Firstly Watch 7678 amid Weak beginning Week

Technical Analysis,Research & Weekly Outlook

(May 16 to May 20,2016)

Nifty-EOD Chart (13-May-2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-1 beginning after bottom formation at 6825.80 on 29-02-2016

2- Corrective Wave-A of Wave-2 beginning after Wave-1 completion at 7992 on 28-04-2016

3- Wave-A completion at 7678.35 on 06-05-2016

4- Signals of Wave-B completion at 7916.05 on 2-05-2016

5- Signals of Wave-C continuation with bottom formation at 7784.20 on 13-05-2016

6- Hovering around Long Term Trend decider 200 Day EMA(today at 7780) for the last 10 sessions

Conclusions from EOD chart analysis

The rally(impulsive Wave-1) which begun from 6825.80 on Budget 2016-17 day(29-02-2016) completed at 7992 on 28-04-2016 and ABC correction of Wave-2 started. Now it seems that its Wave-C is on with recent bottom formation at 7784.20 on 13-05-2016. As Nifty is hovering around Long Term Trend decider 200 Day EMA(today at 7780) for the last 10 sessions between 7678-7916 therefore finally sustaining it beyond will confirm Long Term Trend and next more than 5% one sided big move as well.

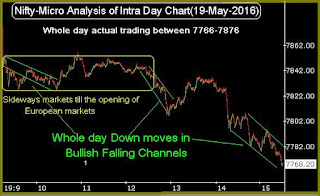

Intra Day Chart Analysis(13-05-2016)

Nifty-Intra Day Chart (13-May-2016):-

|

| Just click on chart for its enlarged view |

Technical Patterns and Formations in today intraday charts

1- Slipping 40 points in first minute

2- More than 2 hours selling between 7825-7844

3- All the Up moves in Bearish Rising Channel in last 3 hours

4- Whole day actual trading between 7785-7880

Conclusions from intra day chart analysis

Firstly slipping 40 points in first minute and after that more than 2 hours selling between 7825-7844 as well as all the Up moves in Bearish Rising Channel in last 3 hours therefore possibility of slipping below day's lowest(7785) in the beginning of next week.

Conclusions (After Putting All Studies Together)

All the trends are sideways and finally sustaining beyond 7678-7916 will be following confirmation of next trends:-

1- Slipping below 7678 will confirm Wave-C with fresh down moves beginning towards 7412(161.8% of Wave-A)

2- Sustaining above 7916 will mean correction completion at 7678.35 on 06-05-2016 and high possibility of fresh up moves above the top of post Budget 2016-17 rally(7992)

Although Nifty closed after recovering 30 points points from lower levels but selling patterns formation last Friday therefore expected that firstly down moves towards 7678 will be seen in the beginning of next weak and finally moves beyond 7678 will decide next big moves which should be firstly watched in next week.