As lower levels supports and consolidation today therefore now trading near the highs of today and expected that Nifty will firstly trade as well as prepare for next trend between 6172-6260 in the beginning of next week. Indian markets are sideways for the last 18 previous sessions between 6130-6415 and expected that will remain within this range some more sessions. Strong supports above 6130 and supports with consolidation seen above it today between 6172-6187,if Nifty sustains above 6172 in the coming week then yesterday started correction completion will be considered.

Trading Calls

This is the "Oldest & Only Website" of whole World

which is updating Nifty & Indian Stock Markets

"Daily and Weekly accurate Outlooks"

with "Intraday Charts Analysis"for the

last more than "14 years" means from "2010".

For its live Proofs just see "Archive"

in the "bottom of this Website".

Trading "calls" from our "Software" with more than "90% accuracy"

Mid-session Outlook(03-01-2014)

Whole day negative zone trading after gap down opening but lower levels supports and indication of consolidation also today. As 7 sessions trading range broken down forcefully yesterday therefore complete follow up consolidation is required for any sustained up moves. As supports above 6172 today therefore firstly sustaining it beyond will give next immediate moves confirmation. Expected that Nifty will pass some more sessions between 6130-6260 for the preparation of next trend. As supports above 6172 today therefore valid break out of 6172-6260 will give next moves first indication.

Technical Analysis and Market Outlook(03-01-2014)

Nifty-Intra Day Chart (02-Jan-2014):-

Technical Patterns and Formations in today intraday charts

1- Firstly fast forceful up moves immediately after opening.

2- More than 4 hours trading between 6328-6356

3- Sharp 75 points crashed in 15 minutes

4- Whole day actual trading between 6211-6356

7 sessions(from 23-12-2013 to 01-01-2014) trading between 6260-6344 and firstly breaking out of this range but after that sharp breaking down of this range also in highly volatile market today. Nifty closed well below 6260 at 6,221.15 today and once sustaining below 6260 will mean its breaking down confirmation and in that situation deeper correction will be seen and next big trend will be decided by valid break out of 18 previous sessions range(6130-6415)

As strong supports near 6130 and selling seen in previous week therefore following topic of Weekly Outlook(Dec 30 to Jan 03,2014) was updated on 29-12-2013:-

Next strong supports near 6130 and lowest of previous 7 sessions trading range is at 6260 therefore following trends will be decided by valid break out of 6130-6260:-

1- Below 6130 will mean high possibility of down moves towards 200-Day EMA(today at 5949)

2- Above 6260 will mean hopes of Wave-3 continuation turning alive but confirmation will be after sustaining above 6415.

|

| Just click on chart for its enlarged view |

1- Firstly fast forceful up moves immediately after opening.

2- More than 4 hours trading between 6328-6356

3- Sharp 75 points crashed in 15 minutes

4- Whole day actual trading between 6211-6356

Conclusions from intra day chart analysis

7 sessions(from 23-12-2013 to 01-01-2014) trading between 6260-6344 and firstly breaking out of this range but after that sharp breaking down of this range also in highly volatile market today. Nifty closed well below 6260 at 6,221.15 today and once sustaining below 6260 will mean its breaking down confirmation and in that situation deeper correction will be seen and next big trend will be decided by valid break out of 18 previous sessions range(6130-6415)

As strong supports near 6130 and selling seen in previous week therefore following topic of Weekly Outlook(Dec 30 to Jan 03,2014) was updated on 29-12-2013:-

Next strong supports near 6130 and lowest of previous 7 sessions trading range is at 6260 therefore following trends will be decided by valid break out of 6130-6260:-

1- Below 6130 will mean high possibility of down moves towards 200-Day EMA(today at 5949)

2- Above 6260 will mean hopes of Wave-3 continuation turning alive but confirmation will be after sustaining above 6415.

Expected that Nifty will trade and prepare for next trend between 6130-6260 in the coming sessions.

Mid-session Outlook-3(02-01-2014)

Sentiment turned completely depressed immediately after negative news regarding Adani group and market crashed as well as Nifty slipped below last 7 sessions trading range(6260-6344) after first hour trading above it today.

As sustaining below 6260 will be confirmation of 7 sessions trading range breaking down and deeper correction as well therefore should be firstly watched today and in the coming sessions.

Mid-session Outlook-2(02-01-2014)

As some negative news regaring Adani group which is close to Narendra Modi therefore market is sharp down and Nifty slipped below next resistance range(6330-6355). Certainly news based market and sustaining beyond 6330 should be watched for next move confirmations.

Mid-session Outlook(02-01-2014)

Last 2 resistance ranges of Nifty are as follows:-

1- Resistance between 6360-6387

2- Resistance between 6330-6355

Nifty is trading between 1st resistance range for the last 2 hours after first 15 minutes strong recovery today. Nifty traded last 7 sessions between 6274-6344 and today trading after forceful recovery from lower levels therefore expected that now Nifty will cross both resistances and trade above 6387 in the coming sessions/week.

1- Resistance between 6360-6387

2- Resistance between 6330-6355

Nifty is trading between 1st resistance range for the last 2 hours after first 15 minutes strong recovery today. Nifty traded last 7 sessions between 6274-6344 and today trading after forceful recovery from lower levels therefore expected that now Nifty will cross both resistances and trade above 6387 in the coming sessions/week.

Post-open Outlook(02-01-2014)

Nifty-Intra Day Chart (01-Jan-2014):-

Although higher levels selling but down moves below 6300 were without required force and Bullish Falling Channel formation also seen in last 2 hours yesterday therefore we told following line in Mid-session Outlook-2(01-01-2014):-

"firstly sustaining beyond 6300 will be watched for immediate moves first indication"

Nifty traded last 7 sessions between 6274-6344 and now trading below 6344 after fast forceful up moves immediately after opening today. All trends are up,impulsive Wave-3 is on and Bull markets consolidate also at higher levels as well as it has happened after last 2 hours Bullish Falling Channel formation yesterday therefore expected that today started rally will remain continued above 6344 after higher levels consolidation.

|

| Just click on chart for its enlarged view |

"firstly sustaining beyond 6300 will be watched for immediate moves first indication"

Nifty traded last 7 sessions between 6274-6344 and now trading below 6344 after fast forceful up moves immediately after opening today. All trends are up,impulsive Wave-3 is on and Bull markets consolidate also at higher levels as well as it has happened after last 2 hours Bullish Falling Channel formation yesterday therefore expected that today started rally will remain continued above 6344 after higher levels consolidation.

Mid-session Outlook-2(01-01-2014)

As selling above 6300 therefore Nifty slipped below 6300 but without required force and Bullish Falling Channel formation also in last 2 hours therefore firstly sustaining beyond 6300 will be watched for immediate moves first indication and after that sustaining beyond 6260 for next big trend confirmation.

Mid-session Outlook(01-01-2014)

As good closing of US markets yesterday therefore sentiment is positive today and whole day Green Indian markets on 1st trading day of 2014 resultant whole day trading above 6300. Selling seen above 6300 yesterday and today also selling patterns formation above it and expected that finally Nifty will sustain below 6300 in the coming sessions despite whole day trading above it today.

Technical Analysis and Market Outlook(01-01-2014)

Nifty-Intra Day Chart (31-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- Selling patterns between 6305-6317

2- Selling patterns between 6300-6305

3- Whole day actual trading between 6287-6317

Conclusions from intra day chart analysis

Almost whole day positive zone trading but selling patterns formation above 6300 therefore expected that Nifty will not sustain above it and finally slip below 6300 despite today closing at 6304 today.

Intraday support between 6274-6287 yesterday and selling patterns formation between 6314-6324 on 27-12-2013 therefore mixed technical positions in last 3 sessions and firstly Nifty has to prepare for next decisive moves between 6274- 6324. It is clear that sustaining beyond 6274- 6324 will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation and should be firstly watched in the coming sessions.

|

| Just click on chart for its enlarged view |

1- Selling patterns between 6305-6317

2- Selling patterns between 6300-6305

3- Whole day actual trading between 6287-6317

Conclusions from intra day chart analysis

Almost whole day positive zone trading but selling patterns formation above 6300 therefore expected that Nifty will not sustain above it and finally slip below 6300 despite today closing at 6304 today.

Intraday support between 6274-6287 yesterday and selling patterns formation between 6314-6324 on 27-12-2013 therefore mixed technical positions in last 3 sessions and firstly Nifty has to prepare for next decisive moves between 6274- 6324. It is clear that sustaining beyond 6274- 6324 will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation and should be firstly watched in the coming sessions.

Pre-closing Outlook(31-12-2013)

Most time narrow range trading within 23 points between 6292-6315 with selling indications therefore finally down moves are expected in the coming sessions.

Technical Analysis and Market Outlook(31-12-2013)

Nifty-Intra Day Chart (30-Dec-2013):-

Technical Patterns and Formations in today intraday charts

1- Higher levels selling immediately after opening.

2- Most time trading in first 5 hours between 6290-6309.

3- Selling patterns formation between 6300-6309.

4- Bullish Falling Channel pattern formation.

5- Down moves without required force.

6- Support between 6274-6287.

7- Whole day actual trading between 6274-6344.

As intraday selling patterns formation between 6314-6324 last Friday therefore slipping below 6304 was told same day and it was seen today after follow up selling at higher levels today but Bullish pattern formation and lower levels supports also seen today therefore sustaining beyond today trading range should be firstly watched for next immediate moves confirmations because:-

1- Both intraday buying and selling patterns formation seen today.

2- Although selling in previous week but buying patterns seen above those selling levels today.

All trends are up,impulsive Wave-3 is on and Bull markets consolidate also at higher levels therefore firstly sustaining beyond today trading range(6274-6344) will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation. Follow up intraday moves in the coming sessions will be watched for first indication of next moves and will be updated in Mid-session Outlooks as being done for the last more than 3 years.

|

| Just click on chart for its enlarged view |

1- Higher levels selling immediately after opening.

2- Most time trading in first 5 hours between 6290-6309.

3- Selling patterns formation between 6300-6309.

4- Bullish Falling Channel pattern formation.

5- Down moves without required force.

6- Support between 6274-6287.

7- Whole day actual trading between 6274-6344.

Conclusions from intra day chart analysis

As intraday selling patterns formation between 6314-6324 last Friday therefore slipping below 6304 was told same day and it was seen today after follow up selling at higher levels today but Bullish pattern formation and lower levels supports also seen today therefore sustaining beyond today trading range should be firstly watched for next immediate moves confirmations because:-

1- Both intraday buying and selling patterns formation seen today.

2- Although selling in previous week but buying patterns seen above those selling levels today.

All trends are up,impulsive Wave-3 is on and Bull markets consolidate also at higher levels therefore firstly sustaining beyond today trading range(6274-6344) will give next immediate moves confirmation and finally sustaining beyond 6130-6415 will give next big trend confirmation. Follow up intraday moves in the coming sessions will be watched for first indication of next moves and will be updated in Mid-session Outlooks as being done for the last more than 3 years.

Pre-closing Outlook(30-12-2013)

Most time trading between 6274-6309 with mixed intraday patterns formations because higher levels selling but down moves without required force and with lower levels supports also therefore firstly sustaining beyond mentioned range should be watched for next immediate moves confirmations.

Mid-session Outlook-2(30-12-2013)

Most time trading between 6290-6309 with intraday selling patterns formations and slipped below 6290 also but not forcefully and consolidation indications also developing in today intraday charts therefore mixed formations and sustaining below 6290 should be firstly watched for next immediate moves confirmations.

Mid-session Outlook(30-12-2013)

As Nifty traded most time between 6304-6319 with selling patterns formations on 27-12-2013 therefore slipped below this range within first half hour today and since then trading between 6290-6309 with intraday selling patterns formations and expected that Nifty will slip below today lowest as well.

Post-open Outlook(30-12-2013)

Following lines were told:-

1- In Pre-closing Outlook on 27-12-2013:- "Nifty will firstly slip below 6304 in next week"

2- In Firstly Down Moves towards Next Strong Supports on 29-12-2013:- "firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend"

1- In Pre-closing Outlook on 27-12-2013:- "Nifty will firstly slip below 6304 in next week"

2- In Firstly Down Moves towards Next Strong Supports on 29-12-2013:- "firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend"

Now Nifty is trading below 6304 and should be kept in mind that fast down moves are possible after valid breaking down of 6260 because that will be confirmation of last 4 sessions selling.

Firstly Down Moves towards Next Strong Supports

Technical Analysis,Research & Weekly Outlook

(Dec 30 to Jan 03,2014)

Nifty-EOD Chart (27-Dec-2013):- |

| Just click on chart for its enlarged view |

1- Bottom formation at 5118.85 on 28-08-2013 and Wave-1 beginning

2- Wave-1(6142.50 on 19-09-2013)

3- Wave-2(5700.95 on 01-10-2013)

4- Wave-i of Wave-3(6342.95 on 03-11-2013)

5- Wave-ii of Wave-3(5972.45 on 13-11-2013)

6- Wave-iii of Wave-3(6415.25 on 09-12-2013)

7- Wave-iv of Wave-3(6129.95 on 18-12-2013)

8- Wave-v of Wave-3 continuation with recent top formation at 6324.90 on 27-12-2013.

Conclusions from EOD chart analysis

All Trends were up and Wave-3 continuation towards minimum target of Nifty at 6724.60. Its calculation has already been updated in following topic on 21-10-2013:-

It must be kept in mind that it is price vice target and not time vice therefore market will take its own time to achieve it.

Nifty-Intra Day Chart (Dec 09 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Strong support range 6130-6180

2- Resistance between 6360-6387

3- Resistance between 6330-6355

4- Sideways trading between 6260-6324 within only 64 points with higher levels selling in previous week.

5- 14 Sessions actual trading between 6130-6415

Conclusions from 14 Sessions intra day chart analysis

Multiple resistances between 6330-6387 and just below it previous week sideways trading with higher levels selling therefore emergence of down moves possibility.

Nifty-Intra Day Chart (Dec 23 to Dec 27,2013):-

|

| Just click on chart for its enlarged view |

1- Daily higher levels selling in all 4 trading sessions of previous week.

3- 4 Sessions actual trading between 6260-6324

Conclusions from 4 Sessions intra day chart analysis

Previous whole week sideways trading within only 64 points therefore sustaining beyond this range will give big moves. As most time selling patterns seen in last 4 sessions therefore finally down moves are expected in the coming week despite previous week closing near weekly highest levels.

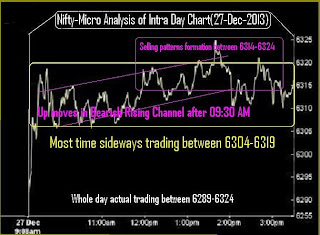

Nifty-Intra Day Chart (27-Dec-2013):-

|

| Just click on chart for its enlarged view |

1- Up moves in Bearish Rising Channel after 09:30 AM.

2- Most time sideways trading between 6304-6319.

3- Selling patterns formation between 6314-6324.

4- Whole day actual trading between 6289-6324.

Conclusions from intra day chart analysis

Most time sideways trading between 6304-6319 with Bearish Rising Channel and higher levels selling patterns formation therefore down moves below 6304 are expected in next week.

Conclusions (After Putting All Indicators Together)

Impulsive Wave-v of impulsive Wave-3 is on with closing near the weekly highest last Friday but most time selling patterns seen in all last 4 sessions of previous week therefore firstly down moves are expected in next week. As strong supports above 6130 also developed in last 14 sessions therefore Nifty will not easily slip below it.

Expected that finally Nifty will sustain above 6415 and move towards minimum 6724.60 but firstly slip below 6304/6289/6260/6130 and sustaining beyond 6130 will be watched to understand next trend but high possibility of up trend beginning after fresh consolidations near about 6130.

As Indian markets are in Bullish phase therefore expected that Nifty will remain range bound in broader range of last 14 sessions 6130-6415 and prepare for next big trend in the coming weeks.

Subscribe to:

Comments (Atom)