Firstly watch last 19 sessions trading range for the life and size correction

Technical Analysis,Research & Weekly

Outlook(Oct 04 to Oct 08,2021)

Nifty-EOD Chart Analysis

(Averages,Stochastic & MACD)

Nifty-EOD Chart (01-Oct-2021):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 continuation with recent high and new life time top formation at 17947.65 on 24-09-2021

2-Averages

A- 5-Day SMA is today at 17693

B- 21-Day SMA is today at 17530

3- Stochastic- %K(5) is at 21.27 & %D(3) is at 37.67

4- Stochastic- %K(5) line has intersected %D(3) line downward and both lines are moving towards Over sold zone.

5- In MACD- MACD line has intersected Average line downward and its both lines are moving downward in positive zone.

Conclusions from EOD chart analysis

(Averages,Stochastic & MACD)

As EOD Waves structure of Nifty was updated in previous week weekly Outlook and no material change in it since then therefore only Short Term Averages and Indicators analysis is being updated in this week Weekly Outlook.

Last Friday closing was at 17532 which is below 5-Day SMA(17693) and testing 21-Day SMA(17530). It means that Short Term Trend has turned down and first signal of Intermediate Term Trend moving down will emerge after sustaining below 21-Day SMA therefore firstly sustaining it beyond should be watched in next week.

As in Stochastic %K(5) line has intersected %D(3) line downward and both lines are moving towards Over sold zone and have not turned Oversold therefore some more down moves may also be seen in next week.

As in MACD both lines are falling in positive zone after MACD line downward intersection of Average line therefore it is confirming downward trend formations and some more down moves possibilities in next week.

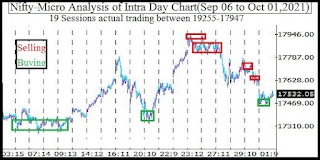

Nifty-Last 19 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Oct 01 & Oct 01,2021):-

Technical Patterns formation in last 19 Sessions intraday charts

1- Selling(Resistances) in last 19 Sessions are as follows:-

A- 17638-17685

B- 17678-17742

C- 17755-17781

D- 17822-17896

E- 17907-17943

2- Consolidation(Supports) in last 19 Sessions are as follows:-

A- 17462-17486

B- 17360-17411

C- 17280-17305

3- Last 19 Sessions actual trading between 19255-17947

Conclusions from 19 Sessions

intra day chart analysis

Last 19 Sessions trading between 19255-17947 with above mentioned lower levels supports and higher levels resistances within it as well as last Friday closing was almost in the middle of this range. As these supports and resistances are almost equally strong therefore expected that Nifty will firstly traded within this last 19 Sessions trading range and will prepare for next decisive moves beyond this range.

Nifty-Intra Day Chart Analysis

(01-Oct-2021)

Nifty-Intra Day Chart (01-Oct-2021):-

Technical Patterns formation in today intraday charts

1- Selling between 17515-17550

2- Support between 17462-17486

3- Last 3 hours up moves with downward corrections

4- Whole day actual trading between 17453-17557

Conclusions from intra day chart analysis

Although firstly selling after gap down opening but lower levels support has also developed therefore up moves were seen in last 3 hours last Friday. As these up moves were with with downward corrections hence consolidation will be understood and resultant some up moves will be seen in the beginning of next week.

Conclusions

(After Putting All Studies Together)

1- Long Term Trend is up.

2- Intermediate Term Trend is sideways between 19255-17947 for the last 19 Sessions.

3- Short Term Trend is down.

As in previous week long Weekly Black Candle was formed and last Friday closing was near the lower levels of Week therefore emergence of weakness beginning signals.

Although firstly some up moves are expected in the beginning of next week because 3 hours consolidation was seen last Friday after lower levels supports but MACD is showing downward trend formations and Stochastic is also suggesting some more down moves possibilities therefore finally correction continuation is expected within last 19 Sessions trading range(19255-17947) in next week.

As many times Bullish markets completes its corrections through Short Term corrections or sideways trading therefore firstly sustaining beyond last 19 sessions trading range(19255-17947) should be watched in the coming week/weeks for the life and size of previous week started correction amid some more down moves possibilities within this range in next week