Finally corrective Wave-A continuation expectations

Technical Analysis,Research & Weekly Outlook

(Jul 29 to Aug 02,2019)

Nifty-EOD Chart Analysis(Corrective Waves)

Nifty-EOD Chart (26-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A of "ABC" correction beginning

2- Corrective Wave-A continuation with recent bottom formation at 11210.00 on 26-07-2019

3- Support between 11109-11172(Immediate Supports)

4- Long Term Trend decider 200-Day SMA(today at 11135)

5- Short Term Indicator "Stochastic" is Oversold

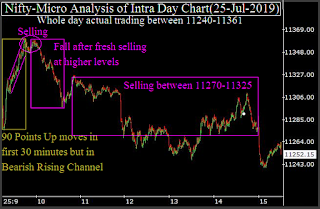

Nifty-Intra Day Chart Analysis(26-07-2019)

Nifty-Intra Day Chart (26-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Consolidation between 11211-11235(Immediate Supports)

2- Up moves in Bearish Rising Channel

3- Mixed Patterns formation between 11257-11308

4- Whole day actual trading between 11211-11308

Conclusions (After Putting All Studies Together)

As corrective Wave-A of "ABC" correction beginning confirmation after Impulsive Wave-5 completion therefore Nifty will correct whole rally which started from 6825.80 on 29-02-2016 and completed at 12103.00 on 03-06-2019. Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) with Waves structure has already been updated in previous weekly Outlook(Jul 21 to Jul 26,2019).

Nifty has not slipped below Long Term Trend decider 200-Day SMA(today at 11135) and it is still up as well as Short Term Indicator "Stochastic" has turned Oversold therefore emergence of Pull Back Rally beginning possibility because lower levels some consolidation was seen yesterday and previous sessions also.

Firstly sideways sideways trading between 11103-11400 and finally corrective Wave-A continuation is expected below 11103.