NIFTY-Jan Put Option(6000)-Buy-Positional-SL-14-TGT-64-CMP-28.50(Lalit39)

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Pre-Closing Outlook(18-01-2013)

Although strong Global markets and good opening in Indian markets but we were not Bullish and showed our doubts with technical reasons in all the today Outlooks. First 5 hours trading between 6060-6082 and this range broken down after 02:15 PM but before that we told following lines:-

1- At 01:04:PM-"Selling patterns formations at higher levels today"

2- At 11:23 AM-"Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks"

1- At 01:04:PM-"Selling patterns formations at higher levels today"

2- At 11:23 AM-"Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks"

Same view yet which was updated at 11:23 AM today.

Mid-session Outlook(18-01-2013)

As selling between 6030-6065 in last 3 sessions therefore Nifty could not sustain at higher levels retested 6065 at 10:48 AM today. Minor profit booking at higher levels today,view is cautious and until Nifty will not cross today high(6083) till then next up move will not be considered and valid break down of 6065 will mean that correction about which we have already updated in previous 2 Outlooks.

Post-open Outlook(18-01-2013)

Although Nifty Jan Fut. has not shown required strength but Nifty Spot is above 6065 after gaining sufficiently required points. As such strong opening and trading so much positive is very much possible in today like heated sentiment therefore next decisive up moves confirmation through sustaining above 6065 after follow up consolidation is still required because selling between 6030-6065 in last 3 sessions.

Pre-open Outlook(18-01-2013)

All the Asian markets are in Green with Nikkei and Hang Sang are more than 2% and 1% up respectively therefore sentiment is strong today morning therefore positive opening will be seen in Indian markets. Good selling seen between 6030-6065 in last 3 sessions therefore complete consolidation is required for sustaining above 6065. As Bull Markets consolidate at higher levels and up moves possibilities up to 6331 are still alive therefore rally continuation after follow up consolidation can not be ruled out but follow up selling in heated sentiment today will mean straight fall toward 5970 also.

12 Sessions sideways trading between 5950-6065 with good selling between 6030-6065 in last 3 sessions therefore market is well prepared for down moves also but strong Global markets and declaration of RIL Quaeterly results today therefore firstly follow up buying/selling will be watched and valid break out of 6030-6065 will give following moves confirmations;-

1- Above 6065 will mean rally continuation towards 6239.95/6331

2- Below 6030 will mean sharp down toward 5970/5950.

12 Sessions sideways trading between 5950-6065 with good selling between 6030-6065 in last 3 sessions therefore market is well prepared for down moves also but strong Global markets and declaration of RIL Quaeterly results today therefore firstly follow up buying/selling will be watched and valid break out of 6030-6065 will give following moves confirmations;-

1- Above 6065 will mean rally continuation towards 6239.95/6331

2- Below 6030 will mean sharp down toward 5970/5950.

Down Moves Possibility also within 12 Sessions Range

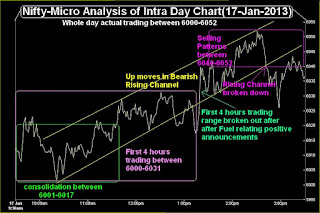

Nifty-Intra Day Chart (17-Jan-2013):-

Technical Patterns and Formations in today intraday charts

1- First 4 hours trading between 6000-6031

1- consolidation between 6001-6017

3- First 4 hours trading range broken out after after Fuel relating positive announcements

4- Selling Patterns between 6040-6052

5- Rising Channel broken down

6- Whole day Up moves in Bearish Rising Channel

7- Whole day actual trading between 6000-6052

First 4 hours trading between 6000-6031 with consolidation between 6001-6017 and first 4 hours trading range broken out after after Fuel relating positive announcements but selling patterns formations also between 6040-6052 therefore market could not sustain at higher levels and slipped. As Whole day Up moves in Bearish Rising Channel therefore this channel also broken down after higher levels seling and closing seen below it today.

12 Sessions trading between 5950-6065 with following immediate supports and resistances:

1- Supports- 5970-6017

2- Resistances- 6030-6065

Intraday selling was seen in previous sessions between 6030-6065 and again selling patterns formations between this range today therefore previous resistance becomes stronger and down moves between 5950-6065 can not be ruled out in the coming sessions. As last 2 hours trading between 6030-60652 was Fuel relating positive announcements generated and market forces reacts in their own manner after such news therefore therefore valid break out of 6030-6065 should be firstly watched tomorrow for next down moves confirmations between 12 sessions range(5950-6065)

If global markets does not gives any side strong sentiment then Nifty will firstly trade between today trading range(6000-6052). As higher levels selling today therefore down moves are possible between 5970-6000.

|

| Just click on chart for its enlarged view |

1- First 4 hours trading between 6000-6031

1- consolidation between 6001-6017

3- First 4 hours trading range broken out after after Fuel relating positive announcements

4- Selling Patterns between 6040-6052

5- Rising Channel broken down

6- Whole day Up moves in Bearish Rising Channel

7- Whole day actual trading between 6000-6052

Conclusions from intra day chart analysis

First 4 hours trading between 6000-6031 with consolidation between 6001-6017 and first 4 hours trading range broken out after after Fuel relating positive announcements but selling patterns formations also between 6040-6052 therefore market could not sustain at higher levels and slipped. As Whole day Up moves in Bearish Rising Channel therefore this channel also broken down after higher levels seling and closing seen below it today.

12 Sessions trading between 5950-6065 with following immediate supports and resistances:

1- Supports- 5970-6017

2- Resistances- 6030-6065

Intraday selling was seen in previous sessions between 6030-6065 and again selling patterns formations between this range today therefore previous resistance becomes stronger and down moves between 5950-6065 can not be ruled out in the coming sessions. As last 2 hours trading between 6030-60652 was Fuel relating positive announcements generated and market forces reacts in their own manner after such news therefore therefore valid break out of 6030-6065 should be firstly watched tomorrow for next down moves confirmations between 12 sessions range(5950-6065)

If global markets does not gives any side strong sentiment then Nifty will firstly trade between today trading range(6000-6052). As higher levels selling today therefore down moves are possible between 5970-6000.

FII & DII trading activity in Capital Market Segment on 17-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(17-Jan-2013)

1- Benchmark Indices closed in Green except CNX SMALLCAP.

2- Diesel deregulation positive news led up moves but not sustaining at higher levels also.

3- White Candle formations.

Ratios

Index Options Put Call Ratio: 1.00

Total Options Put Call Ratio: 0.93

Nifty P/E Ratio(17-Jan-2013): 18.20

Advances & Declines

BSE Advances : 1,380

BSE Declines : 1,503

NSE Advances : 656

NSE Declines : 779

Nifty Open Interest Changed Today

Nifty- 5700 CE(Jan)- -4,650(-0.69%)

Nifty- 5700 PE(Jan)- -47,050(-0.92%)

Nifty- 5800 CE(Jan)- 5,550(0.60%)

Nifty- 5800 PE(Jan)- 669,050(8.96%)

Nifty- 5900 CE(Jan)- -4,200(-0.25%)

Nifty- 5900 PE(Jan)- 806,800(10.34%)

Nifty- 6000 CE(Jan)- -116,500(-2.62%)

Nifty- 6000 PE(Jan)- 1,452,350(24.57%)

Nifty- 6100 CE(Jan)- -421,700(-6.57%)

Nifty- 6100 PE(Jan)- 138,850(7.41%)

Closing

Sensex- closed at 19,964.03(146.40 Points & 0.74%)

Nifty- closed at 6,039.20(37.35 Points & 0.62%)

CNX Midcap - closed at 8,592.85(25.80 Points & 0.30%)

CNX Smallcap- closed at 3,787.15(-1.75 Points & -0.05%)

Nifty Spot-Levels & Trading Strategy for 18-01-2013

R3 6130

R2 6091

R1 6065

Avg 6026

S1 6000

S2 5961

S3 5935

Nifty Spot-Trading Strategy

H6 6104 Trgt 2

H5 6089 Trgt 1

H4 6074 Long breakout

H3 6056 Go Short

H2 6050

H1 6044

L1 6033

L2 6027

L3 6021 Long

L4 6003 Short Breakout

L5 5988 Trgt 1

L6 5973 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 18-01-2013

R3 6156

R2 6114

R1 6084

Avg 6042

S1 6012

S2 5970

S3 5940

Nifty(Jan Fut)-Trading Strategy

H6 6126 Trgt 2

H5 6110 Trgt 1

H4 6093 Long breakout

H3 6073 Go Short

H2 6067

H1 6060

L1 6047

L2 6040

L3 6034 Long

L4 6014 Short Breakout

L5 5997 Trgt 1

L6 5981 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 18-01-2013

R3 12931

R2 12853

R1 12771

Avg 12693

S1 12611

S2 12533

S3 12451

Bank Nifty(Jan Fut)-Trading Strategy

H6 12850 Trgt 2

H5 12814 Trgt 1

H4 12778 Long breakout

H3 12734 Go Short

H2 12719

H1 12704

L1 12675

L2 12660

L3 12646 Long

L4 12602 Short Breakout

L5 12565 Trgt 1

L6 12529 Trgt 2

Pre-Closing Outlook(17-01-2013)

Indian market gave positive indication through outperforming Global cues and it was updated also at 10:17 AM today. First 4 hours trading between 6001-6031 with consolidation between 6001-6017 today. As 6031 Broken out after Fuel relating positive announcements and after that up moves are positive news generated therefore firstly confirmation is required through sustaining above 6031.

Now Nifty is trading between next resistance range(6030-3065) therefore complete consolidation is required for break out above 6065 but positive news generated short covering by general traders also can not be ruled out within this range.

Valid break out of 6030-3065 is most crucial now for next immediate moves confirmations therefore should be firstly watched.

Now Nifty is trading between next resistance range(6030-3065) therefore complete consolidation is required for break out above 6065 but positive news generated short covering by general traders also can not be ruled out within this range.

Valid break out of 6030-3065 is most crucial now for next immediate moves confirmations therefore should be firstly watched.

Mid-session Outlook(17-01-2013)

The Cabinet Committee on Economic Affairs (CCEA) did not hiked Fuel price today and partial deregulation of Diesel decided therefore Indian markets soared. Indian markets gave positive indications immediately after opening and economy favouring decision gave up moves trigger.

As intraday charts are showing consolidation between 6001-6017 today therefore this range will give support but good selling between 6030-3065 yesterday therefore more follow up consolidation is required for next rally above 6065. Nifty traded first 4 hours between 6001-6031 today and firstly sustaining above 6031 should be watched for next rally confirmation because today last half hour up moves are positive news reaction also.

As intraday charts are showing consolidation between 6001-6017 today therefore this range will give support but good selling between 6030-3065 yesterday therefore more follow up consolidation is required for next rally above 6065. Nifty traded first 4 hours between 6001-6031 today and firstly sustaining above 6031 should be watched for next rally confirmation because today last half hour up moves are positive news reaction also.

Post-open Outlook(17-01-2013)

Although all the Asian markets are in Red and some are sufficiently down also as well as Dow's Futures is also 35 points down but Indian markets outperformed and .20 up today. It is first positive indication and follow up consolidation is must after good selling yesterday.. Quiet market is expected if big fall is not seen in Global markets.

Let market prepare and intraday charts form patterns then next expected moves will be updated accordingly,as if now we can say only positive indications development today and also possible that Indian markets will firstly prepare for next moves between 5970-6030.

Let market prepare and intraday charts form patterns then next expected moves will be updated accordingly,as if now we can say only positive indications development today and also possible that Indian markets will firstly prepare for next moves between 5970-6030.

11 Sessions range trapped market & Big Trend Ahead

Nifty-Intra Day Chart (16-Jan-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling between 6050-6055

2- Selling between 6030-6048

3- Sharp down moves in last 40 minutes.

3- Whole day actual trading between 5992-6055.

9 Sessions sideways trading between 5950-6026 from 02-01-2013 to 14-01-2013 and its break out was seen yesterday but Nifty again slipped into this range after higher levels good selling and closing within this range at 6001.85 today. Now actual trading range has changed after good selling today and valid break out of following range will decide next trend:-

Now we are reproducing all those most crucial technical views which have already been updated in previous 4 days:-

Following 2 targets were updated in Market Cautious after Indo-Pak Cross Border Firing on 13-01-2013:-

1- Sub Wave-5 of Wave-3 minimum and maximum targets are between 6031-6331.

2- Sub Wave-3 of Sub Wave-5 is on and its minimum target is 6239.95.

As Sub Wave-5 of Wave-3 has achieved its minimum target after trading above 6031 and made a top of 6068.50 on 15-01-2013 after gaining 1298.15 points therefore its correction beginning possibility after mentioned Wave completion at 6068.50 can not be ruled out. Whenever correction will start then will be deep because market will correct whole 1298.15 points or may be more also if correction starts after making new top formation above 6068.50

It should be kept in mind that on going Sub Wave-5 which started from 5548.35 on 20-11-2012 is showing Negative Divergence and lacking required force also therefore expected that whole up move of this wave will also be corrected after reversal of on going rally. its detailed analysis has already been updated in following topic on 13-01-2013:-

Following lines were told yesterday in Technical Analysis and Market Outlook(16-01-2013)

Although Wave-3 correction will start between 6031-6331 but before that complete selling patterns are required in intraday and minimum on Daily charts,until that will not happen till then any big correction will not be considered. As no such development yet therefore rally continuation will be seen in the coming sessions but with intraday to very short term corrections also.

As weakness perceived therefore down moves possibilities with technical positions were also updated in all intraday Outlooks and following lines were told:-

1- Told at 11:122 AM-"Intraday charts are showing intraday selling patterns between 6050-6055 today"

2- Told at 12:11 PM-"Confirm intraday selling between 6050-6055 today"

3- Told at 12:40 PM-"Lower top formation at 6041 with minor intraday selling between 6035-6041 and emergence of more down moves possibility toward 6019 and below"

4- Told at 02:42 PM-"As last more than 2 hours trading is showing intraday selling patterns again therefore more down moves are expected below 6019"

As per our view above mentioned major correction will be seen after Union Budget-2013 and till then slow up moves toward 6331 are possible. Although Sub Wave-5 of Wave-3 has achived its minimum target after trading above 6031 but top of the rally has not got confirmation yet and it may be above present top(6068.50) also. As Nifty reentered into 9 Sessions sideways trading range(now changed to 5950-6065) therefore its valid break out should be firstly watched for following conclusions:-

1- Below 5950 will mean above mentioned complete correction of whole 1298.15 points.

2- Above 6055 will mean up moves toward 6331 and then firstly selling patterns formations are must on intraday and daily charts and after that complete correction of Sub Wave-5 of Wave-3 gaining points will be seen.

Tomorrow Outlook

11 Sessions trading trapped between 5950-6065 and news based high volatility last 4 sessions within it. Expected that Nifty will remain range bound within this range in the coming sessions and prepare for next big trend. Immediate supports and resistances between this range are as follows:-

1- Supports- 5970-6000

2- Resistances- 6030-6065

Nifty will firstly trade between 5970-6030 in the coming sessions and prepare for next moves tomorrow . Let market prepare then next moves will be updated in Mid Sessions Outlooks according to intraday charts patterns formations.

|

| Just click on chart for its enlarged view |

1- Selling between 6050-6055

2- Selling between 6030-6048

3- Sharp down moves in last 40 minutes.

3- Whole day actual trading between 5992-6055.

Conclusions from intra day chart analysis

9 Sessions sideways trading between 5950-6026 from 02-01-2013 to 14-01-2013 and its break out was seen yesterday but Nifty again slipped into this range after higher levels good selling and closing within this range at 6001.85 today. Now actual trading range has changed after good selling today and valid break out of following range will decide next trend:-

5950-6065

Now we are reproducing all those most crucial technical views which have already been updated in previous 4 days:-

Following 2 targets were updated in Market Cautious after Indo-Pak Cross Border Firing on 13-01-2013:-

1- Sub Wave-5 of Wave-3 minimum and maximum targets are between 6031-6331.

2- Sub Wave-3 of Sub Wave-5 is on and its minimum target is 6239.95.

As Sub Wave-5 of Wave-3 has achieved its minimum target after trading above 6031 and made a top of 6068.50 on 15-01-2013 after gaining 1298.15 points therefore its correction beginning possibility after mentioned Wave completion at 6068.50 can not be ruled out. Whenever correction will start then will be deep because market will correct whole 1298.15 points or may be more also if correction starts after making new top formation above 6068.50

It should be kept in mind that on going Sub Wave-5 which started from 5548.35 on 20-11-2012 is showing Negative Divergence and lacking required force also therefore expected that whole up move of this wave will also be corrected after reversal of on going rally. its detailed analysis has already been updated in following topic on 13-01-2013:-

Following lines were told yesterday in Technical Analysis and Market Outlook(16-01-2013)

Although Wave-3 correction will start between 6031-6331 but before that complete selling patterns are required in intraday and minimum on Daily charts,until that will not happen till then any big correction will not be considered. As no such development yet therefore rally continuation will be seen in the coming sessions but with intraday to very short term corrections also.

As weakness perceived therefore down moves possibilities with technical positions were also updated in all intraday Outlooks and following lines were told:-

1- Told at 11:122 AM-"Intraday charts are showing intraday selling patterns between 6050-6055 today"

2- Told at 12:11 PM-"Confirm intraday selling between 6050-6055 today"

3- Told at 12:40 PM-"Lower top formation at 6041 with minor intraday selling between 6035-6041 and emergence of more down moves possibility toward 6019 and below"

4- Told at 02:42 PM-"As last more than 2 hours trading is showing intraday selling patterns again therefore more down moves are expected below 6019"

Conclusions (After Putting All Studies Together)

As per our view above mentioned major correction will be seen after Union Budget-2013 and till then slow up moves toward 6331 are possible. Although Sub Wave-5 of Wave-3 has achived its minimum target after trading above 6031 but top of the rally has not got confirmation yet and it may be above present top(6068.50) also. As Nifty reentered into 9 Sessions sideways trading range(now changed to 5950-6065) therefore its valid break out should be firstly watched for following conclusions:-

1- Below 5950 will mean above mentioned complete correction of whole 1298.15 points.

2- Above 6055 will mean up moves toward 6331 and then firstly selling patterns formations are must on intraday and daily charts and after that complete correction of Sub Wave-5 of Wave-3 gaining points will be seen.

Tomorrow Outlook

11 Sessions trading trapped between 5950-6065 and news based high volatility last 4 sessions within it. Expected that Nifty will remain range bound within this range in the coming sessions and prepare for next big trend. Immediate supports and resistances between this range are as follows:-

1- Supports- 5970-6000

2- Resistances- 6030-6065

Nifty will firstly trade between 5970-6030 in the coming sessions and prepare for next moves tomorrow . Let market prepare then next moves will be updated in Mid Sessions Outlooks according to intraday charts patterns formations.

FII & DII trading activity in Capital Market Segment on 16-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(16-Jan-2013)

1- All the Indices closed in Red except CNX ENERGY.

2- Closing near the lowest of the day after goor selling.

3- Black Candle formation.

Ratios

Index Options Put Call Ratio: 0.97

Total Options Put Call Ratio: 0.92

Nifty P/E Ratio(16-Jan-2013): 18.02

Advances & Declines

BSE Advances : 905

BSE Declines : 2,069

NSE Advances : 420

NSE Declines : 1,352

Nifty Open Interest Changed Today

Nifty- 5700 CE(Jan)- -600(-0.09%)

Nifty- 5700 PE(Jan)- 284,150(5.82%)

Nifty- 5800 CE(Jan)- -2,600(-0.28%)

Nifty- 5800 PE(Jan)- 105,900(1.44%)

Nifty- 5900 CE(Jan)- 99,900(6.23%)

Nifty- 5900 PE(Jan)- -60,800(-0.74%)

Nifty- 6000 CE(Jan)- 568,800(14.31%)

Nifty- 6000 PE(Jan)- -684,650(-9.79%)

Closing

Sensex- closed at 19,817.63(-169.19 Points & -0.85%)

Nifty- closed at 8,567.05(-117.20 Points & -1.35%)

CNX Midcap - closed at 8,567.05(-117.20 Points & -1.35%)

CNX Smallcap- closed at 3,788.90(-59.20 Points & -1.54%)

Nifty Spot-Levels & Trading Strategy for 17-01-2013

R3 6103

R2 6079

R1 6040

Avg 6016

S1 5977

S2 5953

S3 5914

Nifty Spot-Trading Strategy

H6 6064 Trgt 2

H5 6049 Trgt 1

H4 6035 Long breakout

H3 6018 Go Short

H2 6012

H1 6006

L1 5995

L2 5989

L3 5983 Long

L4 5966 Short Breakout

L5 5952 Trgt 1

L6 5937 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 17-01-2013

R3 6123

R2 6099

R1 6059

Avg 6035

S1 5995

S2 5971

S3 5931

Nifty(Jan Fut)-Trading Strategy

H6 6083 Trgt 2

H5 6068 Trgt 1

H4 6054 Long breakout

H3 6036 Go Short

H2 6030

H1 6024

L1 6013

L2 6007

L3 6001 Long

L4 5983 Short Breakout

L5 5969 Trgt 1

L6 5954 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 17-01-2013

R3 13074

R2 12984

R1 12831

Avg 12741

S1 12588

S2 12498

S3 12345

Bank Nifty(Jan Fut)-Trading Strategy

H6 12921 Trgt 2

H5 12866 Trgt 1

H4 12811 Long breakout

H3 12744 Go Short

H2 12722

H1 12700

L1 12655

L2 12633

L3 12611 Long

L4 12544 Short Breakout

L5 12489 Trgt 1

L6 12434 Trgt 2

Live Proofs of our 100% Accurate Indian Stock Markets predictions

1- Told at 11:122 AM-"Intraday charts are showing intraday selling patterns between 6050-6055 today"2- Told at 12:11 PM-"Confirm intraday selling between 6050-6055 today"

3- Told at 12:40 PM-"Lower top formation at 6041 with minor intraday selling between 6035-6041 and emergence of more down moves possibility toward 6019 and below"

4- Told at 02:42 PM-"As last more than 2 hours trading is showing intraday selling patterns again therefore more down moves are expected below 6019"

Nifty is now trading at 5994

Live Proofs of our Accurate Levels and Indian Stock Markets predictions

Pre-Closing Outlook(16-01-2013)

Although today lowest of 6018.85 was formed at 01:12 AM today but we told about it today 4 times:-

1- Told at 12:40 PM-"down moves possibility toward 6019 and below"

2- Told at 12:11 PM-" Consolidation seen between 6019-6033 yesterday and more intraday selling is required for slipping below 6019 and sustaining beyond 6019-6033 should be firstly watched now"

3- Told at 11:22 AM-"firstly more down moves are expected within yesterday trading range(6019-6068)"

4- Told at 07:52 AM-"Nifty will firstly trade between yesterday range(6019-6068)"

How we are 100% accurate

1- We told for down moves possibility toward 6019 and below and Nifty reversed from 6018.85

2- We told for today trading between 6019-6068 and Nifty traded between 6018.85-6055.95

3- We told for support between 6019-6033 and Nifty is trading between 6019-6034 for the last more than 2 hours

As last more than 2 hours trading is showing intraday selling patterns again therefore more down moves are expected below 6019

Mid-session Outlook-2(16-01-2013)

Lower top formation at 6041 with minor intraday selling between 6035-6041 and emergence of more down moves possibility toward 6019 and below.

Mid-session Outlook(16-01-2013)

This fact should be kept in mind that only skirmish will be seen and no possibility of any big war between India and Pakistan as well as expected that things will be normal within 2/3 weeks but sentiment turns weak and market reacts in very Short Term. As mounting of tension on Indo-Pak Border again today therefore cautious view was updated in Pre-open Outlook today and yesterday range(6019-6068) was given for next moves confirmations,

Confirm intraday selling between 6050-6055 today but Consolidation seen between 6019-6033 yesterday and more intraday selling is required for slipping below 6019 and sustaining beyond 6019-6033 should be firstly watched now for:-

1- Rentering into previous 9 sessions range(5950-6026) below 6019 after follow up selling or

2- Rally continuation above 6055/6068 after follow up consolidations.

Confirm intraday selling between 6050-6055 today but Consolidation seen between 6019-6033 yesterday and more intraday selling is required for slipping below 6019 and sustaining beyond 6019-6033 should be firstly watched now for:-

1- Rentering into previous 9 sessions range(5950-6026) below 6019 after follow up selling or

2- Rally continuation above 6055/6068 after follow up consolidations.

Post-open Outlook(16-01-2013)

As cooling down of rate cut expectations later this month after RBI Governor Subbarao statement that inflation still high therefore Banknifty is more than .50% down and sentiment is also depressed due escalation of firing on Indo-Pak Border resultant weak Indian markets today. Intraday charts are showing intraday selling patterns between 6050-6055 today therefore firstly more down moves are expected within yesterday trading range(6019-6068).

Pre-open Outlook(16-01-2013)

Although some Asian markets are positive but both major Indices(Nikkei and Hang Sang) are in Red as well as Nikkei is more than 1.75% down therefore sentiment is weak today morning and negative opening will be seen in Indian markets. Although good recovery seen from lower levels yesterday but intraday selling and mixed patterns were also seen therefore follow up consolidation is required for decisive up moves above yesterday high.

As per our view some stream is still left and more up moves are also expected in the coming sessions but view is cautious today because fresh cross Border firing news from Indo-Pak Border. Nifty will firstly trade between yesterday range(6019-6068) and prepare for next moves,follow up moves and its valid break out will also be watched.

As per our view some stream is still left and more up moves are also expected in the coming sessions but view is cautious today because fresh cross Border firing news from Indo-Pak Border. Nifty will firstly trade between yesterday range(6019-6068) and prepare for next moves,follow up moves and its valid break out will also be watched.

Technical Analysis and Market Outlook(16-01-2013)

Nifty-Intra Day Chart (15-Jan-2013):-

Technical Patterns and Formations in today intraday charts

1- Consolidation between 6019-6033

2- Selling patterns between 6035-6039

3- Mixed Patterns between 60346-6068

4- Whole day actual trading between 6019-6068

Although lower levels consolidations patterns between 6019-6033 but just above selling patterns also seen between 6035-6039 during almost first 5 hours. As market consolidate also at higher levels in Bull markets therefore sharp surge after 02:00 PM and rest more than 1 hour trading with mixed patterns between 60346-6068.

The abstract sums up of today trading is rally continuation despite mixed intraday patterns and it is very much common also in Bullish rallies. Following 2 targets were updated in Market Cautious after Indo-Pak Cross Border Firing on 13-01-2013:-

1- Sub Wave-5 of Wave-3 minimum and maximum targets are between 6031-6331.

2- Sub Wave-3 of Sub Wave-5 is on and its minimum target is 6239.95.

It must be kept in mind that on going Sub Wave-5 which started from 5548.35 on 20-11-2012 is showing Negative Divergence and expected that whole up move of this wave will be corrected after reversal of on going rally.(its detailed analysis has alrready been updated in above mentioned topic).

|

| Just click on chart for its enlarged view |

1- Consolidation between 6019-6033

2- Selling patterns between 6035-6039

3- Mixed Patterns between 60346-6068

4- Whole day actual trading between 6019-6068

Conclusions from intra day chart analysis

Although lower levels consolidations patterns between 6019-6033 but just above selling patterns also seen between 6035-6039 during almost first 5 hours. As market consolidate also at higher levels in Bull markets therefore sharp surge after 02:00 PM and rest more than 1 hour trading with mixed patterns between 60346-6068.

The abstract sums up of today trading is rally continuation despite mixed intraday patterns and it is very much common also in Bullish rallies. Following 2 targets were updated in Market Cautious after Indo-Pak Cross Border Firing on 13-01-2013:-

1- Sub Wave-5 of Wave-3 minimum and maximum targets are between 6031-6331.

2- Sub Wave-3 of Sub Wave-5 is on and its minimum target is 6239.95.

It must be kept in mind that on going Sub Wave-5 which started from 5548.35 on 20-11-2012 is showing Negative Divergence and expected that whole up move of this wave will be corrected after reversal of on going rally.(its detailed analysis has alrready been updated in above mentioned topic).

Although Wave-3 correction will start between 6031-6331 but before that complete selling patterns are required in intraday and minimum on Daily charts,until that will not happen till then any big correction will not be considered. As no such development yet therefore rally continuation will be seen in the coming sessions but with intraday to very short term corrections also.

FII & DII trading activity in Capital Market Segment on 15-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(15-Jan-2013)

1- Benchmark Indices closed in Green but CNX Smallcap closed in Red.

2- Market surged after 4 hours sideways moves.

3- White Candle formation.

Ratios

Index Options Put Call Ratio: 0.95

Total Options Put Call Ratio: 0.89

Nifty P/E Ratio(15-Jan-2013): 18.15

Advances & Declines

BSE Advances : 1,342

BSE Declines : 1,550

NSE Advances : 706

NSE Declines : 728

Nifty Open Interest Changed Today

Nifty- 5800 CE(Jan)- -9,550(-1.01%)

Nifty- 5800 PE(Jan)- 322,550(4.43%)

Nifty- 5900 CE(Jan)- -376,200(-18.46%)

Nifty- 5900 PE(Jan)- 250,000(3.07%)

Nifty- 6000 CE(Jan)- -102,850(-2.38%)

Nifty- 6000 PE(Jan)- 1,451,550(25.78%)

Nifty- 6100 CE(Jan)- -275,450(-4.53%)

Nifty- 6100 PE(Jan)- 118,700(5.58%)

Closing

Sensex- closed at 19,986.82(80.41 Points & 0.40%)

Nifty- closed at 6,056.60(32.55 Points & 0.54%)

CNX Midcap - closed at 8,684.25(19.70 Points & 0.23%)

CNX Smallcap- closed at 3,848.10(-6.80 Points & -0.18%)

Nifty Spot-Levels & Trading Strategy for 16-01-2013

R3 6126

R2 6097

R1 6076

Avg 6047

S1 6026

S2 5997

S3 5976

Nifty Spot-Trading Strategy

H6 6106 Trgt 2

H5 6094 Trgt 1

H4 6083 Long breakout

H3 6069 Go Short

H2 6065

H1 6060

L1 6051

L2 6046

L3 6042 Long

L4 6028 Short Breakout

L5 6017 Trgt 1

L6 6005 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 16-01-2013

R3 6166

R2 6131

R1 6106

Avg 6071

S1 6046

S2 6011

S3 5986

Nifty(Jan Fut)-Trading Strategy

H6 6141 Trgt 2

H5 6127 Trgt 1

H4 6114 Long breakout

H3 6097 Go Short

H2 6092

H1 6086

L1 6075

L2 6070

L3 6064 Long

L4 6048 Short Breakout

L5 6034 Trgt 1

L6 6020 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 16-01-2013

R3 13205

R2 13090

R1 13000

Avg 12885

S1 12795

S2 12680

S3 12590

Bank Nifty(Jan Fut)-Trading Strategy

H6 13117 Trgt 2

H5 13070 Trgt 1

H4 13022 Long breakout

H3 12966 Go Short

H2 12947

H1 12928

L1 12891

L2 12872

L3 12853 Long

L4 12797 Short Breakout

L5 12750 Trgt 1

L6 12702 Trgt 2

Pre-Closing Outlook(15-01-2013)

Following line was told yesterday in Valid Break Out Confirmation is Must after 2 Sessions High Volatility

1- today started up moves continuation is expected in the coming session.

2- expectation turned alive for up moves towards its minimum target at 6239.95(as per Elliot Wave theory).

1- today started up moves continuation is expected in the coming session.

2- expectation turned alive for up moves towards its minimum target at 6239.95(as per Elliot Wave theory).

Rally continuation today after lower levels consolidations as well as last 9 sessions range break out. Complete selling patterns are required in intraday and minimum on Daily charts for any down trend,until that will not happen till then any big correction will not be considered.

Mid-session Outlook(15-01-2013)

As some profit booking immediately after opening therefore Nifty slipped into Red zone after more than 3 hours positive zone trading and consolidated between 6020-6034. Last 9 sessions range break out confirmation after today intraday consolidation near about 6026 and rally continuation towards minimum target at 6239.95(as per Elliot Wave theory).

Post-open Outlook-2(15-01-2013)

Although continuous up moves after low formation at 6025 but without required force therefore emergence of profit booking possibility and confirmation through sustaining above 5026 is must.

Post-open Outlook(15-01-2013)

Immediate slipping after minor gap up opening because weakness in most Asian markets and follow up buying/selling today will decide the fate of of last 9 sessions actual trading range break out above 6026. As more than 5 hours consolidation between 5979-6007 yesterday therefore this range is first support and complete selling is required for its breaking down. As yesterday up moves were due to positive news flow during trading hours also therefore confirmation through sustaining above 5026 is must for strong rally towards minimum target at 6239.95(as per Elliot Wave theory).

Valid Break Out Confirmation is Must after 2 Sessions High Volatility

Nifty-Intra Day Chart (Jan 11 & Jan 14,2013):-

Technical Patterns and Formations in last 2 Sessions intraday charts

1- Whole day down moves due to tension on Indo-Pak Border last Friday.

2- Whole day up moves due to continuous positive news flow today.

1- More than 5 hours consolidation between 5979-6007 today.

3- 2 Sessions actual trading between 5941-6037

8 previous sessions sideways trading range(5950-6026) broken down and closing near lowest of the day last Friday due to tension on Indo-Pak Border but Flag meeting between Indo-Pak scheduled for today therefore tension relaxed and sentiment boosted after the positive news of improved December inflation data and positive announcement on GAAR by F.M. therefore closing near the top of the day today. News based high volatility in last 2 sessions and 8 previous sessions range(5950-6026) broken out both sides in following manner:-

1- 8 sessions sideways trading range(5950-6026) broken down last Friday and closing at 5951 after lowest formation at 5941.

2- 8 sessions sideways trading range(5950-6026) broken out today and closing at 6024 after highest formation at 6037.

Although closing near the lowest of the day with closing below the next trend deciding 5965 therefore following line was told in Market Cautious after Indo-Pak Cross Border Firing yesterday:-

closing below 5965 was due to most sensitive negative news of tension mounting on LOC therefore sustaining below 5965 should also be firstly watched.

As closing well above 5965 today therefore survival of Sub Wave-5 of Wave-3 and expectation turned alive for up moves towards its minimum target at 6239.95(as per Elliot Wave theory). As more than 5 hours consolidation also between 5979-6007 today therefore today started up moves continuation is expected in the coming session.

|

| Just click on chart for its enlarged view |

1- Whole day down moves due to tension on Indo-Pak Border last Friday.

2- Whole day up moves due to continuous positive news flow today.

1- More than 5 hours consolidation between 5979-6007 today.

3- 2 Sessions actual trading between 5941-6037

Conclusions from 2 Sessions intra day chart analysis

8 previous sessions sideways trading range(5950-6026) broken down and closing near lowest of the day last Friday due to tension on Indo-Pak Border but Flag meeting between Indo-Pak scheduled for today therefore tension relaxed and sentiment boosted after the positive news of improved December inflation data and positive announcement on GAAR by F.M. therefore closing near the top of the day today. News based high volatility in last 2 sessions and 8 previous sessions range(5950-6026) broken out both sides in following manner:-

1- 8 sessions sideways trading range(5950-6026) broken down last Friday and closing at 5951 after lowest formation at 5941.

2- 8 sessions sideways trading range(5950-6026) broken out today and closing at 6024 after highest formation at 6037.

Although closing near the lowest of the day with closing below the next trend deciding 5965 therefore following line was told in Market Cautious after Indo-Pak Cross Border Firing yesterday:-

closing below 5965 was due to most sensitive negative news of tension mounting on LOC therefore sustaining below 5965 should also be firstly watched.

As closing well above 5965 today therefore survival of Sub Wave-5 of Wave-3 and expectation turned alive for up moves towards its minimum target at 6239.95(as per Elliot Wave theory). As more than 5 hours consolidation also between 5979-6007 today therefore today started up moves continuation is expected in the coming session.

As news based highly volatile markets in last 2 sessions and today strong up moves were also on the back of continuous positive news flow therefore valid break out confirmation is must through sustaining beyond last 9 sessions sideways trading range(5950-6026)

FII & DII trading activity in Capital Market Segment on 14-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(14-Jan-2013)

1- All the Indices closed in Green except CNX PHARMA.

2- Closing at the highest of the day.

3- Long White candle formation.

Ratios

Index Options Put Call Ratio: 1.11

Total Options Put Call Ratio: 1.05

Nifty P/E Ratio(14-Jan-2013):18.92

Advances & Declines

BSE Advances : 1,691

BSE Declines : 1,207

NSE Advances : 884

NSE Declines : 557

Nifty Open Interest Changed Today

Nifty- 5800 CE(Jan)- -61,050(-5.91%)

Nifty- 5800 PE(Jan)- -39,550(-0.52%)

Nifty- 5900 CE(Jan)- -201,200(-8.88%)

Nifty- 5900 PE(Jan)- 1,172,000(15.80%)

Nifty- 6000 CE(Jan)- -963,500(-17.95%)

Nifty- 6000 PE(Jan)- 1,923,200(50.85%)

Nifty- 6100 CE(Jan)- -400,950(-5.75%)

Nifty- 6100 PE(Jan)- 220,750(11.70%)

Closing

Sensex- closed at 19,906.41(242.77 Points & 1.23%)

Nifty- closed at 6,024.05(72.75 Points & 1.22%)

CNX Midcap - closed at 8,664.55(120.55 Points & 1.41%)

CNX Smallcap- closed at 3,854.90(53.40 Points & 1.40%)

Nifty Spot-Levels & Trading Strategy for 15-01-2013

R3 6126

R2 6081

R1 6052

Avg 6007

S1 5978

S2 5933

S3 5904

Nifty Spot-Trading Strategy

H6 6098 Trgt 2

H5 6081 Trgt 1

H4 6064 Long breakout

H3 6044 Go Short

H2 6037

H1 6030

L1 6017

L2 6010

L3 6003 Long

L4 5983 Short Breakout

L5 5966 Trgt 1

L6 5949 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 15-01-2013

R3 6169

R2 6118

R1 6087

Avg 6036

S1 6005

S2 5954

S3 5923

Nifty(Jan Fut)-Trading Strategy

H6 6139 Trgt 2

H5 6121 Trgt 1

H4 6102 Long breakout

H3 6079 Go Short

H2 6072

H1 6064

L1 6049

L2 6041

L3 6034 Long

L4 6011 Short Breakout

L5 5992 Trgt 1

L6 5974 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 15-01-2013

R3 13103

R2 12980

R1 12912

Avg 12789

S1 12721

S2 12598

S3 12530

Bank Nifty(Jan Fut)-Trading Strategy

H6 13038 Trgt 2

H5 12994 Trgt 1

H4 12950 Long breakout

H3 12897 Go Short

H2 12880

H1 12862

L1 12827

L2 12809

L3 12792 Long

L4 12739 Short Breakout

L5 12695 Trgt 1

L6 12651 Trgt 2

GAAR will be effected from Apr 2016

Mid-session Outlook-2(14-01-2013)

Finance Minister positive announcement of postponing GAAR for 3 years and will be effected from Apr 2016 as well as acceptance of major proposals of shome committee,it is 2nd positive news after improved December inflation data today and Nifty is trading near 6000 for the last 4 hours.

As intraday consolidation patterns also seen today therefore confirmation of reentering into 8 sessions sideways trading range(5950-6026) but more consolidation is required between next resistance range(6000-6026) for crossing and sustaining above 6026.

Follow up moves and valid break out of 8 sessions sideways trading range(5950-6026) will give following confirmations:-

1- Above 6026 will mean up moves toward next target between 6239-6331.

2- Below 5950 will mean correction after Sub Wave-5 achieving its 1st target between 6031-6331 at 6042.15 on 07-01-2013.

Mid-session Outlook(14-01-2013)

As negative news flow from Indo-Pak last Friday therefore whole day down moves and closing below 5965 was seen but today trading into last 8 sessions sideways trading range(5950-6026) because sentiment improved due to more than 2.45% up moves in Chinese markets and lower levels recovery in all Asian markets. Sentiment again improved due to improved December inflation data and now trading near 6000,next resistance is between 6000-6026 therefore complete consolidation is required for decisive up moves above 6026..

Reentering into 8 sessions sideways trading range(5950-6026) and its valid break out will give next trend confirmation therefore should be firstly watched now.

Reentering into 8 sessions sideways trading range(5950-6026) and its valid break out will give next trend confirmation therefore should be firstly watched now.

Firstly watch sustaining beyond 5965

Post-open Outlook(14-01-2013)

As last Friday down moves and closing below most crucial and next trend deciding 5965 was due to negative news of Heavy Firing on LOC and tension escalation with Pakistan therefore following line was told in previous Outlook yesterday:-

closing below 5965 was due to most sensitive negative news of tension mounting on LOC therefore sustaining below 5965 should also be firstly watched.

As some Asian markets are trading with good gains therefore positive opening in Indian markets and If Nifty sustains above 5965 then market reentering into last 8 sessions sideways trading range(5950-6026) and finally sustaining below 5965 will mean correction beginning after Sub Wave-5 completion at 6042.15 on 07-01-2013.

Market Cautious after Indo-Pak Cross Border Firing

Technical Analysis,Research & Weekly Outlook

(Jan 14 to Jan 18,2013)

Waves Structure of Sub Wave-5 of Wave-3

Nifty-EOD Chart (11-Jan-2013):- |

| Just click on chart for its enlarged view |

1- 5548.35 on 20-11-2012(Sub Wave-4 completion and Sub Wave-5 coontinuation)

2- 5865.45 on 11-12-2012 (Sub Wave-1 of Wave-5 completion and Sub Wave-2 continuation)

3- 5823.15 on 18-12-2012 (Sub Wave-2 of Wave-5 completion and Sub Wave-3 continuation)

4- 6042.15 on 07-01-2013 (Top of Sub Wave-3 of Wave-5)

5- Closing below Sub Wave-1 top(5865.45) on 11-01-2013

Conclusions from EOD chart analysis

As Sub Wave-3 continuation in previous week therefore its minimum target(as per Elliot Wave theory) of 6239.95 with calculation was updated on 08-01-2013 as well as condition of closing above 5965 was also posted on 07-01-2013. As intraday Bullish patterns formations on 10-01-2013 therefore expectation of rally continuation was told on 10-01-2013 and it was seen also on 11-01-2013 but sentiment turned depressed due to escalation of Indo-Pak cross border firing therefore Indian markets could not sustain at higher levels and closed below 5965 on 11-01-2013.

As closing below 5965 on 11-01-2013 therefore as per Elliot Wave theory strong indication of failure of Sub Wave-3 of Wave-5 and emergence of correction possibility as well. Now Sub Wave-5 of Wave-3 is on and when its formation was got confirmation then following topic was posted on 08-12-2012:-

Rally after Short Term Correction

Just click above topic link for detaied analysis and those important features which should be immediately considered are also being reproduced with EOD chart of that day:-

Nifty-EOD Chart (07-Dec-2012):-

|

| Just click on chart for its enlarged view |

1- Wave-2 completion(4770.35 on 04-06-2012)

2- Sub Wave-1 gained 578.20 points(5348.55 on 10-07-2012)

3- Sub Wave-2(5032.40 on 26-07-2012)

4- Sub Wave-3 gained 782.95 points(5815.35 on 05-10-2012)

5- Sub Wave-4(5548.35 on 20-11-2012)

6- Sub Wave-5 of Wave-3 is on.

Conclusions from EOD chart analysis

Sub Wave-5 of Wave-3 is on after Sub Wave-4 correction completion with Bullish Flag formation therefore strong up moves will be seen. As per Elliot Wave theory Wave-3 should never be shorter than both Wave-1 and Sub Wave-5. Wave-3 gained 782.95 points as per theory Sub Wave-5 will gain less than 782.95 point from the bottom of Wave-4(5548.35) therefore Sub Wave-5 maximum target will be less than 6331.30(5548.35+782.95). Previous tops above 6000 are as follows:-

1- 6357.10 on 08-01-2008.

2- 6338.50 on 05-11-2010.

As on going Sub Wave-5 rally possible maximum target is near 6331 therefore Triple Top formation may be seen. Expected that Sub Wave-5 will not gain less than 61.8% of Sub Wave-3 gains and Sub Wave-5 targets should be between 6031-6331.

As on going Sub Wave-5 made a top of 6042.15 on 07-01-2013 and it is above 6031(calculation given above) therefore Sub Wave-5 at 6042.15 can not be ruled out.

Indicators showing Negative Divergence

Nifty-Daily Indicators Analysis Chart(11-Jan-2013):-

|

| Just click on chart for its enlarged view |

Sub Wave-5 is moving up while 4 indicators are moving down therefore Negative Divergence is clearly visible in EOD charts and strong possibility of whole Sub Wave-5 correction.

Conclusions (After Putting All Studies Together)

Following possibilities were updated in previous sessions:-

1- Sub Wave-5 minimum and maximum targets between 6031-6331 was given on 08-12-2012.

2- Minimum target(as per Elliot Wave theory) of 6239.95 with calculation was updated on 08-01-2013 as well as condition of closing above 5965 was also posted on 07-01-2013.

As closing of Sub Wave-3 of Sub Wave-5 below 5965 on 11-01-2013 therefore strong indication of its failure without achieving next target(6239.95) but closing below 5965 was due to most sensitive negative news of tension mounting on LOC therefore sustaining below 5965 should also be firstly watched. If Nifty sustains above 5965 then whole Sub Wave-5 correction will start from any levels between 6239.95-6331 and finally sustaining below 5965 will mean Sub Wave-5 completion at 6042.15 on 07-01-2013.

Sustaining below 5965 in the coming week will mean possibility of whole Sub Wave-5 correction which started from 4770.35 on 04-06-2012 and completed at 6042.15 on 07-01-2013 after gaining 1271.80 points. As correction beginning possibility after Sub Wave-5 achieving its targets at 6042.15(between 6031-6331) therefore deeper correction can not be ruled out. Let correction beginning confirmation come then size of correction,next Levels and crucial supports will be updated.

As on going impulsive View Sub Wave-5 has achieved its 1st target and negative news of Indo-Pak Cross Border Firing also and sentiment has turned dampened as well as view is cautious therefore sustaining beyond 5965 should be firstly watched for the confirmation of last Friday started correction continuation or correction beginning possibility between 6239.95-6331.

FII & DII trading activity in Capital Market Segment on 11-Jan-2013

| ||||||||||||||||

| ||||||||||||||||

Indian Stock Markets Closing Reports(11-Jan-2013)

1- All the Indices closed in Red except CNX IT and CNX MEDIA.

2- Heavy Firing on LOC news led down moves.

3- Black Candle formation.

Ratios

Index Options Put Call Ratio: 1.01

Total Options Put Call Ratio: 0.97

Nifty P/E Ratio(11-Jan-2013):18.68

Advances & Declines

BSE Advances : 954

BSE Declines :1,995

NSE Advances : 412

NSE Declines :1,336

Nifty Open Interest Changed Today

Nifty- 5700 CE(Jan)- 2,050(0.31%)

Nifty- 5700 PE(Jan)- 1,271,300(19.24%)

Nifty- 5800 CE(Jan)- 36,800(3.70%)

Nifty- 5800 PE(Jan)- 11,650(0.15%)

Nifty- 5900 CE(Jan)- 162,700(7.74%)

Nifty- 5900 PE(Jan)- 613,250(9.01%)

Nifty- 6000 CE(Jan)- 402,900(8.12%)

Nifty- 6000 PE(Jan)- -661,450(-14.89%)

Nifty- 6100 CE(Jan)- 31,150(11.71%)

Nifty- 6100 PE(Jan)- -77,450(-3.94%)

Closing

Sensex- closed at 19,663.64(0.09 Points & 0.00%)

Nifty- closed at 5,951.30(-17.35 Points & -0.29%)

CNX Midcap - closed at 8,544.00(-155.55 Points & -1.79%)

CNX Smallcap- closed at 3,801.50(-56.95 Points & -1.48%)

Nifty Spot-Levels & Trading Strategy for 14-01-2013

R3 6077.33

R2 6047.67

R1 5999.33

Avg 5969.67

S1 5921.33

S2 5891.67

S3 5843.33

Nifty Spot-Trading Strategy

H6 6029 Trgt 2

H5 6011 Trgt 1

H4 5993 Long breakout

H3 5972 Go Short

H2 5965

H1 5958

L1 5943

L2 5936

L3 5929 Long

L4 5908 Short Breakout

L5 5890 Trgt 1

L6 5872 Trgt 2

Nifty(Jan Fut)-Levels & Trading Strategy for 14-01-2013

R3 6089.33

R2 6063.67

R1 6020.33

Avg 5994.67

S1 5951.33

S2 5925.67

S3 5882.33

Nifty(Jan Fut)-Trading Strategy

H6 6046 Trgt 2

H5 6030 Trgt 1

H4 6014 Long breakout

H3 5995 Go Short

H2 5989

H1 5983

L1 5970

L2 5964

L3 5958 Long

L4 5939 Short Breakout

L5 5923 Trgt 1

L6 5907 Trgt 2

Bank Nifty(Jan Fut)-Levels & Trading Strategy for 14-01-2013

R3 13068.33

R2 12976.67

R1 12829.33

Avg 12737.67

S1 12590.33

S2 12498.67

S3 12351.33

Bank Nifty(Jan Fut)-Trading Strategy

H6 12921 Trgt 2

H5 12867 Trgt 1

H4 12813 Long breakout

H3 12747 Go Short

H2 12725

H1 12703

L1 12660

L2 12638

L3 12616 Long

L4 12550 Short Breakout

L5 12496 Trgt 1

L6 12442 Trgt 2

Nifty Spot-Weekly Levels & Trading Strategy(Jan 14 to Jan 18,2013)

R3 6116.00

R2 6079.00

R1 6015.00

Avg 5978.00

S1 5914.00

S2 5877.00

S3 5813.00

Nifty Spot-Weekly Trading Strategy

H6 6052 Trgt 2

H5 6029 Trgt 1

H4 6006 Long breakout

H3 5978 Go Short

H2 5969

H1 5960

L1 5941

L2 5932

L3 5923 Long

L4 5895 Short Breakout

L5 5872 Trgt 1

L6 5849 Trgt 2

Bank Nifty Spot-Weekly Levels & Trading Strategy(Jan 14 to Jan 18,2013)

R3 13029.00

R2 12933.00

R1 12775.00

Avg 12679.00

S1 12521.00

S2 12425.00

S3 12267.00

Bank Nifty Spot-Weekly Trading Strategy

H6 12871 Trgt 2

H5 12814 Trgt 1

H4 12756 Long breakout

H3 12686 Go Short

H2 12663

H1 12640

L1 12593

L2 12570

L3 12547 Long

L4 12477 Short Breakout

L5 12419 Trgt 1

L6 12362 Trgt 2

Subscribe to:

Comments (Atom)