Sustaining beyond last 5 sessions trading range will confirm next Short to Long Term Trend

Technical Analysis,Research & Weekly Outlook

(Nov 07 to Nov 11,2022)

Nifty-EOD Chart Analysis

(Corrective Waves)

Nifty-EOD Chart (04-Nov-2022):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-5 completion after new life time top formation at 18604.50 on 19-10-2021 and corrective Wave-A of "ABC" correction beginning with Double Zig-Zag pattern formation.

2- Wave-A completion at 16410.20 on 20-12-2021.

3- Wave-B completion at 18351.00 on 18-01-2022.

4- Wave-C bottom formation at 15671.5 on 08-03-2022.

5- Wave-X completion at 18114.70 on 04-04-2022.

6- Wave-A completion at 15735.80 on 12-05-2021.

7- Wave-B completion at 16793.80 on 03-06-2022.

8- Wave-C completion at 15183.4 on 17-06-2022.

9- Wave-X continuation with recent top formation at 18178.80 on 02-11-2022.

Conclusions from EOD chart analysis

(Corrective Waves)

Corrective Wave-A of "ABC" correction started after impulsive Wave-5 completion with new life time top formation at 18604.50 on 19-10-2021. Finally "ABC" correction has corrected with Double Zig-Zag pattern formation between 15183.4-18604.50 for the last more than 12 months.

Now Wave-X of Double Zig-Zag correction continuation with recent top formation at at 18178.80 on 02-11-2022 and no confirmation of its completion yet on EOD and intraday charts.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (04-Nov-2022):-

Technical Patterns and Formations in EOD charts

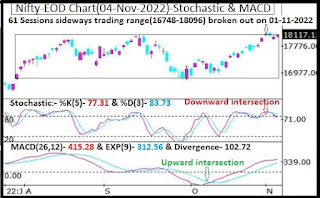

1- 61 Sessions sideways trading range(16748-18096) broken out on 01-11-2022.

2- Wave-X continuation with recent top formation at 18178.80 on 02-11-2022.

3- Stochastic- %K(5) line has intersected %D(3) line downward and its both lines are falling nearabout Over bought zone.

4- Stochastic:- %K(5)- 77.31 & %D(3)- 83.73.

5- In MACD- MACD line has intersected Average line upward and its both lines are rising in positive zone.

6- MACD(26,12)- 415.28 & EXP(9)- 312.56 & Divergence- 102.72

Conclusions from EOD chart analysis

(Stochastic & MACD)

Nifty traded sideways 61 sessions between 16748-18096 and this 61 sessions like big trading range was broken out on 01-11-2022 and on going Wave-X of Double Zig-Zag pattern is in continuation with recent top formation at 18178.80 on 02-11-2022 as well as no confirmation off its completion yet on EOD and intraday charts.

Let Nifty to sustain above last 61 sessions trading range highest(18096) in the coming week/weeks then up moves will be seen towards life time highest at 18604.50 and then possibility of strong rally above it also can not be ruled out. Positions of Short Term indicators are as follows:-

1- In Stochastic indicator %K(5) line has intersected %D(3) line downward and its both lines are falling near about Over bought zone therefore showing high possibility of Short Term Correction beginning from any day of next week

2- In MACD its MACD line has intersected Average line upward and its both lines are rising in positive zone therefore confirming upward trend formations

Final conclusion from both the above indicators is that up moves will restart after Short Term correction completion but correction should not be deeper because divergence in MACD is only 102.72 and in the situation of deeper correction MACD line will intersect Average line downward and then will start to generate downward trend formation signals.

Nifty-Intra Day Chart Analysis

(04-Nov-2022)

Nifty-Intra Day Chart (04-Nov-2022):-

Technical Patterns formation in today intraday charts

1- Down moves in first 2 hours after flat opening

2- 4 Hours consolidation between 18018-18078

3- Sharp up moves in last half hour

4- Whole day actual trading between 18018-18135

Conclusions from intra day chart analysis

Although firstly down moves in first 2 hours after flat opening but after that lower levels 4 Hours good consolidation was seen between 18018-18078 therefore Sharp up moves developed in last half hour and last Friday started up moves continuation is expected towards next resistances between 18121-18175 in the beginning of next week also.

Conclusions

(After putting all studies together)

All the trends are up and 61 sessions like big trading range(16748-18096) has been broken out in previous week but confirmation of sustaining above 18096 is still required. Let Nifty to sustain above 18096 then strong rally will be seen towards life time highest(18604.50) and above it also.

Immediate resistances above 18096 are as follows:-

1- 18121-18175

2- 18230-18314

3- 18379-18458

4- 18548-18604

Immediate supports below last Friday closing(18,117.15) are as follows:-

1- 17938-17964

2- 17724-17765

3- 17655-17712

4- 17477-17591

5- 17381-17401(Gap support)

6- 17226-17374

7- 17106-17219

8- 16941-17029

9- 16760-16855

Now Wave-X continuation with recent top formation at 18178.80 on 02-11-2022 with above mentioned resistances. As no confirmation of its completion yet on EOD and intraday charts therefore firstly sustaining beyond last 5 sessions trading range(17900-18082) should be watched in the coming week/weeks for next Short to Long Term Trend beginning confirmations.