Wave-A of "ABC" correction beginning confirmations

Technical Analysis,Research & Weekly Outlook

(Jul 21 to Jul 26,2019)

Nifty-EOD Chart Analysis(Waves structure)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- Impulsive Wave-1 beginning from 6825.80 on 29-02-2016 after 1 financial year(2015-16) correction completion.

2- Impulsive Wave-1 completion at 8968.70 on 07-09-2016 and corrective Wave-2 beginning

3- Corrective Wave-2 completion at 7893.80 on 26-12-2016 and impulsive Wave-3 beginning

4- Impulsive Wave-3 completion at 11760.20 on 28-08-2018 and corrective Wave-4 beginning

5- Corrective Wave-4 completion at 10004.55 on 26-10-2018 and impulsive Wave-5 beginning

6- Impulsive Wave-5 completion after life time top formation at 12103.00 on 03-06-2019 and corrective Wave-A beginning

7- Corrective Wave-A continuation with recent bottom formation at 11399.30 on 19-07-2019

Nifty-EOD Chart Analysis(Modi ji's Victory gap)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019

2- "Modi ji's Victory gap" filled up on 19-07-2019 after Nifty slipping below 11426 and on that day intraday lowest formation was at 11399.30.

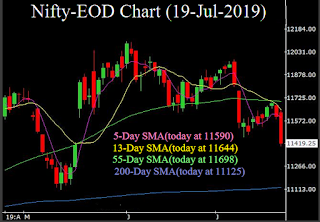

Nifty-EOD Chart Analysis(Averages)

Nifty-EOD Chart (19-Jul-2019):- |

| Just click on chart for its enlarged view |

1- 5-Day SMA(today at 11590)

2- 13-Day SMA(today at 11644)

3- 55-Day SMA(today at 11698)

4- 200-Day SMA(today at 11125)

Conclusions (After Putting All Studies Together)

1- Long Term Trend is up which will be down after sustaining below 200-Day SMA(today at 11125)

2- Intermediate Term Trend has turned down after last 10 sessions closing and sustaining below below 55-Day SMA(today at 11698)

3- Short Term Trend is down

Although 165 Points "Modi ji's Victory gap" supports formations between 11426-11591 on 20-05-2019 after Exit Polls results on 19-05-2019 but this gap filled up after slipping below 11426 therefore strong rally hopes after Modi ji's Victory have come to an end.

As real disappointment erupted from Union Budget 2019-20 therefore the correction which begun on very that day remained continued on next trading day(08-07-2019) in crashing like situation and Nifty closed on that day below 55-Day SMA. Last 10 sessions closing is below 55-Day SMA and it means that Intermediate Term Trend has turned down. As life of Intermediate Term Trend is minimum from 3 weeks to 3 months therefore this trend will remain down for this period and may be more than it also.

Wave-A beginning confirmation of that 5 Waves rally which started from 6825.80 on 29-02-2016 and finished at 12103.00 on 03-06-2019 after gaining 5278 points. Fibonacci Retracement levels of Wave-1 to Wave-5(6825-12103) are as follows:-

1- 13.0%-11,416

2- 23.6%-10,857

3- 27.0%-10,677

4- 38.2%-10,086(Crucial)

5- 50.0%-9,464(Crucial)

6- 61.8%-8,841(Crucial)

7- 70.7%-8,371

8- 76.4%-8,070

9- 78.6%-7,954

10-88.6%-7,426

Wave-A of "ABC" correction is on and 13.0%(11416) retracement level has been tested last friday as well as testing of above mentioned lower levels can not be ruled out in next weeks and months because it is just beginning of correction and Nifty has to correct those 5278 points which it gained in 5 Waves rally of 40 months.

Last hope for the Bulls is only Long Term Trend which is still up and that will be down after sustaining below 200-Day SMA(today at 11125) as well as its testing can not be ruled out in the coming weeks.

As and when Short Term Indicators will turn oversold then Pull Back Rallies will be seen which will fuse near about following resistances:-

1- 11467-11493

2- 11511-11543

3- 11637-11700

Correction is on and "investments in Bear markets is like catching a falling knief which results own hand is full of own blood" therefore firstly wait for trend reversal after complete consolidation and correction completion. Although short term trading opportunities through buying will remain avalable after Short Term Indicators turning oversold and emergence of Pull Back rally beginning signals..