Bullish Rally continuation after Very Short Term/intraday correction completion

Technical Analysis,Research & Weekly

Outlook(Sep 16 to Sep 20,2024)

Nifty-EOD Chart Analysis

(Waves structure)

Nifty-EOD Chart (13-Sep-2024):-

Technical Patterns and Formations in EOD charts

1- Corrective Wave-C of previous Waves structure "ABC correction" completion at 15183.40 on 17-06-2022 and Impulsive Wave-1 of new Waves structure beginning.

2- Impulsive Wave-1 completion at 18887.60 on 01-12-2022.

3- Corrective Wave-2 completion at 16828.30 on 20-03-2023.

4- Impulsive Wave-(i) of Wave-3 completion at 20222.45 on 15-09-2023 and Wave-A of "ABC" correction beginning.

5- Wave-A of Wave-(ii) of Wave-3 completion at 19333.60 on 04-10-2023.

6- Wave-B of Wave-(ii) of Wave-3 completion at 19849.80 on 17-10-2023.

7- Corrective Wave-C of Wave-(ii) of Wave-3 completion at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 beginning.

8- Impulsive Wave-(iii) of Wave-3 continuation with its recent high and new life time top formations at 25433.30 on 12-09-2024.

Conclusions from EOD chart analysis

(Waves structure)

Corrective Wave-C of "ABC correction" of previous Waves structure completed at 15183.40 on 17-06-2022 and from his level Impulsive Wave-1 of new Waves structure started. Wave-1 completed at 18887.60 on 01-12-2022 and from this level Wave-2 begun which completed at 16828.30 on 20-03-2023 and Impulsive Wave-3 begun from this level which is now in continuation.

Impulsive Wave-(i) of Wave-3 completed at 20222.45 and from this level corrective Wave-A of "ABC" correction of Wave-(ii) of Wave-3 started which completed at 19333.60 on 04-10-2023 and Wave-B begun. Wave-B completed at 19849.80 on 17-10-2023 and Wave-C started from this levels which completed at 18837.80 on 26-10-2023 and impulsive Wave-(iii) of Wave-3 begun from this level.

Now impulsive Wave-(iii) of Wave-3 is in continuation with its recent high and new life time top formations at 25433.30 on 12-09-2024 and no indication of its completion yet on EOD charts.

Nifty-EOD Chart Analysis

(Stochastic & MACD)

Nifty-EOD Chart (13-Sep-2024):-

Technical Patterns and Formations in EOD charts

1- Stochastic- %K(5) line has intersected %D(3) line upward and its both lines are rising towards Over Over bought zone.

2- Stochastic:- %K(5)- 71.27 & %D(3)- 57.01.

3- In MACD- MACD line has intersected Average line downward and its both lines are falling in positive zone.

4- MACD(26,12)- 219.47 & EXP(9)- 353.65 & Divergence- -134.18

Conclusions from EOD chart analysis (Stochastic & MACD)

Technical positions of Short Term indicators are as follows:-

1- As in Stochastic its %K(5) line has intersected %D(3) line upward and its both lines are rising towards Over Over bought zone therefore it will be understood that at present this indicator is showing sigals of some more upward moves possibilities.

2- As in MACD indicator its MACD line has intersected Average line downward and its both lines are falling in positive zone therefore it will be understood that this indicator has shown first signal of Short Term downward trend formations. Let it move into negative zone then decisive downwrad moves will be seen after downward trend formation confirmations.

Nifty-Intra Day Chart Analysis

(13-Sep-2024)

Nifty-Intra Day Chart (13-Sep-2024):-

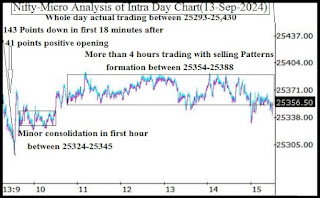

Technical Patterns formation in today intraday charts

1- 143 Points down in first 18 minutes after 41 points positive opening

2- Minor consolidation in first hour between 25324-25345

3- More than 4 hours trading with selling Patterns formation between 25354-25388

4- Whole day actual trading between 25293-25430

Conclusions from intra day chart analysis

Although positive opening last Friday but firstly 143 points sharp fall was seen in first 18 minutes and Nifty traded 96 points down also. As lower levels minor consolidation developed therefore some up moves were seen and Nifty traded flat also. More than last 4 hours trading developed also with intraday selling Patterns formation last Friday therefore expected that down moves below last Friday lowest(25292.45) will be seen in the beginning of next week.

Conclusions (After putting all studies together)

1- Long Term Trend is up.

2- Intermediate Term trend is up.

3- Short Term Trend is up.

Now impulsive Wave-(iii) of Wave-3 is in continuation forcefully with its recent high and new life time top formations at 25433.30 last Thursday and no indication of its completion yet on EOD charts.

Although Short Term MACD indicator has shown first signal of Short Term downward trend formations but at present no confirmations and Short Term Stochastic indicator is showing some more upward moves possibilities therefore it will be understood that firstly some upward moves will se seen. Let complete selling patterns develop on EOD and intraday charts and MACD to move into negative zone in downward intersection mode then decisive downward moves will be seen after Downward Trend formation confirmations.

As intraday chart of last Friday is showing more than 4 hours selling Patterns formation therefore Very Short Term/intraday correction is expected towards following next supports in the beginning of next week and firstly sustaining them beyond should be watched for the life and of expected Short Term correction:-

1- 25324-25345(Minor Supports)

2- 24942-25062(Strong Supports)

3- 24894-24927

4- 24816-24872

Until complete selling patterns will not develop on intraday and EOD charts till then any bigger correction will not be seen and on going Bullish Rally will remained continued after Very Short Term/intraday correction completion.