Finally on going Pull Back rally continuation expectations after routine Short Term corrections completion

Technical Analysis,Research & Weekly Outlook

(Feb 20 to Feb 24,2023)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (17-Feb-2023):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of "ABC correction" completion at 15183.4 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning

2- Impulsive Wave-[(i)] of Wave-1 completion at 18096.2 on 15-09-2022.

3- Corrective Wave-[(ii)] of Wave-1 completion at 16747.7 on 30-09-2022.

4- Impulsive Wave-(i) of Wave-[(iii)] of Wave-1 completion at 18887.6 on 01-12-2022.

5- Corrective Wave-(ii) of Wave-[(iii)] of Wave-1 completion indications at 17353.40 on 01-02-2023.

6- Pull Back Rally continuation with recent top formations at 18134.80 on 16-02-2023.

Conclusions from EOD chart analysis

(Waves structure)

Impulsive Wave-1 of new "Waves structure" started after "ABC correction" of previous Waves structure completion at 15183.4 on 17-06-2022. Wave-(i) of Wave-[(iii)] of Impulsive Wave-1 completed at 18887.6 on 01-12-2022 and its corrective Wave-(ii) of Wave-[(iii)] of Wave-1 begun. Its completion indications emerged after on going Pull Back Rally strongly continuation with recent top formations at 18134.80 on 16-02-2023 and no confirmation of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Corrective Waves)

Nifty-EOD Chart (17-Feb-2023):-

Technical Patterns and Formations in EOD charts

1- Impulsive Wave-(i) of Wave-[(iii)] of Wave-1 completion at 18887.6 on 01-12-2022 and corrective Wave-(ii) of Wave-[(iii)] of Wave-1 begun.

2- Previous 24 sessions sideways trading range(17762-18265)

3- Previous 24 sessions sideways trading range broken down on 27-01-2023

4- Corrective Wave-(ii) of Wave-[(iii)] of Wave-1 completion indications at 17353.40 on 01-02-2023.

5- Pull Back Rally continuation with recent top formations at 18134.80 on 16-02-2023.

6- Last Friday closing within previous 24 sessions trading range at 17944.20

Conclusions from EOD chart analysis

(Corrective Waves)

Corrective Wave-(ii) of Wave-[(iii)] of Wave-1 started from 18887.6 on 01-12-2022 and this wave traded 24 sessions sideways 17762-18265 which was broken down 3 sessions before Budget on 27-01-2023. Lowest of this corrective wafe was formed on Budget day(01-02-2023) at 17353.40 and Pull Back rally started which is in continuation with recent top formations at 18134.80 on 16-02-2023.

As on going Pull Back rally is moving up strongly and gained 781 points as well as last 2 weeks weekly closing was within previous 24 sessions sideways trading range(17762-18265) at 17856.50 and 17944.20 respectatively therefore indications of corrective Wave-(ii) of Wave-[(iii)] of Wave-1 completion emerged. Let Nifty to sustain above previous 24 sessions trading range highest(18265) then this corrective wave completion will get confirmation.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (17-Feb-2023):-

Technical Patterns and Formations in EOD charts

1- Stochastic- Its both lines %K(5) & %D(3) are kissing in the Over bought zone.

2- Stochastic:- %K(5)- 74.82 & %D(3)- 79.19.

3- In MACD- MACD line has intersected Average line upward and its both lines are rising in positive and negative zone.

4- MACD(26,12)- 10.88 & EXP(9)- -90.77 & Divergence- 101.65

Conclusions from EOD chart analysis

(Stochastic & MACD)

Positions of Daily indicators are as follows:-

1- In Stochastic its both lines %K(5) & %D(3) are kissing in the Over bought zone therefore showing Short term correction signals which will be seen if fresh intraday selling will develop in next week.

2- In MACD its both lines are rising in positive and negative zone therefore showing Short Term upward Trend formation signals which will get confirmations after EXP line moving into positive zone.

These indicators are showing finally up moves beginning signals after Short term correction completion.

Nifty-EOD Chart Analysis

(Averages)

Nifty-EOD Chart (17-Feb-2023):-

Technical Patterns and Formations in EOD charts

Averages:-

A- 5-Day SMA is today at 17939

B- 21-Day SMA is today at 17860

C- 55-Day SMA is today at 18088

D- 100-Day SMA is today at 17967

E- 200-Day SMA is today at 17336

Conclusions from EOD chart analysis

(Averages)

Although Nifty tested Intermediate Term Trend decider 55-Day SMA on 16-02-2023 but closed below it in both previous seessions therefore Intermediate Term Trend is still down. As Nifty closed well above Long Term Trend decider 200-Day SMA therefore this trend is still up.

Short Term Trend is sideways between 17854-18134 for the last 3 sessions because its decider both 5-Day and 21-Day SMA are lying between last 3 sessions trading range and Nifty has also closed within this range also for the last 4 sessions therefore let Nifty to sustain beyond 17854-18134 then this trend will be understood accordingly.

Nifty-Last 3 Sessions

intraday charts analysis

Nifty-Intra Day Chart (Feb 15 to Feb 17,2023):-

Technical Patterns formation in last 3 Sessions intraday charts

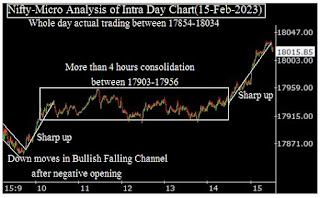

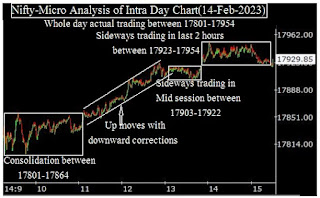

1- More than 4 hours consolidation between 17903-17956 on 15-02-2023

2- Good selling between 18069-18134 on 16-02-2023

3- Selling between 17977-18022 on 17-02-2023

4- Consolidation between 17885-17934 on 17-02-2023

5- Last 3 Sessions actual trading between 17854-18134

Conclusions from 3 Sessions

intra day chart analysis

Although more than 4 hours consolidation on 15-02-2023 but good selling was seen on next day(15-02-2023) also. As both higher levels selling and lower levels buying was seen on 17-02-2023 and it happened within both previoud trading rsnge(17854-18134) therefore expected that Nifty will trade and prepare for next Short Term trend within this range. Finally sustaining beyond(17854-18134) should be watched in the coming week for next Short Term moves beginning confirmations.

Conclusions

(After putting all studies together)

1- Short Term Trend is sideways between 17854-18134.

2- Intermediate Term Trend is down and it will be up after sustaining above its decider 55-Day SMA which is today at 18088 .

3- Long Term Trend is up.

Although no confirmation of corrective Wave-(ii) of Wave-[(iii)] of Wave-1 completion but its completion signals have been developed at 17353.40 on 01-02-2023 because from this levels started on going Pull Back rally is moving up strongly and gained 4.5% ie 781 points. Let corrective Wave-(ii) of Wave-[(iii)] of Wave-1 completion confirmation come then impulsive Wave-(iii) of Wave-[(iii)] of Wave-1 beginning will be considered.

As Short Term indicator Stochastic is showing signals of Short Term correction beginning therefore it may be seen but on the contrary MACD is indicating upward Trend formation possibility also therefore fresh up moves beginning can not be ruled out after Short Term correction completion which may be sidways also.

As Nifty is trading sideways between 17353-18265 after 23-12-2023 fall therefore Nifty is moving within Long Term Trend decider 200-Day SMA and Intermediate Term Trend 55-Day SMA for the last 3 months and preparing for the next big moves beginning after new trend formation. Nifty traded sideways 24 sessions between 17762-18265 and this range was broken down on 27-01-2023 also but last 2 weeks weekly closing was within this range therefore firstly sustaining beyond this previous 24 sessions trading range should be watched in the coming weeek/weeks for first strong signal of next Trend formations.

Short Term Trend is sideways between 17854-18134 which is last 3 sessions trading range also with lower levels consolidation and higher levels selling within this range therefore firstly sustaining beyond this range should be watched in the coming week for next Short Term Trend formation confirmations.

As finally on going Pull Back rally is moving up strongly therefore finally its continuation is expected after routine Short Term corrections completion but Nifty is trading sideways also for the last 3 months between 17353-18265 therefore following levels,supports and resistances within this range should be watched one by one for next decisive moves beginning and Trends formations confirmations:-

Levels:-

1- 17854-18134

2- 17762-18265

3- 17353-18265

Next supports:-

1- 17885-17956

2- 17801-17864

3- 17720-17801

4- 17585-17718

5- 17513-17552

6- 17438-17492

Next resistances:-

1- 17977-18022

2- 18069-18132

3- 18155-18192

4- 18216-18240