53000(Feb Fut-Rates for all Options)-CMP-5272

Pre-Closing Outlook(02-02-2012)

Firstly positive global news based gap up opening and after that S.C.judgement on 2G Scam based highly volatile market today with following 2 main features:-

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

1- Although tested 5229 but most of the time sustained above it

2- Most of the time trading between 5250-5290 with intraday mixed patterns and clear intraday selling patterns between 5272-5290.

Although lower levels support amid high volatility but sustaining above 5290 is also must for next immediate up moves. More consolidation is required for sustaining above 5290 and range of 5250-5290 will be firstly watched for next moves confirmations.

Live Proofs of Our Bullish 2012 Predictions

Strong Rally in Jan 2012 but when Rally begun on 20-12-2011 then only we told on following line on 22-12-2011 in 4693 is Long Term Trend Decider for 2012:-

"2012 will prove Bullish year after all corrections completion in 2011"

Above topic was updated in mudraa.com also and anyone may verify our above statement through clicking following link also:-

http://www.mudraa.com/trading/113122/0/4693-is-long-term-trend-decider-for-2012.html

Three Bullish cross overs on 1st Feb.2012

Technical Analysis,Researches & Market Outlook for

02-02-2012

Nifty-EOD Chart(01-Feb-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- 6339 on 05-11-2010

2- 4532 on 20-12-2011

3-Nifty closing above trend Reversal 121 Sessions sideways market between 4720-5229.

4- Closing at 5235.70 on 01-02-2012

Three Bullish cross overs on 01-02-2012

1- Closing above 200 Day(SMA)-5195

2- Closing above 200 Day(EMA)-5132

3- Closing above 121 sessions sideways trading range(5229)

Conclusions from EOD chart analysis

Closing above crucial resistance levels yesterday and Our postings in our Blog are live proofs of this fact that we told for such moves dozens of times since 20-12-2011.

Strong Rally in Jan 2012 but when Rally begun on 20-12-2011 then only we told on following line on 22-12-2011 in 4693 is Long Term Trend Decider for 2012:-

"2012 will prove Bullish year after all corrections completion in 2011"

Above topic was updated in mudraa.com also and anyone may verify our above statement through clicking following link also:-

http://www.mudraa.com/trading/113122/0/4693-is-long-term-trend-decider-for-2012.html

Last formality of confirmation through sustaining above 5229 is left and after this only Bullish Indian markets will be seen in 2012 after all trends turning upward confirmations.

US markets are mre than 1% up after European markets more than 1.80% positive closing therefore expected that sentiment will be Bullish today morning but Nifty should firstly trade and sustain above 5265 for long term trend upward confirmations. As setiment may be most heated today morning therefore profit booking posibility also can not be ruled out but finally sustaining above 5229 is must for blasting bullish market in this month.

Expected that finally Nifty will give confirmation of sustaining above 5229 but has to be seen that it will happen within couple of days or after after very short term correction.

FII & DII trading activity in Capital Market Segment on 01-Feb-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(01-Feb-2012)

1- White Candle.

2- Closing above all crucial levels.

3- Positive closing after negative opening.

Ratios

Nifty Put Call Ratio: 0.98

Nifty P/E Ratio(01-Feb-2012): 18.66

Advances & Declines

BSE Advances : 1865

BSE Declines : 989

NSE Advances : 1031

NSE Declines : 416

Nifty Open Interest Changed Today

Nifty- 5100 CE(Feb)- -15350(-0.64%)

Nifty- 5100 PE(Feb)- +856500(+17.69%)

Nifty- 5200 CE(Feb)- -411250(-8.94%)

Nifty- 5200 PE(Feb)- +680450(+22.33%)

Nifty- 5300 CE(Feb)- +938450(+17.01%)

Nifty- 5300 PE(Feb)- +779450(+84.82%)

Closing

Nifty- closed at 5,235.70(+36.45 Points & +0.70%)

Sensex- closed at 17,300.58(+107.03 Points & +0.62% )

CNX Midcap - closed at 7,188.40(+87.85 Points & +1.24%)

BSE Smallcap- closed at 6,573.58(+110.28 Points & +1.71%)

Nifty Spot-Levels & Trading Strategy for 02-02-2012

R3 5351

R2 5297

R1 5266

Avg 5212

S1 5181

S2 5127

S3 5096

Nifty Spot-Trading Strategy

H6 5321 Trgt 2

H5 5301 Trgt 1

H4 5281 Long breakout

H3 5258 Go Short

H2 5250

H1 5242

L1 5227

L2 5219

L3 5211 Long

L4 5188 Short Breakout

L5 5168 Trgt 1

L6 5148 Trgt 2

Nifty(Feb Fut)-Levels & Trading Strategy for 02-02-2012

R3 5389

R2 5330

R1 5296

Avg 5237

S1 5203

S2 5144

S3 5110

Nifty(Feb Fut)-Trading Strategy

H6 5356 Trgt 2

H5 5334 Trgt 1

H4 5313 Long breakout

H3 5287 Go Short

H2 5279

H1 5270

L1 5253

L2 5244

L3 5236 Long

L4 5210 Short Breakout

L5 5189 Trgt 1

L6 5167 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 02-02-2012

R3 10293

R2 10142

R1 10057

Avg 9906

S1 9821

S2 9670

S3 9585

Bank Nifty(Feb Fut)-Trading Strategy

H6 10213 Trgt 2

H5 10157 Trgt 1

H4 10101 Long breakout

H3 10036 Go Short

H2 10015

H1 9993

L1 9950

L2 9928

L3 9907 Long

L4 9842 Short Breakout

L5 9786 Trgt 1

L6 9730 Trgt 2

Pre-Closing Outlook(01-02-2012)

Nifty is trading above 5229 after lower levels supports and last formality of sustaining above confirmation is left which will be seen in the coming couple of sessions and its possibility is high.

Mid-session Outlook-4(01-02-2012)

As soon as support developed at lower levels then it was updated and sharp surge seen after opening of European markets. First 4 hours trading range broken out force fully and it is strong indication of fresh rally.Sustaining above 5217/5229 will mean blasting up moves after all trends turning up..

Mid-session Outlook-3(01-02-2012)

Down after intraday selling at higher levels but minor support at lower levels also seen after formation of new intraday trading low therefore mixed intraday trading patterns today.

Market is preparing for next moves within sideways moves and sustaining beyond today trading range(5160-5190) will be give next moves first strong indication therefore should be firstly watched.

Market is preparing for next moves within sideways moves and sustaining beyond today trading range(5160-5190) will be give next moves first strong indication therefore should be firstly watched.

Mid-session Outlook-2(01-02-2012)

Selling confirmations at higher levels therefore down moves possibility turns higher.

Mid-session Outlook(01-02-2012)

Following lines were told in Blasting Rally after sustaining above 5229

"expected that Nifty will firstly trade between 5150-5217 and prepare for next moves and follow up buying/selling within this range will give next moves first indication and sustaining it beyond will be confirmations"

Above lines should be kept in mind for final confirmation and first indication will be after sustaining beyond today achual trading range(5168-5190) and Nifty is preparing for next moves within it for the last 3 hours.

"expected that Nifty will firstly trade between 5150-5217 and prepare for next moves and follow up buying/selling within this range will give next moves first indication and sustaining it beyond will be confirmations"

Above lines should be kept in mind for final confirmation and first indication will be after sustaining beyond today achual trading range(5168-5190) and Nifty is preparing for next moves within it for the last 3 hours.

Blasting Rally after sustaining above 5229

Technical Analysis,Researches & Market Outlook

(01-02-2012)

Nifty-EOD Chart(31-Jan-2012):-

|

| Just click on chart for its enlarged view |

1- Rally is continued above rising trend line.

2- Rally closing near its top yesterday.

3- Nifty near the top of Trend Reversal 120 Sessions sideways market between 4720-5229.

4- Trend Reversal Broadening Pattern at the bottom of 14 months correction and it has also given strong support at lower levels to long term correction.

Conclusions from EOD chart analysis

Nifty above 5200 yesterday but when Nifty was below 4600 since then we projected rally and up moves more than 75 times as well as showed our full confidence in Bullish formations in above EOD Chart as well as we updated following conclusions:

More than 14 months long term correction and at its bottom huge 120 sessions above mentioned two trend reversal formations and they have complete strength to reverse whole long term correction.

Today anyone can say for rally but only we told non stop daily for that Rally which was seen in January 2012. When we told for correction of this rally then also it was seen on 30-01-2012

Nifty-Micro Analysis of 5 days Intra Day Chart

(Jan 24 to Jan 31,2012)

Nifty-Intra Day Chart(Jan 24 to Jan 31,2012):-

|

| Just click on chart for its enlarged view |

1- Condolidation between 5050-5155 is last 5 days

2- Selling Formations also at higher levels.

3- Mixed Patterns between 5150-5160

4- 5 Sessions trading between 5050-5217.

Conclusions from 5 days intra day chart analysis

Resistances were as follows;-

1- 5070-5098

2- 5130-5225

3- 5260-5310

4- 5340-5375

Nifty has almost covered above mentioned first 2 resistances in last 5 sessions rally with lower levels good support but higher levels selling also within it.

Conclusions (After Putting All Studies Together)

Crucial Averages are as follows:

200-Day EMA is at-5131

200-Day SMA is at-5198(Nifty faced stiff resistance 3 times earlier)

We told only for very short term correction and it was seen on Monday and Rally is on after yesterday sharp surge. As higher levels selling in last 5 days and mixed intraday patterns also seen yesterday despite fast up moves above that therefore more consolidations are required for sustaining above the top(5217) of last 5 sessions.

Sustaining above 5217/5229 will mean blast rally after:-

1- Clearing of 3 times resistance(200-Day SMA)

2- Break out of 120 sessions trading range.

Since long telling only for strong rally above 5229 after break out and its possibility is high also but short term indicators are over bought and higher levels selling also in last 5 sessions therefore more consolidation as well as cooling down of indicators are firstly required in the coming sessions.

Expected that finally strong rally will be seen above 5229 but selling above 5150 in last 5 sessions therefore expected that Nifty will firstly trade between 5150-5217 and prepare for next moves and follow up buying/selling within this range will give next moves first indication and sustaining it beyond will be confirmations.

1- Above 5217 will mean strong rally after break out

2- Below 5150 will mean firstly short term correction and then rally after its completion.

3- Correction is completed in sideways in Bull markets therefore this possibility will also be kept in mind.

FII & DII trading activity in Capital Market Segment on 31-Jan-2012

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(31-Jan-2012)

1- Long White Candle

2- All the Indices closed in Green.

3- Closing near the higher levels of the day after strong recovery.

Ratios

Nifty Put Call Ratio: 0.93

Nifty P/E Ratio(31-Jan-2012): 18.53

Advances & Declines

BSE Advances : 1821

BSE Declines : 1031

NSE Advances : 1028

NSE Declines : 416

Nifty Open Interest Changed Today

Nifty- 5000 CE(Jan)- -82950(-3.56%)

Nifty- 5000 PE(Jan)- +969550(+20.65%)

Nifty- 5100 CE(Jan)- -306200(-11.21%)

Nifty- 5100 PE(Jan)- +1218550(+32.79%)

Nifty- 5200 CE(Jan)- -119300(-2.48%)

Nifty- 5200 PE(Jan)- +1315650(+73.35%)

Closing

Nifty- closed at 5,199.25(+111.95 Points & +2.20%)

Sensex- closed at 17,193.55(+330.25 Points & +1.96% )

CNX Midcap - closed at 7,100.55(+160.80 Points & +2.32%)

BSE Smallcap- closed at 6,463.30(+89.71 Points & +1.41%)

Nifty Spot-Levels & Trading Strategy for 01-02-2012

R3 5331

R2 5273

R1 5236

Avg 5178

S1 5141

S2 5083

S3 5046

Nifty Spot-Trading Strategy

H6 5295 Trgt 2

H5 5273 Trgt 1

H4 5251 Long breakout

H3 5225 Go Short

H2 5216

H1 5207

L1 5190

L2 5181

L3 5172 Long

L4 5146 Short Breakout

L5 5124 Trgt 1

L6 5102 Trgt 2

Bank Nifty(Feb Fut)-Levels & Trading Strategy for 01-02-2012

R3 10444

R2 10212

R1 10082

Avg 9850

S1 9720

S2 9488

S3 9358

Bank Nifty(Feb Fut)-Trading Strategy

H6 10326 Trgt 2

H5 10238 Trgt 1

H4 10151 Long breakout

H3 10051 Go Short

H2 10018

H1 9985

L1 9918

L2 9885

L3 9852 Long

L4 9752 Short Breakout

L5 9665 Trgt 1

L6 9577 Trgt 2

Pre-Closing Outlook(31-01-2012)

Only very short term correction was expected and it has been seen yesterday. First 5 hours intraday trading between 5130-5164 and after that and its break out is indicating strong rally after yesterday correction and today consolidation. Next resistance is between 5200-5210 and its crossing will be fresh phase of strong rally confirmation as well as its possibility can not be ruled out after today lower levels good consolidations..

Post-open Outlook(31-01-2012)

Positive global cues led strong Indian markets trading between 200-Day EMA(5130) and 200-Day SMA(5201). Sustaining beyond these two averages will give following

conclusions:-

1- Sustaining above 200-Day SMA(5201) will mean continuation of correction.worst is over after Long term trend turning up.

2- Sustaining below 200-Day EMA(5130) will mean continuation of yesterday begun correction.

Strong market today and above two averages will give confirmation to Long term trend therefore 5130-5201 must be watched for long term positions and investment decisions.

conclusions:-

1- Sustaining above 200-Day SMA(5201) will mean continuation of correction.worst is over after Long term trend turning up.

2- Sustaining below 200-Day EMA(5130) will mean continuation of yesterday begun correction.

Strong market today and above two averages will give confirmation to Long term trend therefore 5130-5201 must be watched for long term positions and investment decisions.

Pre-open Outlook(31-01-2012)

Although European markets closed in Red yesterday but US markets closed flat after good recovery from intraday lower levels as well as its futures are also positive(Dow is +37) therefore Asian markets are flat to positive and sentiment is good today morning. Indian markets will open positive after pleasantly maintained sentiment and Nifty will firstly hover around 5100 and will prepare for next moves after yesterday very short term expected correction ae well as sustaining it beyond will be first indication of next moves

Follow up buying/selling today morning and sustaining beyond 5100 will give next moves first indication therefore should be firstly watched today.

Follow up buying/selling today morning and sustaining beyond 5100 will give next moves first indication therefore should be firstly watched today.

Correction Life Decider 5000-5050

Nifty-Micro Analysis of Intra Day Chart For 31-01-2012

Nifty-Intra Day Chart(30-Jan-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Selling between 5147-5165

2- Whole day down moves in falling channel

3- Whole day trading between 5077-5165

Conclusions from intra day chart analysis

Very Short Term correction was told in following topics during last 3 days and sustaining below 5120 possibility was also told during trading hours. All that which was told for today market proved 100% accurate during trading hours:-

1- Very Short Term Correction is Due

2- Rally after very short term correction

Correction was due and it was seen today.Good support between 5000-5050,its testing possibility can not be ruled out as well as this range will be firstly watched for the life of on going correction.

As Nifty moved down and closed below last 3 sessions range more down moves possibility can not be ruled out as well as sustaining beyond mentioned support will be firstly watched for next moves confirmations.

Just Watch 5000-5050 for correction completion/continuation confirmations.

Indian Stock Markets Closing Reports(30-Jan-2012)

1 Long Black Candle

2- All the Indices closed in Red.

3- Closing near the lowest of the day.

Ratios

Nifty Put Call Ratio: 1.12

Nifty P/E Ratio(30-Jan-2012): 18.13

Advances & Declines

BSE Advances : 1015

BSE Declines : 1820

NSE Advances : 397

NSE Declines : 1062

Nifty Open Interest Changed Today

Nifty- 5000 CE(Jan)- -17150(-0.73%)

Nifty- 5000 PE(Jan)- -53000(-1.05%)

Nifty- 5100 CE(Jan)- +248500(+10.01%)

Nifty- 5100 PE(Jan)- -170600(-4.28%)

Nifty- 5200 CE(Jan)- +656650(+14.76%)

Nifty- 5200 PE(Jan)- -612400(-24.92%)

Closing

Nifty- closed at 5,087.30(-117.40 Points & -2.26%)

Sensex- closed at 16,863.30(-370.68 Points & -2.15% )

CNX Midcap - closed at 6,939.75(-149.90 Points & -2.11%)

BSE Smallcap- closed at 6,373.59(-118.10 Points & -1.82%)

Nifty Spot-Levels & Trading Strategy for 31-01-2012

R3 5233

R2 5199

R1 5143

Avg 5109

S1 5053

S2 5019

S3 4963

Nifty Spot-Trading Strategy

H6 5177 Trgt 2

H5 5156 Trgt 1

H4 5136 Long breakout

H3 5111 Go Short

H2 5103

H1 5095

L1 5078

L2 5070

L3 5062 Long

L4 5037 Short Breakout

L5 5017 Trgt 1

L6 4996 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 31-01-2012

R3 5256

R2 5223

R1 5167

Avg 5134

S1 5078

S2 5045

S3 4989

Nifty(Jan Fut)-Trading Strategy

H6 5201 Trgt 2

H5 5181 Trgt 1

H4 5160 Long breakout

H3 5136 Go Short

H2 5128

H1 5120

L1 5103

L2 5095

L3 5087 Long

L4 5063 Short Breakout

L5 5042 Trgt 1

L6 5022 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 31-01-2012

R3 9896

R2 9818

R1 9683

Avg 9605

S1 9470

S2 9392

S3 9257

Bank Nifty(Jan Fut)-Trading Strategy

H6 9762 Trgt 2

H5 9714 Trgt 1

H4 9666 Long breakout

H3 9607 Go Short

H2 9588

H1 9568

L1 9529

L2 9509

L3 9490 Long

L4 9431 Short Breakout

L5 9383 Trgt 1

L6 9335 Trgt 2

Pre-Closing Outlook(30-01-2012)

Very Short Term Correction was told again and again and following projection was also updated in Mid-session Outlook(30-01-2012) today:

Sustaining below 5120 is expected

Nifty slipped below 5120 and low at 5080.00 has been formed today. Correction is on and levels near 5050 will be watched now.

Sustaining below 5120 is expected

Nifty slipped below 5120 and low at 5080.00 has been formed today. Correction is on and levels near 5050 will be watched now.

Mid-session Outlook(30-01-2012)

Very short term correction was very much due and it was clearly told also as well as being seen today. Support of 5120 has been tested and next support below it at 5050..

Intraday patterns are showing selling at higher levels and sustaining below 5120 will mean 5050 fast.

Very short term correction was expected and it has been seen today. Follow up buying/selling within 5120-5130 in the next couple of hours as well as Sustaining it beyond wiil give confirmation of continuation or completion of today begun correction.

Sustaining below 5120 is expected and sustaining beyond 5120-5130 will be firstly watched for next moves confirmations.

Intraday patterns are showing selling at higher levels and sustaining below 5120 will mean 5050 fast.

Very short term correction was expected and it has been seen today. Follow up buying/selling within 5120-5130 in the next couple of hours as well as Sustaining it beyond wiil give confirmation of continuation or completion of today begun correction.

Sustaining below 5120 is expected and sustaining beyond 5120-5130 will be firstly watched for next moves confirmations.

Rally after very short term correction

Technical Analysis,Research & Weekly Outlook

Nifty-EOD Chart(27-Jan-2012):-

Technical Patterns and Formations in EOD charts

1- Begining of strong rally on 20-12-2011 from 4531.15.

2- Trend Reversal 113 Sessions sideways market between 4720-5229 is intact.

3- Trend Reversal Broadening Pattern at the bottom of 14 months correction is intact.

4- Falling Trendline Correction from 5399 and its upward cross over.

5- Testing of Falling trend line from 6336 and Nifty retraced 7 times earlier from this falling trendline.

Conclusions from EOD chart analysis

Bullish pattrens are very much intact and Nifty is trading near the higher levels of these patterns. Testing of Falling trend line from 6336 and Nifty retraced 7 times earlier from this falling trendline. As sentiment is heated therefore therefore very short term correction is due now.

Nifty-Intra Day Chart(27-Jan-2012):-

Technical Patterns and Formations in today intraday charts

1- Support between 5163-5185

2- Selling Patterns between 5187-5194

3- Selling Patterns between 5200-5210

4- Up moves without force in rising channel.

5- Whole day trading between 5163-5210

Conclusions from intra day chart analysis

Although closing near the top of the day after lower levels support but up moves have been without force as well as higher levels selling patterns also therefore view is cautions. Rally is on but correction is over due because short term indicators are heated and very short term correction may be seen for cooling down of overbought indicators.

Conclusions (After Putting All Studies Together)

1- Testing of Falling trend line from 6336 and Nifty retraced 7 times earlier from this falling trendline.

2- Testing of 200-Day SMA and Nifty got stiff resistance at 200-Day SMA 3 times earlier.

Strong rally in 2012 and short term cotrrection will be seen only after complete distribution patterns and that has not beeen seen yet but very short term correction is due and that may be seen any day.

(Jan 30 to Feb 03, 2012)

Nifty-EOD Chart(27-Jan-2012):-

|

| Just click on chart for its enlarged view |

Averages are as follows:

200-Day EMA is at-5131

200-Day SMA is at-5202

Conclusions

Short and Intermediate term trends are up and long term trend turning up confirmation will be after sustaining above 200-Day EMA as well as 200-Day SMA. Last 2 sessions closing above 200-Day EMA and testing of 200-Day SMA on 27-01-2012.

Strong breathless rally seen in last one month but last confirmation for blasing rally is left through sustaining above 200-Day SMA because Nifty got stiff resistance at 200-Day SMA 3 times earlier.

Long term trend turning up final confirmation will be after sustaining above 200-Day SMA and should be watched firstly in next week.

1- Begining of strong rally on 20-12-2011 from 4531.15.

2- Trend Reversal 113 Sessions sideways market between 4720-5229 is intact.

3- Trend Reversal Broadening Pattern at the bottom of 14 months correction is intact.

4- Falling Trendline Correction from 5399 and its upward cross over.

5- Testing of Falling trend line from 6336 and Nifty retraced 7 times earlier from this falling trendline.

Conclusions from EOD chart analysis

Bullish pattrens are very much intact and Nifty is trading near the higher levels of these patterns. Testing of Falling trend line from 6336 and Nifty retraced 7 times earlier from this falling trendline. As sentiment is heated therefore therefore very short term correction is due now.

Nifty-Intra Day Chart(27-Jan-2012):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Support between 5163-5185

2- Selling Patterns between 5187-5194

3- Selling Patterns between 5200-5210

4- Up moves without force in rising channel.

5- Whole day trading between 5163-5210

Conclusions from intra day chart analysis

Although closing near the top of the day after lower levels support but up moves have been without force as well as higher levels selling patterns also therefore view is cautions. Rally is on but correction is over due because short term indicators are heated and very short term correction may be seen for cooling down of overbought indicators.

Conclusions (After Putting All Studies Together)

Nifty tested following 2 crucial resistances on 27-Jan-2012;-

2- Testing of 200-Day SMA and Nifty got stiff resistance at 200-Day SMA 3 times earlier.

Although Nifty retraced several times from above mentioned levels but it does not mean that it will again happen. I posted following topic on 31-12-2011:-

I am Bullish from the very first day of 2012 and not expecting more than very short term correction and hoping that on going rally will remain continued after expected very short term correction.

Subscribe to:

Comments (Atom)