Nifty-Intra Day Chart (11-Dec-2014):-

Technical Patterns and Formations in today intraday charts

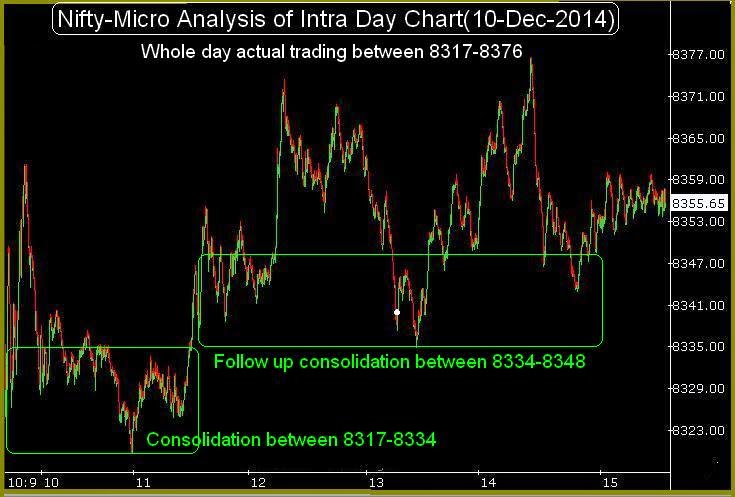

1- Down moves in Bullish Falling Channel

2- Consolidation between 8273-8285

3- Up moves in Bearish Rising Channel

4- Selling between 8330-8348

5- Whole day actual trading between 8273-8348

Following lines were told in Technical Analysis and Market Outlook(05-12-2014):-

1- emergence of correction possibility which may be minimum Short Term to Intermediate term.

2- deeper correction will be considered only after sustaining below 8290

Minimum Short Term to Intermediate term correction possibility was told on 05-12-2014 and since then continuous down moves seen in almost all the previous sessions. Importance of 8290 was also told and it was tested today as well as today closing is also near about it at 8292.90.

As highly volatile market with consolidation below 8290 and selling above it therefore today intraday patterns will be understood mixed and more follow up technical positions formations is firstly required for next decisive moves beyond today trading range. Sustaining beyond 8273-8348 should be firstly watched in the coming sessions for:-

1- Much deeper correction below 8273

2- First signal of correction completion above 8348(same level was given yesterday also and today highest is at 8348.30)

|

| Just click on chart for its enlarged view |

1- Down moves in Bullish Falling Channel

2- Consolidation between 8273-8285

3- Up moves in Bearish Rising Channel

4- Selling between 8330-8348

5- Whole day actual trading between 8273-8348

Conclusions from intra day chart analysis

Following lines were told in Technical Analysis and Market Outlook(05-12-2014):-

1- emergence of correction possibility which may be minimum Short Term to Intermediate term.

2- deeper correction will be considered only after sustaining below 8290

Minimum Short Term to Intermediate term correction possibility was told on 05-12-2014 and since then continuous down moves seen in almost all the previous sessions. Importance of 8290 was also told and it was tested today as well as today closing is also near about it at 8292.90.

As highly volatile market with consolidation below 8290 and selling above it therefore today intraday patterns will be understood mixed and more follow up technical positions formations is firstly required for next decisive moves beyond today trading range. Sustaining beyond 8273-8348 should be firstly watched in the coming sessions for:-

1- Much deeper correction below 8273

2- First signal of correction completion above 8348(same level was given yesterday also and today highest is at 8348.30)